November 11th, is a festivity known as “Singles’ day” in China, when single people celebrate their sentimental status and, in the last years, enjoy taking care about themselves through self-made gifts. Sunday, November 11th, 2018, will be remembered the largest e-commerce day ever, led by the Chinese giant Alibaba and its parent companies. It is not a case that it was organized in coincidence with the Singles’ Day, but the striking element is that this is a festivity limited to China only, and all figures presented must be looked as pertaining to a single country only.

Singles’ Day, which has become Alibaba’s equivalent to Amazon’s PrimeDay starting from a student festivity, is a 24-hour shopping event when discounts are proposed on its online platforms. For the 10th anniversary of the event, the company decided to go big. A huge advertising campaign has been organized and has culminated in a gala started as early as Saturday and ongoing up until the end of the 11:11 festival. Media coverage was assured by the worldwide known Cirque du Soleil and the presence not only of far east stars, but also American VIPs such as Mariah Carey and Kobe Bryant. Of course, Jack Ma’s presence was out of discussion, even though he gave no speech whatsoever.

Over 180.000 domestic and foreign brands took part in the event. Two orders out of five were placed to international brands, among which figured Nike, Adidas, Nestle, L’Oréal and, of course, Apple. American products are still appealing to Chinese consumers, despite the trade war going on: American goods were second only to Japanese goods in terms of GMV. Weakness is shown, however, in home furniture, durable goods and more generally high price tag items, signaling uncertainty in the future outlook by consumers.

Singles’ Day, which has become Alibaba’s equivalent to Amazon’s PrimeDay starting from a student festivity, is a 24-hour shopping event when discounts are proposed on its online platforms. For the 10th anniversary of the event, the company decided to go big. A huge advertising campaign has been organized and has culminated in a gala started as early as Saturday and ongoing up until the end of the 11:11 festival. Media coverage was assured by the worldwide known Cirque du Soleil and the presence not only of far east stars, but also American VIPs such as Mariah Carey and Kobe Bryant. Of course, Jack Ma’s presence was out of discussion, even though he gave no speech whatsoever.

Over 180.000 domestic and foreign brands took part in the event. Two orders out of five were placed to international brands, among which figured Nike, Adidas, Nestle, L’Oréal and, of course, Apple. American products are still appealing to Chinese consumers, despite the trade war going on: American goods were second only to Japanese goods in terms of GMV. Weakness is shown, however, in home furniture, durable goods and more generally high price tag items, signaling uncertainty in the future outlook by consumers.

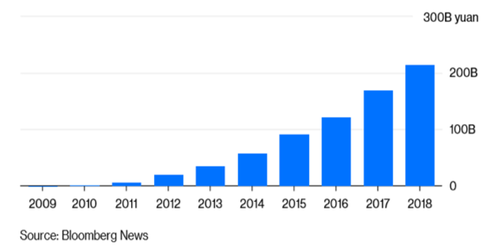

Sales revenues for an online retailer can be expressed as Gross Merchandise Ratio (GMV), a figure which, in this case, hit over $30.8 billion in 24 hours. If we look at it in nominal terms, no doubts that it was the greatest e-commerce day ever, with GMV being double that of Amazon’s Black Friday and Cyber Monday combined, according to Forbes. The event raised $1 billion just after one minute and 25 seconds, and the $25.3 billion collected in 2017 were surpassed already in the afternoon. Over one billion packages were handled. These nominal numbers are stunning, yet some concernment can arise if they are compared in relative terms. The GMV rate of growth is actually declining, with a +27% registered on the previous year while the 2017 increase over 2016 was +39%. These figures are comprehensive of the total sales, which of course are not made by Alibaba only. A galaxy of subsidiaries has been forming over the years, dealing with a specific geographic area or product type. These subsidiaries, on Singles’ Day, formed a huge conglomerate able to fulfill the needs of diverse clients. The range goes from general selling sites such as Taobao or Tmall to more specific ones: Ele.me, which deals with food delivery, the new acquired Lazada which has a strong focus on Southeast Asia and AliExpress, which provides retail selling. Moreover, Singles’ Day was not limited to certain categories, sellers or geographical areas. Ele.me, for example, delivered for Starbucks, with whom it has struck a deal previously this year. Tech sector was on the hype too, despite concerns about smartphones’ market saturation: in the early sales, Apple and the Chinese Xiaomi were the top-selling companies. Despite new acquisitions, deals and entering into new markets, the company failed to keep up previous years’ growth pace.

Nonetheless, as for Alibaba’s stock performance when sales from the 11:11 event were announced, BABA title price registered a +9.38% increase in the following three days. Yet some skepticism arises, because since it has gone public on the NYSE, GMV for Singles’ Day underwent a 179-fold increase while revenues went up only 21 times, according to Bloomberg. Indeed, a research conducted by Bloomberg itself showed no correlation between the GMV and revenues or profit: it is confirmed by Alibaba, whose gap between the two measures is increasing. Conclusions cannot be drawn precisely, thus, on expected profits – and stock price – the company will make. Yet, as observed by Forbes, investors may shift to Alibaba’s stocks instead of holding shares of American companies which perform the same activities, Amazon in particular. Interest rate increases in the US may lead to lower confidence in the American market, while companies as Alibaba provide growth supported by large amount of sales. In this view, sales assume more relevance and be a driver for stock price.

The reasons for such a great success of Singles’ Day must be found in Alibaba’s strategy of targeting the uprising Chinese middle class. This is a long-run strategy towards a consumer segment which will triple by 2030, according to OECD analysis: Chinese middle class will grow to over 850 million people from current 300 million and Alibaba knows it well. “Middle-class consumers have experienced significant real wage growth over the past decade, and they are looking for high-quality products to satisfy their […] sophisticated lifestyle” said Vice Chairman Joe Tsai. He added that this is a trend which is not going to stop due to current China-USA trade war and affirms demand in the domestic market is still buoyant: good news for investors worried by the recent political escalation and by the Asian bear market.

On the stocks’ future there is little to comment, as diverse outcomes of current political and economic scene may arise. On the contrary, some predictions about online retail could be made. More specifically, according to Tsai, consumers’ demand does not give signs of slowdown following China’s cooling economy. Furthermore, only a tiny percentage of commerce, 17.5%, is made online. Alibaba’s growth opportunities are impressive: a growing Chinese middle class, which spends more and may spend through the web, will surely be attracted by this local major player. And by Singles’ Day too.

Luigi Marchese

Nonetheless, as for Alibaba’s stock performance when sales from the 11:11 event were announced, BABA title price registered a +9.38% increase in the following three days. Yet some skepticism arises, because since it has gone public on the NYSE, GMV for Singles’ Day underwent a 179-fold increase while revenues went up only 21 times, according to Bloomberg. Indeed, a research conducted by Bloomberg itself showed no correlation between the GMV and revenues or profit: it is confirmed by Alibaba, whose gap between the two measures is increasing. Conclusions cannot be drawn precisely, thus, on expected profits – and stock price – the company will make. Yet, as observed by Forbes, investors may shift to Alibaba’s stocks instead of holding shares of American companies which perform the same activities, Amazon in particular. Interest rate increases in the US may lead to lower confidence in the American market, while companies as Alibaba provide growth supported by large amount of sales. In this view, sales assume more relevance and be a driver for stock price.

The reasons for such a great success of Singles’ Day must be found in Alibaba’s strategy of targeting the uprising Chinese middle class. This is a long-run strategy towards a consumer segment which will triple by 2030, according to OECD analysis: Chinese middle class will grow to over 850 million people from current 300 million and Alibaba knows it well. “Middle-class consumers have experienced significant real wage growth over the past decade, and they are looking for high-quality products to satisfy their […] sophisticated lifestyle” said Vice Chairman Joe Tsai. He added that this is a trend which is not going to stop due to current China-USA trade war and affirms demand in the domestic market is still buoyant: good news for investors worried by the recent political escalation and by the Asian bear market.

On the stocks’ future there is little to comment, as diverse outcomes of current political and economic scene may arise. On the contrary, some predictions about online retail could be made. More specifically, according to Tsai, consumers’ demand does not give signs of slowdown following China’s cooling economy. Furthermore, only a tiny percentage of commerce, 17.5%, is made online. Alibaba’s growth opportunities are impressive: a growing Chinese middle class, which spends more and may spend through the web, will surely be attracted by this local major player. And by Singles’ Day too.

Luigi Marchese