A Primer on Opportunity Zone Funds

The 2017 Tax Cuts and Jobs Act created the Qualified Opportunity Zone program to provide a tax incentive for private, long-term investment in economically distressed communities. Although the program was enacted a couple of years ago, money managers and investors alike are still fumbling to figure out how exactly to take advantage of the new investing strategy as confusing rules and stipulations surround the legislation. As attorneys begin to unravel the complicated codes, fund managers are beginning to fundraise for their new vintages.

What is an Opportunity Zone?

An Opportunity Zone is an economically-distressed community that is nominated by the state and certified by the Treasury Department as a qualified area. As of June 14, 2018, there are certified zone in all 50 states with approximately 8,700 Opportunity Zones nationwide. The purpose of this program is to bring private investment into historically underserved neighborhoods by allowing investors to defer and potentially reduce tax on recognized capital gains. To take advantage of this tax treatment, the investor has 180 days from the date of the sale of appreciated property to invest capital gains into a Qualified Opportunity Zone Fund. Tax on the gain of the sale would be deferred until 2026. Principal on the sale may be invested as well, but only the portion of the investment attributed to the realized gain would be eligible for the exemption from tax on further appreciation of the Opportunity Zone Fund investment.

What is an Opportunity Zone Fund?

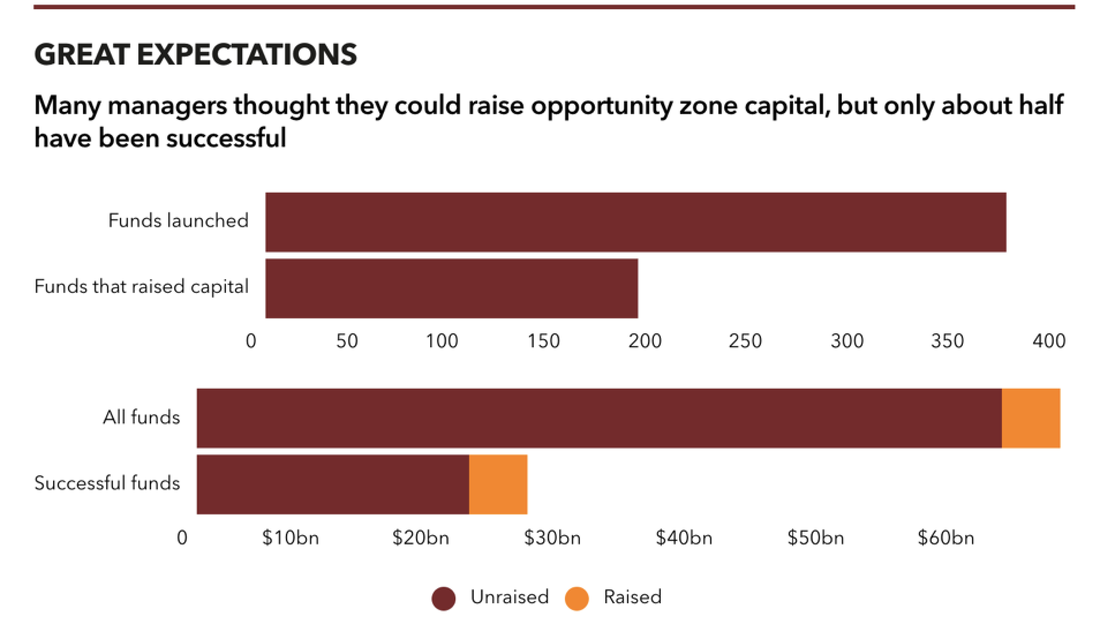

A Qualified Opportunity Zone Fund is any investment vehicle that is organized with the intention of investing in Qualified Opportunity Zone property. At least 90% of the assets held in the fund must be Qualified Opportunity Zone property. Therefore, the investment made by clients flow into a fund to be used for direct investment in real estate properties. As of December 12, 2019, managers have launched more than 366 funds, with most of the funds in the small to mid-size range.

The Current State of Opportunity Zone Funds

While this program sounds like a fund manager’s dream to carve a niche in the oversaturated asset management landscape, confusing regulation and discrepancies on capital requirements have stymied fundraising efforts. Of the 366 funds that have been launched since the program went into effect, only 184 have raised capital. Respondents of a survey conducted by Novogradac reported raising $4.46 billion against a total target of nearly $66 billion. Managers including CIM Group, Starwood Capital Partners, Brookfield Asset Management and Bridge Investment Group have mostly been targeting wealthy individual investors in commingled fund structures. Tax-exempt investors such as pension funds, endowments and foundations are unlikely to invest in these funds as managers target retail investors. One example of an attempt to democratize the vehicle is SkyBridge Capital’s Skybridge-EJF Opportunity Zone REIT, which is targeting $3 billion.

The 2017 Tax Cuts and Jobs Act created the Qualified Opportunity Zone program to provide a tax incentive for private, long-term investment in economically distressed communities. Although the program was enacted a couple of years ago, money managers and investors alike are still fumbling to figure out how exactly to take advantage of the new investing strategy as confusing rules and stipulations surround the legislation. As attorneys begin to unravel the complicated codes, fund managers are beginning to fundraise for their new vintages.

What is an Opportunity Zone?

An Opportunity Zone is an economically-distressed community that is nominated by the state and certified by the Treasury Department as a qualified area. As of June 14, 2018, there are certified zone in all 50 states with approximately 8,700 Opportunity Zones nationwide. The purpose of this program is to bring private investment into historically underserved neighborhoods by allowing investors to defer and potentially reduce tax on recognized capital gains. To take advantage of this tax treatment, the investor has 180 days from the date of the sale of appreciated property to invest capital gains into a Qualified Opportunity Zone Fund. Tax on the gain of the sale would be deferred until 2026. Principal on the sale may be invested as well, but only the portion of the investment attributed to the realized gain would be eligible for the exemption from tax on further appreciation of the Opportunity Zone Fund investment.

What is an Opportunity Zone Fund?

A Qualified Opportunity Zone Fund is any investment vehicle that is organized with the intention of investing in Qualified Opportunity Zone property. At least 90% of the assets held in the fund must be Qualified Opportunity Zone property. Therefore, the investment made by clients flow into a fund to be used for direct investment in real estate properties. As of December 12, 2019, managers have launched more than 366 funds, with most of the funds in the small to mid-size range.

The Current State of Opportunity Zone Funds

While this program sounds like a fund manager’s dream to carve a niche in the oversaturated asset management landscape, confusing regulation and discrepancies on capital requirements have stymied fundraising efforts. Of the 366 funds that have been launched since the program went into effect, only 184 have raised capital. Respondents of a survey conducted by Novogradac reported raising $4.46 billion against a total target of nearly $66 billion. Managers including CIM Group, Starwood Capital Partners, Brookfield Asset Management and Bridge Investment Group have mostly been targeting wealthy individual investors in commingled fund structures. Tax-exempt investors such as pension funds, endowments and foundations are unlikely to invest in these funds as managers target retail investors. One example of an attempt to democratize the vehicle is SkyBridge Capital’s Skybridge-EJF Opportunity Zone REIT, which is targeting $3 billion.

Source: Novogradac

In addition to regulatory confusion, the program itself is being criticized from a moral perspective. Some critics argue that while the premise is noble in theory, reality may see gentrification in these areas displacing the inhabitants who would no longer be able to afford rising rents. Others point to several reports showing how politically connected investors influenced the selection of zones to benefit themselves, with many of the qualified zones overlapping areas that are not underserved. With impact investing not mandated in the program, ESG-minded investors may also be turned-off by insufficient reporting or impact measures.

With the first significant deadline for the Qualified Opportunity Zone Program passed at the end of 2019, it remains to be seen if money managers will be able to convert interest into fundraising for Opportunity Zone Funds.

Kevin Kim

With the first significant deadline for the Qualified Opportunity Zone Program passed at the end of 2019, it remains to be seen if money managers will be able to convert interest into fundraising for Opportunity Zone Funds.

Kevin Kim