|

Reddit IPO: profitability uncertainty amidst initial investors optimism - April 9th 2024

In the wake of Reddit's recent IPO, shares initially surged 48%, reflecting investors' enthusiasm. However, beneath the surface of this market optimism a crucial question: can Reddit achieve profitability? This article takes an in-depth look at Reddit's IPO journey, analyzing its financial performance, challenges and prospects for future profitability Shifts in the Automotive Landscape: Unraveling the UAW Strike and its Ripple Effects on Wages, Industry Dynamics, and Global Economic Outlook - December 2023

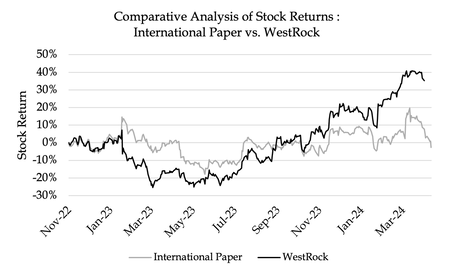

The UAW strike has conducted transformative changes in the automotive sector. This article explores the impact on workers, the economy, and the global automotive landscape, touching on wage disputes, evolving labor relations, and implications for the industry's transition to electric vehicles (EVs). We examine the broader economic consequences, outlining the challenges and opportunities ahead for the automotive sector. Navigating Market Trends: Core CPI Deceleration, Tech Giants' Influence, and Emerging Risks in the Evolving Financial Landscape of 2023-2024

The "Magnificent Seven" tech giants - Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia, and Tesla - drove a 19% S&P 500 increase in 2023, reaching a nearly $4 trillion market cap. Despite a 71% return, concerns about high expectations and market concentration linger. The current P/E ratio is lower than historical norms, indicating financial strength, but caution is urged due to potential 2024 economic risks. Find out more on our in-depth analysis on the Financial Landscape. Arctos Partners take a turn into F1 with the acquisition of a minority stake in Aston Martin Racing- December 7th 2023

Aston Martin Racing sold a share to Arctos Partners, leveraging Lawrence Stroll's success. Stroll, propelled by a fashion empire, led the purchase of Aston Martin F1 in 2020. This mirrors the brand's historical ties to F1. Arctos' move aligns with Formula One's growing investment allure, promising value amplification for Aston Martin Racing and validating Stroll's strategic foresight. Amgen acquisition of Horizon Therapeutics: A historical mark in the healthcare industry - November 13th, 2023

Amgen's strategic objective of providing innovative medicines while enhancing its leading inflammation portfolio in response to the latest developments and incentives in the pharmaceutical industry has led the acquirer to initiate a deal that could potentially improve the company's efficiency and expand its services. |

|

Argentina's Bond Market Turbulence: An In-Depth Analysis of Economic Challenges and the Role of Bonds - November 9th, 2023

In 2022, global inflation rose due to the pandemic and geopolitical events, impacting Argentina's economy. The nation's elections were marked by inflation concerns and a proposal to adopt the US dollar. An unexpected surge in bond yields added uncertainty. Argentina's political and economic future hinges on the election's second round, with investor outlook and bond prices affected by the country's history of defaults and political uncertainty. |

|

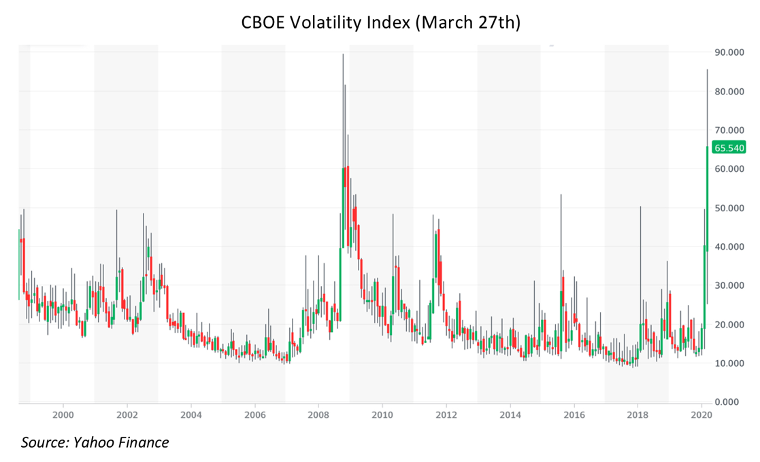

The incredible growth of the Jamaican Stock Market - November 3, 2019

The Jamaican Stock Market has been one of the best performer stock indexes in 2019. Its performance is even more impressive if we look over the last five years, with capital gains above 500%. But what are the reasons behind this incredible stock market boom? How was it possible for a market with a total capitalization smaller than the one of Chipotle Mexican Grill Inc. to become one of the hottest markets in the world? |

|

Houston, we don't have a problem here - April 18, 2019

On March 10, 2019, a Boeing 737 Max of Ethiopian Airlines from Addis Ababa to Nairobi crashed few minutes after the departure, killing 157 people. Similarities have been found with another 737 Max flight that 5 months before crashed near Indonesia. What could be the effects on such an aerospace giant? |

|

Uber in talks to acquire Deliveroo - December 6, 2018

Last year, Deliveroo raised $482 million in venture funding, in a deal valuing the company at around $2 billion. Why is Deliveroo trying to raise so much cash? It is supposedly an effort to strengthen its hand for prospective negotiations with Uber by increasing its valuation. As a matter of fact, Uber is targeting the UK’s food delivery market with plans to link up with Deliveroo. |