Introduction

On October 26th, German real-estate giant Vonovia SE announced that it had successfully acquired 87.6% of the voting rights of Deutsche Wohnen, another German real-estate company mainly focused on doing business in Berlin. The deal constitutes the largest ever real estate merger in Europe and further strengthens the influence of Vonovia, especially in the real estate market of Berlin. The acquisition comes after almost 6 years and two previously failed takeover attempts: in 2015, Vonovia first announced its desire to acquire Deutsche Wohnen, valued approximately €14bn including debt. However, the hostile takeover bid failed after not reaching the minimum acceptance threshold of 50%. Vonovia made yet another bid in May 2021, valuing Deutsche Wohnen at approximately €18 bn. Even though, in contrast to the hostile takeover attempt in 2015, the Deutsche Wohnen top management and supervisory boards supported the offer it yet again failed to reach the minimum acceptance threshold. Eventually, a third and final bid made by Vonovia in August 2021 got accepted by the majority of Deutsche Wohnen shareholders, but only after Vonovia waived the minimum acceptance threshold in a move largely criticized by involved hedge-funds.

On October 26th, German real-estate giant Vonovia SE announced that it had successfully acquired 87.6% of the voting rights of Deutsche Wohnen, another German real-estate company mainly focused on doing business in Berlin. The deal constitutes the largest ever real estate merger in Europe and further strengthens the influence of Vonovia, especially in the real estate market of Berlin. The acquisition comes after almost 6 years and two previously failed takeover attempts: in 2015, Vonovia first announced its desire to acquire Deutsche Wohnen, valued approximately €14bn including debt. However, the hostile takeover bid failed after not reaching the minimum acceptance threshold of 50%. Vonovia made yet another bid in May 2021, valuing Deutsche Wohnen at approximately €18 bn. Even though, in contrast to the hostile takeover attempt in 2015, the Deutsche Wohnen top management and supervisory boards supported the offer it yet again failed to reach the minimum acceptance threshold. Eventually, a third and final bid made by Vonovia in August 2021 got accepted by the majority of Deutsche Wohnen shareholders, but only after Vonovia waived the minimum acceptance threshold in a move largely criticized by involved hedge-funds.

Industry overview

Introduction and impact of COVID-19 outbreak

The global COVID-19 outbreak created a high degree of uncertainty in global markets. Given the major disparities between policies and stimulus packages distributed by European governments, the markets are adjusting to the post-pandemic conditions in varying ways and speeds. With Germany being the center of Vonovia’s and Deutsche Wohnen’s operations, it is crucial to examine the current state of the country’s real estate market and how the global pandemic has influenced house prices and rents, as well as project construction and transaction activity.

Focusing on the German economy as a whole, even though its GDP contracted by 3% in 2020, the European Commission expects it to grow by 3.4% over 2021. In the real estate market, a combination of factors, such as low interest rates, increasing construction activity, and accelerating transaction activity imply that the ongoing cycle of increased demand and increasing prices in Germany will remain relatively unaffected. According to Mordor Intelligence, the industry currently has a projected CAGR of 3% over the next five years, making it a stimulating environment for the firms in question to grow.

Increase of Housing Price Indices and Rent Prices

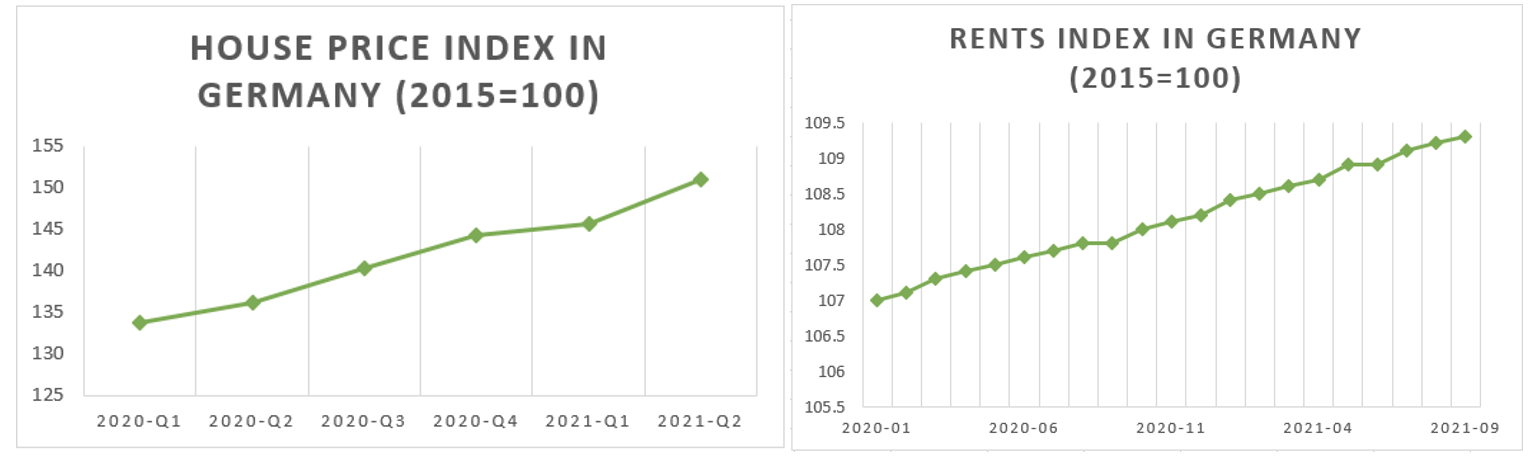

The German housing market has been growing continuously for the past 6 years, with house prices up by almost 67% from Q1 2014. Despite the pandemic, this trend is continuing and there has been a total increase of 10.94% in the House Price Index (as measured by EUROSTAT) during the year to Q2 2021, with quarterly increases of 1.79% in 2020-Q2, 3.01% in 2020-Q3, 2.85% in 2020-Q4, 0.97% in 2021-Q1 and 3.71% in 2021-Q2. Similarly, the rents have also continued their increasing trend, with a total increase of 2.15% from January 2020 to September 2021 in the monthly rents index (EUROSTAT).

Introduction and impact of COVID-19 outbreak

The global COVID-19 outbreak created a high degree of uncertainty in global markets. Given the major disparities between policies and stimulus packages distributed by European governments, the markets are adjusting to the post-pandemic conditions in varying ways and speeds. With Germany being the center of Vonovia’s and Deutsche Wohnen’s operations, it is crucial to examine the current state of the country’s real estate market and how the global pandemic has influenced house prices and rents, as well as project construction and transaction activity.

Focusing on the German economy as a whole, even though its GDP contracted by 3% in 2020, the European Commission expects it to grow by 3.4% over 2021. In the real estate market, a combination of factors, such as low interest rates, increasing construction activity, and accelerating transaction activity imply that the ongoing cycle of increased demand and increasing prices in Germany will remain relatively unaffected. According to Mordor Intelligence, the industry currently has a projected CAGR of 3% over the next five years, making it a stimulating environment for the firms in question to grow.

Increase of Housing Price Indices and Rent Prices

The German housing market has been growing continuously for the past 6 years, with house prices up by almost 67% from Q1 2014. Despite the pandemic, this trend is continuing and there has been a total increase of 10.94% in the House Price Index (as measured by EUROSTAT) during the year to Q2 2021, with quarterly increases of 1.79% in 2020-Q2, 3.01% in 2020-Q3, 2.85% in 2020-Q4, 0.97% in 2021-Q1 and 3.71% in 2021-Q2. Similarly, the rents have also continued their increasing trend, with a total increase of 2.15% from January 2020 to September 2021 in the monthly rents index (EUROSTAT).

Source: EUROSTAT

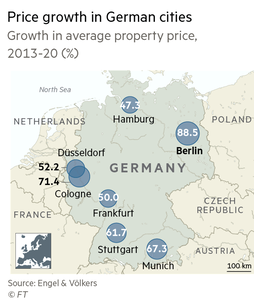

Rents on a monthly basis in Germany are above the average of EU27 countries and house prices at a quarterly basis have further increased the gap with the EU27 average in the first quarter of 2021. Since Vonovia and Deutsche Wohnen’s activity is mainly located in the metropolitan cities, it would be worthwhile to individually examine 7 of the biggest ones, namely Berlin, Hamburg, Düsseldorf, Cologne, Munich, Frankfurt and Stuttgart. According to Deutsche Bank, house prices for existing homes in these cities have risen by 123.7% on average from 2009 to 2019. This figure is astonishingly high when compared to houses’ price increase in the same time frame in other major European cities, such as London, where it increased only by 66%, according to Nationwide. Additionally, based on research conducted by Engel & Völkers, the growth rate in average property price over the period 2013-2020 was the highest in Berlin with an 88.5% increase and Cologne with a 71.4%.

Housing Stock and Construction Activity

The main characteristic of the housing market in Germany is the substantial imbalance between demand and supply, with many analysts considering it rather unlikely that it is alleviated by the creation of new homes soon, given the fact that the government is not on track to meet its target of building 1.5 million new units by the end of 2021. According to Engel & Völkers, Germany’s efficient handling of the pandemic may also lead to a future inflow of immigrants and investors, similarly to the beginning of the 2008 crisis, thus further increasing demand for housing. Even though the construction industry has been working at maximum capacity for a long time now, the pandemic caused considerable delays because it disrupted the consistent flow of new labor and caused supply bottlenecks in building sites.

Residential construction activity did however continue to increase with dwelling permits presenting an almost 20% rise year to year (2021 Q1) to 95,916 units in 2021, according to the Federal Statistical Office (Destatis). Furthermore, building projects with a total of more than 300,000 apartments were completed in 2020 and the number of building permits has reached approximately 370,000. Finally, a considerably high number of 780,000 apartments have yet to be completed. However, it must be noted that Germany’s gross value added of the housing construction sector as a percentage of the total gross value added remains below the EU27 average for the past ten years but the gap keeps reducing.

In Germany, the vast majority of residents are tenants and a significant - even though slightly decreasing lately- share of each household’s disposable income is allocated to housing (around 25.9%). Finally, another important positive characteristic of the residential real estate market is the fact that there was essentially no increase in rental default during the climate of economic uncertainty at the beginning of the COVID-19 pandemic.

The situation in Berlin is particularly interesting since over one-third of the owners are private companies, and there are almost 330,000 residential buildings and a total of 2 million apartments, with about 1.64 million of them being rented. Additionally, over 75% of city dwellers are tenants, while only 17.5% are owners, allowing real estate services companies to cater to the needs of a wide portion of the total population and increase their revenues.

Transaction Activity in the Residential Real Estate Market: Size & Concentration

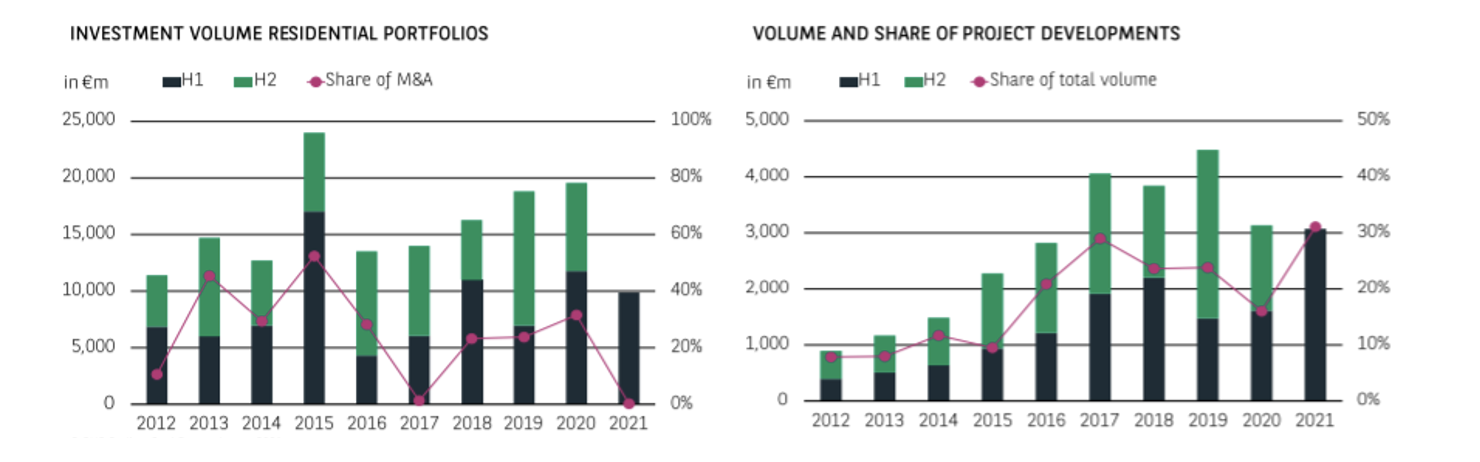

According to BNP Paribas Real Estate, an exceptional transaction volume of approximately 200 deals and almost €9.9 billion was recorded in the first half of 2021 in the German residential real estate market. The outstanding performance of the residential investment markets is evident when considering that the ten-year average was exceeded by almost 14%. Moreover, almost €3.1 billion was invested in projects in this period, setting a new historical record and further highlighting the investors’ expectations of sustained positive development in the market.

Another important trait of transaction activity in Germany is the fact that there is no dominance of large deals, as it can be seen from the graph below, since only 49% of investment volume is accounted for by deals over 100€ million, compared to 70% of the same period last year. There is still, however, very high investment activity, providing supporting evidence for a broad base of demand with residential investments being the preferred asset class.

The main characteristic of the housing market in Germany is the substantial imbalance between demand and supply, with many analysts considering it rather unlikely that it is alleviated by the creation of new homes soon, given the fact that the government is not on track to meet its target of building 1.5 million new units by the end of 2021. According to Engel & Völkers, Germany’s efficient handling of the pandemic may also lead to a future inflow of immigrants and investors, similarly to the beginning of the 2008 crisis, thus further increasing demand for housing. Even though the construction industry has been working at maximum capacity for a long time now, the pandemic caused considerable delays because it disrupted the consistent flow of new labor and caused supply bottlenecks in building sites.

Residential construction activity did however continue to increase with dwelling permits presenting an almost 20% rise year to year (2021 Q1) to 95,916 units in 2021, according to the Federal Statistical Office (Destatis). Furthermore, building projects with a total of more than 300,000 apartments were completed in 2020 and the number of building permits has reached approximately 370,000. Finally, a considerably high number of 780,000 apartments have yet to be completed. However, it must be noted that Germany’s gross value added of the housing construction sector as a percentage of the total gross value added remains below the EU27 average for the past ten years but the gap keeps reducing.

In Germany, the vast majority of residents are tenants and a significant - even though slightly decreasing lately- share of each household’s disposable income is allocated to housing (around 25.9%). Finally, another important positive characteristic of the residential real estate market is the fact that there was essentially no increase in rental default during the climate of economic uncertainty at the beginning of the COVID-19 pandemic.

The situation in Berlin is particularly interesting since over one-third of the owners are private companies, and there are almost 330,000 residential buildings and a total of 2 million apartments, with about 1.64 million of them being rented. Additionally, over 75% of city dwellers are tenants, while only 17.5% are owners, allowing real estate services companies to cater to the needs of a wide portion of the total population and increase their revenues.

Transaction Activity in the Residential Real Estate Market: Size & Concentration

According to BNP Paribas Real Estate, an exceptional transaction volume of approximately 200 deals and almost €9.9 billion was recorded in the first half of 2021 in the German residential real estate market. The outstanding performance of the residential investment markets is evident when considering that the ten-year average was exceeded by almost 14%. Moreover, almost €3.1 billion was invested in projects in this period, setting a new historical record and further highlighting the investors’ expectations of sustained positive development in the market.

Another important trait of transaction activity in Germany is the fact that there is no dominance of large deals, as it can be seen from the graph below, since only 49% of investment volume is accounted for by deals over 100€ million, compared to 70% of the same period last year. There is still, however, very high investment activity, providing supporting evidence for a broad base of demand with residential investments being the preferred asset class.

Source: BNP Paribas Real Estate

Key Players

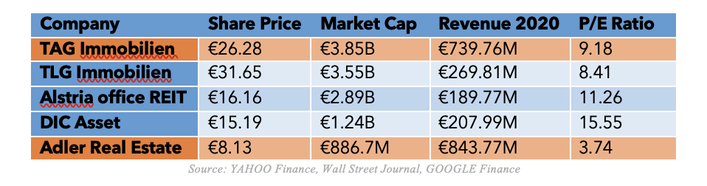

The real estate services market in Germany is rather fragmented with various competitors, depending on the specific sector (residential, commercial, office, etc.). In the following table, the ones with a market capitalization of over 850M € are included and the ones specializing in residential real estate are highlighted in orange (except for Vonovia and Deutsche Wohnen, of course, which will be analyzed in greater detail later):

TAG Immobilien AG is a company focusing on the acquisition, development and management of residential real estate in northern and eastern Germany and recently Poland. Its main locations include Hamburg and Berlin, the Salzgitter and Thuringia/Saxony regions, as well as the North Rhine-Westphalia and currently has over 88,000 units under management.

Adler Real Estate AG is one of the fastest-growing listed integrated real estate companies in Germany, with a focus on metropolitan regions and over 52,000 rental units available. With a base in Berlin and a focus on Lower Saxony and North Rhine-Westphalia, ADLER provides its tenants with a wide range of apartment-related services.

The real estate services market in Germany is rather fragmented with various competitors, depending on the specific sector (residential, commercial, office, etc.). In the following table, the ones with a market capitalization of over 850M € are included and the ones specializing in residential real estate are highlighted in orange (except for Vonovia and Deutsche Wohnen, of course, which will be analyzed in greater detail later):

TAG Immobilien AG is a company focusing on the acquisition, development and management of residential real estate in northern and eastern Germany and recently Poland. Its main locations include Hamburg and Berlin, the Salzgitter and Thuringia/Saxony regions, as well as the North Rhine-Westphalia and currently has over 88,000 units under management.

Adler Real Estate AG is one of the fastest-growing listed integrated real estate companies in Germany, with a focus on metropolitan regions and over 52,000 rental units available. With a base in Berlin and a focus on Lower Saxony and North Rhine-Westphalia, ADLER provides its tenants with a wide range of apartment-related services.

Company overview

Vonovia SE

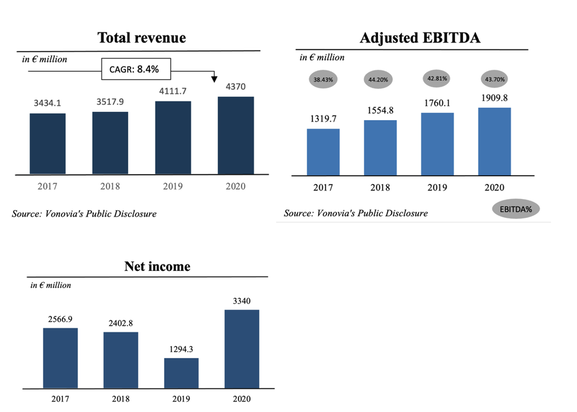

Vonovia is Europe’s leading company operating in the private residential real estate sector, with a focus on four segments, namely Rental, Value-Add, Recurring Sales and Development. Based in Bochum, Germany, the company manages a portfolio of 414.000 residential units and 72.000 apartments across Germany, Sweden and Austria, worth more than €63 billion. Vonovia was created through a merger between Deutsche Annington and Gagfah, a $4.8 billion deal which dates back to 2015. Since then, the company has seen its valuation appreciate from €8.6 billion in Q1 2015 to €31 billion as of today, thanks to various acquisitions, which include Südewo (Q2 2015), Convert (Q1 2017), BUWOG (Q2 2018) and Hembla AB (Q4 2019). The largest shareholder is currently Norges Bank, with a 10% stake, followed by BlackRock (9%) and APG (3%), with the remaining 78% of the shares being free float.

Vonovia SE

Vonovia is Europe’s leading company operating in the private residential real estate sector, with a focus on four segments, namely Rental, Value-Add, Recurring Sales and Development. Based in Bochum, Germany, the company manages a portfolio of 414.000 residential units and 72.000 apartments across Germany, Sweden and Austria, worth more than €63 billion. Vonovia was created through a merger between Deutsche Annington and Gagfah, a $4.8 billion deal which dates back to 2015. Since then, the company has seen its valuation appreciate from €8.6 billion in Q1 2015 to €31 billion as of today, thanks to various acquisitions, which include Südewo (Q2 2015), Convert (Q1 2017), BUWOG (Q2 2018) and Hembla AB (Q4 2019). The largest shareholder is currently Norges Bank, with a 10% stake, followed by BlackRock (9%) and APG (3%), with the remaining 78% of the shares being free float.

Source: Vonovia's Public Disclosure

The company’s business model has proved to be strong and solid enough to attain strong operational performance in spite of COVID-19 restrictions. During the pandemic the firm was able to protect both employees and customers, avoiding eviction of tenants who struggled financially. In H1 2021, total revenues increased by 10% from €2,109 million in H1 2020 to €2,312.3 million in the first half of 2021, the main drivers being disposal of properties in the Recurring Sales and Development segments and an increase in rental income linked to organic growth. The continuity of the business model was also reflected in the financing position. The increase in debt registered in H1 2021 was mainly due to the issuance of Vonovia’s first green bond in the amount of €600 million and five unsecured bonds in the amount of €4 billion, with an average coupon of 0.68% and an average maturity of 9.5 years.

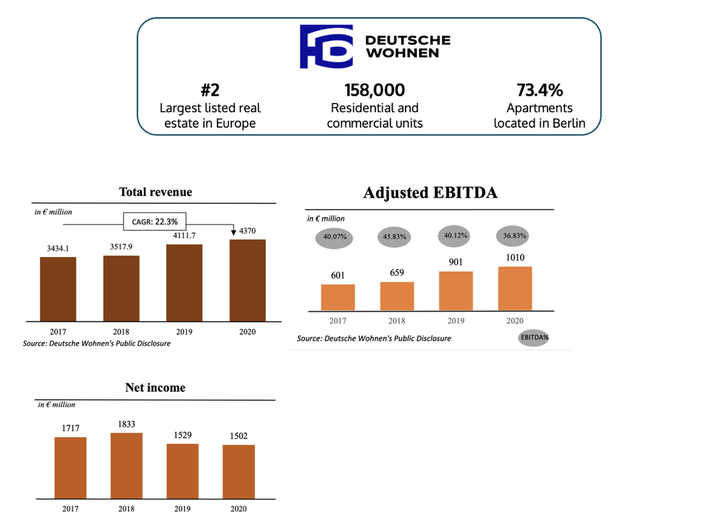

Deutsche Wohnen AG

Deutsche Wohnen AG is one of the leading property companies in Germany and Europe, which has joined the DAX index of Deutsche Börse in June 2020. The company operates in four segments, namely Residential Property Management, Disposals, Nursing Operations and Nursing Properties, and it manages a portfolio of 157.600 residential and commercial units, together with nursing properties for assisted living, with a total fair value of approximately €27.8 billion. As of 2020, Deutsche Wohnen has a revenue of €2.7 billion and a €705 million EBITDA. Founded in 1998 as a subsidiary of Deutsche Bank, the company merged with GEHAG nine years later and then took over BauBeCon (2007), GSW Immobilien AG (2013) and GETEC media GmbH (2018). In particular, this last deal is part of Deutsche Wohnen’s digitalisation strategy. Even though the pandemic has forced the company to face additional expenses, it has not had a material impact on the group’s earnings to date. Regarding the shareholding structure, the recent takeover made Vonovia SE the largest shareholder, with almost a 65% stake, followed by BlackRock (7%), J.P. Morgan Chase (5%) and State Street Corporation (3%). The remaining 20% is owned by other entities, each of which has no more than 3% of the voting shares.

Deutsche Wohnen AG

Deutsche Wohnen AG is one of the leading property companies in Germany and Europe, which has joined the DAX index of Deutsche Börse in June 2020. The company operates in four segments, namely Residential Property Management, Disposals, Nursing Operations and Nursing Properties, and it manages a portfolio of 157.600 residential and commercial units, together with nursing properties for assisted living, with a total fair value of approximately €27.8 billion. As of 2020, Deutsche Wohnen has a revenue of €2.7 billion and a €705 million EBITDA. Founded in 1998 as a subsidiary of Deutsche Bank, the company merged with GEHAG nine years later and then took over BauBeCon (2007), GSW Immobilien AG (2013) and GETEC media GmbH (2018). In particular, this last deal is part of Deutsche Wohnen’s digitalisation strategy. Even though the pandemic has forced the company to face additional expenses, it has not had a material impact on the group’s earnings to date. Regarding the shareholding structure, the recent takeover made Vonovia SE the largest shareholder, with almost a 65% stake, followed by BlackRock (7%), J.P. Morgan Chase (5%) and State Street Corporation (3%). The remaining 20% is owned by other entities, each of which has no more than 3% of the voting shares.

Source: Deutsche Wohnen's Public Disclosure

Strong financial results reported in H1 2021 and confidence by the management team about the future business outlook of the company serve as one of the main arguments for undervaluation of the company in Vonovia’s offer.

History of the Deal

Hostile Takeover, 2016

Vonovia first announced a bid for Deutsche Wohnen in October 2015. The takeover was expected to create synergies of €84m, and the takeover was valued at €14bn. In exchange for 11 Deutsche Wohnen shares, shareholders of Deutsche Wohnen were offered 7 Vonovia shares and €83.14 in cash. However, Deutsche Wohnen CEO Michael Zahn labeled the offer as unacceptable for three major reasons: First, he found the price to be too low – indeed, the premium on the share price proposed by Vonovia was one of the lowest ever recorded and reportedly did not adequately factor in the growth potential of Deutsche Wohnen. Second, Zahn expected that the deal would actually destroy value. Lastly, the risk for Deutsche Wohnen shareholders would rise significantly due to the high indebtedness of Vonovia. After the Deutsche Wohnen management fought tooth-and-nail against the merger, Vonovia only secured 30.4% of Deutsche Wohnen shares, short of the minimum acceptance threshold of 50% that the deal was subject to.

Voluntary Public Takeover Offer, May 2021

Fast forward to May 2021, when Vonovia announced yet again its intention to acquire Deutsche Wohnen in a deal valued at €18bn to take advantage of the legal certainty around the rent cap before the German general elections. However, this time DW management and supervisory board supported the all-cash consideration for 100% of the share capital that offered €53.03 (cum dividend of €1.03) in exchange for one Deutsche Wohnen share. The share price constituted a 17.9% premium to the then-share price of Deutsche Wohnen of €44.99, slightly lower than the average premium paid in similar M&A transactions. As in 2015/2016, the offer was subject to certain customary conditions, including a 50% threshold. Again, the deal did not go through, as Vonovia announced on July 23rd that the offer had only been accepted by 48% of Deutsche Wohnen shareholders, short of the minimum acceptance threshold – this time though, the reasons for the failure were quite different to the hostile takeover attempt: approximately 20% of the Deutsche Wohnen shares were owned by so-called passive investors, such as index funds. Passive investors are, in sharp contrast to active investors, only allowed to sell their shares when the offer is unconditional – meaning that the deal goes through either way. In addition, hedge-funds, including Paul E. Singer, were reportedly speculating on a higher subsequent offer: German law allows an acquirer of a company to strike a domination agreement with the target company, which gives it the right to control the target´s cash flows. In such case, Vonovia would have needed to offer compensation to holdouts, e.g., the hedge funds, that would have been above the offer price.

Voluntary Public Takeover Offer, August 2021

In August, Vonovia, already owning approximately 30% of Deutsche Wohnen shares already, filed a third and last public takeover offer for Deutsche Wohnen, after the German Federal Financial Supervisory Authority “BaFin” granted clearance for a new public takeover offer to the shareholders of Deutsche Wohnen. A new public takeover offer after a failed attempt is usually subject to a one-year blocking period unless the target company consents and BaFin grants an exemption. The offer was officially made on August 23rd, with an acceptance period until September 20th, and consisted of an all-cash bid of €53 per Deutsche Wohnen share, valuing the company at €19bn. But this time, Rolf Buch, CEO of Vonovia, had one more ace up his sleeve for the deal to finally succeed: On September 13th, Vonovia decided to waive the minimum acceptance threshold of 50%, thereby moving back the deadline by two weeks until October 4th. In fact, Vonovia always had the option of lowering or cancelling the minimum acceptance threshold with the permission of Deutsche Wohnen. As the last offer failed because 2% of Deutsche Wohnen shares were not acquired, CEO Rolf Buch wanted the deal to go through no matter what. Indeed, by waiving the conditions on the offer, Vonovia would be able to simply buy the missing shares at a later time without having to make a mandatory offer to the remaining shareholders of Deutsche Wohnen. Moreover, the offer documents submitted by Vonovia revealed a passage that enabled Vonovia to profit from a capital increase (approximately 5.17% of shares) if the minimum acceptance threshold was waived. Thus, the merger was destined to happen: Vonovia announced that it had acquired more than 60% of the Deutsche Wohnen shares after the regular acceptance period ended on October 4th, and that it secured 87.6% of the voting rights on October 21st, the end of the additional acceptance period.

Deal Rationale

Both companies encouraged the deal under the motto “Joining Forces to Manage the Residential Megatrends”. Thus, there are several motives underlying the attempts of Vonovia to eventually acquire Deutsche Wohnen.

The real estate industry faces three megatrends that must be successfully managed: Energy efficiency, urbanization, and demographic change. The ratification of the Paris Agreement in response to climate change means that real estate companies needs to be climate-neutral by 2050. To achieve climate-neutrality, Vonovia needs to invest in the energy-efficiency refurbishments of its apartment portfolio, which will require significant financial resources. Urbanization has prompted a severe housing shortage in large German cities, which again means that Vonovia will need to invest in the construction of new apartments in the future. Also, demographic change means that a larger percentage of Germans will need senior-friendly homes. To provide adequate apartments, the company plans on converting more than one third of its portfolio into fully accessible or barrier-free apartments. Through the deal, Vonovia would eventually be able to achieve economies of scale: A larger number of apartments under control would allow for lower fixed costs per apartment, which would free financial resources that could in turn be used to further invest into the solutions regarding the three megatrends. The larger scale would also allow the company to further engage in research and development in CO2 reduction strategies due to larger capacity and funds.

The combination of operations is expected to create synergies of approximately €105m EBITDA per year, which are assumed to be fully in place by the end of 2024. Such synergies are thought to be achieved through lowering the staff number and eliminating general corporate expenses, as well as cost savings from the combined purchase power.

Hostile Takeover, 2016

Vonovia first announced a bid for Deutsche Wohnen in October 2015. The takeover was expected to create synergies of €84m, and the takeover was valued at €14bn. In exchange for 11 Deutsche Wohnen shares, shareholders of Deutsche Wohnen were offered 7 Vonovia shares and €83.14 in cash. However, Deutsche Wohnen CEO Michael Zahn labeled the offer as unacceptable for three major reasons: First, he found the price to be too low – indeed, the premium on the share price proposed by Vonovia was one of the lowest ever recorded and reportedly did not adequately factor in the growth potential of Deutsche Wohnen. Second, Zahn expected that the deal would actually destroy value. Lastly, the risk for Deutsche Wohnen shareholders would rise significantly due to the high indebtedness of Vonovia. After the Deutsche Wohnen management fought tooth-and-nail against the merger, Vonovia only secured 30.4% of Deutsche Wohnen shares, short of the minimum acceptance threshold of 50% that the deal was subject to.

Voluntary Public Takeover Offer, May 2021

Fast forward to May 2021, when Vonovia announced yet again its intention to acquire Deutsche Wohnen in a deal valued at €18bn to take advantage of the legal certainty around the rent cap before the German general elections. However, this time DW management and supervisory board supported the all-cash consideration for 100% of the share capital that offered €53.03 (cum dividend of €1.03) in exchange for one Deutsche Wohnen share. The share price constituted a 17.9% premium to the then-share price of Deutsche Wohnen of €44.99, slightly lower than the average premium paid in similar M&A transactions. As in 2015/2016, the offer was subject to certain customary conditions, including a 50% threshold. Again, the deal did not go through, as Vonovia announced on July 23rd that the offer had only been accepted by 48% of Deutsche Wohnen shareholders, short of the minimum acceptance threshold – this time though, the reasons for the failure were quite different to the hostile takeover attempt: approximately 20% of the Deutsche Wohnen shares were owned by so-called passive investors, such as index funds. Passive investors are, in sharp contrast to active investors, only allowed to sell their shares when the offer is unconditional – meaning that the deal goes through either way. In addition, hedge-funds, including Paul E. Singer, were reportedly speculating on a higher subsequent offer: German law allows an acquirer of a company to strike a domination agreement with the target company, which gives it the right to control the target´s cash flows. In such case, Vonovia would have needed to offer compensation to holdouts, e.g., the hedge funds, that would have been above the offer price.

Voluntary Public Takeover Offer, August 2021

In August, Vonovia, already owning approximately 30% of Deutsche Wohnen shares already, filed a third and last public takeover offer for Deutsche Wohnen, after the German Federal Financial Supervisory Authority “BaFin” granted clearance for a new public takeover offer to the shareholders of Deutsche Wohnen. A new public takeover offer after a failed attempt is usually subject to a one-year blocking period unless the target company consents and BaFin grants an exemption. The offer was officially made on August 23rd, with an acceptance period until September 20th, and consisted of an all-cash bid of €53 per Deutsche Wohnen share, valuing the company at €19bn. But this time, Rolf Buch, CEO of Vonovia, had one more ace up his sleeve for the deal to finally succeed: On September 13th, Vonovia decided to waive the minimum acceptance threshold of 50%, thereby moving back the deadline by two weeks until October 4th. In fact, Vonovia always had the option of lowering or cancelling the minimum acceptance threshold with the permission of Deutsche Wohnen. As the last offer failed because 2% of Deutsche Wohnen shares were not acquired, CEO Rolf Buch wanted the deal to go through no matter what. Indeed, by waiving the conditions on the offer, Vonovia would be able to simply buy the missing shares at a later time without having to make a mandatory offer to the remaining shareholders of Deutsche Wohnen. Moreover, the offer documents submitted by Vonovia revealed a passage that enabled Vonovia to profit from a capital increase (approximately 5.17% of shares) if the minimum acceptance threshold was waived. Thus, the merger was destined to happen: Vonovia announced that it had acquired more than 60% of the Deutsche Wohnen shares after the regular acceptance period ended on October 4th, and that it secured 87.6% of the voting rights on October 21st, the end of the additional acceptance period.

Deal Rationale

Both companies encouraged the deal under the motto “Joining Forces to Manage the Residential Megatrends”. Thus, there are several motives underlying the attempts of Vonovia to eventually acquire Deutsche Wohnen.

The real estate industry faces three megatrends that must be successfully managed: Energy efficiency, urbanization, and demographic change. The ratification of the Paris Agreement in response to climate change means that real estate companies needs to be climate-neutral by 2050. To achieve climate-neutrality, Vonovia needs to invest in the energy-efficiency refurbishments of its apartment portfolio, which will require significant financial resources. Urbanization has prompted a severe housing shortage in large German cities, which again means that Vonovia will need to invest in the construction of new apartments in the future. Also, demographic change means that a larger percentage of Germans will need senior-friendly homes. To provide adequate apartments, the company plans on converting more than one third of its portfolio into fully accessible or barrier-free apartments. Through the deal, Vonovia would eventually be able to achieve economies of scale: A larger number of apartments under control would allow for lower fixed costs per apartment, which would free financial resources that could in turn be used to further invest into the solutions regarding the three megatrends. The larger scale would also allow the company to further engage in research and development in CO2 reduction strategies due to larger capacity and funds.

The combination of operations is expected to create synergies of approximately €105m EBITDA per year, which are assumed to be fully in place by the end of 2024. Such synergies are thought to be achieved through lowering the staff number and eliminating general corporate expenses, as well as cost savings from the combined purchase power.

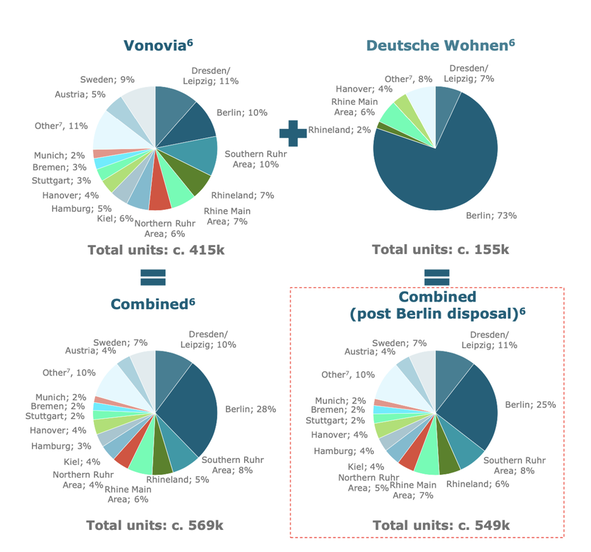

Source: Vonovia's presentation 24-05-2021

The merger is also thought to make sense because of the ease of integration: As Vonovia’s and Deutsche Wohnen’s strategies have largely converged, there is significant strategic fit between both companies. Moreover, 73% of Deutsche Wohnen’s portfolio of 155,000 apartments is located in the German capital of Berlin, so that Vonovia would rise to a bigger player in the real estate industry of Berlin as a result of the consolidation. Berlin has in the past been one of the fastest growing cities of Germany. In fact, urbanization increased the housing shortage in Berlin in such a way that advertised apartments in the city now have an average number of 137 applicants – more than double the number of Cologne, which comes after Berlin in second place. The supply/demand imbalance in Berlin is expected to contribute to long-term rental growth, which would prove to be beneficial for the profits of Vonovia.

Source: Vonovia presentation 24-05-2021

Announcement Effects - Market Reaction

Deutsche Wohnen

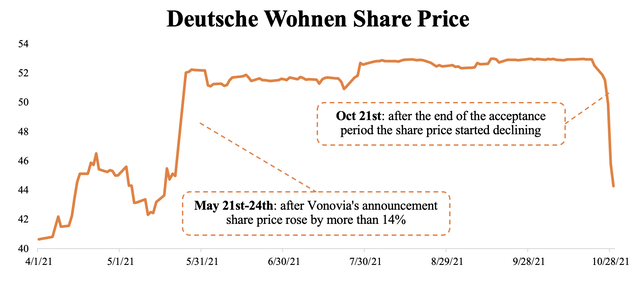

The first significant shock to Deutsche Wohnen’s price was witnessed by May 24th, the day that Vonovia announced that it would pursue an all-cash consideration of €52 (cum dividend €53.03) per Deutsche Wohnen share. On May 21st, Deutsche Wohnen shares closed at €44.99. After the announcement, the share price rose by 14% to 52.06, showing investors´ confidence in a successful deal. Trading volume also increased from 1.23 million shares to 18.45 million in the same time interval. During the entire acceptance period, the share price of Deutsche Wohnen shares fluctuated moderately, yet remaining in the price range of €51 and €52. A second significant shock was seen on June 22nd, when Deutsche Wohnen’s price dropped below €51 after that they confirmed that the offer had been unsuccessful; however, it did not drop further as rumors of a potential third offer of Vonovia circulated. In light of the third offer, the share price of Deutsche Wohnen rose again and converged around €53 after Vonovia waived the minimum acceptance threshold, signaling the market´s certainty that the deal would go through. After the extended acceptance period ended October 21st, the share price dropped down below €46, just a little higher than before the second takeover offer was publicly announced.

Deutsche Wohnen

The first significant shock to Deutsche Wohnen’s price was witnessed by May 24th, the day that Vonovia announced that it would pursue an all-cash consideration of €52 (cum dividend €53.03) per Deutsche Wohnen share. On May 21st, Deutsche Wohnen shares closed at €44.99. After the announcement, the share price rose by 14% to 52.06, showing investors´ confidence in a successful deal. Trading volume also increased from 1.23 million shares to 18.45 million in the same time interval. During the entire acceptance period, the share price of Deutsche Wohnen shares fluctuated moderately, yet remaining in the price range of €51 and €52. A second significant shock was seen on June 22nd, when Deutsche Wohnen’s price dropped below €51 after that they confirmed that the offer had been unsuccessful; however, it did not drop further as rumors of a potential third offer of Vonovia circulated. In light of the third offer, the share price of Deutsche Wohnen rose again and converged around €53 after Vonovia waived the minimum acceptance threshold, signaling the market´s certainty that the deal would go through. After the extended acceptance period ended October 21st, the share price dropped down below €46, just a little higher than before the second takeover offer was publicly announced.

Source: YAHOO Finance

Vonovia

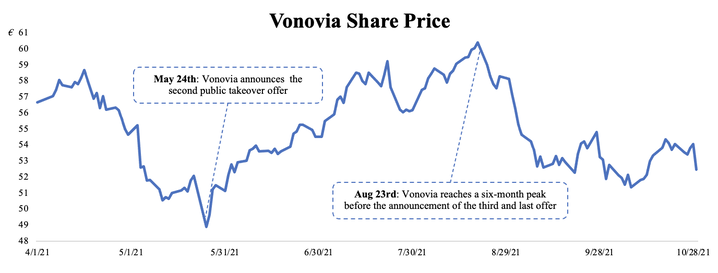

In contrast to Deutsche Wohnen, share prices of Vonovia proved to be more volatile. After the announcement of the second public takeover offer in May, share prices dropped to €48.91, a one-year low. The drop can be explained by the significant short-term costs that Vonovia would face in case of a successful acquisition. The price rose fairly steadily during the acceptance period of the second bid, and only experienced another significant drop after Vonovia confirmed the takeover had been unsuccessful. However, the share price sharply dropped from its six-month high of 60.42 on with the beginning of the third public takeover offer and did not recover as the deal was destined to be successful.

In contrast to Deutsche Wohnen, share prices of Vonovia proved to be more volatile. After the announcement of the second public takeover offer in May, share prices dropped to €48.91, a one-year low. The drop can be explained by the significant short-term costs that Vonovia would face in case of a successful acquisition. The price rose fairly steadily during the acceptance period of the second bid, and only experienced another significant drop after Vonovia confirmed the takeover had been unsuccessful. However, the share price sharply dropped from its six-month high of 60.42 on with the beginning of the third public takeover offer and did not recover as the deal was destined to be successful.

Source: YAHOO Finance

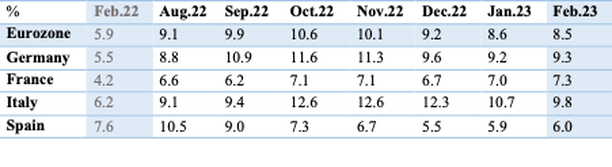

Future developments and outlook

On the one hand, the future after the merger of Vonovia and Deutsche Wohnen seems to be rather optimistic, given the aforementioned well-being and positive outlook of the German residential real estate market. It might be able to benefit from new regulatory measures to further increase the supply of housing enforced by the next coalition German government, as well as overall emerging housing trends, such as the move towards single households and an increasing demand for new and high-quality apartments. On the other hand, it is also possible that the nationwide price cycle comes to an end by 2024, according to Deutsche Bank, which also warns against a potential interest rate hike that could harm the company’s activities. Moreover, there is a possibility that in an effort to respond to calls to more affordable housing the German government enforces measures such as a rent cap, similar to the one which was established in Berlin last year and was recently repealed by the German Constitutional Court. Finally, population figures in Germany have stagnated for the first time since 2011, while immigration is declining, and micro-living and a new settlement pattern is on the rise. It is therefore crucial for the newly merged company to be able to adapt quickly and face with confidence these future changes that are approaching.

On the one hand, the future after the merger of Vonovia and Deutsche Wohnen seems to be rather optimistic, given the aforementioned well-being and positive outlook of the German residential real estate market. It might be able to benefit from new regulatory measures to further increase the supply of housing enforced by the next coalition German government, as well as overall emerging housing trends, such as the move towards single households and an increasing demand for new and high-quality apartments. On the other hand, it is also possible that the nationwide price cycle comes to an end by 2024, according to Deutsche Bank, which also warns against a potential interest rate hike that could harm the company’s activities. Moreover, there is a possibility that in an effort to respond to calls to more affordable housing the German government enforces measures such as a rent cap, similar to the one which was established in Berlin last year and was recently repealed by the German Constitutional Court. Finally, population figures in Germany have stagnated for the first time since 2011, while immigration is declining, and micro-living and a new settlement pattern is on the rise. It is therefore crucial for the newly merged company to be able to adapt quickly and face with confidence these future changes that are approaching.

Sources

- EUROSTAT

- Yahoo Finance

- Statista.com

- Financial Times

- BNP Paribas

- Wikipedia

- Vonovia - Investor Relations

- Deutsche Wohnen - Investor Relations

Jorvis Marxsen, Stergios Mastoris, Federico Russo