Air India, India’s state-owned national carrier, once soared high. It propelled Asia into the Jet Age and dominated the national market. However, financially-imprudent decisions over many years, coupled with the blitz of new private airlines in the industry, have crippled the airline.

It is no surprise then that the Government of India is keen on cutting off the flow of taxpayer money that props up the underperforming airline by divesting its stake. The government is seeking to sell 76% of its equity stake in Air India Limited. Subsidiaries of Air India Limited, Air India Express (low-cost carrier) and AISATS (provider of ground handling operations like baggage handling), will also be a part of the transaction.

Tailwinds For Private Investors

Air India and its subsidiary, Air India Express, boast of a combined fleet of 138 planes including some of the newer Boeing 787 Dreamliner aircraft and is thus a major player in one of the largest aviation markets globally.

Moreover, the airline already owns more than 6,200 (arrival and departure) slots at airports within and outside India. It owns prime slots at some of the world’s busiest airports like New York and London’s Heathrow.

As the graph illustrates, Air India dominates its Indian competitors in terms of international travel.

Being the flag carrier of India carries inherent value that could help potential buyers. Air India’s brand value is estimated at around $750 million. Branding expert, Saurabh Uboweja says, “The real value of Air India is in the brand and not in the physical asset[s] of [the] carrier.”

In what could improve the optics for potential suitors, after many years, Air India managed to squeeze out an operating profit – though small – of $16 million for the fiscal year 2016. That figure more than doubled in 2017.

Moreover, buyers do not need to worry about the government using its remaining 24% stake to interfere in the operations of Air India once the sale goes through. India’s Minister of State for Civil Aviation, Jayant Sinha, has assured, “the winning bidder is going to have full management control and will be able to operate the company in the way that will maximise revenues, profitability and value creation.”

Investors will also be attracted by the buoyancy of the large and expanding Indian market.

In 2011, domestic flights flew around 60 million people. In only six years, the figure just about doubled to 117 million people. Moreover, between financial years 2007 and 2017, international traffic grew at a compound annual growth rate (CAGR) of 11%. Projections also look positive.

On a related note, the forecasted boom in tourism and the Government’s plan to invest $6 billion in airport infrastructure will only help nurture India’s air travel market further.

Investors Should Also Be Cautious

As of September 2017, the 86-year-old Air India was placed only fourth in terms of market share of domestic flights with a mere 13.5%. This was a fraction of the share of market leader, IndiGo (launched as recently as 2006), which had 38.2%. Air India is by no means a star in the industry.

Indeed, the airline faces intense competition from private players who are far more operationally-efficient. Air India’s on-time performance is one of the worst in the industry and it is no surprise that customers flock to the competition. A few years ago, a report emerged underscoring the airline’s poor operational efficiency yet again – it had doled out large sums of money for repairs that should have been paid for by the warranty.

Moreover, the move to privatise has already been met with some resistance from worker unions who see the move as “arbitrary and against national interests."

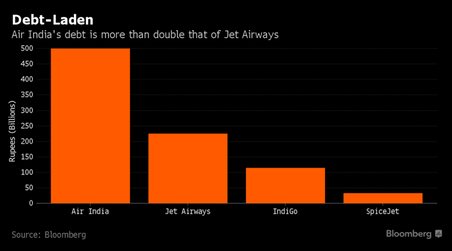

However, the elephant in the room is the burden of Air India’s roughly $5 billion in debt that would be placed on the shoulders of the new buyer.

It is no surprise then that the Government of India is keen on cutting off the flow of taxpayer money that props up the underperforming airline by divesting its stake. The government is seeking to sell 76% of its equity stake in Air India Limited. Subsidiaries of Air India Limited, Air India Express (low-cost carrier) and AISATS (provider of ground handling operations like baggage handling), will also be a part of the transaction.

Tailwinds For Private Investors

Air India and its subsidiary, Air India Express, boast of a combined fleet of 138 planes including some of the newer Boeing 787 Dreamliner aircraft and is thus a major player in one of the largest aviation markets globally.

Moreover, the airline already owns more than 6,200 (arrival and departure) slots at airports within and outside India. It owns prime slots at some of the world’s busiest airports like New York and London’s Heathrow.

As the graph illustrates, Air India dominates its Indian competitors in terms of international travel.

Being the flag carrier of India carries inherent value that could help potential buyers. Air India’s brand value is estimated at around $750 million. Branding expert, Saurabh Uboweja says, “The real value of Air India is in the brand and not in the physical asset[s] of [the] carrier.”

In what could improve the optics for potential suitors, after many years, Air India managed to squeeze out an operating profit – though small – of $16 million for the fiscal year 2016. That figure more than doubled in 2017.

Moreover, buyers do not need to worry about the government using its remaining 24% stake to interfere in the operations of Air India once the sale goes through. India’s Minister of State for Civil Aviation, Jayant Sinha, has assured, “the winning bidder is going to have full management control and will be able to operate the company in the way that will maximise revenues, profitability and value creation.”

Investors will also be attracted by the buoyancy of the large and expanding Indian market.

In 2011, domestic flights flew around 60 million people. In only six years, the figure just about doubled to 117 million people. Moreover, between financial years 2007 and 2017, international traffic grew at a compound annual growth rate (CAGR) of 11%. Projections also look positive.

On a related note, the forecasted boom in tourism and the Government’s plan to invest $6 billion in airport infrastructure will only help nurture India’s air travel market further.

Investors Should Also Be Cautious

As of September 2017, the 86-year-old Air India was placed only fourth in terms of market share of domestic flights with a mere 13.5%. This was a fraction of the share of market leader, IndiGo (launched as recently as 2006), which had 38.2%. Air India is by no means a star in the industry.

Indeed, the airline faces intense competition from private players who are far more operationally-efficient. Air India’s on-time performance is one of the worst in the industry and it is no surprise that customers flock to the competition. A few years ago, a report emerged underscoring the airline’s poor operational efficiency yet again – it had doled out large sums of money for repairs that should have been paid for by the warranty.

Moreover, the move to privatise has already been met with some resistance from worker unions who see the move as “arbitrary and against national interests."

However, the elephant in the room is the burden of Air India’s roughly $5 billion in debt that would be placed on the shoulders of the new buyer.

It has been alleged that corruption at important levels of the Indian government led to decisions in the past that could continue to be detrimental to the airline for years to come. In 2004, the civil aviation ministry, more than doubled Air India’s aircraft purchase order without reasoning in terms of a route-map for these additional aircraft. Even worse, the cost of the purchase order was six times the airline’s turnover for that year. At the same time, profitable routes were given away to private airlines.

The impact of such decisions can be seen in Air India’s dismal financial statements which have been showing increasing losses each year. The airline’s net loss for the fiscal year 2017 totalled to $885 million, a deterioration from the $590 million loss posted in 2016.

Conclusion

It seems that privatizing Air India is in line with the Modi administration’s recent string of reforms. It is obvious that the business savvy of private investors is necessary to once again make the airline fly high. A few players like IndiGo and Singapore Airlines have shown interest. The question is who will overlook the mountain of debt and be the one to help Air India stay airborne.

Rohan Matthew

The impact of such decisions can be seen in Air India’s dismal financial statements which have been showing increasing losses each year. The airline’s net loss for the fiscal year 2017 totalled to $885 million, a deterioration from the $590 million loss posted in 2016.

Conclusion

It seems that privatizing Air India is in line with the Modi administration’s recent string of reforms. It is obvious that the business savvy of private investors is necessary to once again make the airline fly high. A few players like IndiGo and Singapore Airlines have shown interest. The question is who will overlook the mountain of debt and be the one to help Air India stay airborne.

Rohan Matthew