Introduction

Late January Hindenburg Research, a New-York based activist short-selling investment research firm, released a 413-page report on the Adani Group, overall accusing the group of stock manipulation, bad accounting practices, use of tax havens, and great mismanagement of debt. This article aims to analyze Hindenburg’s short-selling mechanism, the fallout of the report, and India’s regulatory framework.

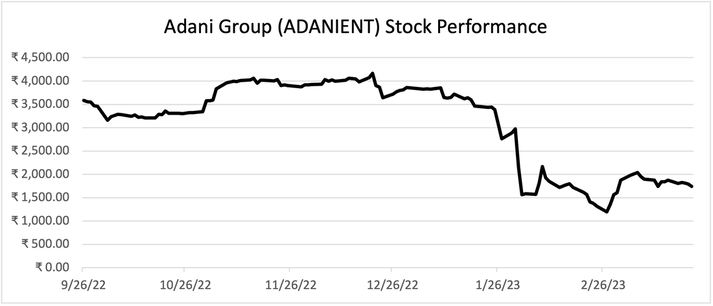

The Adani Group is an Indian conglomerate, composed of seven publicly traded companies, which focuses on energy, commodities, and infrastructure, generating $7.9B (2022) revenues with 23,000 employees [Forbes, 2023]. The striking news sent a shock across the financial world as many questioned the trustworthiness of the Adani Group and India’s regulatory system, causing a fallout on the stock market worth $84B and forcing them to withdraw its $2.5B public offering, making Adani lose the crown of the third richest man in the world [Lee, 2023]. Adani Group, which has previously been plagued by environmental and local community scandals, has denied any wrongdoing and has accused Hindenburg Research of making “misleading claims around offshore entities” among others [Upadhyay et al., 2023]. Nevertheless, Hindenburg Research continues to stand its ground by short-selling the Group back in January, leading way for a lengthy battle between the two [Reuters, 2023].

Late January Hindenburg Research, a New-York based activist short-selling investment research firm, released a 413-page report on the Adani Group, overall accusing the group of stock manipulation, bad accounting practices, use of tax havens, and great mismanagement of debt. This article aims to analyze Hindenburg’s short-selling mechanism, the fallout of the report, and India’s regulatory framework.

The Adani Group is an Indian conglomerate, composed of seven publicly traded companies, which focuses on energy, commodities, and infrastructure, generating $7.9B (2022) revenues with 23,000 employees [Forbes, 2023]. The striking news sent a shock across the financial world as many questioned the trustworthiness of the Adani Group and India’s regulatory system, causing a fallout on the stock market worth $84B and forcing them to withdraw its $2.5B public offering, making Adani lose the crown of the third richest man in the world [Lee, 2023]. Adani Group, which has previously been plagued by environmental and local community scandals, has denied any wrongdoing and has accused Hindenburg Research of making “misleading claims around offshore entities” among others [Upadhyay et al., 2023]. Nevertheless, Hindenburg Research continues to stand its ground by short-selling the Group back in January, leading way for a lengthy battle between the two [Reuters, 2023].

Shorting Adani Group: Overcoming Challenges and Using Derivatives to Make Money

An interesting question to ask is how did Hindenburg actually make money with their bet against Adani? The most common approach for betting against a company in financial markets is by short-selling its stocks. Short selling is the practice of borrowing stocks from a counterparty, selling these stocks, and buying them back (at preferably a lower price) to settle the stock lending. In India, however, this practice comes with certain difficulties.

First of all, the regulations are much stricter than in most western markets. The Securities and Exchange Board of India (SEBI) has mandated that short-selling orders must be announced the latest the day before the execution and brokers have to make all information regarding the shorts of their clients public. In addition, SEBI has imposed restrictions on the number of shares that can be short-sold. The regulator has imposed a circuit breaker system, which suspends short selling of stock for a day if the stock price falls by more than 10% in a single trading session (SEBI, 2023). This limits the power of investors to profit from adverse news in Indian companies.

In the case of the Adani Enterprise stock, some more issues would arise when short-selling its stock. Adani has a very low free float of stocks in the market because a lot of the shares are owned by large holdings and there are not many institutional investors owning the stock. This makes shorting hard and expensive as it will be hard to find counterparties to borrow from (Financial Times, 2023). A solution to this problem would be so-called naked short selling, which is very similar to regular short selling but doesn’t involve borrowing the stock from a third party, but this practice is also prohibited in India by the SEBI.

They have given very limited information about how they executed this trade but made a short statement saying that they used “US traded bonds and Indian traded derivatives” (Hindenburg, 2023). Since this does not say much specifically, there has been a lot of speculation about this “Indian traded derivatives” part. To get around the heavy regulations on short selling in India, Hindenburg likely used offshore counterparties (e.g. Singaporean banks) that can structure products such as bespoke forward contracts (Financial Times, 2023) on the Nifty 50, which is a stock index composed of India’s largest companies. These types of products would allow Hindenburg to receive the value of Adani’s weighting (around 23% in the Nifty Metal) in the index and sell the rest of the index straight in the market. The downside is that these products have very low liquidity, which comes of course with a risk when Hindenburg would want to unload its positions.

An interesting question to ask is how did Hindenburg actually make money with their bet against Adani? The most common approach for betting against a company in financial markets is by short-selling its stocks. Short selling is the practice of borrowing stocks from a counterparty, selling these stocks, and buying them back (at preferably a lower price) to settle the stock lending. In India, however, this practice comes with certain difficulties.

First of all, the regulations are much stricter than in most western markets. The Securities and Exchange Board of India (SEBI) has mandated that short-selling orders must be announced the latest the day before the execution and brokers have to make all information regarding the shorts of their clients public. In addition, SEBI has imposed restrictions on the number of shares that can be short-sold. The regulator has imposed a circuit breaker system, which suspends short selling of stock for a day if the stock price falls by more than 10% in a single trading session (SEBI, 2023). This limits the power of investors to profit from adverse news in Indian companies.

In the case of the Adani Enterprise stock, some more issues would arise when short-selling its stock. Adani has a very low free float of stocks in the market because a lot of the shares are owned by large holdings and there are not many institutional investors owning the stock. This makes shorting hard and expensive as it will be hard to find counterparties to borrow from (Financial Times, 2023). A solution to this problem would be so-called naked short selling, which is very similar to regular short selling but doesn’t involve borrowing the stock from a third party, but this practice is also prohibited in India by the SEBI.

They have given very limited information about how they executed this trade but made a short statement saying that they used “US traded bonds and Indian traded derivatives” (Hindenburg, 2023). Since this does not say much specifically, there has been a lot of speculation about this “Indian traded derivatives” part. To get around the heavy regulations on short selling in India, Hindenburg likely used offshore counterparties (e.g. Singaporean banks) that can structure products such as bespoke forward contracts (Financial Times, 2023) on the Nifty 50, which is a stock index composed of India’s largest companies. These types of products would allow Hindenburg to receive the value of Adani’s weighting (around 23% in the Nifty Metal) in the index and sell the rest of the index straight in the market. The downside is that these products have very low liquidity, which comes of course with a risk when Hindenburg would want to unload its positions.

Hindenburg also said they used US-traded bonds to bet against Adani, that is Adani bonds issued in the US and are therefore traded under US regulations. A common way to make money from bond prices falling would be to buy credit default swaps on them, but since there are not any tradable CDSs on US Adani bonds in the market this is not what happened. Instead, it is most likely that Hindenburg has just shorted these bonds (Financial Times, 2023), which is allowed since these US-traded products are not subject to the heavy regulations of the SEBI in India. The last question that remains is how much money Hindenburg has made after publishing its Adani report. This is, however, something that only Hindenburg themselves know, but considering the drastic price movements in the markets after they released the report, they probably did well.

Adani Efforts to Manage Fallout from Hindenburg's Allegations

The short-term consequences for Hindenburg shorting Adani Group could spread among various areas such as increased scrutiny and legal action. The Adani Group has denied the allegations made by Hindenburg and has threatened counteractions. The stock lost 60% of its value and this impacts the company's ability to raise capital and undertake new projects.

The short-term consequences for Hindenburg shorting Adani Group could spread among various areas such as increased scrutiny and legal action. The Adani Group has denied the allegations made by Hindenburg and has threatened counteractions. The stock lost 60% of its value and this impacts the company's ability to raise capital and undertake new projects.

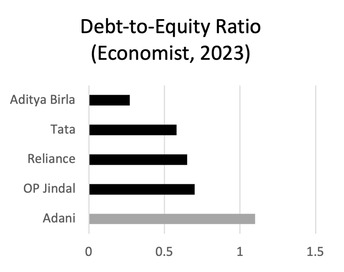

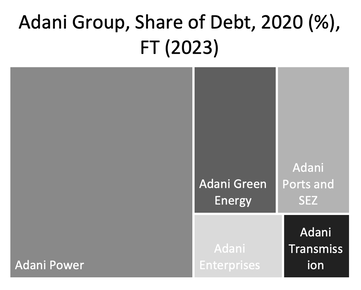

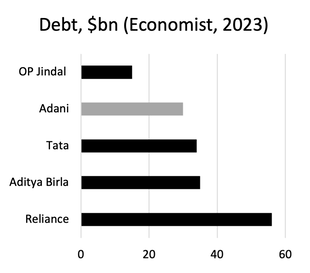

A few days after Hindenburg’s publication Adani announced that it won’t proceed with a planned equity issuance. Adani Group’s debt-to-equity ratio is one of the highest compared to other Indian conglomerates. In fact, there was speculation about the sell-off of parts of the business to meet liquidity needs and decrease its debt level. Most recent news indicate that Gautam Adani is indeed seeking to sell a stake in his cement business (Ambuja Cement) worth about $450mn, steak worth five percent of the conglomerate, as part of efforts to reduce debt and restore investor confidence in his conglomerate.

Apart from that, according to the latest news, French TotalEnergies put a hold on investments for their hydrogen joint venture. It can be expected that future investors will no longer consider Adani group as stable and reliable, though the US private equity fund GCQ partners agreed to buy 1.9 billion worth of stocks to underline its trust in the conglomerate.

Apart from that, according to the latest news, French TotalEnergies put a hold on investments for their hydrogen joint venture. It can be expected that future investors will no longer consider Adani group as stable and reliable, though the US private equity fund GCQ partners agreed to buy 1.9 billion worth of stocks to underline its trust in the conglomerate.

Indian Growth Model and Big Business

The Hindenburg report clearly has impacted the Adani Group’s progress irreversibly. But in the long-term the Hindenburg report also impacts the Indian economy overall; in particular the areas of India’s economic structure, political connections, and regulatory oversight. Now, big businesses, like Adani Group, are key in the economic growth model of India as set up by Prime Minister of India, Narendra Modi, which focuses on infrastructure to spur economic growth. Adani is responsible for 7% of the capital investment by India’s 500 largest non-financial firms (The Economist, 2023b). One investment analyst said: “We need ports before we need e-commerce” (Sender, 2020). The Indian business environment mostly comprises relatively few but very big companies, which are spread into many industries throughout India. In fact, India is developing its own economic structure. The structure is based on the government backing of national champions, who aim to achieve the ever-great scale of production and sales (Sender, 2020). This is contrary to the prominent Western view of greater market competition and relatively little government involvement.

The Hindenburg report clearly has impacted the Adani Group’s progress irreversibly. But in the long-term the Hindenburg report also impacts the Indian economy overall; in particular the areas of India’s economic structure, political connections, and regulatory oversight. Now, big businesses, like Adani Group, are key in the economic growth model of India as set up by Prime Minister of India, Narendra Modi, which focuses on infrastructure to spur economic growth. Adani is responsible for 7% of the capital investment by India’s 500 largest non-financial firms (The Economist, 2023b). One investment analyst said: “We need ports before we need e-commerce” (Sender, 2020). The Indian business environment mostly comprises relatively few but very big companies, which are spread into many industries throughout India. In fact, India is developing its own economic structure. The structure is based on the government backing of national champions, who aim to achieve the ever-great scale of production and sales (Sender, 2020). This is contrary to the prominent Western view of greater market competition and relatively little government involvement.

These large businesses often have strong connections with the government due to their size and their economic importance, but the Adani group is special in this case. Adani and Modi have known each other for over 20 years and have had strong ties since before either reached their current levels of power and richness (Findlay & Lockett, 2020; Sender, 2020). Modi also freely used Adani’s plane before his election and to Delhi when he was elected Prime Minister in 2014 (Bala, 2023a; The Economist, 2023a). At the 2023 Munich Security Conference, George Soros, an investor, said: “Modi and business tycoon Adani are close allies; their fate is intertwined” (Bala, 2023a).

Big Business and Soft Treatment from Government

The Economist rightly asks: “If a tiny firm of short-sellers in New York can ask hard questions, why didn’t the regulators?” (2023a). After the political turmoil caused by the Hindenburg report, the Indian Supreme court formed a panel to investigate whether there were any regulatory failures and probed SEBI to investigate any unlawful manipulation of stock prices (Bala, 2023b). SEBI has previously neglected to publicly investigate the use of offshore entities that allegedly inflate the Adani Group stock’s price. The strong relationship of big conglomerates with the government could be a reason for the lack of institutional-government oversight. In India, Modi’s government tightly controls the mainstream media channels which also restricts their ability to strongly criticize government actions or inactions (Reed & Singh, 2023; Srivas & Agarwal, 2023; The Economist, 2023a). The limited power of investors to request information and their inability to directly short an Indian stock has as a consequence less critical oversight from investors.

In recent years, India has had difficulty attracting foreign capital which it needs to sustain growth. In the case of Adani Group, there is now concern that it might be too short of funds to maintain and further expand on its position as a large contributor to India’s infrastructural development [Rajvanshi, 2023]. As foreign investors are reevaluating governance, transparency, and indebtedness for Indian companies, this could lead to a major shakeup in the Indian equities market [The Economic Times, 2023]. That is why, many journalists and investors alike hope that this crisis pushes the Indian government to improve regulation and drive reforms to spur sustainable economic growth (The Economist, 2023a; Hirsch & Woods, 2023). Although Modi still stands strong in polls, the political and societal backlash after the Hindenburg report could push Modi to aim for stronger reforms (Bala, 2023a).

The Economist rightly asks: “If a tiny firm of short-sellers in New York can ask hard questions, why didn’t the regulators?” (2023a). After the political turmoil caused by the Hindenburg report, the Indian Supreme court formed a panel to investigate whether there were any regulatory failures and probed SEBI to investigate any unlawful manipulation of stock prices (Bala, 2023b). SEBI has previously neglected to publicly investigate the use of offshore entities that allegedly inflate the Adani Group stock’s price. The strong relationship of big conglomerates with the government could be a reason for the lack of institutional-government oversight. In India, Modi’s government tightly controls the mainstream media channels which also restricts their ability to strongly criticize government actions or inactions (Reed & Singh, 2023; Srivas & Agarwal, 2023; The Economist, 2023a). The limited power of investors to request information and their inability to directly short an Indian stock has as a consequence less critical oversight from investors.

In recent years, India has had difficulty attracting foreign capital which it needs to sustain growth. In the case of Adani Group, there is now concern that it might be too short of funds to maintain and further expand on its position as a large contributor to India’s infrastructural development [Rajvanshi, 2023]. As foreign investors are reevaluating governance, transparency, and indebtedness for Indian companies, this could lead to a major shakeup in the Indian equities market [The Economic Times, 2023]. That is why, many journalists and investors alike hope that this crisis pushes the Indian government to improve regulation and drive reforms to spur sustainable economic growth (The Economist, 2023a; Hirsch & Woods, 2023). Although Modi still stands strong in polls, the political and societal backlash after the Hindenburg report could push Modi to aim for stronger reforms (Bala, 2023a).

What’s Next?

Investors’ trust in transparency, the quality of governance, and the strength of institutions will be decisive to attract foreign capital to realize India’s economic ambitions (Financial Times, 2023). High geopolitical tensions over the last few years let India solidify itself as the next large hub for cheap manufacturing of tech products as companies increasingly move away from China.Moreover, to prevent cases like the Adani overvaluation and potential fraud, India needs to disconnect its politics from business to the extent that it can allow for the press and market regulators to freely do their job. Observing the consequences that the Adani Group faces and will continue to due to the ever-lasting impact of the Hindenburg report, it will have to once again prove to foreign investors its credibility to flourish within the Indian economy and pursue expansion of its operations.

Investors’ trust in transparency, the quality of governance, and the strength of institutions will be decisive to attract foreign capital to realize India’s economic ambitions (Financial Times, 2023). High geopolitical tensions over the last few years let India solidify itself as the next large hub for cheap manufacturing of tech products as companies increasingly move away from China.Moreover, to prevent cases like the Adani overvaluation and potential fraud, India needs to disconnect its politics from business to the extent that it can allow for the press and market regulators to freely do their job. Observing the consequences that the Adani Group faces and will continue to due to the ever-lasting impact of the Hindenburg report, it will have to once again prove to foreign investors its credibility to flourish within the Indian economy and pursue expansion of its operations.

Written by: Pietro Golzio, Tobias Van Winkel, Vasara Silininkaite, Willem van der Mee

References

Adani Enterprises | Company Overview & News. (2023). Forbes. https://www.forbes.com/companies/adani-enterprises/?sh=46eb32df4a87

Adani Enterprises Limited (ADANIENT.NS) Latest Stock News & Headlines - Yahoo Finance. (n.d.). Finance.yahoo.com. Retrieved March 24, 2023, from https://finance.yahoo.com/quote/ADANIENT.NS/news?p=ADANIENT.NS

Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History. (2023, January 25). Hindenburg Research. https://hindenburgresearch.com/adani/

Adani’s $108 billion crisis shakes investors’ faith in India. (2023, February 3). The Economic Times. https://economictimes.indiatimes.com/markets/stocks/news/adanis-108-billion-crisis-shakes-investors-faith-in-india/articleshow/97566730.cms

Bala, S. (2023a, February 15). Adani’s fall reignites scrutiny of billionaire’s close ties with Modi. CNBC. https://www.cnbc.com/2023/02/16/adanis-epic-fall-reignites-scrutiny-on-tycoons-close-ties-modi-.html

Bala, S. (2023b, March 8). Adani fallout could have political implications for India in the longer term, economist says. CNBC. https://www.cnbc.com/2023/03/08/adani-fallout-could-have-political-implications-for-india-economist.html

Check out Adani Enterprises Ltd’s stock price (ADANIENT-IN) in real time. (n.d.). CNBC. Retrieved March 23, 2023, from https://www.cnbc.com/quotes/ADANIENT-IN

Financial Times. (2023, January 30). Adani affair is a test for India Inc. Financial Times. https://www.ft.com/content/8157b75d-67a9-4307-ba21-6b6409dbab1d

Findlay, S., & Lockett, H. (2020, November 13). “Modi’s Rockefeller”: Gautam Adani and the concentration of power in India. Financial Times. https://www.ft.com/content/474706d6-1243-4f1e-b365-891d4c5d528b?utm_source=substack&utm_medium=email

Gautam Adani seeks to sell stake in cement business for $450mn to reduce debt. (2023, March 10). Financial Times. https://www.ft.com/content/7308e842-8f61-45cf-9361-7832ba16eead

Hirsch, P., & Woods, D. (2023, February 9). What does the Adani Group’s crash mean for India’s economy? : The Indicator from Planet Money. NPR. https://www.npr.org/2023/02/09/1155855212/what-does-the-adani-groups-crash-mean-for-indias-economy

How did Hindenburg short Adani stock? (2023, February 17). Financial Times. https://www.ft.com/content/6a8a5548-0927-41e4-9818-1eb25c72d96f

Lee, J. (2023, February 1). Adani vs. Hindenburg: How Asia’s richest man lost his crown in just a few days. CNBC. https://www.cnbc.com/2023/02/01/adani-vs-hindenburg-how-asias-richest-man-lost-his-crown-in-just-a-few-days.html

LIC’s investment in loss, Adani out of top 25 rich list: The impact of Hindenburg report. (2023, February 26). Business Today. https://www.businesstoday.in/latest/corporate/story/lics-investment-in-loss-adani-out-of-top-25-rich-list-the-impact-of-hindenburg-report-371489-2023-02-26

Market predator Hindenburg preys on Adani stock. (n.d.). Domain-B.com. Retrieved March 23, 2023, from https://www.domain-b.com/investments/brokers/20230306_preys.html

Rajvanshi, A. (2023, February 1). What Adani’s Downfall Says About India’s Crony Capitalism. Time. https://time.com/6251935/gautam-adani-group-india-hindenburg/

Reed, J., & Singh, J. (2023, March 23). Rahul Gandhi sentenced to two years in prison over Modi remarks. Financial Times. https://www.ft.com/content/3c5af11d-6cb4-41e4-b1cb-30006b00cd39

Reuters. (2023, February 10). Adani Group reels after report from U.S. short-seller Hindenburg. Reuters. https://www.reuters.com/markets/adani-group-reels-after-report-us-short-seller-hindenburg-2023-02-10/

Sender, H. (2020, October 27). Gautam Adani’s success shows importance of connections and execution. Financial Times. https://www.ft.com/content/212ab93d-c7b4-453d-964f-c10a59f960d4

Srivas, A., & Agarwal, K. (2023, March 6). What Does the Adani Crisis Mean for India’s Growth Story? Foreign Policy. https://foreignpolicy.com/2023/03/06/adani-group-crisis-hindenburg-india-modi-economy-growth/?tpcc=onboarding_trending

The Economist. (2023a, February 9). The humbling of Gautam Adani is a test for Indian capitalism. The Economist. https://www.economist.com/leaders/2023/02/09/the-humbling-of-gautam-adani-is-a-test-for-indian-capitalism

The Economist. (2023b, February 9). Why Adani Group’s troubles will reverberate across India. The Economist. https://www.economist.com/briefing/2023/02/09/why-adani-groups-troubles-will-reverberate-across-india

Upadhyay, J. P., Kalra, A., & Shah, A. (2023, January 30). Adani hits back at Hindenburg, says it made all disclosures. Reuters. https://www.reuters.com/business/indias-adani-group-hindenburg-report-intended-create-false-market-2023-01-29/

Adani Enterprises | Company Overview & News. (2023). Forbes. https://www.forbes.com/companies/adani-enterprises/?sh=46eb32df4a87

Adani Enterprises Limited (ADANIENT.NS) Latest Stock News & Headlines - Yahoo Finance. (n.d.). Finance.yahoo.com. Retrieved March 24, 2023, from https://finance.yahoo.com/quote/ADANIENT.NS/news?p=ADANIENT.NS

Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History. (2023, January 25). Hindenburg Research. https://hindenburgresearch.com/adani/

Adani’s $108 billion crisis shakes investors’ faith in India. (2023, February 3). The Economic Times. https://economictimes.indiatimes.com/markets/stocks/news/adanis-108-billion-crisis-shakes-investors-faith-in-india/articleshow/97566730.cms

Bala, S. (2023a, February 15). Adani’s fall reignites scrutiny of billionaire’s close ties with Modi. CNBC. https://www.cnbc.com/2023/02/16/adanis-epic-fall-reignites-scrutiny-on-tycoons-close-ties-modi-.html

Bala, S. (2023b, March 8). Adani fallout could have political implications for India in the longer term, economist says. CNBC. https://www.cnbc.com/2023/03/08/adani-fallout-could-have-political-implications-for-india-economist.html

Check out Adani Enterprises Ltd’s stock price (ADANIENT-IN) in real time. (n.d.). CNBC. Retrieved March 23, 2023, from https://www.cnbc.com/quotes/ADANIENT-IN

Financial Times. (2023, January 30). Adani affair is a test for India Inc. Financial Times. https://www.ft.com/content/8157b75d-67a9-4307-ba21-6b6409dbab1d

Findlay, S., & Lockett, H. (2020, November 13). “Modi’s Rockefeller”: Gautam Adani and the concentration of power in India. Financial Times. https://www.ft.com/content/474706d6-1243-4f1e-b365-891d4c5d528b?utm_source=substack&utm_medium=email

Gautam Adani seeks to sell stake in cement business for $450mn to reduce debt. (2023, March 10). Financial Times. https://www.ft.com/content/7308e842-8f61-45cf-9361-7832ba16eead

Hirsch, P., & Woods, D. (2023, February 9). What does the Adani Group’s crash mean for India’s economy? : The Indicator from Planet Money. NPR. https://www.npr.org/2023/02/09/1155855212/what-does-the-adani-groups-crash-mean-for-indias-economy

How did Hindenburg short Adani stock? (2023, February 17). Financial Times. https://www.ft.com/content/6a8a5548-0927-41e4-9818-1eb25c72d96f

Lee, J. (2023, February 1). Adani vs. Hindenburg: How Asia’s richest man lost his crown in just a few days. CNBC. https://www.cnbc.com/2023/02/01/adani-vs-hindenburg-how-asias-richest-man-lost-his-crown-in-just-a-few-days.html

LIC’s investment in loss, Adani out of top 25 rich list: The impact of Hindenburg report. (2023, February 26). Business Today. https://www.businesstoday.in/latest/corporate/story/lics-investment-in-loss-adani-out-of-top-25-rich-list-the-impact-of-hindenburg-report-371489-2023-02-26

Market predator Hindenburg preys on Adani stock. (n.d.). Domain-B.com. Retrieved March 23, 2023, from https://www.domain-b.com/investments/brokers/20230306_preys.html

Rajvanshi, A. (2023, February 1). What Adani’s Downfall Says About India’s Crony Capitalism. Time. https://time.com/6251935/gautam-adani-group-india-hindenburg/

Reed, J., & Singh, J. (2023, March 23). Rahul Gandhi sentenced to two years in prison over Modi remarks. Financial Times. https://www.ft.com/content/3c5af11d-6cb4-41e4-b1cb-30006b00cd39

Reuters. (2023, February 10). Adani Group reels after report from U.S. short-seller Hindenburg. Reuters. https://www.reuters.com/markets/adani-group-reels-after-report-us-short-seller-hindenburg-2023-02-10/

Sender, H. (2020, October 27). Gautam Adani’s success shows importance of connections and execution. Financial Times. https://www.ft.com/content/212ab93d-c7b4-453d-964f-c10a59f960d4

Srivas, A., & Agarwal, K. (2023, March 6). What Does the Adani Crisis Mean for India’s Growth Story? Foreign Policy. https://foreignpolicy.com/2023/03/06/adani-group-crisis-hindenburg-india-modi-economy-growth/?tpcc=onboarding_trending

The Economist. (2023a, February 9). The humbling of Gautam Adani is a test for Indian capitalism. The Economist. https://www.economist.com/leaders/2023/02/09/the-humbling-of-gautam-adani-is-a-test-for-indian-capitalism

The Economist. (2023b, February 9). Why Adani Group’s troubles will reverberate across India. The Economist. https://www.economist.com/briefing/2023/02/09/why-adani-groups-troubles-will-reverberate-across-india

Upadhyay, J. P., Kalra, A., & Shah, A. (2023, January 30). Adani hits back at Hindenburg, says it made all disclosures. Reuters. https://www.reuters.com/business/indias-adani-group-hindenburg-report-intended-create-false-market-2023-01-29/