Introduction

The third quarter has been very volatile, acting as a round trip for U.S. stock investors. Indeed, strong earnings had lifted U.S. stocks in the run-up to August, thanks to the Federal Reserve (Fed) confirmation about its hesitance in tightening policy too fast. But later in the quarter, growth and inflation concerns caused the market to fall back to where it had been three months earlier. Despite a volatile third quarter, BlackRock Inc., a leading company in the sectors of investment management, risk management and advisory services with institutional and retail clients worldwide, had achieved record-breaking results. Its revenues had climbed to record highs and its assets under management (AUM) slightly declined but is still close to an industry peak of $9.5tn.

Industry performance

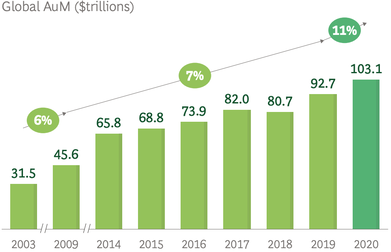

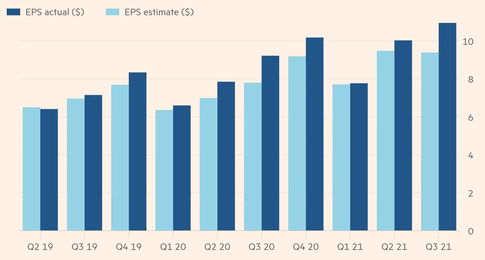

Despite the heightened economic uncertainty and the initial shock that the pandemic caused, markets around the globe concluded the year with healthy returns, as the total value of assets under management by the global asset management industry reached $103 trillion by the end of 2020, with an increase of 11% with respect to $93 trillion in 2019.

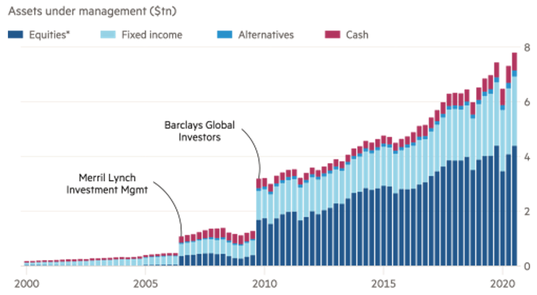

One of the most important investment companies is Vanguard Group Inc., which started 2021 with over $7.2tn AUM. The firm has benefitted from its low-cost investment funds, which recruited more than 30m clients since its foundation. But the boost in its financial performance was given by the shift of investors into index-tracking ETFs, which can be satisfied by its services, like passive investing in ETFs, mutual funds and stocks. Those needs were satisfied by Vanguard Group Inc. and its greatest competitor, BlackRock, the leading firm in the sector of asset management, allowing them to leave the rest of the companies a long way behind. The astonishing performance of BlackRock was due to the commitment of the firm to invest in high growth opportunities and industry-leading innovation, as well as adopting environmental strategies. This was further favoured by the continuous demand of clients for BlackRock’s insights and advice and the strong demand for ESG, which generated a high inflow across its sustainable active and index strategies. Blackrock has witnessed remarkable growth in assets under management thanks in particular to iShares exchange-traded funds (ETFs), through which BlackRock provides whole portfolio solutions to individuals through a single investment and reduced fund fees, that increased from $500Bn in 2009 to $2.7Tn in 2021.

The third quarter has been very volatile, acting as a round trip for U.S. stock investors. Indeed, strong earnings had lifted U.S. stocks in the run-up to August, thanks to the Federal Reserve (Fed) confirmation about its hesitance in tightening policy too fast. But later in the quarter, growth and inflation concerns caused the market to fall back to where it had been three months earlier. Despite a volatile third quarter, BlackRock Inc., a leading company in the sectors of investment management, risk management and advisory services with institutional and retail clients worldwide, had achieved record-breaking results. Its revenues had climbed to record highs and its assets under management (AUM) slightly declined but is still close to an industry peak of $9.5tn.

Industry performance

Despite the heightened economic uncertainty and the initial shock that the pandemic caused, markets around the globe concluded the year with healthy returns, as the total value of assets under management by the global asset management industry reached $103 trillion by the end of 2020, with an increase of 11% with respect to $93 trillion in 2019.

One of the most important investment companies is Vanguard Group Inc., which started 2021 with over $7.2tn AUM. The firm has benefitted from its low-cost investment funds, which recruited more than 30m clients since its foundation. But the boost in its financial performance was given by the shift of investors into index-tracking ETFs, which can be satisfied by its services, like passive investing in ETFs, mutual funds and stocks. Those needs were satisfied by Vanguard Group Inc. and its greatest competitor, BlackRock, the leading firm in the sector of asset management, allowing them to leave the rest of the companies a long way behind. The astonishing performance of BlackRock was due to the commitment of the firm to invest in high growth opportunities and industry-leading innovation, as well as adopting environmental strategies. This was further favoured by the continuous demand of clients for BlackRock’s insights and advice and the strong demand for ESG, which generated a high inflow across its sustainable active and index strategies. Blackrock has witnessed remarkable growth in assets under management thanks in particular to iShares exchange-traded funds (ETFs), through which BlackRock provides whole portfolio solutions to individuals through a single investment and reduced fund fees, that increased from $500Bn in 2009 to $2.7Tn in 2021.

Source: BCG report of the Global Asset Managment Industry

BlackRock Inc. recent performance

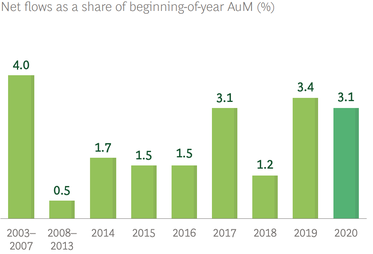

During 2021, the overall assets under management at BlackRock reached $9.46tn at the end of September, up 21% from last year but below the peak of $9.49tn reached in June. This made it the top player in the asset management industry, with Vanguard following with $8.3tn of AUM at the end of August. Even though some analysts forecasted that BlackRock would have smashed the $10tn AUM milestone this quarter, less accommodating market conditions stopped the company from reaching this objective, making the accomplishment a 2022 event.

The IMF recently decided to introduce tougher regulation of investment funds to stem the threat of asset fire sales during periods of market stress (resiliency-improvement of the financial system) due to the presence of companies like BlackRock in exchange-traded funds (ETF) and mutual funds.

The world’s top asset manager managed to reach a 16% increase in revenue for the third quarter over the past year, shifting from $4.4bn to a record $5.1bn. This accomplishment was reached thanks to higher client demand for actively managed and sustainable funds and higher technology services revenue, which offset lower performance fees.

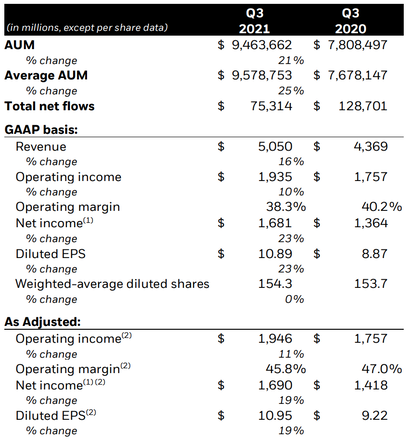

Net income raised by 23% over the past year, passed from $1.36bn to $1.68bn. A higher share of income is non-operating in nature, driven in part by a drop in performance fees. Indeed, the operating margin fell to 38.3% from the previous 40.2%. Adjusted earnings per share reached $10.95, exceeding the forecast of Wall Street of $9.39, boosted also by higher non-operating income deriving from gains in strategic minority investments.

Broad-based growth in their active platform and their ETF product categories boosted the company’s long-term investment flows to $98bn. Another meaningful source of growth for the asset manager is its environmental, social, and governance strategies, which attracted $31bn of net inflows with its sustainable products. BlackRock shares are up 18.5% for the year and have surpassed the 16% rise in the S&P 500.

BlackRock Inc. recent performance

During 2021, the overall assets under management at BlackRock reached $9.46tn at the end of September, up 21% from last year but below the peak of $9.49tn reached in June. This made it the top player in the asset management industry, with Vanguard following with $8.3tn of AUM at the end of August. Even though some analysts forecasted that BlackRock would have smashed the $10tn AUM milestone this quarter, less accommodating market conditions stopped the company from reaching this objective, making the accomplishment a 2022 event.

The IMF recently decided to introduce tougher regulation of investment funds to stem the threat of asset fire sales during periods of market stress (resiliency-improvement of the financial system) due to the presence of companies like BlackRock in exchange-traded funds (ETF) and mutual funds.

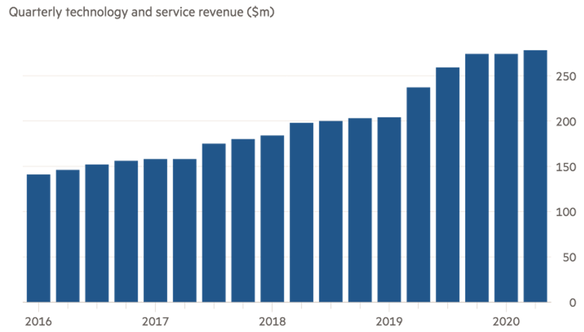

The world’s top asset manager managed to reach a 16% increase in revenue for the third quarter over the past year, shifting from $4.4bn to a record $5.1bn. This accomplishment was reached thanks to higher client demand for actively managed and sustainable funds and higher technology services revenue, which offset lower performance fees.

Net income raised by 23% over the past year, passed from $1.36bn to $1.68bn. A higher share of income is non-operating in nature, driven in part by a drop in performance fees. Indeed, the operating margin fell to 38.3% from the previous 40.2%. Adjusted earnings per share reached $10.95, exceeding the forecast of Wall Street of $9.39, boosted also by higher non-operating income deriving from gains in strategic minority investments.

Broad-based growth in their active platform and their ETF product categories boosted the company’s long-term investment flows to $98bn. Another meaningful source of growth for the asset manager is its environmental, social, and governance strategies, which attracted $31bn of net inflows with its sustainable products. BlackRock shares are up 18.5% for the year and have surpassed the 16% rise in the S&P 500.

Source: BlackRock Q3 earnings release

BlackRock’s performance driver

Behind Blackrock’s outstanding performance – just in Q3, net income increased 23% up to US$1.68bn, EPS touched US$10.95, despite US$9.39 forecasts – there are 3 major performance drivers with the possibility of shaping Blackrock’s growth also in the future.

BlackRock extends eps positive streak. Source: Bloomberg

Passive investments & ETFs

Since the advent of the 21st century, the macroeconomic scenario has created favorable conditions for passive investment products. BlackRock has been among the first to offer a wide array of passive products to gain market share in this skyrocketing niche.

Nowadays, BlackRock is the undisputed most valuable player in passive investment strategies, as over half of the yearly revenue was the result of passive products. In particular, BlackRock has heavily betted on ETFs and index investment options for institutional and retail investors. ETFs are baskets of stocks based on themes, giving investors a wide range of holdings at a low cost (on average, 30 cents every 1000 thousand dollars). In this sector, iShares – which was bought in 2009 from Barclays - leads the way and has surpassed the US$3 trillion milestones. During the yearly investor conference, BlackRock announced the expectations of a generational shift towards the ETF space, which is expected to almost double to US$15 trillion by 2024-25. In particular, great attention is put towards sustainable ETFs, thanks to almost US$50 billion in inflows for all of 2020. BlackRock is positioning itself as a socially conscious voice of the financial industry. One of the central components of the firm’s program is to issue funds with strict ESG standards on business conduct, as Blackrock is four times the size of the second biggest player in sustainable ETFs, managing over US$120 billion in this specific niche. Sustainable investment strategies saw over $400bn of inflows in 2020, and BlackRock expects that sustainable ETFs will triple (US$1.2 trillion) during the next decade. Nowadays. “The growing number of ESG ETFs enables investors to do broad-based ESG investing as well as enabling customized portfolios around specific areas, such as climate investing or investing for net-zero,” Espeskog (Co-head of sustainable investing Apac) said. Sustainable investing in the future: 3 in 4 sustainable equity funds beat their Morningstar category average in 2020. The annualized performance of IShares ESG Aware ETF (+18.95% since the beginning of 2017) has done better than both the S&P 500 Index and the MSCI USA Index (respectively, +17.97%, and +18.51%).

Aladdin

CEO Larry Fink stated that the company’s investment platform allows BlackRock to be in the position to constantly meet the clients’ changing needs, positioning the firm ahead of the curve both attracting new investors and retaining old ones. This is made a reality thanks to Aladdin, BlackRock’s investment and risk management technology offering. It is based on a Monte Carlo-style algorithm to uncover scenarios in which investments could fail. Blackrock’s tech-driven approach proved successful over time, as witnessed by their constant increase in assets AUM, and revenues. It collects data from public markets and private markets and is the same technology the firm uses for its investments. BlackRock has been working on Aladdin Climate, a technology solution for investors to dive into climate risk analytics. It provides a measure of the risks at the asset and portfolio levels, gauging the impact from physical risks like extreme weather, new technologies, energy supply.

Moreover, BlackRock partnered with Baringa to increase the efficiency of its climate analytics and risk management tools. The partnership leverages Baringa's climate transition risk models with Aladdin's financial and physical risk models to help investors customize their climate risk exposures.

Aladdin powers BlackRock’s tech revenue to record high. Source: BlackRock

The scale

BlackRock's scale is, without any doubt, the biggest one and this has helped to achieve better stickiness of client assets. It has allowed BlackRock to retain its clients as they have no reason to shift to a different player in the industry when BlackRock offers everything. Its scale has proven attractive also from an institutional point of view. Amid Coronavirus’s outbreaks, the Federal Reserve asked BlackRock to direct approximately US$10 billion in bond purchases. Tyler Gellasch (Healthy Markets Association) declared that “This is the Fed tapping Goliath for help. BlackRock is so large that its investment decision impacts the market like a federal agency”. BlackRock dealt with the execution of the trades for the purchases of commercial mortgage-backed securities, secured by multi-family home mortgages. The company managed two programs concerning bond-buying and was responsible for a facility backed by the Federal Reserve for the purchase of new investment-grade bonds from American firms. In parallel, BlackRock oversaw a further vehicle to purchase already issued investment-grade bonds. The FED has included ETFs in its purchasing program but stated that “it will not purchase more than 20% of the assets of any particular ETF”. Larry Fink’s perfect machine is, without any doubt, the biggest winner of Federal Reserve purchases of corporate bonds ETFs taking into account that the large purchase by the Fed has been iShares iBoxx$ Investment Grade Corporate Bond ETF (LQD) and that Blackrock already declared that it won’t change its management fees on Fed’s purchases. BlackRock used extensively Aladdin in these tasks, monitoring more than US$20 trillion in assets.

The scale

BlackRock's scale is, without any doubt, the biggest one and this has helped to achieve better stickiness of client assets. It has allowed BlackRock to retain its clients as they have no reason to shift to a different player in the industry when BlackRock offers everything. Its scale has proven attractive also from an institutional point of view. Amid Coronavirus’s outbreaks, the Federal Reserve asked BlackRock to direct approximately US$10 billion in bond purchases. Tyler Gellasch (Healthy Markets Association) declared that “This is the Fed tapping Goliath for help. BlackRock is so large that its investment decision impacts the market like a federal agency”. BlackRock dealt with the execution of the trades for the purchases of commercial mortgage-backed securities, secured by multi-family home mortgages. The company managed two programs concerning bond-buying and was responsible for a facility backed by the Federal Reserve for the purchase of new investment-grade bonds from American firms. In parallel, BlackRock oversaw a further vehicle to purchase already issued investment-grade bonds. The FED has included ETFs in its purchasing program but stated that “it will not purchase more than 20% of the assets of any particular ETF”. Larry Fink’s perfect machine is, without any doubt, the biggest winner of Federal Reserve purchases of corporate bonds ETFs taking into account that the large purchase by the Fed has been iShares iBoxx$ Investment Grade Corporate Bond ETF (LQD) and that Blackrock already declared that it won’t change its management fees on Fed’s purchases. BlackRock used extensively Aladdin in these tasks, monitoring more than US$20 trillion in assets.

Source: BlackRock

.

Long-Term Outlook

Looking ahead, BlackRock’s strategy aims to continuously place focus on a consumer-centric approach, through investing in high growth opportunities incorporating new investment choices, data analytics and technology enhancement, as well as innovation in order to secure an industry-leading position. Amongst the drive growth engines, BlackRock aims to lead as a whole portfolio adviser through offering over 1,100 iShares ETFs. In addition, BlackRock aims to achieve growth through continuous drive in developing technologies and its Aladdin platform, as well as becoming a global leader in sustainable investing within private markets. As of November 2020, 100% of Blackrock’s active portfolios and advisory strategies incorporate environmental, social and governance (ESG) factors. As well as creating Aladdin Climate with over 1,000 ESG metrics in order for financial institutions and investors to quantify climate risk, the increased focus on sustainable investment strategies will place BlackRock in a favourable position within the sustainable investing space.

Future of the Asset Management Industry

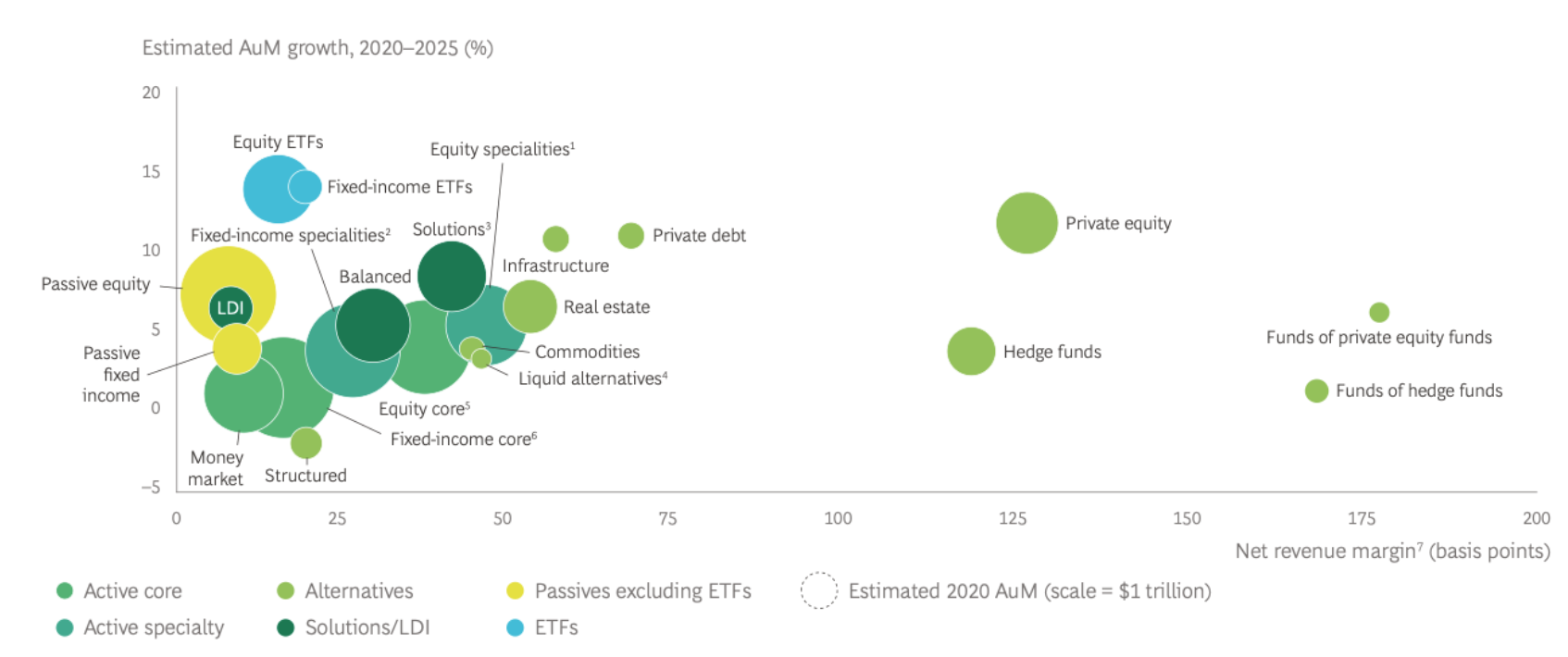

The new realities we are facing as we shift into a post-pandemic world present several challenges within the industry in costs and competition, whilst simultaneously bringing opportunities for growth for certain players. While the pandemic has accelerated operating model innovation, digital leaders have been seen to significantly outperform laggards, giving rise to a “digital divide”. Asset managers having the strongest digital and remote capabilities witnessed sales and service satisfaction rise by four percentage points, compared to their performance a year earlier. The asset management business will be entering an era that will involve structural trends, with shifts in product strategies and go-to-market strategies for new players.

In order to gain a competitive edge, advanced data, analytics and technologies must be incorporated in operations throughout processes in order for asset management firms. The increasing technology advancements have also become a catalyst for new deals, as we see capability-driven M&A such as focusing on tech-based digital analysis, as well as expansions into wealth management, insurance and technology, and cross-border growth. Yet we can also expect an increasing trend of technology-enabled smaller players to thrive in the industry, with efficient operational models, costs and increased flexibility compared to traditional players. In terms of revenues, new asset classes and differentiated products, specifically within private markets and alternatives, will spur growth in the coming years.

Long-Term Outlook

Looking ahead, BlackRock’s strategy aims to continuously place focus on a consumer-centric approach, through investing in high growth opportunities incorporating new investment choices, data analytics and technology enhancement, as well as innovation in order to secure an industry-leading position. Amongst the drive growth engines, BlackRock aims to lead as a whole portfolio adviser through offering over 1,100 iShares ETFs. In addition, BlackRock aims to achieve growth through continuous drive in developing technologies and its Aladdin platform, as well as becoming a global leader in sustainable investing within private markets. As of November 2020, 100% of Blackrock’s active portfolios and advisory strategies incorporate environmental, social and governance (ESG) factors. As well as creating Aladdin Climate with over 1,000 ESG metrics in order for financial institutions and investors to quantify climate risk, the increased focus on sustainable investment strategies will place BlackRock in a favourable position within the sustainable investing space.

Future of the Asset Management Industry

The new realities we are facing as we shift into a post-pandemic world present several challenges within the industry in costs and competition, whilst simultaneously bringing opportunities for growth for certain players. While the pandemic has accelerated operating model innovation, digital leaders have been seen to significantly outperform laggards, giving rise to a “digital divide”. Asset managers having the strongest digital and remote capabilities witnessed sales and service satisfaction rise by four percentage points, compared to their performance a year earlier. The asset management business will be entering an era that will involve structural trends, with shifts in product strategies and go-to-market strategies for new players.

In order to gain a competitive edge, advanced data, analytics and technologies must be incorporated in operations throughout processes in order for asset management firms. The increasing technology advancements have also become a catalyst for new deals, as we see capability-driven M&A such as focusing on tech-based digital analysis, as well as expansions into wealth management, insurance and technology, and cross-border growth. Yet we can also expect an increasing trend of technology-enabled smaller players to thrive in the industry, with efficient operational models, costs and increased flexibility compared to traditional players. In terms of revenues, new asset classes and differentiated products, specifically within private markets and alternatives, will spur growth in the coming years.

Double-digit growth is forecasted for ETFs and select private assets. Source: BCG report of Global Asset Managment Industry

As seen in the Figure above, the universe of alternatives is predicted to be a fast-growing segment of global AuM from 2020 - 2025, along with thematic ETFs. New investing levers of growth include multi-asset strategies, non-traditional yield sources, focus on “whole portfolio” solutions and return-oriented private markets strategies. In addition, client demand for deploying capital in a socially responsible manner has led to the increased pressure of sustainability offerings and portfolio construction decisions, with North American asset managers predicted to integrate ESG into 30 percent of their AUM within the next five years.

Conclusion

In conclusion, it is possible to look at the size of Blackrock as the size of BlackRock as a key factor feeding a vicious cycle of increasing efficiency. Indeed, in an hyper-concentrated industry - Just 3 players dominate the ETF Market: BlackRock, Vanguard, and State Street Global Advisors, respectively with 36.9%, 19.4%, 12.5% of market share - where the possibility of differentiation is relatively low, wins over competitors are made (i) attracting investors with low fees, (ii) make clients stick to your services offering a wide range of diversified investment products. The umbrella under which these two necessary conditions to have success fell is the same: have a huge scale.

Moreover, as the importance of digital capabilities plays an ever-increasing role in the asset management industry, BlackRock’s established technology platform Aladdin and continuous technological innovations places the firm in a favourable position within the market to capture robust growth opportunities in the future.

Jasmin Esermann

Andrea de Chiro

Alessandro Chen

Conclusion

In conclusion, it is possible to look at the size of Blackrock as the size of BlackRock as a key factor feeding a vicious cycle of increasing efficiency. Indeed, in an hyper-concentrated industry - Just 3 players dominate the ETF Market: BlackRock, Vanguard, and State Street Global Advisors, respectively with 36.9%, 19.4%, 12.5% of market share - where the possibility of differentiation is relatively low, wins over competitors are made (i) attracting investors with low fees, (ii) make clients stick to your services offering a wide range of diversified investment products. The umbrella under which these two necessary conditions to have success fell is the same: have a huge scale.

Moreover, as the importance of digital capabilities plays an ever-increasing role in the asset management industry, BlackRock’s established technology platform Aladdin and continuous technological innovations places the firm in a favourable position within the market to capture robust growth opportunities in the future.

Jasmin Esermann

Andrea de Chiro

Alessandro Chen