Introduction

The US dollar (USD) is the most widely used currency in the world, according to the International Monetary Fund, accounting for almost 60% of all known central bank foreign currency reserves. A global reserve currency is one that is widely accepted in international transactions, such as trade in commodities between countries or repayments of international debt obligations. Despite the lack of an official title, the US dollar has de facto been the world reserve currency for over 60 years, and replaced the British sterling in this role in 1944, through the creation of the Bretton Woods regime. During this time, as part of this regime, the dollar was pegged to gold, and fixed exchange rates were implemented between the USD and most major currencies.

While in the past these currencies were individually pegged to gold, the Bretton Woods agreements gave the USD a dominant role in the global financial system, since it was now the only currency to have direct convertibility to gold, guaranteed by the U.S. government. The dollar, which was therefore "just as good as gold" became an important part of central bank reserves around the world, as it could replace the physical gold reserves of the past. As a result of this arrangement, dollars became the primary intervention currency, and consequently, the reserve currency. Limits on the convertibility of other currencies, particularly in the early years of the Bretton Woods system, also aided the dollar's role as a reserve currency.

The demise of the Bretton Woods system in 1971, when then president Richard Nixon suspended the dollar’s convertibility to gold, led to high inflation in the U.S. and destabilized the dollar's exchange rate with other currencies. Still, the dollar’s reserve currency status remained unaffected, given the scope of influence of the U.S. on the world stage. With the recent emergence of other global economic powers, China comes to mind, several forecasts of the dollar's endangerment as the principal reserve currency have been made. The dollar's proportion has fluctuated throughout time, but it has never gone below 50%, an indicator that it is still widely regarded as the leading reserve currency today.

Threats to the dollar

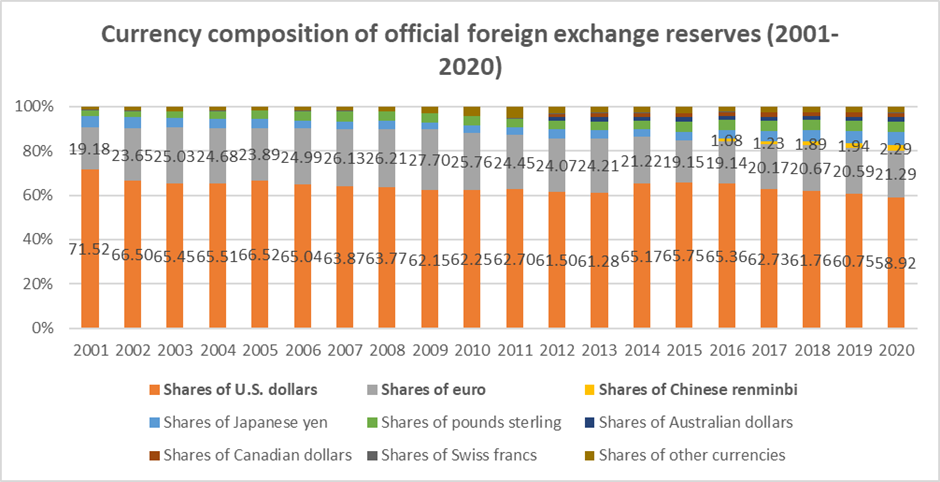

Even though dollars account for the greatest amount of foreign reserves by far, looking at the graph below, we notice that shares of USD have been following a downward trend for the last 20 years: in fact, they dropped from more than 70% in 2001 to 58.9% in 2020, their lowest since 1995. Why did this happen?

The US dollar (USD) is the most widely used currency in the world, according to the International Monetary Fund, accounting for almost 60% of all known central bank foreign currency reserves. A global reserve currency is one that is widely accepted in international transactions, such as trade in commodities between countries or repayments of international debt obligations. Despite the lack of an official title, the US dollar has de facto been the world reserve currency for over 60 years, and replaced the British sterling in this role in 1944, through the creation of the Bretton Woods regime. During this time, as part of this regime, the dollar was pegged to gold, and fixed exchange rates were implemented between the USD and most major currencies.

While in the past these currencies were individually pegged to gold, the Bretton Woods agreements gave the USD a dominant role in the global financial system, since it was now the only currency to have direct convertibility to gold, guaranteed by the U.S. government. The dollar, which was therefore "just as good as gold" became an important part of central bank reserves around the world, as it could replace the physical gold reserves of the past. As a result of this arrangement, dollars became the primary intervention currency, and consequently, the reserve currency. Limits on the convertibility of other currencies, particularly in the early years of the Bretton Woods system, also aided the dollar's role as a reserve currency.

The demise of the Bretton Woods system in 1971, when then president Richard Nixon suspended the dollar’s convertibility to gold, led to high inflation in the U.S. and destabilized the dollar's exchange rate with other currencies. Still, the dollar’s reserve currency status remained unaffected, given the scope of influence of the U.S. on the world stage. With the recent emergence of other global economic powers, China comes to mind, several forecasts of the dollar's endangerment as the principal reserve currency have been made. The dollar's proportion has fluctuated throughout time, but it has never gone below 50%, an indicator that it is still widely regarded as the leading reserve currency today.

Threats to the dollar

Even though dollars account for the greatest amount of foreign reserves by far, looking at the graph below, we notice that shares of USD have been following a downward trend for the last 20 years: in fact, they dropped from more than 70% in 2001 to 58.9% in 2020, their lowest since 1995. Why did this happen?

Source: IMF

Three main threats are now jeopardizing the dollar’s hegemony:

Domestic Threats: Fiscal and Monetary Policy

Other than being considered the world’s reserve currency, the US dollar is primarily the national currency of the United States, and it is issued by the Federal Reserve. Thus, the US fiscal and monetary policy has a direct impact on the stability of the dollar. To this extent, the US dollar must be backed by the US financial stability and by the capability of the Fed to handle inflation.

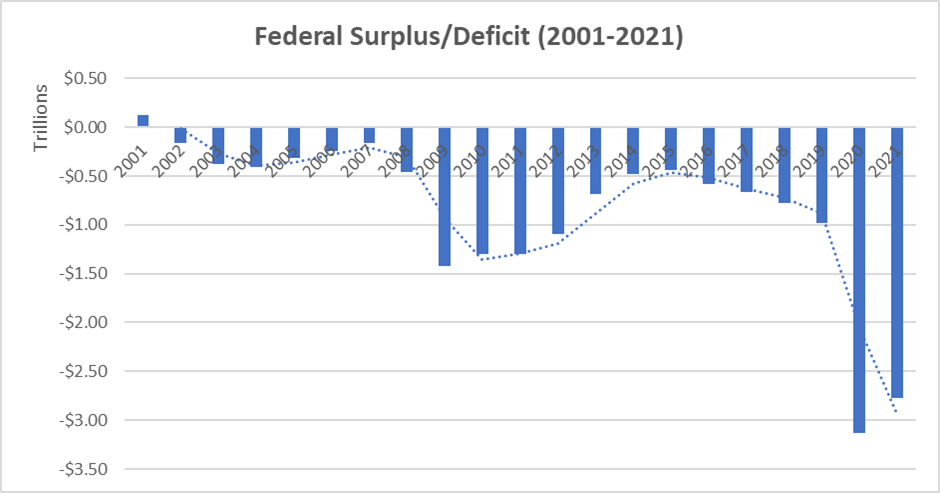

As for fiscal policy, a major threat comes from the large deficit and the high level of debt, factors that may undermine the financial solvency of the United States. In August 2021, the US debt reached its ceiling, set at $28.4 trillion. The debt ceiling represents the maximum amount of public debt the Federal government can have. This made it necessary to increase that limit by $2.5 trillion to avoid the risk of default, which would have catastrophic consequences for the US economy. In FY2021, the deficit run by the federal government reached $2.8 trillion. The large deficit allowed the government to finance the stimulus packages passed by the Biden administration in response to the crisis caused by the pandemic. However, the fiscal deficit was following an upward trend even before the pandemic and the US has not had a surplus since 2001, as the graph below shows.

- Domestic threats

- External threats

- Geopolitical factors.

Domestic Threats: Fiscal and Monetary Policy

Other than being considered the world’s reserve currency, the US dollar is primarily the national currency of the United States, and it is issued by the Federal Reserve. Thus, the US fiscal and monetary policy has a direct impact on the stability of the dollar. To this extent, the US dollar must be backed by the US financial stability and by the capability of the Fed to handle inflation.

As for fiscal policy, a major threat comes from the large deficit and the high level of debt, factors that may undermine the financial solvency of the United States. In August 2021, the US debt reached its ceiling, set at $28.4 trillion. The debt ceiling represents the maximum amount of public debt the Federal government can have. This made it necessary to increase that limit by $2.5 trillion to avoid the risk of default, which would have catastrophic consequences for the US economy. In FY2021, the deficit run by the federal government reached $2.8 trillion. The large deficit allowed the government to finance the stimulus packages passed by the Biden administration in response to the crisis caused by the pandemic. However, the fiscal deficit was following an upward trend even before the pandemic and the US has not had a surplus since 2001, as the graph below shows.

Source: Data Lab

All these elements led to a sharp increase in public debt, which reached $30 trillion and accounted for 133% of GDP at the end of 2021.

As for monetary policy, the most relevant issue is inflation. After a long period of price stability, the inflation rate went up to 7.9% year on year, the highest level since 1982. High inflation is correlated with a depreciation of the value of a currency, while foreign reserve currencies are held for their ability to maintain their value better than national currencies – especially for developing countries.

The Fed has delayed its path to the normalization of monetary policy, claiming that inflation was transitory – due to supply chain bottlenecks – and would decrease in a few months. This questioned the capability of the Fed to keep inflation under control and could cause inflation expectations to de-anchor, as it happened in the 1970s. Now, the Fed has become more hawkish: in March 2022, the Board approved a 0.25% rate hike, and the Fed’s Chairman, J. Powell, claimed that more aggressive interest rate hikes will be considered if necessary to handle inflation. However, economists are concerned that such a restrictive monetary policy may end up causing a recession in the US economy.

External Threats From Other Currencies

The dollar’s preeminence is threatened by other reserve currencies, namely the euro and the yuan, that may be seen as more attractive due to certain features they have.

The euro was considered the ideal candidate for overtaking and eventually replacing the dollar. The euro is backed by a large, developed economy, reliable and stable political institutions, and an efficient financial market. This was true especially in the early years of the Great Financial Crisis, in which the Euro hit the highest exchange rate of its history ($1.60) and the largest share of foreign currency reserves (27%). However, the Debt Crisis of 2011 exposed all the weaknesses of the Eurozone and put a limit to the euro’s ambitions.

It has recently made a comeback due to a renewed spirit of European integration, fostered by the measures taken in response to the pandemic crisis. The attempts to achieve a fiscal union between the Member States and the creation of a common debt market are serious threats to the dollar’s hegemony. In addition, the euro is in a better position to benefit from the growing trend of green bond issuance.

An even bigger challenge for the dollar is represented by the yuan, China’s national currency. China is predicted to become the largest economy in the world by GDP within 2030. Moreover, China plays a primary role in global trade, being the world’s largest exporter: as more Countries engage in financial transactions with China, they are more likely to hold a greater share of their foreign reserves in Yuan.

Yuan’s internationalization is a key strategic goal for the Chinese government. The first driver to achieve this goal is trading: along with the development of new strategies aimed at creating and improving trade links, such as the Belt and Road Initiative (BRI), China promotes the usage of its national currency for bilateral transactions. In this way, the Yuan was able to earn the status of reserve currency, as announced by the IMF in 2015.

The second key driver is digitalization. The People’s Bank of China (PBOC) has been working on the creation of the digital Yuan since 2014, so it has accumulated a big advantage over the other major central banks. In January 2022, the PBOC launched its pilot digital Yuan, backed by the largest Chinese tech firms, namely Alibaba, WeChat, and Tencent. Digitalization would allow Beijing to enhance the Yuan’s global usage by providing a faster, cheaper, and safer payment system.

Geopolitical Factors

The preeminent role of the dollar has many geopolitical implications. In particular, the dollar can be used as a weapon to impose sanctions against other countries, as is happening with Russia. The removal of Russian banks from the SWIFT system and the freezing of Russian dollar assets aim at limiting Russian sources of financing and isolating the Country. However, this could trigger the creation of a parallel financial system by China and Russia. Indeed, the two countries had already started laying the groundwork for a complete de-dollarization by settling to use their national currencies in bilateral trades.

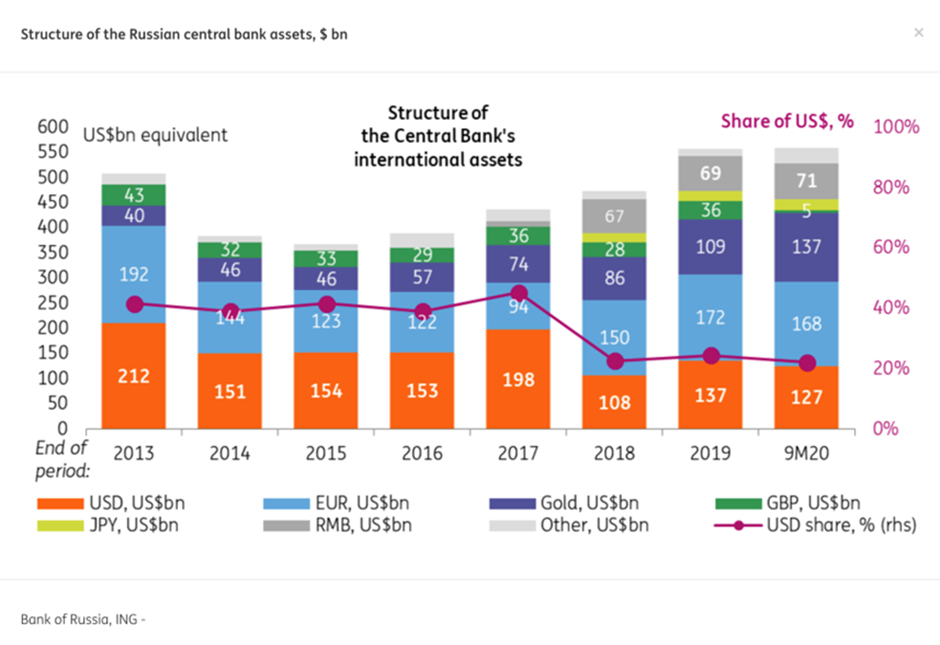

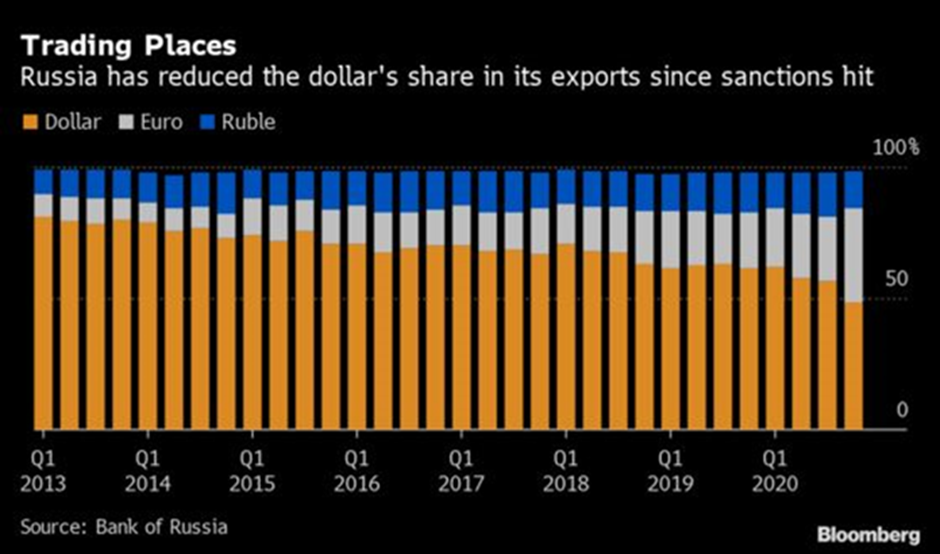

In particular, Russia began to reduce its dollar exposure to avoid the sanctions imposed after it invaded Crimea. As the two graphs below illustrate, this resulted in a decrease both in dollar reserves held by the Russian Central Bank – mainly replaced by Yuan and gold – and in the share of exports paid in dollars, which went below 50% of total exports for the first time in 2021Q1.

As for monetary policy, the most relevant issue is inflation. After a long period of price stability, the inflation rate went up to 7.9% year on year, the highest level since 1982. High inflation is correlated with a depreciation of the value of a currency, while foreign reserve currencies are held for their ability to maintain their value better than national currencies – especially for developing countries.

The Fed has delayed its path to the normalization of monetary policy, claiming that inflation was transitory – due to supply chain bottlenecks – and would decrease in a few months. This questioned the capability of the Fed to keep inflation under control and could cause inflation expectations to de-anchor, as it happened in the 1970s. Now, the Fed has become more hawkish: in March 2022, the Board approved a 0.25% rate hike, and the Fed’s Chairman, J. Powell, claimed that more aggressive interest rate hikes will be considered if necessary to handle inflation. However, economists are concerned that such a restrictive monetary policy may end up causing a recession in the US economy.

External Threats From Other Currencies

The dollar’s preeminence is threatened by other reserve currencies, namely the euro and the yuan, that may be seen as more attractive due to certain features they have.

The euro was considered the ideal candidate for overtaking and eventually replacing the dollar. The euro is backed by a large, developed economy, reliable and stable political institutions, and an efficient financial market. This was true especially in the early years of the Great Financial Crisis, in which the Euro hit the highest exchange rate of its history ($1.60) and the largest share of foreign currency reserves (27%). However, the Debt Crisis of 2011 exposed all the weaknesses of the Eurozone and put a limit to the euro’s ambitions.

It has recently made a comeback due to a renewed spirit of European integration, fostered by the measures taken in response to the pandemic crisis. The attempts to achieve a fiscal union between the Member States and the creation of a common debt market are serious threats to the dollar’s hegemony. In addition, the euro is in a better position to benefit from the growing trend of green bond issuance.

An even bigger challenge for the dollar is represented by the yuan, China’s national currency. China is predicted to become the largest economy in the world by GDP within 2030. Moreover, China plays a primary role in global trade, being the world’s largest exporter: as more Countries engage in financial transactions with China, they are more likely to hold a greater share of their foreign reserves in Yuan.

Yuan’s internationalization is a key strategic goal for the Chinese government. The first driver to achieve this goal is trading: along with the development of new strategies aimed at creating and improving trade links, such as the Belt and Road Initiative (BRI), China promotes the usage of its national currency for bilateral transactions. In this way, the Yuan was able to earn the status of reserve currency, as announced by the IMF in 2015.

The second key driver is digitalization. The People’s Bank of China (PBOC) has been working on the creation of the digital Yuan since 2014, so it has accumulated a big advantage over the other major central banks. In January 2022, the PBOC launched its pilot digital Yuan, backed by the largest Chinese tech firms, namely Alibaba, WeChat, and Tencent. Digitalization would allow Beijing to enhance the Yuan’s global usage by providing a faster, cheaper, and safer payment system.

Geopolitical Factors

The preeminent role of the dollar has many geopolitical implications. In particular, the dollar can be used as a weapon to impose sanctions against other countries, as is happening with Russia. The removal of Russian banks from the SWIFT system and the freezing of Russian dollar assets aim at limiting Russian sources of financing and isolating the Country. However, this could trigger the creation of a parallel financial system by China and Russia. Indeed, the two countries had already started laying the groundwork for a complete de-dollarization by settling to use their national currencies in bilateral trades.

In particular, Russia began to reduce its dollar exposure to avoid the sanctions imposed after it invaded Crimea. As the two graphs below illustrate, this resulted in a decrease both in dollar reserves held by the Russian Central Bank – mainly replaced by Yuan and gold – and in the share of exports paid in dollars, which went below 50% of total exports for the first time in 2021Q1.

Source: Bank of Russia

Source: Bank of Russia

Other Countries may follow the Russian example and decide to dump the dollar to reduce their dependence on the US. Relating to this issue, it has been reported that Saudi Arabia might decide to accept Yuan alongside dollars for crude oil payments. This move can be determined by economic reasons – Saudi Arabia sells about 25% of its oil to China and it is its largest supplier – but also by political issues – indeed, diplomatic relations between the US and Saudi Arabia deteriorated under the Biden administration. This move would be a hard blow to the dollar’s supremacy and would accelerate the Yuan’s rise.

How the U.S. can fight these threats and the importance of doing so

The U.S. is highly incentivized to uphold and protect the dollar’s status as the leading global reserve currency. Indeed with this status comes what has been historically called an “exorbitant privilege”. Said privilege includes advantages in international trade, as U.S.-based entities don’t have to pay currency conversion fees; seigniorage gains for the U.S. government, but most importantly, the ability to run current accounts deficits and the leverage when it comes to weaponization of its currency, or financial warfare. To explain the former better, current account deficits are made possible by cheap and easy financing, as high demand for the dollar and dollar-denominated securities (T-bills in particular) keeps interest rates low and liquidity high for American companies and banks. Finally, as it relates to the weaponization of the USD, it does have negative effects on its worldwide use (making possible enemy countries more reluctant to use it), but the fact that so many countries have to hold dollar reserve (for example to buy oil) and are dependent on the dollar, as it dominates the global financial system, gives a lot of leverage to the U.S. . Current events, for example, have shown how freezing a foreign country’s central bank’s dollar reserves and excluding it from international payment systems, which mostly adopt the USD, can have severe repercussions on its financial stability and strength.

When it comes to defending the dollar’s dominant position from internal and external threats, the U.S. is starting from a position of strength, given the advantage of incumbency. Through a network effect, as others trading in dollars makes it more attractive for any firm to trade in dollars themselves, and the self-reinforcing liquidity and depth of USD-denominated markets, demand for the U.S. currency is still high.

As it pertains to facing internal threats, the most important thing is for the U.S. to maintain its long-standing credibility and confidence of foreign investors. There are two main players to consider here, the political sphere, which includes the presidency and congress/senate, and the monetary one, i.e. the Federal Reserve. The first step for the U.S. to increase trust in its institutions is to return to a higher level of political stability, which has been declining due to rising tensions between the two main parties and the growing polarization which culminated in the election of former President Trump. Additionally, reducing the government deficit, through stricter fiscal policies and more efficient spending would further increase stability and limit concerns of higher inflation. This brings us to the role of the Fed, which faces the challenging task of combating the highest inflation in 40 years and simultaneous risks of economic stagnation. There is no easy answer on how to solve this, but in general, it’s crucial that the Fed maintain its political independence and reinforces its credibility through carefully-weighted monetary policy decisions and effective forward guidance policy in the form of reliable, trustworthy announcements. Overall, in spite of recent developments, global trust in U.S. institutions is still at good levels, which is what matters most at the end of the day. This means that while internal threats are very challenging to mitigate, they are less dangerous compared to external ones.

The biggest external threats consist in foreign nations and their currencies gaining influence at the detriment of the U.S. and the dollar. Talking about the euro first, which has just recently (with the emergence of a common fiscal policy) become a more credible threat, it currently has the advantage of ESG bonds, which investors find very attractive. However, it seems unlikely that the euro will overtake the USD and thus should not be considered particularly dangerous, given global concerns about the stability of the currency stemming from the euro crisis and the overall fragmentation of the eurozone into different countries. Nevertheless, an appropriate response from the U.S. could be to match the offering of an environmentally friendly and socially conscious currency by taking stronger action in its own sustainability and carbon neutrality efforts.

The second, and currently only other potentially threatening currency is China’s renminbi. China is on track to pass the U.S. as the world’s largest economy, is gaining importance in worldwide trade and is pushing to distance itself from USD-dependence, even more so as the weaponization of the dollar becomes more real. While capital controls on its currency, the renminbi, currently reduce its demand from foreign investors, especially with the creation of the e-yuan (its new digital currency), it is evident that the People’s Republic is trying to rival the status of the USD as the world reserve currency. It should be considered the most real threat among all those seen so far, as China is aggressively trying to gain worldwide influence and the power of its currency is a main tool to achieve that goal. Therefore, this is very likely the biggest threat right now for the U.S. and the dollar. As it pertains to the expansion in trade initiatives, such as the BRI, there isn’t much that the U.S. can do to fight it directly, at least not in a peaceful way. On the other hand, a reversal of the recent protectionist and isolationist policies in favor of new trade agreements with partner countries around the world, could prevent the U.S. from losing influence in global trade patterns. Additionally, Following China’s move and developing a digital currency of its own could allow the U.S. to stand up to the threat of all foreign digital currencies, China’s included. However, its implementation is still at least 5-10 years away, according to the Fed.

Finally, addressing the consequences of geopolitical tensions and the weaponization of the dollar, it has to be looked at as a double-edged sword. The USD’s dominance in global financial markets gives the U.S. the ability to influence global trade and destabilize rival nations, as outlined earlier. However, doing this leads more and more countries to want to reduce their respective dependence on the dollar and eventually weakens its position as the world reserve currency and more broadly reduces the U.S.’ sphere of influence. It’s therefore a trade-off, between strengthening global position but having to remain more neutral in times of high tensions, and taking a more aggressive stance against certain nations but losing strategic influence over potentially a whole bloc of the world. This is a threat, in a way, created knowingly by the U.S. itself, and as of right now, seems to be one it is choosing to live with. It has to be additionally considered that once the influence over a country is lost, it will be very difficult to gain it back, which is why even if these actions are voluntary, they could very well have long-term negative consequences for the U.S.

Can innovation remove the need for reserve currencies completely?

The case for crypto vs. (digital) currencies

The last few years have been characterized by a boom in the cryptocurrency market, which 4 months ago passed the $3 trillion market cap, while more recently getting back down to around $2 trillion. While this already foreshadows one of the main downsides of the crypto space, it should first be discussed what fueled this increase in popularity. To explain cryptocurrencies in one sentence, they are a form of digital money exchanged via distributed ledgers known as blockchains, completely decentralized and used in peer-to-peer transactions.

Their appeal, in the context of international trade specifically and possible replacement for reserve currencies, comes from the fact that they eliminate the need for a financial intermediary and allow for a faster and cheaper cross-border payments system accessible to everyone. Another current advantage lies in the anonymity of transactions and their verifiability through the blockchain. However, as governments fear that the widespread use of these unregulated instruments could undermine financial stability, combined with the fact that the anonymity aspect of the transaction heavily facilitates illegal dealings, a more restrictive regulation of cryptocurrencies is to be expected in the near future.

Even if, once properly regulated, cryptocurrencies become perfectly legitimate and widely adopted, there is still an important downside, and that is volatility. The reason for such significant fluctuation in the price of many crypto coins is that they are heavily influenced by speculation (as the underlying value is very hard to estimate), investor and user sentiment, and (social) media hype. The proposed solution takes place in the form of “stablecoins”, i.e. cryptocurrencies that are backed by other assets, very often the USD, and can be converted into those assets at a fixed exchange rate. While there currently are concerns over their effective convertibility into traditional fiat currencies, given the lack of regulation and reserve requirements, these are the biggest threat at the moment, in terms of technological innovation, to reserve currencies.

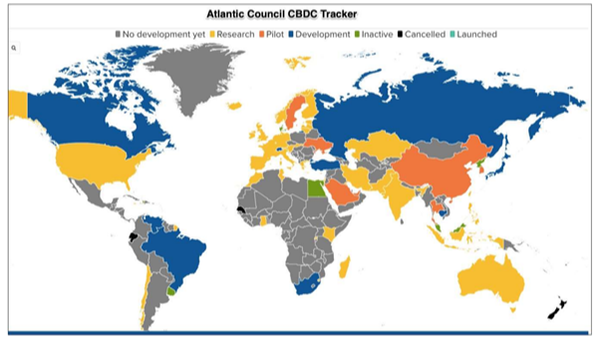

There is a way governments can avoid having their national currency become obsolete and replaced by cryptos: embrace the digital transition and create a digital currency of their own. That’s exactly what, as mentioned before, China has done, and what many other countries, the U.S. included, are considering doing (as can be seen in the following map, source: Econlife.com). These currencies are referred to as Central Bank Digital Currencies (CBDC in short) and consist of digital liabilities of a CB that are widely available to the general public, just like paper money, but in digital form. The difference compared to bank accounts is that the CBDC is a liability of the central bank, not a commercial one. As a consequence, it is directly backed by a central bank such as the Fed, and would therefore be the safest digital asset available to the general public, with no credit or liquidity risk related to it. If implemented successfully, CBDCs would eliminate the need for "stablecoins" and other cryptocurrencies (in legitimate transactions at least) as they carry the same benefits, in the efficiency of faster and cheaper payments (even cheaper considering many cryptos have transaction fees in the form of “fuel”) while at the same time being considerably less volatile, as well as “safer”, since they are backed by a national government.

How the U.S. can fight these threats and the importance of doing so

The U.S. is highly incentivized to uphold and protect the dollar’s status as the leading global reserve currency. Indeed with this status comes what has been historically called an “exorbitant privilege”. Said privilege includes advantages in international trade, as U.S.-based entities don’t have to pay currency conversion fees; seigniorage gains for the U.S. government, but most importantly, the ability to run current accounts deficits and the leverage when it comes to weaponization of its currency, or financial warfare. To explain the former better, current account deficits are made possible by cheap and easy financing, as high demand for the dollar and dollar-denominated securities (T-bills in particular) keeps interest rates low and liquidity high for American companies and banks. Finally, as it relates to the weaponization of the USD, it does have negative effects on its worldwide use (making possible enemy countries more reluctant to use it), but the fact that so many countries have to hold dollar reserve (for example to buy oil) and are dependent on the dollar, as it dominates the global financial system, gives a lot of leverage to the U.S. . Current events, for example, have shown how freezing a foreign country’s central bank’s dollar reserves and excluding it from international payment systems, which mostly adopt the USD, can have severe repercussions on its financial stability and strength.

When it comes to defending the dollar’s dominant position from internal and external threats, the U.S. is starting from a position of strength, given the advantage of incumbency. Through a network effect, as others trading in dollars makes it more attractive for any firm to trade in dollars themselves, and the self-reinforcing liquidity and depth of USD-denominated markets, demand for the U.S. currency is still high.

As it pertains to facing internal threats, the most important thing is for the U.S. to maintain its long-standing credibility and confidence of foreign investors. There are two main players to consider here, the political sphere, which includes the presidency and congress/senate, and the monetary one, i.e. the Federal Reserve. The first step for the U.S. to increase trust in its institutions is to return to a higher level of political stability, which has been declining due to rising tensions between the two main parties and the growing polarization which culminated in the election of former President Trump. Additionally, reducing the government deficit, through stricter fiscal policies and more efficient spending would further increase stability and limit concerns of higher inflation. This brings us to the role of the Fed, which faces the challenging task of combating the highest inflation in 40 years and simultaneous risks of economic stagnation. There is no easy answer on how to solve this, but in general, it’s crucial that the Fed maintain its political independence and reinforces its credibility through carefully-weighted monetary policy decisions and effective forward guidance policy in the form of reliable, trustworthy announcements. Overall, in spite of recent developments, global trust in U.S. institutions is still at good levels, which is what matters most at the end of the day. This means that while internal threats are very challenging to mitigate, they are less dangerous compared to external ones.

The biggest external threats consist in foreign nations and their currencies gaining influence at the detriment of the U.S. and the dollar. Talking about the euro first, which has just recently (with the emergence of a common fiscal policy) become a more credible threat, it currently has the advantage of ESG bonds, which investors find very attractive. However, it seems unlikely that the euro will overtake the USD and thus should not be considered particularly dangerous, given global concerns about the stability of the currency stemming from the euro crisis and the overall fragmentation of the eurozone into different countries. Nevertheless, an appropriate response from the U.S. could be to match the offering of an environmentally friendly and socially conscious currency by taking stronger action in its own sustainability and carbon neutrality efforts.

The second, and currently only other potentially threatening currency is China’s renminbi. China is on track to pass the U.S. as the world’s largest economy, is gaining importance in worldwide trade and is pushing to distance itself from USD-dependence, even more so as the weaponization of the dollar becomes more real. While capital controls on its currency, the renminbi, currently reduce its demand from foreign investors, especially with the creation of the e-yuan (its new digital currency), it is evident that the People’s Republic is trying to rival the status of the USD as the world reserve currency. It should be considered the most real threat among all those seen so far, as China is aggressively trying to gain worldwide influence and the power of its currency is a main tool to achieve that goal. Therefore, this is very likely the biggest threat right now for the U.S. and the dollar. As it pertains to the expansion in trade initiatives, such as the BRI, there isn’t much that the U.S. can do to fight it directly, at least not in a peaceful way. On the other hand, a reversal of the recent protectionist and isolationist policies in favor of new trade agreements with partner countries around the world, could prevent the U.S. from losing influence in global trade patterns. Additionally, Following China’s move and developing a digital currency of its own could allow the U.S. to stand up to the threat of all foreign digital currencies, China’s included. However, its implementation is still at least 5-10 years away, according to the Fed.

Finally, addressing the consequences of geopolitical tensions and the weaponization of the dollar, it has to be looked at as a double-edged sword. The USD’s dominance in global financial markets gives the U.S. the ability to influence global trade and destabilize rival nations, as outlined earlier. However, doing this leads more and more countries to want to reduce their respective dependence on the dollar and eventually weakens its position as the world reserve currency and more broadly reduces the U.S.’ sphere of influence. It’s therefore a trade-off, between strengthening global position but having to remain more neutral in times of high tensions, and taking a more aggressive stance against certain nations but losing strategic influence over potentially a whole bloc of the world. This is a threat, in a way, created knowingly by the U.S. itself, and as of right now, seems to be one it is choosing to live with. It has to be additionally considered that once the influence over a country is lost, it will be very difficult to gain it back, which is why even if these actions are voluntary, they could very well have long-term negative consequences for the U.S.

Can innovation remove the need for reserve currencies completely?

The case for crypto vs. (digital) currencies

The last few years have been characterized by a boom in the cryptocurrency market, which 4 months ago passed the $3 trillion market cap, while more recently getting back down to around $2 trillion. While this already foreshadows one of the main downsides of the crypto space, it should first be discussed what fueled this increase in popularity. To explain cryptocurrencies in one sentence, they are a form of digital money exchanged via distributed ledgers known as blockchains, completely decentralized and used in peer-to-peer transactions.

Their appeal, in the context of international trade specifically and possible replacement for reserve currencies, comes from the fact that they eliminate the need for a financial intermediary and allow for a faster and cheaper cross-border payments system accessible to everyone. Another current advantage lies in the anonymity of transactions and their verifiability through the blockchain. However, as governments fear that the widespread use of these unregulated instruments could undermine financial stability, combined with the fact that the anonymity aspect of the transaction heavily facilitates illegal dealings, a more restrictive regulation of cryptocurrencies is to be expected in the near future.

Even if, once properly regulated, cryptocurrencies become perfectly legitimate and widely adopted, there is still an important downside, and that is volatility. The reason for such significant fluctuation in the price of many crypto coins is that they are heavily influenced by speculation (as the underlying value is very hard to estimate), investor and user sentiment, and (social) media hype. The proposed solution takes place in the form of “stablecoins”, i.e. cryptocurrencies that are backed by other assets, very often the USD, and can be converted into those assets at a fixed exchange rate. While there currently are concerns over their effective convertibility into traditional fiat currencies, given the lack of regulation and reserve requirements, these are the biggest threat at the moment, in terms of technological innovation, to reserve currencies.

There is a way governments can avoid having their national currency become obsolete and replaced by cryptos: embrace the digital transition and create a digital currency of their own. That’s exactly what, as mentioned before, China has done, and what many other countries, the U.S. included, are considering doing (as can be seen in the following map, source: Econlife.com). These currencies are referred to as Central Bank Digital Currencies (CBDC in short) and consist of digital liabilities of a CB that are widely available to the general public, just like paper money, but in digital form. The difference compared to bank accounts is that the CBDC is a liability of the central bank, not a commercial one. As a consequence, it is directly backed by a central bank such as the Fed, and would therefore be the safest digital asset available to the general public, with no credit or liquidity risk related to it. If implemented successfully, CBDCs would eliminate the need for "stablecoins" and other cryptocurrencies (in legitimate transactions at least) as they carry the same benefits, in the efficiency of faster and cheaper payments (even cheaper considering many cryptos have transaction fees in the form of “fuel”) while at the same time being considerably less volatile, as well as “safer”, since they are backed by a national government.

Source: Econlife

In the case of the U.S. in particular, the creation of a U.S.-issued CBDC could help preserve the international importance of the dollar and its role as the world reserve currency, something already touched upon previously. Indeed with foreign countries, such as China, issuing CBDCs, which, for all the reasons outlined above, can be considered more attractive than existing forms of currency, the USD as it exists now could risk being “left behind” as global preferences shift towards these other currencies. As of right now, even including the e-yuan, arguably the most advanced digital currency at this date, CBDCs are still in an experimental phase and are not definitive in their current form. There are still important issues to sort out, such as the effect on the current financial system, considering that if CBDCs replace bank deposits, banks are not going to have any money to loan out and the amount of credit in the economy will reduce drastically. Another crucial point could be the negative effects of monetary policy, as the introduction of a CBDC could undermine monetary policy implementation and interest rate control by affecting the level of supply reserves in the banking system.

To conclude this part, a Central Bank Digital Currency issued by the Fed could very well become the world’s new reserve currency and protect the U.S. dollar both against the rise of cryptos, “stablecoins” in particular, and against external threats, such as China’s e-yuan. However, the process of implementing such a currency will probably take a considerable amount of time. Additionally, it hinges on the assumption that all causes for concern are properly evaluated and duly addressed, which will not be easy.

Conclusion

We have discussed so far the rise of the US dollar as the preeminent reserve currency, the advantages brought by this status, and the factors that could threaten its dominant role. But how realistic is the downfall of the dollar? And if so, how long will it take for another currency to replace it?

The current scenario is characterized by a decrease in shares of foreign reserves denominated in dollars. This downward trend will likely keep going on, meaning that foreign reserves will tend to be more differentiated in the medium term. This will benefit primarily the Euro and the Yuan, especially if certain conditions are met – on the one hand, the establishment of a European fiscal and banking union, and on the other hand, the development of a truly free, and mature financial market in China.

Nonetheless, the dollar will remain the leading global reserve currency. Indeed, no other country or monetary union can match the US political, military, and economic supremacy, so that the dollar’s importance is enhanced. At the same time, the dollar is one of the elements that help the US maintain its power. Therefore, these two aspects form a virtuous cycle that makes it difficult to undermine the dollar’s role.

Finally, we do not see a real threat coming from cryptocurrencies or any other alternative asset, at least in the short-to-medium run. The main reason is that they cannot provide the same financial stability and convertibility as fiat currencies. They will probably represent a bigger challenge in the long term, as the technology further develops and they become more regulated. However, central banks seem aware of this and are already preparing to embrace the digital revolution by issuing their digital currency alongside traditional ones.

In conclusion, we can state that, although the increasingly challenging environment, the dollar’s dominance is far from reaching its end.

Sources:

Alexjandro Frattini, Joris Pema, Matthias Puricella

To conclude this part, a Central Bank Digital Currency issued by the Fed could very well become the world’s new reserve currency and protect the U.S. dollar both against the rise of cryptos, “stablecoins” in particular, and against external threats, such as China’s e-yuan. However, the process of implementing such a currency will probably take a considerable amount of time. Additionally, it hinges on the assumption that all causes for concern are properly evaluated and duly addressed, which will not be easy.

Conclusion

We have discussed so far the rise of the US dollar as the preeminent reserve currency, the advantages brought by this status, and the factors that could threaten its dominant role. But how realistic is the downfall of the dollar? And if so, how long will it take for another currency to replace it?

The current scenario is characterized by a decrease in shares of foreign reserves denominated in dollars. This downward trend will likely keep going on, meaning that foreign reserves will tend to be more differentiated in the medium term. This will benefit primarily the Euro and the Yuan, especially if certain conditions are met – on the one hand, the establishment of a European fiscal and banking union, and on the other hand, the development of a truly free, and mature financial market in China.

Nonetheless, the dollar will remain the leading global reserve currency. Indeed, no other country or monetary union can match the US political, military, and economic supremacy, so that the dollar’s importance is enhanced. At the same time, the dollar is one of the elements that help the US maintain its power. Therefore, these two aspects form a virtuous cycle that makes it difficult to undermine the dollar’s role.

Finally, we do not see a real threat coming from cryptocurrencies or any other alternative asset, at least in the short-to-medium run. The main reason is that they cannot provide the same financial stability and convertibility as fiat currencies. They will probably represent a bigger challenge in the long term, as the technology further develops and they become more regulated. However, central banks seem aware of this and are already preparing to embrace the digital revolution by issuing their digital currency alongside traditional ones.

In conclusion, we can state that, although the increasingly challenging environment, the dollar’s dominance is far from reaching its end.

Sources:

- CNBC

- FT

- NPR

- Bloomberg

- WSJ

- Quartz

- HSBC

- Nikkei Asia

- South China Morning Post

- Barclays

- Livemint

- TheHill

- Federal Reserve

- Fortune

- Investopedia

- Georgetown Journal of International Affairs

- BNY Mellon

- Yahoo Finance

- Richmond Fed

- IMF Blog

- Barry Eichengreen, Exorbitant Privilege. The Rise and Fall of the Dollar and the Future of the International Monetary System

- The Balance

- The White House

- Atlantic Council

- Axios

Alexjandro Frattini, Joris Pema, Matthias Puricella