On 23th March 2018, Siemens, a German conglomerate company and Alstom, a French rail transport firm have signed the agreement on the business combination of the mobility division of Siemens and the rail traction drives division of Alstom. The aim of this transaction is to build a joint Franco-German rail champion signaling solutions in the European Economic Area (EEA) in terms of geographic footprint of their activities and in terms of size competing with Chinese giant.

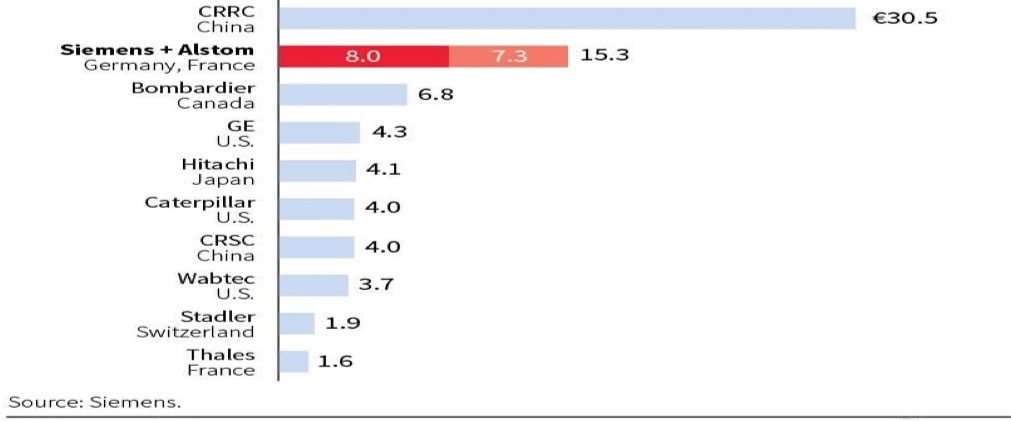

The two companies have looked to the deal to stave off the competition from bigger Chinese rival, China Railway Rolling Stock Corporation, and Canada's Bombardier Transportation, creating the second largest player in mobility with combined revenues of about €15 billion ($17.05 billion), by far less than the size of China’s state-owned CRRC but twice the size of Canada’s Bombardier.

This, can be seen from the chart below, in fact, the new merged company, Siemens-Alstom, would have been positioned as second actor out of the top 10 players within the rail business in terms of rail activities revenue (€bn):

The two companies have looked to the deal to stave off the competition from bigger Chinese rival, China Railway Rolling Stock Corporation, and Canada's Bombardier Transportation, creating the second largest player in mobility with combined revenues of about €15 billion ($17.05 billion), by far less than the size of China’s state-owned CRRC but twice the size of Canada’s Bombardier.

This, can be seen from the chart below, in fact, the new merged company, Siemens-Alstom, would have been positioned as second actor out of the top 10 players within the rail business in terms of rail activities revenue (€bn):

Alstom, as it clearly explains on its website, offers a variety of “railway solutions in terms of high-speed trains, metros and tramways but also passenger, infrastructure and signaling solutions while Siemens AG operates in the sector of electrification, automation and digitalization. Siemens offers also infrastructure solutions as well as automation, drive and software solutions for industry”.

Under the key terms and conditions of the Memorandum of Understanding signed in the September 2017, the new merged company, Siemens Alstom, would have benefitted from an order backlog of €61.2 billion, approximate revenue of €15 billion, an adj. EBIT of €1.2 billion with an adjusted EBIT margin of 8%, based on the latest information available in the financial statements of the two companies. In a combined scenario, Siemens and Alstom would have been expected to generate annual synergies of €470 million latest in year four post-closing, targeting the net-cash position at closing in the range of €0.5 billion and €1 billion, leveraging on a total workforce of c.62,000 employees all over the world.

The Siemens Alstom headquarters as well as the management team would have been located in Paris also because the combined entity would have remained listed in the French stock exchange; while the headquarters of the Mobility Solutions business would have been located in Berlin, Germany.

The transaction was intended to be constructed in the way that Siemens would have received the 50 percent of the newly issued share capital of the combined entity, gaining a stake in Alstom, following the rationale that Siemens would have contributed its Mobility Division as well as its rail traction drives business receiving Alstom’s shares in exchange, without involving money from Siemens. Alstom’s existing shareholders would have received two special dividends from Alstom.

Few weeks ago, Margrethe Vestager, in charge of competition policy, said: “Trains and the signaling equipment that guide them are essential for transport in Europe. The Commission will investigate whether the proposed acquisition of Alstom by Siemens would deprive European rail operators of a choice of suppliers and innovative products, and lead to higher prices, which could ultimately harm the millions of Europeans who use rail transportation every day for work or leisure.”

The Commission, following the European competition law, is concerned that the proposed combination could lead into a kind of monopoly: requiring higher prices, less choice and less innovation due to reduced competitiveness in the sector. This would be to the detriment of train and infrastructure operators and also European passengers who use trains and metros regularly every day.

Siemens said that it is not prepared to make further concessions, meaning that the approval will rest in the hands of the European Commission, whose 28 commissioners are themselves split on the issue and will take a decision in the following days, without any public on its deliberations before the date.

Roberto Senatore

Under the key terms and conditions of the Memorandum of Understanding signed in the September 2017, the new merged company, Siemens Alstom, would have benefitted from an order backlog of €61.2 billion, approximate revenue of €15 billion, an adj. EBIT of €1.2 billion with an adjusted EBIT margin of 8%, based on the latest information available in the financial statements of the two companies. In a combined scenario, Siemens and Alstom would have been expected to generate annual synergies of €470 million latest in year four post-closing, targeting the net-cash position at closing in the range of €0.5 billion and €1 billion, leveraging on a total workforce of c.62,000 employees all over the world.

The Siemens Alstom headquarters as well as the management team would have been located in Paris also because the combined entity would have remained listed in the French stock exchange; while the headquarters of the Mobility Solutions business would have been located in Berlin, Germany.

The transaction was intended to be constructed in the way that Siemens would have received the 50 percent of the newly issued share capital of the combined entity, gaining a stake in Alstom, following the rationale that Siemens would have contributed its Mobility Division as well as its rail traction drives business receiving Alstom’s shares in exchange, without involving money from Siemens. Alstom’s existing shareholders would have received two special dividends from Alstom.

Few weeks ago, Margrethe Vestager, in charge of competition policy, said: “Trains and the signaling equipment that guide them are essential for transport in Europe. The Commission will investigate whether the proposed acquisition of Alstom by Siemens would deprive European rail operators of a choice of suppliers and innovative products, and lead to higher prices, which could ultimately harm the millions of Europeans who use rail transportation every day for work or leisure.”

The Commission, following the European competition law, is concerned that the proposed combination could lead into a kind of monopoly: requiring higher prices, less choice and less innovation due to reduced competitiveness in the sector. This would be to the detriment of train and infrastructure operators and also European passengers who use trains and metros regularly every day.

Siemens said that it is not prepared to make further concessions, meaning that the approval will rest in the hands of the European Commission, whose 28 commissioners are themselves split on the issue and will take a decision in the following days, without any public on its deliberations before the date.

Roberto Senatore