China’s Ant Group – the techfin branch of the Chinese e-commerce giant Alibaba, in which this latter has a 33% stake - was expected to make its market debut on the 5th of November, with an IPO that would have been remembered as the biggest-ever market listing.

Through the dual IPO across Shanghai and Hong Kong, the Ant Group was expected to raise at least $34.4bn, topping the $29.4bn raised in 2019 by oil major Saudi Aramco.

However, two days before the expected debut, Beijing published a draft regulation regarding the roaring micro-lending sector, causing a halt on the Ant’s listing.

According to what declared by China’s foreign ministry spokesman, further inspections on the Alibaba’s techfin integrated platform are aimed at protecting investors’ interest and at “better maintaining the stability of the capital markets”. A broad understanding of the reasons behind this unexpected scrutiny requires to take one step back on the Group’s revenues, analysing Ant’s business lines.

A multi-dimensional Techfin colossus

Formally created in October 2014 from Alibaba’s spinoff, Ant Group (whose Net Income in 2019 was around Rmb2.1bn) traces its origins back to Alipay, the online payment service launched in 2004 by the e-commerce platform Alibaba. Originally conceived as nothing else than an “escrow account” – a service for buyers on Alibaba’s e-commerce site – today Ant Group is the world’s highest-valued FinTech company, with more than 1bn of active users over the past year.

As highlighted by its founder and controller Jack Ma, more than a FinTech company, Ant Group distinguishes itself for being a TechFin colossus: it is a tech, rather than a financial services company, become a real “digital supermarket” of others’ offerings.

Through its four dimensions, Ant has made of China the undisputed leader in digital transactions, changing the way people manage their money and giving entrepreneurs and consumers greater access to loans, in a Country where access to credit is not so obvious and there are still roughly 460m people without formal bank credit histories.

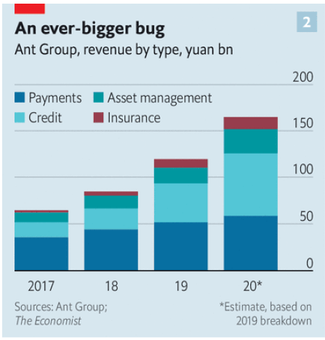

Ant’s business model is multi-dimensional, with the Group deriving revenues from four big sections: payment services, credit, asset management and insurance services.

The original Ant’s segment – the Payment service – unprofitable as a standalone business line – acts today as a conduit drawing users into Ant’s ecosystem of other offerings. With more than 80m merchants every month taking payments through the app, the payment platform is the operating arm necessary to attract, understand and monitor users of any kind. The colossal amount of data gathered through the payment platform is beneficial to the Ant’s two lending arms, the credit platforms Huabei and Jiabei.

With an automated system deciding to grant loans within three minutes, on the basis of credit-risk models relying on more than 3000 variables, Credit has become Ant’s biggest single business segment, accounting for 39% of its revenues in the first half of 2020.

The Credit business – which has become a relevant part of the group’s revenues, as evident from the graph above – is today so big that about 10% of all China’s non-mortgage loans are issued through the platform, arising concerns among Chinese government’s people related to the possible “social risks” connected with this booming micro-lending sector.

The two most recent business lines, Asset management and Insurance, are in continuous expansion and now make up approximately a quarter of revenues.

Through the dual IPO across Shanghai and Hong Kong, the Ant Group was expected to raise at least $34.4bn, topping the $29.4bn raised in 2019 by oil major Saudi Aramco.

However, two days before the expected debut, Beijing published a draft regulation regarding the roaring micro-lending sector, causing a halt on the Ant’s listing.

According to what declared by China’s foreign ministry spokesman, further inspections on the Alibaba’s techfin integrated platform are aimed at protecting investors’ interest and at “better maintaining the stability of the capital markets”. A broad understanding of the reasons behind this unexpected scrutiny requires to take one step back on the Group’s revenues, analysing Ant’s business lines.

A multi-dimensional Techfin colossus

Formally created in October 2014 from Alibaba’s spinoff, Ant Group (whose Net Income in 2019 was around Rmb2.1bn) traces its origins back to Alipay, the online payment service launched in 2004 by the e-commerce platform Alibaba. Originally conceived as nothing else than an “escrow account” – a service for buyers on Alibaba’s e-commerce site – today Ant Group is the world’s highest-valued FinTech company, with more than 1bn of active users over the past year.

As highlighted by its founder and controller Jack Ma, more than a FinTech company, Ant Group distinguishes itself for being a TechFin colossus: it is a tech, rather than a financial services company, become a real “digital supermarket” of others’ offerings.

Through its four dimensions, Ant has made of China the undisputed leader in digital transactions, changing the way people manage their money and giving entrepreneurs and consumers greater access to loans, in a Country where access to credit is not so obvious and there are still roughly 460m people without formal bank credit histories.

Ant’s business model is multi-dimensional, with the Group deriving revenues from four big sections: payment services, credit, asset management and insurance services.

The original Ant’s segment – the Payment service – unprofitable as a standalone business line – acts today as a conduit drawing users into Ant’s ecosystem of other offerings. With more than 80m merchants every month taking payments through the app, the payment platform is the operating arm necessary to attract, understand and monitor users of any kind. The colossal amount of data gathered through the payment platform is beneficial to the Ant’s two lending arms, the credit platforms Huabei and Jiabei.

With an automated system deciding to grant loans within three minutes, on the basis of credit-risk models relying on more than 3000 variables, Credit has become Ant’s biggest single business segment, accounting for 39% of its revenues in the first half of 2020.

The Credit business – which has become a relevant part of the group’s revenues, as evident from the graph above – is today so big that about 10% of all China’s non-mortgage loans are issued through the platform, arising concerns among Chinese government’s people related to the possible “social risks” connected with this booming micro-lending sector.

The two most recent business lines, Asset management and Insurance, are in continuous expansion and now make up approximately a quarter of revenues.

Ant Group’s revenues in the period 2017-2020, divided by business line.

During the recent years, the Credit segment has become a more relevant part of the group’s revenues.

During the recent years, the Credit segment has become a more relevant part of the group’s revenues.

The IPO

Through its dual listing across Shanghai and Hong Kong, Ant Group was expected to issue roughly 3.34bn shares, accounting for 11% of Ant’s total outstanding stock after IPO, split evenly between the two Bourses. For the Shanghai portion, where Ant Group’s shares would have traded on the technology-focused Star market, the price of each stock had been set at Rmb68.80 ($10.26) each, while the price for its Hong Kong shares had been set at HK$80 (US$10.32).

The Alibaba’s affiliate’s IPO has generated such a huge demand among both institutional funds and retail traders that in Shanghai retail bids exceeded the value of the shares on sale by more than 870 times, therefore leading banks to trigger a green-shoe option to increase the offering. A green-shoe option both on the Shanghai and Hong Kong sides of the deal could have taken total funds raised to $39.6bn, therefore exceeding the initial predictions on the listing.

Regulatory concerns on a not-under-control sector: impact on Ant Group’s value

It was mainly the huge participation of retail traders in the IPO of the “CreditTech” giant – with lots of them willing to take on huge amounts of leverage – that has led Beijing to draft a new regulation on the micro-lending sector, with the urgency of re-considering carefully the possible social risks connected with investing in a booming sector no more under the Party’s Control.

Indeed, it is true that the Ant’s Credit business has been expanding over the recent years, giving entrepreneurs and consumers easier access to loans, but it is also true that this has been possible thanks to an asset-light business model, based on the securitisation and elimination from the Balance Sheet of around 98% of the loans generated. In other words, only 2% of loans granted remain in Ant’s balance sheet and this arises huge concerns on the eventual social impact of higher default levels of loans (the level of default on Ant’s loans has always been low in the recent years, but increasing concerns are related with the realistic scenario of an acute slowdown of Chinese economic).

If the new rules were to be implemented, Ant Group should submit a new IPO prospectus in Hong Kong and should respond to Chinese regulators’ demand, increasing the amount of Capital. Based on the estimates that Ant has Rmb1.8tn in consumer loans outstanding, as a consequence of this new draft Ant could be called to hold in its balance sheet at least Rmb540bn, equivalent to the 30% of total consumer loans granted.

It is almost certain that Ant Group will return to the market at certain point, but a potential 6-months delay would not only “make everyone very nervous”, as declared by an Honk-Kong based IPO lawyer (think about the $400m of banker fees now put on hold), but would have a deep impact on Ant’s valuation. Indeed, Ant’s value, which after the record IPO was expected to be at least $316bn (ignoring the exercise of green-shoe options by the underwriters), surpassing that of some big American banks such as Goldman Sachs and Wells Fargo, could shrink to $200bn if Ant were to trade at 20x forward earnings instead of the 30x forward earnings at which was trading before the listing (just to make a comparison, consider that traditional local lenders trade today at 5x).

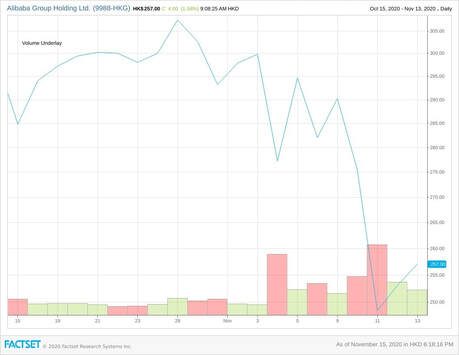

In conclusion, foreign investors have always looked at Alibaba Group and its integrated techfin platform with anxiety and curiosity, but today its missed listing – which had also involved many Wall Street investors, despite Trump’s pursuit of a tech trade war with China – seems to be the confirmation of the potential brutal impacts of politic decisions on the markets.

Through its dual listing across Shanghai and Hong Kong, Ant Group was expected to issue roughly 3.34bn shares, accounting for 11% of Ant’s total outstanding stock after IPO, split evenly between the two Bourses. For the Shanghai portion, where Ant Group’s shares would have traded on the technology-focused Star market, the price of each stock had been set at Rmb68.80 ($10.26) each, while the price for its Hong Kong shares had been set at HK$80 (US$10.32).

The Alibaba’s affiliate’s IPO has generated such a huge demand among both institutional funds and retail traders that in Shanghai retail bids exceeded the value of the shares on sale by more than 870 times, therefore leading banks to trigger a green-shoe option to increase the offering. A green-shoe option both on the Shanghai and Hong Kong sides of the deal could have taken total funds raised to $39.6bn, therefore exceeding the initial predictions on the listing.

Regulatory concerns on a not-under-control sector: impact on Ant Group’s value

It was mainly the huge participation of retail traders in the IPO of the “CreditTech” giant – with lots of them willing to take on huge amounts of leverage – that has led Beijing to draft a new regulation on the micro-lending sector, with the urgency of re-considering carefully the possible social risks connected with investing in a booming sector no more under the Party’s Control.

Indeed, it is true that the Ant’s Credit business has been expanding over the recent years, giving entrepreneurs and consumers easier access to loans, but it is also true that this has been possible thanks to an asset-light business model, based on the securitisation and elimination from the Balance Sheet of around 98% of the loans generated. In other words, only 2% of loans granted remain in Ant’s balance sheet and this arises huge concerns on the eventual social impact of higher default levels of loans (the level of default on Ant’s loans has always been low in the recent years, but increasing concerns are related with the realistic scenario of an acute slowdown of Chinese economic).

If the new rules were to be implemented, Ant Group should submit a new IPO prospectus in Hong Kong and should respond to Chinese regulators’ demand, increasing the amount of Capital. Based on the estimates that Ant has Rmb1.8tn in consumer loans outstanding, as a consequence of this new draft Ant could be called to hold in its balance sheet at least Rmb540bn, equivalent to the 30% of total consumer loans granted.

It is almost certain that Ant Group will return to the market at certain point, but a potential 6-months delay would not only “make everyone very nervous”, as declared by an Honk-Kong based IPO lawyer (think about the $400m of banker fees now put on hold), but would have a deep impact on Ant’s valuation. Indeed, Ant’s value, which after the record IPO was expected to be at least $316bn (ignoring the exercise of green-shoe options by the underwriters), surpassing that of some big American banks such as Goldman Sachs and Wells Fargo, could shrink to $200bn if Ant were to trade at 20x forward earnings instead of the 30x forward earnings at which was trading before the listing (just to make a comparison, consider that traditional local lenders trade today at 5x).

In conclusion, foreign investors have always looked at Alibaba Group and its integrated techfin platform with anxiety and curiosity, but today its missed listing – which had also involved many Wall Street investors, despite Trump’s pursuit of a tech trade war with China – seems to be the confirmation of the potential brutal impacts of politic decisions on the markets.

Alibaba stock price evolution in the days after the halt’s announcement

Source: Factset

Source: Factset

Chiara Pampillonia