|

Empowering Growth: Prysmian's Acquisition of Encore Wire - 10th May 2024

On April 15th, the cable market saw a major development: Prysmian Group, a global leader in cable manufacturing and energy solutions, acquired Encore Wire. Based in Milan, Prysmian aims to bolster its North American presence through this strategic move, tapping into Encore Wire's expertise. For Encore Wire, the acquisition opens doors to Prysmian's global network for future growth. Telecom Italia's Power Struggle: Bluebell and Merlyn's Attempt to Reshape the Board - 30th April 2024

In the past weeks, a fierce boardroom battle unfolded at Telecom Italia (TIM), as the activist hedge funds Bluebell Capital Partners and Merlyn Advisors proposed two different slates of candidates for the election of the new board of the Italian telecom giant. The decision of Vivendi to abstain from the vote was crucial for the election of the list proposed by the exiting board and the re-appointment of Labriola as CEO. Tod’s Group Delisting: A Standard Private Equity Investment or a Strategic Move by LVMH? - 16th April 2024

Tod's Group plans to leave the Milan Stock Exchange through a private tender offer by L Catterton, the international private equity firm backed by LVMH. The delisting has led to several questions about the real intentions of LVMH, as the luxury group already has a significant stake in the Italian group, and the fair pricing of the transaction. Boom in the number of IPOs in the Middle East - 17th May 2023

2022 was a year to forget for IPOs across most major markets, with listing activity dropping sharply amid global economic turmoil and stock market volatility. Yet during this global market slowdown the Middle East hit the gas, literally, having raised over USD 18 billion last year with the region’s boom estimated to continue throughout the entire 2023. UK - The Outlier in Inflation Data - 9th May 2023

Most of the world’s countries have recently been struggling with high inflation rates, due to the adverse macroeconomic events which have taken place in the last years. However, there is one country in particular which seems to struggle more than others: the United Kingdom. Why is such a powerful economy still trapped in the inflation spiral? What factors have led to this situation? |

|

How energy transition is reshaping M&A activity: A focus on the Spanish market - 20th April 2023

Lately, there has been a significant change in primary energy consumption due to the Russian invasion of Ukraine. Nations, trying to diversify their sources of energy, are pivoting towards renewable energy. In particular, thanks to its strong private and public market, a main character is emerging in the European scene: Spain. |

|

Oracle - Cerner: the acquisition of the year - 30th December 2021

On the 20th December 2021, Oracle Corporation completed its acquisition of Cerner Corporation for approximately $30bn. The acquisition of Cerner is now Oracle’s largest ever deal since the firm acquired cloud computing company NetSuite, in 2016 for $9.3 bn. Many believe that this will turn out to be one of 2021’s most significant acquisitions. |

|

European ETF marketplace: industry overview and analysis of key players - 4th December 2021

In the past few months the European ETF market has witnessed a high resurgence in demand, with investors being particularly keen on “value” stock ETFs, showing an incredible recovery after the outflows witnessed in the first quarter of 2020. Explore a detailed analysis on the latest trends in Europe ETF marketplace |

|

OVHCloud IPO: The debut of the future European cloud champion on France's stock exchange - 14th November 2021

On October 5th, 2021 the French cloud provider OVHCloud announced the launch of its IPO with the objective of raising around €350 million in its debut on the Euronext Paris market. With top U.S. firms currently retaining the majority of the cloud computing market share, OVHCloud is uniquely positioned to become the next European pure-play cloud champion |

|

Italy's biggest banking problem remain unresolved: the failure in MPS-Unicredit deal - 8 November, 2021

Monte dei Paschi di Siena started experiencing major issues with its financial positions leading in 2017, urging more than 5 billions in government assistance, which became its main stakeholder. Failure in negotiations between MPS and Unicredit leaves Italy unable to complete the restructuring of its banking system which started six years ago. Explore the potential of the missed deal, the causes, and repercussion on the system. |

|

European gas prices up: time to turn the heating off ? - 5 November, 2021

In recent times, following the global health crisis of Covid-19, natural gas prices on continental Europe have reached levels not seen for years. Explore the effect on electricity pricing and on fuel-based economies, the contributing factors and investors opinions leading this trend. |

|

The Nordic Laundromat: Scandinavian banks involved in Baltic money-laundering- April 9, 2019

Two CEOs fired and reputations critically damaged, billions of Euros in criminal funds with connections to Russia laundered, and huge amounts of wealth destroyed. This describes the current outcome of one of the biggest money-laundering scandals in modern time. |

|

The Future of the Renault-Nissan Alliance - December 12, 2018

Carlos Ghosn, the mastermind behind the Nissan-Renault-Mitsubishi alliance, was arrested on 19th of November. The sudden fall of such a monumental figure will undoubtedly produce reverberations across the chess board. |

|

Agribusiness: Africa's new gold? - December 10, 2018

It is considered to be one of Africa’s most rapidly emerging industries, valued at over $300 billion. With the United Nations expecting the business to triple its market value to over one trillion USD by 2030, agribusiness has often been referred to as ‘Africa’s new gold’. |

|

Will the German car industry decline affect ECB policies? - November 29, 2018

Car industry is one of the most important sectors of the German economy, which in turn accounts for one third of the entire eurozone aggregate output. Quarterly reports of firms in the sector for the third quarter of 2018 have shown a significant decline in profitability. |

|

A turning point for the German automobile industry - November 17, 2018

Tesla and its enfant terrible Elon Musk have brought massive disruption to the car industry by introducing its line of electric vehicles (EVs) that might mark the ultimate advent of vehicles powered purely by electricity to ordinary consumers. |

|

Italian Banks at Risk - November 12, 2018

A shudder political framework inaugurated an arduous period for Italian banks which are strained by the increasing spread of Italian 10-year debt over equivalent German bonds that is around 300 basis points. |

|

The struggles of European low-cost carriers - November 6, 2018

The European airline industry has seen a surge of bankruptcies in recent times. Three low-cost carriers, including Danish Primera Air, Cypriot based Cobalt Air and SkyWork Airlines filed for bankruptcy over the course of the last month alone. |

|

Risk of Default on Foreign Debt in Zambia - October 27, 2018

Last month, Xi Jinping, China’s president, announced that China would offer $60 billion in new funding to Africa. These funds will be used to finance public infrastructures in the target countries, in order to foster economic development; however, they come with some warnings, first of which is China’s interest in using such loans to control resources and political systems, in view of its global ambitions. |

|

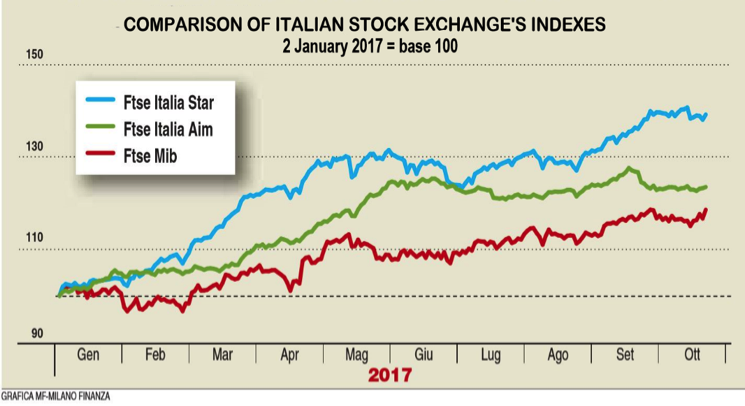

SPACs in the Italian market: what should we expect next? - October 23, 2018

SPACs as investment vehicles will not be enough to solve the chronic Italian scarcity of IPOs in regulated markets, as the reasons of this phenomenon are profoundly intrinsic to the way capitalism has evolved in our country. |

Sainsbury’s and Asda close to £15bn merger - May 12, 2018

A new, multibillion deal might fundamentally change Britain’s supermarket business. Again.

A new, multibillion deal might fundamentally change Britain’s supermarket business. Again.

|

Norway oil fund to undertake structural changes to face new challenges - Mar 7, 2017

Established in 1990 as the Petroleum Fund of Norway, the Norwegian Government Pension Fund Global, generally known as “The Oil Fund", has been created to preserve and invest Norway’s oil revenues for the generations to come. |