In the United States, Walmart is the epitome of a household name. Walmart claims that 90% of the American population lives within 10 miles (about 16km) of a Walmart store, which, with almost 5000 stores across the country, is entirely plausible. Its operations throughout the rest of North America is just as expansive, with 2500 stores in Mexico and Central America and over 400 stores in Canada.

Outside its home continent, Walmart is known with many different local names: perhaps the most well-known is its UK-based subsidiary Asda, which it acquired in 1999; Japan-based Seiyu (2008), with stores in Hong Kong and Singapore; South Africa-based Massmart (2010). If we consider all of its operations, it is the world’s largest company by revenue, cited by Fortune Global 500 as US$514.405 billion.

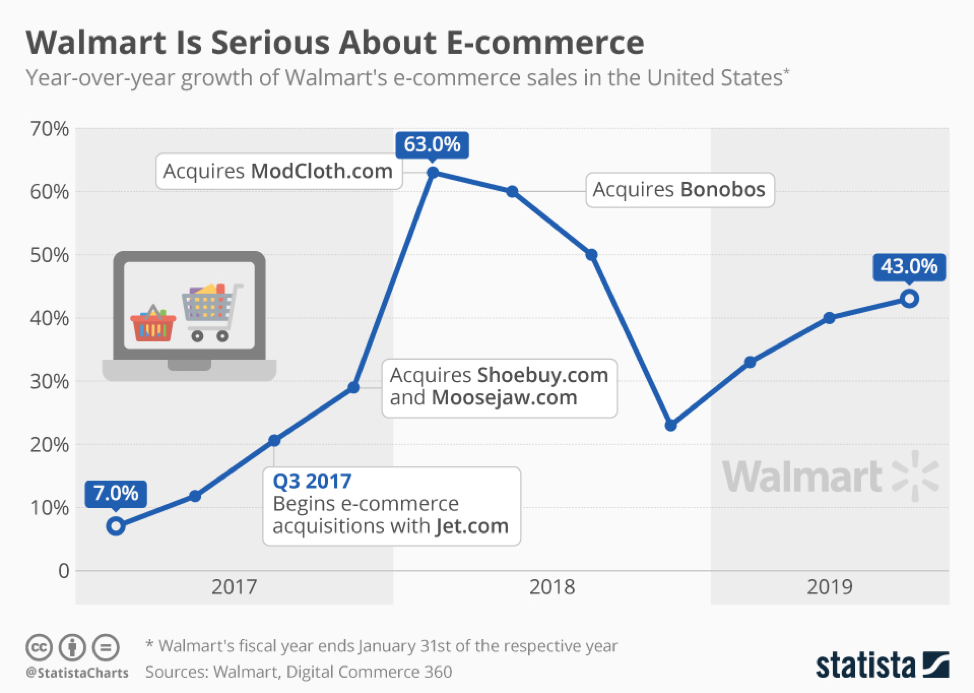

In recent years, Walmart has invested heavily in acquiring e-commerce companies in an attempt to compete with online retail giant Amazon. In 2016, the company announced the acquisition of Jet.com, an online clothing and grocery retailer, which also comprised other companies, such as ShoeBuy and Hayneedle. After the acquisition was announced, Jet.com founder Marc Lore was appointed as the CEO of Walmart eCommerce US, showing the company’s dedication to expanding its online business.

In 2017 Walmart acquired ModCloth, an “indie and vintage-inspired” online women’s clothing retailer; Eloquii, a plus-sized fashion brand; MooseJaw, which specializes in outdoor recreation gear; and Bonobos, a men’s fashion brand. Other recent acquisitions include Parcel, a New York City-based delivery service specializing in e-commerce package delivery such as perishable foods, and e-commerce platforms in international markets, such as buying a controlling stake in Flipkart, based in Bengaluru, India.

Outside its home continent, Walmart is known with many different local names: perhaps the most well-known is its UK-based subsidiary Asda, which it acquired in 1999; Japan-based Seiyu (2008), with stores in Hong Kong and Singapore; South Africa-based Massmart (2010). If we consider all of its operations, it is the world’s largest company by revenue, cited by Fortune Global 500 as US$514.405 billion.

In recent years, Walmart has invested heavily in acquiring e-commerce companies in an attempt to compete with online retail giant Amazon. In 2016, the company announced the acquisition of Jet.com, an online clothing and grocery retailer, which also comprised other companies, such as ShoeBuy and Hayneedle. After the acquisition was announced, Jet.com founder Marc Lore was appointed as the CEO of Walmart eCommerce US, showing the company’s dedication to expanding its online business.

In 2017 Walmart acquired ModCloth, an “indie and vintage-inspired” online women’s clothing retailer; Eloquii, a plus-sized fashion brand; MooseJaw, which specializes in outdoor recreation gear; and Bonobos, a men’s fashion brand. Other recent acquisitions include Parcel, a New York City-based delivery service specializing in e-commerce package delivery such as perishable foods, and e-commerce platforms in international markets, such as buying a controlling stake in Flipkart, based in Bengaluru, India.

Walmart has seen double-digit growth in sales in the US since its embrace of e-commerce. One unique feature the business has over its competitors is that despite its relative newcomer status in the e-commerce industry, it already has the infrastructure to efficiently and quickly fulfill its orders to consumers. Its near-5000 store footprint in the United States means that the business effectively has 5000 warehouses that produce a profit in their own right. This allows for each store to double as a warehouse without incurring additional overhead and has allowed Walmart to become the third-largest retail e-commerce company by sales.

Walmart has seen double-digit growth in sales in the US since its embrace of e-commerce. One unique feature the business has over its competitors is that despite its relative newcomer status in the e-commerce industry, it already has the infrastructure to efficiently and quickly fulfill its orders to consumers. Its near-5000 store footprint in the United States means that the business effectively has 5000 warehouses that produce a profit in their own right. This allows for each store to double as a warehouse without incurring additional overhead and has allowed Walmart to become the third-largest retail e-commerce company by sales.

Despite the fairly effective launch in the online retailer landscape, Walmart is looking to re-evaluate some of its investments only a short while after the investments’ acquisition or launch. Namely: ModCloth and JetBlack, which is an exclusive shopping service operating in New York City.

Earlier in October, news of Walmart selling the assets and operations of ModCloth to Go Global Retail was reported. The sum of the sale was undisclosed. Walmart was unable to see any synergy with ModCloth, as ModCloth’s brand is perceived as more upscale than Walmart; a close association between the two would have run the risk of alienating Modcloth’s target audience. Just a few hours after the announcement of ModCloth’s sale, the Wall Street Journal reported that Walmart was also seeking outside investors for JetBlack. The business is primarily text-based and allows members to order nearly anything for fast delivery. Walmart was hoping to leverage the data it collects through JetBlack into powering an automated personal delivery service. Still, the project is proving to be too costly, with WSJ reporting that JetBlack was losing about US$15,000 per member annually. It is reported that, as a whole, 3-commerce is projected to lose US$1 billion in 2019.

With the recent news, it seems that Walmart will be rethinking its e-commerce strategy to prioritize incubating its own brands, and focusing more on products that are a natural fit to be sold within Walmart stores or in their online store. The thinking behind Walmart’s acquisition of ModCloth, along with many of the other brands like Bonobos and Eloquii, was to acquire products that have proven to be successful in an online environment. However, with the company’s strategic movements within the past year and even earlier this month, the strategy is to focus on products and services that play well with the tried-and-true, hugely profitable Walmart brand. One such example is the widely successful launch of Walmart’s private mattress label Allswell, which does have synergy with the Walmart brand and can be sold in Walmart stores. Another addition to Walmart’s e-commerce offerings is investments in additional ways for consumers to shop: delivery and customer pickup. These additional offerings that are more in line with how Walmart became the retail giant that it is today.

After spending a few years to expand its online presence with very impressive results, but suffering heavy losses in the process, Walmart seems to have found itself once again and will refocus its e-commerce strategy on what it does best - being the store in which Americans can reliably find groceries and basics at an affordable price. Walmart’s strategy in the past few years has been hugely effective in expanding its online retail market share, but now it has to ask itself: how can we make this profitable?

Lawin Miclat

Earlier in October, news of Walmart selling the assets and operations of ModCloth to Go Global Retail was reported. The sum of the sale was undisclosed. Walmart was unable to see any synergy with ModCloth, as ModCloth’s brand is perceived as more upscale than Walmart; a close association between the two would have run the risk of alienating Modcloth’s target audience. Just a few hours after the announcement of ModCloth’s sale, the Wall Street Journal reported that Walmart was also seeking outside investors for JetBlack. The business is primarily text-based and allows members to order nearly anything for fast delivery. Walmart was hoping to leverage the data it collects through JetBlack into powering an automated personal delivery service. Still, the project is proving to be too costly, with WSJ reporting that JetBlack was losing about US$15,000 per member annually. It is reported that, as a whole, 3-commerce is projected to lose US$1 billion in 2019.

With the recent news, it seems that Walmart will be rethinking its e-commerce strategy to prioritize incubating its own brands, and focusing more on products that are a natural fit to be sold within Walmart stores or in their online store. The thinking behind Walmart’s acquisition of ModCloth, along with many of the other brands like Bonobos and Eloquii, was to acquire products that have proven to be successful in an online environment. However, with the company’s strategic movements within the past year and even earlier this month, the strategy is to focus on products and services that play well with the tried-and-true, hugely profitable Walmart brand. One such example is the widely successful launch of Walmart’s private mattress label Allswell, which does have synergy with the Walmart brand and can be sold in Walmart stores. Another addition to Walmart’s e-commerce offerings is investments in additional ways for consumers to shop: delivery and customer pickup. These additional offerings that are more in line with how Walmart became the retail giant that it is today.

After spending a few years to expand its online presence with very impressive results, but suffering heavy losses in the process, Walmart seems to have found itself once again and will refocus its e-commerce strategy on what it does best - being the store in which Americans can reliably find groceries and basics at an affordable price. Walmart’s strategy in the past few years has been hugely effective in expanding its online retail market share, but now it has to ask itself: how can we make this profitable?

Lawin Miclat