Introduction

On the 8th of March 2021, Apollo Global Management (“AGM” or “Apollo”), leading global investment manager, announced plans to merge with Athene Holding (“AH” or “Athene”), leading the US retirement services company. Apollo’s stake in Athene will increase from 35% to 76%. The all-stock merger, which implies an equity value of $11bn for Athene will create one of the US largest financial conglomerates with a combined value of $29bn. The merged company will be able to cover and be a global leader of the full range of products regarding both investments and retirement income. The merger is the final step towards the consolidation of Apollo’s participation and long-term collaboration with Athene. Moreover, thanks to increased transparency and one share / one vote structure, it represents a further move in the direction of stronger governance for Apollo, following Mr Black’s, AGM CEO, decision to step down after a board review of his ties to Jeffrey Epstein.

The deal is expected to close in January 2022, with the combined entity’s equity value estimated at $29bn, making the merged company eligible for inclusion in the S&P 500 index and reinforces Apollo’s position as of the biggest credit players in the world. The combined company will become much more capital intensive and will now be overseen by regulators, potentially impacting Apollo’s business model based on high fees with relatively low tied capital. Moreover, the market might see this large part of the business entitled to insurance and price the combined company according to insurance companies’ valuations, which would diminish its current proforma market value. Apollo’s Rowan stressed that “this merger is not an investment in the insurance business, nor is it an attempt to build a conglomerate. We are building an asset manager”. Will the market believe so?

About Apollo

On the 8th of March 2021, Apollo Global Management (“AGM” or “Apollo”), leading global investment manager, announced plans to merge with Athene Holding (“AH” or “Athene”), leading the US retirement services company. Apollo’s stake in Athene will increase from 35% to 76%. The all-stock merger, which implies an equity value of $11bn for Athene will create one of the US largest financial conglomerates with a combined value of $29bn. The merged company will be able to cover and be a global leader of the full range of products regarding both investments and retirement income. The merger is the final step towards the consolidation of Apollo’s participation and long-term collaboration with Athene. Moreover, thanks to increased transparency and one share / one vote structure, it represents a further move in the direction of stronger governance for Apollo, following Mr Black’s, AGM CEO, decision to step down after a board review of his ties to Jeffrey Epstein.

The deal is expected to close in January 2022, with the combined entity’s equity value estimated at $29bn, making the merged company eligible for inclusion in the S&P 500 index and reinforces Apollo’s position as of the biggest credit players in the world. The combined company will become much more capital intensive and will now be overseen by regulators, potentially impacting Apollo’s business model based on high fees with relatively low tied capital. Moreover, the market might see this large part of the business entitled to insurance and price the combined company according to insurance companies’ valuations, which would diminish its current proforma market value. Apollo’s Rowan stressed that “this merger is not an investment in the insurance business, nor is it an attempt to build a conglomerate. We are building an asset manager”. Will the market believe so?

About Apollo

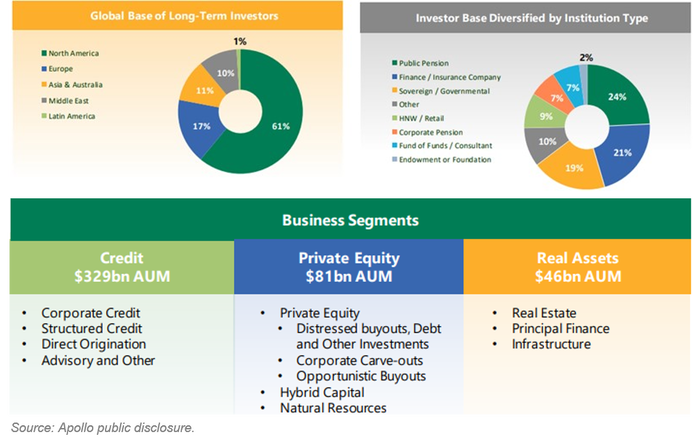

Apollo Global Management (“Apollo” or the “Firm”) is a US-based private equity investment company headquartered in New York. It mainly specialises in LBOs, distressed financing deals, both turnaround and vulture financing, and special situations deals. Some notable characteristics that make Apollo stand-out against other leading investment manager are its contrarian, value-oriented approach, its significant distressed investment experience and its ability to be opportunistic across market cycles. Its investor base is diversified, and its main geography is North America.

The Firm, originally called Apollo Advisors, was founded in 1990 by a team of ex-employees of Drexel Burnham Lambert after its bankruptcy, namely, Leon Black, head of M&A; John Hannan, co-director of international finance; Craig Cogut, a lawyer in the high-yield division; Arthur Bilger, head of corporate finance; Marc Rowan, Josh Harris e Michael Gross, M&A bankers; Antony Ressler, SVP in the high-yield division. The Firm was focused on distressed financing from the start and its first fund managed to raise $400m thanks to the reputation of its founders, kickstarting its operations.

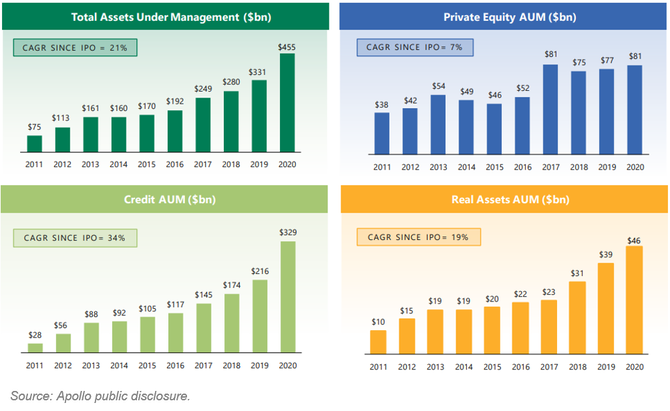

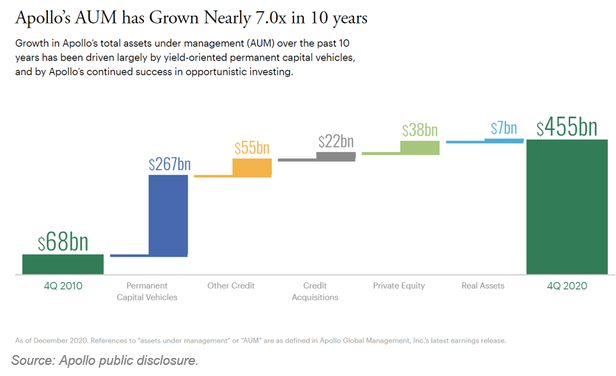

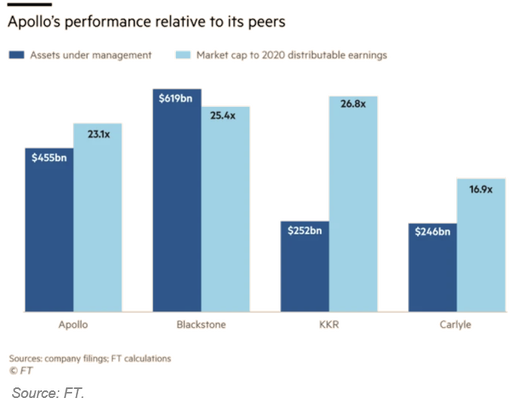

Apollo’s assets under management have grown by nearly 7.0x between 2010 and 2020 and at an annual compounded rate of 21% between 2009 and 2020. As of December 2020, AuM is $455bn, largely attributable to yield-oriented permanent capital vehicles, making Apollo the second-largest US-based investment manager.

About Athene

Athene Holding (“Athene” or the “Firm”) is a Bermuda-based, with US-based subsidiaries, a leader in retirement services, which issues, reinsures and acquires retirement savings products for a wide spectrum of people and organisations. Athene has two main product lines: annuities and funding agreements and operates through four different distribution channels: Retail, Flow Reinsurance, Institutional Products ( including funding agreements and pension risk transfer transactions), Mergers & Acquisitions, and Block Reinsurance. Their business model is able to couple sourcing long-term, illiquid liabilities and investing in a high-quality investment portfolio which can utilise such illiquid liabilities. Athene presents itself as a simpler alternative to “black box” insurance firms because it relies on a “spread” model: insurance holders receive cashflows which are more than covered by the return that Athene gets from its investments, and the difference between what Athene pays and earns goes to shareholders. The Firm’s relationship with Apollo Global Management gives it access to the latter’s investment professionals and world-leading infrastructure. The latter collaboration is expected to deepen and have a stronger implementation after the merger.

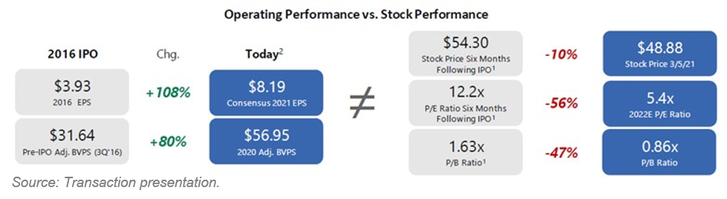

Athene’s business performance has been stellar and above industry average, the only thing keeping it from being an objective top player in its industry is its relationship with Apollo, by far its highest cost. The latter fact reflects strongly in its market valuation, which went in the opposite direction of its underlying business performance.

Athene’s business performance has been stellar and above industry average, the only thing keeping it from being an objective top player in its industry is its relationship with Apollo, by far its highest cost. The latter fact reflects strongly in its market valuation, which went in the opposite direction of its underlying business performance.

The Firm was created in 2009, after the great financial crisis, because its founders, James Belardi and Chip Gillis, saw a gap in the retirement market, created by the exit of many companies due to financial distress caused by the crisis, that could be filled by a company with strong capitalisation and management. The creation of Athene was the start of its relationship with Apollo, the latter being the company that set Athene up and then sold most of its shares through an IPO. At the time of the IPO, Athene already accounted for a quarter of all asset-management fees earned by Apollo and was the 7th largest seller of fixed annuities in the US. The IPO raised $1.08bn, valuing the Firm at $7.4bn, where existing shareholders sold 27m shares at $40/share, Athene did not receive proceeds from its IPO. The relationship with Apollo did not end after the IPO, as Athene’s board remained populated by a strong representation of Apollo’s interests, which became apparent in a shareholder suit filed in 2019 that called the management fees paid by Athene to Apollo “exorbitant”. A FT investigation was able to obtain declarations from Apollo managers saying that the fees paid by Athene were roughly double what it could have obtained in the general investment management industry, which would mean that Athene, due to its toxic relationship with Apollo, could be paying hundreds of millions of dollars more than it should. The two firms’ relationship created uneasiness in the market, which constantly undervalued Athene compared with its stellar performance due to these issues, even after Apollo cut its voting stakes in Athene to 45%.

Industry Overview

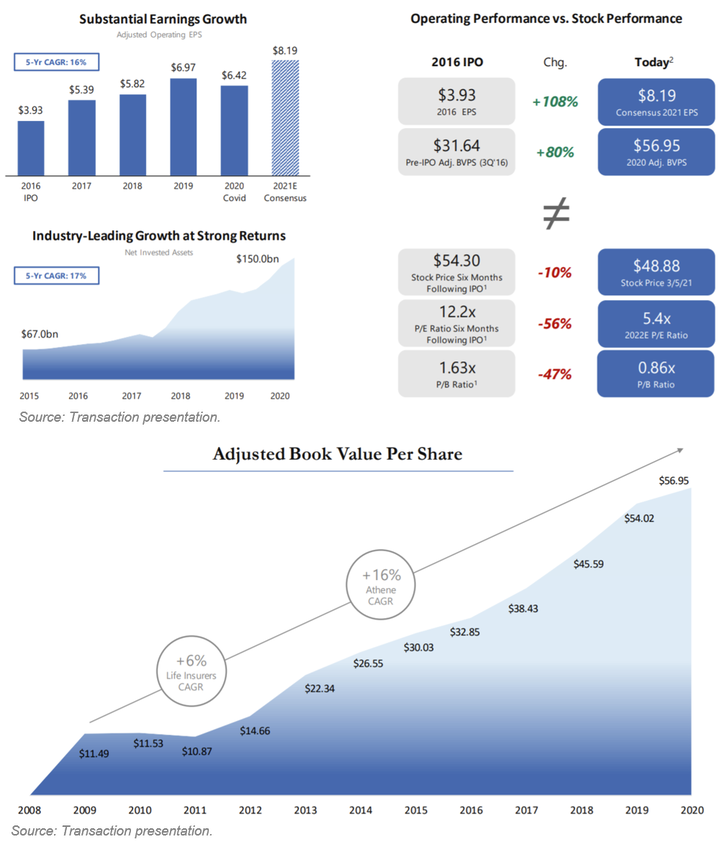

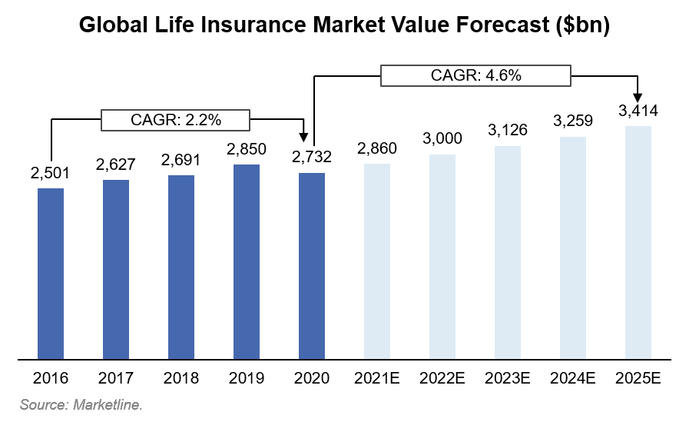

In recent years, the life insurance industry has experienced significant growth, with many new markets, especially in emerging economies, opening up. Between 2016 and 2020, the global life insurance industry created overall gross written premiums of about $2.7bn, with a compound annual growth rate of 2.2%. Nonetheless, recent forecasts suggest that the market's performance will improve, following an already impressive 5-year CAGR of 2.2% and awaiting for an average of 4.6% in the following half of a decade; in comparison, Athene has proved its leading dominance in the industry with a 16% 5-year CAGR over a 6% 5-year CAGR of the US market as well as a long term upwards trend in substantial earnings growth with a consensus of $8.19 EPS (27% increase from 2020 and 43% from the 5-year average).

Industry Overview

In recent years, the life insurance industry has experienced significant growth, with many new markets, especially in emerging economies, opening up. Between 2016 and 2020, the global life insurance industry created overall gross written premiums of about $2.7bn, with a compound annual growth rate of 2.2%. Nonetheless, recent forecasts suggest that the market's performance will improve, following an already impressive 5-year CAGR of 2.2% and awaiting for an average of 4.6% in the following half of a decade; in comparison, Athene has proved its leading dominance in the industry with a 16% 5-year CAGR over a 6% 5-year CAGR of the US market as well as a long term upwards trend in substantial earnings growth with a consensus of $8.19 EPS (27% increase from 2020 and 43% from the 5-year average).

Low consumer trust in their financial capacity and the long-term economic prospects of their countries (hugely deteriorated globally after the spread of the COVID-19 virus) are the major driving forces accounting for the rapid expected growth, which are combined with an averagely high household disposable income.

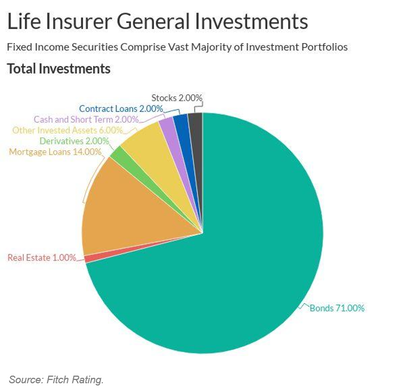

However, the way life insurers market their products has changed forever as a result of the pandemic's spread, as COVID-19 wreaked havoc around the world. Interest rates have fallen sharply globally, affecting the earnings of life insurance market participants significantly. Interest rate risk throws life insurers in jeopardy due to investment leverage, since they choose to guarantee their customers fixed interest rates for a long time. As a consequence, the length of their assets usually does not fit their strategies, posing a risk of sequential reinvestment: Life insurance companies can find it difficult to produce higher returns on their investments. This risk is exacerbated by a market trend: insurers have raised their exposures by buying corporate bonds in search of higher returns. For example, life insurers in the United States are among the largest institutional investors in fixed-income securities. According to recent reports, fixed-income securities account for more than 70% of the industry's portfolio (with the majority of funds invested in corporate and securities). Structured finance securities and bank loans, mutual funds, and exchange-traded funds receive the remaining allocation (ETFs).

However, the way life insurers market their products has changed forever as a result of the pandemic's spread, as COVID-19 wreaked havoc around the world. Interest rates have fallen sharply globally, affecting the earnings of life insurance market participants significantly. Interest rate risk throws life insurers in jeopardy due to investment leverage, since they choose to guarantee their customers fixed interest rates for a long time. As a consequence, the length of their assets usually does not fit their strategies, posing a risk of sequential reinvestment: Life insurance companies can find it difficult to produce higher returns on their investments. This risk is exacerbated by a market trend: insurers have raised their exposures by buying corporate bonds in search of higher returns. For example, life insurers in the United States are among the largest institutional investors in fixed-income securities. According to recent reports, fixed-income securities account for more than 70% of the industry's portfolio (with the majority of funds invested in corporate and securities). Structured finance securities and bank loans, mutual funds, and exchange-traded funds receive the remaining allocation (ETFs).

This accumulated risk and exposure had led to all of these bonds being on the verge of being downgraded to junk status as the downfall can be significantly more damaging than before. Taking this into account and then combining this with the establishment of low-interest record rates set by central banks, fixed-income assets are placed under even more pressure. In addition, insurers must deal with the rising amount of claims and lawsuits as a result of COVID-19-related deaths. The magnitude of the pandemic's disruptions is difficult to estimate due to the pandemic's global existence. However, it is clear that insurers will have to rethink their business models as a result.

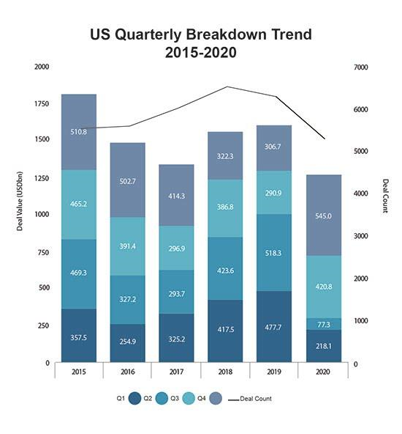

Meanwhile, the spread of the pandemic has compounded the negative impact on M&A transactions in the health insurance sector due to regulatory worries about rivalry(such as insufficient capital to perform said M&A,s due to the irregular market conditions not allowing for the usual flows of capital in many companies). In comparison to 2019, the number of M&A transactions has decreased by about 41%, while the total deal value has decreased by 10%. The average contract value, on the other hand, rose by around 6% year over year, indicating a greater proclivity for transformative deals.

Indeed, in 2019, New York Life and Cigna announced a single transformative M&A deal to rebuild New York Life's business model and grow its customer base, with the help of an established management team and a high-quality workforce. In 2020, however, at least three transactions can be considered transformative: Fidelity National paying $2.7bn to buy out two other owners; KKR acquiring Global Atlantic for $4.4bn; and the Carlyle Group and T&D Holdings completing their purchase of a 76.6 percent stake in Fortitude Group Holdings.

Meanwhile, the spread of the pandemic has compounded the negative impact on M&A transactions in the health insurance sector due to regulatory worries about rivalry(such as insufficient capital to perform said M&A,s due to the irregular market conditions not allowing for the usual flows of capital in many companies). In comparison to 2019, the number of M&A transactions has decreased by about 41%, while the total deal value has decreased by 10%. The average contract value, on the other hand, rose by around 6% year over year, indicating a greater proclivity for transformative deals.

Indeed, in 2019, New York Life and Cigna announced a single transformative M&A deal to rebuild New York Life's business model and grow its customer base, with the help of an established management team and a high-quality workforce. In 2020, however, at least three transactions can be considered transformative: Fidelity National paying $2.7bn to buy out two other owners; KKR acquiring Global Atlantic for $4.4bn; and the Carlyle Group and T&D Holdings completing their purchase of a 76.6 percent stake in Fortitude Group Holdings.

As a result, some analysts believe that the stars are aligning for a favorable insurance M&A market in 2021. Companies are beginning to think about how to surge and return to usual times beyond COVID-19. That's why they're looking at how mergers and acquisitions, divestitures, and investments will help them diversify their holdings and accelerate the transition to digital operating models. More precisely, there is an increasing trend toward carve-outs, which is expected to increase in the near future, enabling businesses to assess their current service portfolio to determine which divisions are performing satisfactorily and if their investments are delivering the expected value.

Deal Structure

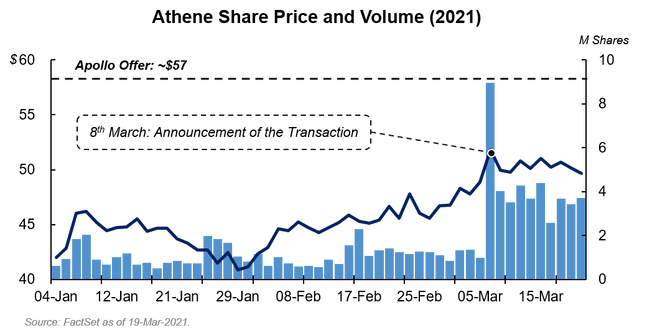

The $7.2bn (purchase equity) transaction for Athene is expected to be all-stock, with an exchange ratio of 1:1.149 resulting in a 16.5% premium to Athene's pre-announcement trading price (04-March) and a price of about $57. The implied equity value is calculated to be between $10.9bn and $11bn, resulting in a 7.0x P/E (LTM) and 0.6x P/BV valuation.

The merger plan for the transaction to be tax-free for U.S. federal income tax purposes, making it tax-efficient for Athene shareholders. Apollo holds approximately 35% of the outstanding Athene Class A common stock, along with some of its associated parties and employees. In consultation with their respective independent financial and legal counsel, a special committee of some disinterested members of the Athene Board of Directors and the disputes committee of the Apollo Board of Directors unanimously approved the merger and judged it to be equitable from a financial standpoint and in the best interests of their shareholders.

On a completely diluted basis, existing Apollo shareholders will own about 76% of the merged business after the transaction closes. Athene shareholders, on the other hand, will keep nearly 24% of the company. The deal will be carried out through a newly established company called "Tango Holdings." The entity will purchase Apollo prior to the completion of the acquisition in order to complete a restructuring transaction. Tango Holdings will be renamed Apollo Global Management Inc. after the transaction is completed.

Ultimately, the deal is scheduled to be completed in January 2022. The deal is subject to shareholder approval from both Apollo and Athene, as well as the expiration or termination of applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, as well as other antitrust and regulatory approvals and customary closing conditions.

Deal Rationale

On March 8th, 2021, Apollo announced that it would merge with its longtime partner and insurance affiliate, Athene, in an all-stock transaction. The long and successful relationship between the two companies had also been controversial in the past years, due to the fact that their close relationship may have given an unfair advantage to Apollo over the insurer. Indeed, in the period 2018-2019, Apollo was accused of charging Athene with major fees for managing its assets – accusations that led to two lawsuits on the basis of having unlawfully exploited its massive influence over the insurer to obtain unparalleled fees. The lawsuits came to an end when the Bermuda Court ordered the two lawsuits to stop and be filed in the Bermuda Islands, where the insurer was indeed incorporated. Later, Apollo tried to compromise with Athene’s shareholders, by putting $1.6bn into the life insurer company and cutting on its voting stake. In this sense, the merger represents a potential solution to the controversial relationships between the companies and could result in an improvement of corporate governance that could benefit the enlarged entity. Athene, being the preeminent platform in the retirement services industry, has managed with Apollo’s partnership to become a solutions provider to retirees and institutions, keeping on providing capital to an industry that has been in continuous restructuring.

The outstanding operating performance of Athene has not been matched by a consistent valuation, which does not reflect the successful operating and financial performance of the company. From its inception in 2008/2009, Athene’s adjusted book value per share has been growing at a CAGR of 16%, compared to only 6% for the other life insurers. Moreover, the life insurer went from $67bn of net invested assets in 2015 to $150bn in 2020, an industry-leading growth with a 5 years CAGR of 17%. Athene also displayed a significant earnings growth with a five-year CAGR of 16% from 2015 to 2020; the consensus projections for 2021 are of an increase in earnings from pre-covid crisis levels.

Deal Structure

The $7.2bn (purchase equity) transaction for Athene is expected to be all-stock, with an exchange ratio of 1:1.149 resulting in a 16.5% premium to Athene's pre-announcement trading price (04-March) and a price of about $57. The implied equity value is calculated to be between $10.9bn and $11bn, resulting in a 7.0x P/E (LTM) and 0.6x P/BV valuation.

The merger plan for the transaction to be tax-free for U.S. federal income tax purposes, making it tax-efficient for Athene shareholders. Apollo holds approximately 35% of the outstanding Athene Class A common stock, along with some of its associated parties and employees. In consultation with their respective independent financial and legal counsel, a special committee of some disinterested members of the Athene Board of Directors and the disputes committee of the Apollo Board of Directors unanimously approved the merger and judged it to be equitable from a financial standpoint and in the best interests of their shareholders.

On a completely diluted basis, existing Apollo shareholders will own about 76% of the merged business after the transaction closes. Athene shareholders, on the other hand, will keep nearly 24% of the company. The deal will be carried out through a newly established company called "Tango Holdings." The entity will purchase Apollo prior to the completion of the acquisition in order to complete a restructuring transaction. Tango Holdings will be renamed Apollo Global Management Inc. after the transaction is completed.

Ultimately, the deal is scheduled to be completed in January 2022. The deal is subject to shareholder approval from both Apollo and Athene, as well as the expiration or termination of applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, as well as other antitrust and regulatory approvals and customary closing conditions.

Deal Rationale

On March 8th, 2021, Apollo announced that it would merge with its longtime partner and insurance affiliate, Athene, in an all-stock transaction. The long and successful relationship between the two companies had also been controversial in the past years, due to the fact that their close relationship may have given an unfair advantage to Apollo over the insurer. Indeed, in the period 2018-2019, Apollo was accused of charging Athene with major fees for managing its assets – accusations that led to two lawsuits on the basis of having unlawfully exploited its massive influence over the insurer to obtain unparalleled fees. The lawsuits came to an end when the Bermuda Court ordered the two lawsuits to stop and be filed in the Bermuda Islands, where the insurer was indeed incorporated. Later, Apollo tried to compromise with Athene’s shareholders, by putting $1.6bn into the life insurer company and cutting on its voting stake. In this sense, the merger represents a potential solution to the controversial relationships between the companies and could result in an improvement of corporate governance that could benefit the enlarged entity. Athene, being the preeminent platform in the retirement services industry, has managed with Apollo’s partnership to become a solutions provider to retirees and institutions, keeping on providing capital to an industry that has been in continuous restructuring.

The outstanding operating performance of Athene has not been matched by a consistent valuation, which does not reflect the successful operating and financial performance of the company. From its inception in 2008/2009, Athene’s adjusted book value per share has been growing at a CAGR of 16%, compared to only 6% for the other life insurers. Moreover, the life insurer went from $67bn of net invested assets in 2015 to $150bn in 2020, an industry-leading growth with a 5 years CAGR of 17%. Athene also displayed a significant earnings growth with a five-year CAGR of 16% from 2015 to 2020; the consensus projections for 2021 are of an increase in earnings from pre-covid crisis levels.

Therefore, the merger at this time represents a very convenient move for Apollo, given the undervaluation of Athene which led to a relatively cheap purchase price for Apollo. Indeed, Apollo bought Athene at a premium, which is nevertheless lower than the price 3 months post its IPO. The two companies plan to merge through an all-stock transaction intended to qualify as tax-free for US federal income tax purposes for the two companies’ common shareholders. Moreover, Apollo plans to convert to a Full C-Corp, with a one share / one vote structure, given the green light from shareholders and regulatory bodies, so as to accelerate the strategic plan, be significantly financially accretive, guarantee a larger market capitalization and low execution risk. In addition, this move would provide them with additional index eligibility, including S&P 500 because of its increased size and market capitalization, liquidity and positive earnings results, and a top-notch, transparent and diverse governance.

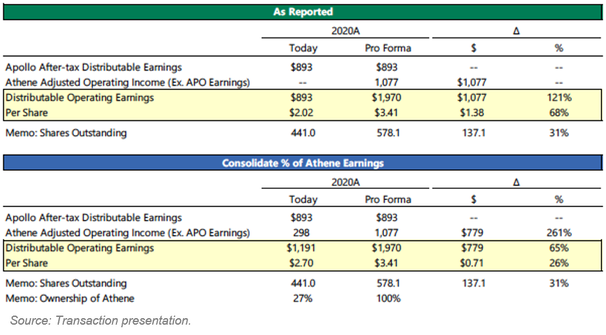

Indeed, from the financial strategic standpoint, Apollo is consolidating 100% of Athene’s earnings for 73% increase in ownership. The full merger creates accretion of $1.38 per share or 68% on 2020 combined after-tax earnings, and the enlarged company’s earnings are expected to be neutral to positive.

Indeed, from the financial strategic standpoint, Apollo is consolidating 100% of Athene’s earnings for 73% increase in ownership. The full merger creates accretion of $1.38 per share or 68% on 2020 combined after-tax earnings, and the enlarged company’s earnings are expected to be neutral to positive.

According to the two companies “, this is about harnessing Apollo’s unique ability to generate excess returns at every point across the risk/reward spectrum (yield, hybrid, opportunistic) for the benefit of our insurance and asset management clients.”

Indeed, both are growth companies that provide products and services, investment returns and retirement income, that are in high demand and powered by market and demographic trends. The merger will ultimately create capital and alignment to scale origination and rationalize ownership of existing platforms, while allowing more value to be derived from the assets the companies originate.

On another note, the simpler regulatory profile and corporate structure, together with the enhanced credit/rating profile and the greater float and share liquidity, will benefit the enlarged financial powerhouse. Indeed, among the strengths of the combined company lies the very low integration risk associated with the continuity of the established management, the fact that there will be no consolidation and both organizations will continue to exist, and the instance for which there has always been an ongoing strong relationship and communication between the two.

All in all, the merger represents a considerable opportunity for Apollo given the fact that Athene is undervalued and that the balance sheet strength will enable further higher and predictable growth. This adds up to the significant combined earnings power, the fact that it will be a highly accretive transaction with low risk given the complete alignment between the two companies, the attractive cash yield (dividend will be set at $1.60 per share and will grow with earnings), the increased float and better trading characteristics and strong ratings.

Market Reaction

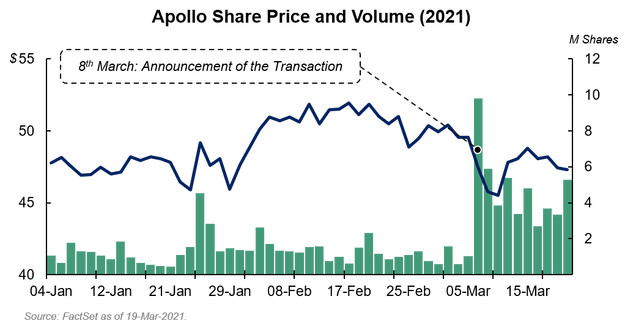

For both companies, the market reaction to the deal was not particularly strong and positive.

Indeed, both are growth companies that provide products and services, investment returns and retirement income, that are in high demand and powered by market and demographic trends. The merger will ultimately create capital and alignment to scale origination and rationalize ownership of existing platforms, while allowing more value to be derived from the assets the companies originate.

On another note, the simpler regulatory profile and corporate structure, together with the enhanced credit/rating profile and the greater float and share liquidity, will benefit the enlarged financial powerhouse. Indeed, among the strengths of the combined company lies the very low integration risk associated with the continuity of the established management, the fact that there will be no consolidation and both organizations will continue to exist, and the instance for which there has always been an ongoing strong relationship and communication between the two.

All in all, the merger represents a considerable opportunity for Apollo given the fact that Athene is undervalued and that the balance sheet strength will enable further higher and predictable growth. This adds up to the significant combined earnings power, the fact that it will be a highly accretive transaction with low risk given the complete alignment between the two companies, the attractive cash yield (dividend will be set at $1.60 per share and will grow with earnings), the increased float and better trading characteristics and strong ratings.

Market Reaction

For both companies, the market reaction to the deal was not particularly strong and positive.

Indeed, on March 8th, Apollo’s shares dropped by 4.24%. This plunge in the company’s stock price is attributable to investors’ scepticism, caused by the long-term issues tied to the close and long-standing relationship between the two companies - scepticism plumped in particular by the extensive influence that Apollo has maintained over the years on Athene. After the announcement date, the company’s shares remained rather flat in the following week, with analysts’ mean consensus increasing only slightly - 1.94% increase (from $56.14 to $56.92).

On the other hand, Athene’s share prices rose by 5.97% on the day of the announcement of the merger - however, still significantly below the premium the asset manager offered for Athene. The fact that also Athene’s shares stabilized in the following week is another sign of investors’ scepticism. On another note, analysts’ target price mean consensus for Athene increased more, specifically by 4.69% (from $55 to $57.58).

Advisors

In the on-going process, Apollo is advised by Perella Weinberg Partners LP, Barclays Capital Inc., Paul, Weiss, Rifkind, Wharton & Garrison LLP, Simpson Thacher & Bartlett LLP and Skadden, Arps, Slate, Meagher & Flom LLP, while Houlihan Lokey Capital Inc., Lazard Frères & Co. LLC, Latham & Watkins LLP and Sidley Austin LLP are working for Athene.

BSCM would like to thank FactSet for giving us access to their platform and providing charts and data.

Clara Carluccio

Francesco Laurina

George Aris Lavas

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Sources:

Advisors

In the on-going process, Apollo is advised by Perella Weinberg Partners LP, Barclays Capital Inc., Paul, Weiss, Rifkind, Wharton & Garrison LLP, Simpson Thacher & Bartlett LLP and Skadden, Arps, Slate, Meagher & Flom LLP, while Houlihan Lokey Capital Inc., Lazard Frères & Co. LLC, Latham & Watkins LLP and Sidley Austin LLP are working for Athene.

BSCM would like to thank FactSet for giving us access to their platform and providing charts and data.

Clara Carluccio

Francesco Laurina

George Aris Lavas

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Sources:

- FactSet

- Fitch Rating

- Apollo public disclosure

- Athene public disclosure

- Transaction official presentation

- FT