Foreign capital swept through A-share market in 2018 and the speed and scale continued to accelerate in 2019.

Recently, the foreign exchange bureau announced that the total investment capacity allowed for qualified foreign institutional investors (QFII) increased from US$150 billion to US$300 billion. At present, domestic and foreign officials are generally optimistic about foreign investment this year. According to Wind data, as of January 30 (the February trading day was included for the Spring Festival holiday), the total amount of funds flowing in was 52.024 billion yuan, which was nearly three times higher than the inflow of 16.143 billion yuan in December 2018. The improvement of the QFII channel can avoid the congestion caused by the unexpected inflow of funds. In the future, less restriction on foreign-funded restrictive policies is a widely-accepted trend.

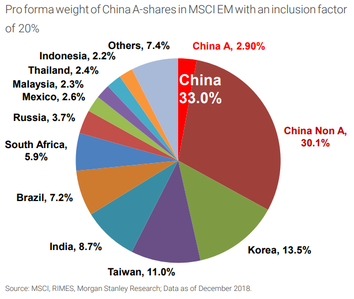

On February 12, 2019, MSCI announced its additional incorporation of 17 A-share companies, including Industrial Fulian (601138.SH), Meituan Review (3690.HK) and Xiaomi Group (1810. HK), etc. The total number of shares of Midea Group (000333.SZ), the largest Chinese electrical appliance manufacturer, held by QFII/RQFII/Shenzhen Stock Connect investors reached 1.719 billion shares, accounting for 26% of total proportion.

"Not only MSCI, this year A shares will also be officially included in the FTSE index. Foreign capital will be an incremental fund that can not be ignored in the dominant market rhythm." Hangzhou Cao Gang, investment director of Zehao Investment, said in an interview with reporters last December.

In terms of industry configuration, foreign investment is concentrated in the consumer and financial sectors, with particular preference to the food and beverage industry. Take the Shanghai-Shenzhen Stock Connect, the main channel for foreign investment, as an example. As of February 1 this year, the total position of the top five heavy warehouses reached 57.8%, and the position of food and beverage in the first heavyweight industry was close to 20%.

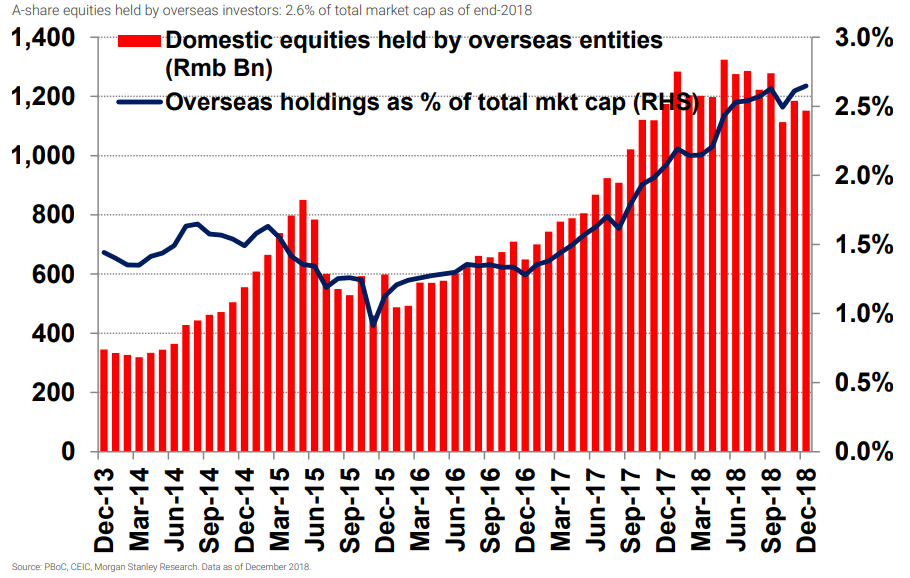

We believe that there are three main reasons: First, under the trend of internationalisation, China, as the world's second largest economy, currently accounts for a low proportion of global asset allocation, with foreign capital accounting for less than 3%. In South Korea and Japan, the allocation of foreign capital has stabilized at 15-30%. Second, the process of opening up the A-shares has been accelerating. Third, in the context of continuous market adjustments throughout the year, the valuation of A-shares is close to the bottom of the history.

Recently, the foreign exchange bureau announced that the total investment capacity allowed for qualified foreign institutional investors (QFII) increased from US$150 billion to US$300 billion. At present, domestic and foreign officials are generally optimistic about foreign investment this year. According to Wind data, as of January 30 (the February trading day was included for the Spring Festival holiday), the total amount of funds flowing in was 52.024 billion yuan, which was nearly three times higher than the inflow of 16.143 billion yuan in December 2018. The improvement of the QFII channel can avoid the congestion caused by the unexpected inflow of funds. In the future, less restriction on foreign-funded restrictive policies is a widely-accepted trend.

On February 12, 2019, MSCI announced its additional incorporation of 17 A-share companies, including Industrial Fulian (601138.SH), Meituan Review (3690.HK) and Xiaomi Group (1810. HK), etc. The total number of shares of Midea Group (000333.SZ), the largest Chinese electrical appliance manufacturer, held by QFII/RQFII/Shenzhen Stock Connect investors reached 1.719 billion shares, accounting for 26% of total proportion.

"Not only MSCI, this year A shares will also be officially included in the FTSE index. Foreign capital will be an incremental fund that can not be ignored in the dominant market rhythm." Hangzhou Cao Gang, investment director of Zehao Investment, said in an interview with reporters last December.

In terms of industry configuration, foreign investment is concentrated in the consumer and financial sectors, with particular preference to the food and beverage industry. Take the Shanghai-Shenzhen Stock Connect, the main channel for foreign investment, as an example. As of February 1 this year, the total position of the top five heavy warehouses reached 57.8%, and the position of food and beverage in the first heavyweight industry was close to 20%.

We believe that there are three main reasons: First, under the trend of internationalisation, China, as the world's second largest economy, currently accounts for a low proportion of global asset allocation, with foreign capital accounting for less than 3%. In South Korea and Japan, the allocation of foreign capital has stabilized at 15-30%. Second, the process of opening up the A-shares has been accelerating. Third, in the context of continuous market adjustments throughout the year, the valuation of A-shares is close to the bottom of the history.