Although acquisitions in the healthcare industry often face unique complexities related to regulations, technology, and clinical trials, the growing market demand for innovative medicines in the pharma sector has led companies to adopt growth strategies to profit from this trend.

Amgen’s strategic objective of providing innovative medicines while enhancing its leading inflammation portfolio in response to the latest developments and incentives in the pharmaceutical industry has led the acquirer to initiate a deal that could potentially improve the company’s efficiency and expand its services.

Amgen’s strategic objective of providing innovative medicines while enhancing its leading inflammation portfolio in response to the latest developments and incentives in the pharmaceutical industry has led the acquirer to initiate a deal that could potentially improve the company’s efficiency and expand its services.

Amgen Inc

Amgen, Inc. is a prominent biotechnology company known for its groundbreaking work in developing innovative therapies. Founded in 1980 by venture capitalists William Bowes and George Rathmann, the company's name derives from the term "Applied Molecular Genetics."

Its initial focus was on discovering, developing, and delivering transformative medicines for grievous illnesses. After its founding in 1980, the company initially operated from a modest facility in California. George Rathmann, the founding CEO, played a pivotal role in setting the company's direction, focusing on biotechnological innovations that could significantly impact healthcare.

In 1983, Amgen secured a groundbreaking partnership with Johnson & Johnson to commercialize Epogen, a recombinant DNA-derived erythropoietin that aimed to treat anemia in patients undergoing dialysis. This collaboration expanded the reach of Amgen's products and solidified its position in the market.

The year 1989 marked the approval of Epogen by the FDA, leading to a substantial increase in the company's growth and revenue. Shortly afterward, in 1991, Amgen's Neupogen, a granulocyte colony-stimulating factor used to stimulate white blood cell production, was also approved by the FDA, further establishing the company's portfolio in critical medical treatments. As Amgen continued to develop new drugs and expand its research, the company experienced remarkable success with various therapeutic breakthroughs. Their advancements include drugs for osteoporosis (such as Prolia and Xgeva), cancer treatments like Vectibix, and Enbrel, a treatment for autoimmune diseases.

Acquisitions also played a significant role in Amgen's growth. Among the most important ones there is the acquisition of Immunex in 2002, through which Amgen gained access to Enbrel (one of its major revenue-generating drugs) and the most recent acquisition of Horizon Therapeutics which solidified Amgen's position as one of the leading biotechnology companies globally.

Amgen, Inc. is a prominent biotechnology company known for its groundbreaking work in developing innovative therapies. Founded in 1980 by venture capitalists William Bowes and George Rathmann, the company's name derives from the term "Applied Molecular Genetics."

Its initial focus was on discovering, developing, and delivering transformative medicines for grievous illnesses. After its founding in 1980, the company initially operated from a modest facility in California. George Rathmann, the founding CEO, played a pivotal role in setting the company's direction, focusing on biotechnological innovations that could significantly impact healthcare.

In 1983, Amgen secured a groundbreaking partnership with Johnson & Johnson to commercialize Epogen, a recombinant DNA-derived erythropoietin that aimed to treat anemia in patients undergoing dialysis. This collaboration expanded the reach of Amgen's products and solidified its position in the market.

The year 1989 marked the approval of Epogen by the FDA, leading to a substantial increase in the company's growth and revenue. Shortly afterward, in 1991, Amgen's Neupogen, a granulocyte colony-stimulating factor used to stimulate white blood cell production, was also approved by the FDA, further establishing the company's portfolio in critical medical treatments. As Amgen continued to develop new drugs and expand its research, the company experienced remarkable success with various therapeutic breakthroughs. Their advancements include drugs for osteoporosis (such as Prolia and Xgeva), cancer treatments like Vectibix, and Enbrel, a treatment for autoimmune diseases.

Acquisitions also played a significant role in Amgen's growth. Among the most important ones there is the acquisition of Immunex in 2002, through which Amgen gained access to Enbrel (one of its major revenue-generating drugs) and the most recent acquisition of Horizon Therapeutics which solidified Amgen's position as one of the leading biotechnology companies globally.

Horizon Therapeutics

Horizon Therapeutics is a biopharmaceutical company dedicated to developing treatments for rare and rheumatic diseases founded in 2008. Throughout its history, Horizon Therapeutics has maintained a focus on pioneering treatments for rare diseases, combining research and development with strategic acquisitions to expand its range of therapeutic offerings. The company's dedication to serving overlooked patient populations remained central to its mission within the biopharmaceutical industry.

A pivotal milestone for Horizon was the 2010 approval and launch of Krystexxa, a solution for chronic refractory gout that didn't respond to traditional treatments. The success of Krystexxa underscored the company's capacity to offer innovative solutions for underserved medical conditions while solidifying its standing in the market. Horizon also focused on acquiring and licensing rights to drugs, including Actimmune in 2014, an approved treatment for certain genetic diseases and severe, malignant osteopetrosis. The strategic acquisition of Vidara Therapeutics International in 2015 significantly expanded its product line, broadening the company's therapeutic portfolio to encompass not only treatments for rare diseases but also diversified medications targeting various health conditions. This move amplified its capacity to cater to a wide range of patient populations with underserved medical conditions.

Horizon Therapeutics is a biopharmaceutical company dedicated to developing treatments for rare and rheumatic diseases founded in 2008. Throughout its history, Horizon Therapeutics has maintained a focus on pioneering treatments for rare diseases, combining research and development with strategic acquisitions to expand its range of therapeutic offerings. The company's dedication to serving overlooked patient populations remained central to its mission within the biopharmaceutical industry.

A pivotal milestone for Horizon was the 2010 approval and launch of Krystexxa, a solution for chronic refractory gout that didn't respond to traditional treatments. The success of Krystexxa underscored the company's capacity to offer innovative solutions for underserved medical conditions while solidifying its standing in the market. Horizon also focused on acquiring and licensing rights to drugs, including Actimmune in 2014, an approved treatment for certain genetic diseases and severe, malignant osteopetrosis. The strategic acquisition of Vidara Therapeutics International in 2015 significantly expanded its product line, broadening the company's therapeutic portfolio to encompass not only treatments for rare diseases but also diversified medications targeting various health conditions. This move amplified its capacity to cater to a wide range of patient populations with underserved medical conditions.

Drug portfolio analysis

Amgen’s portfolio of medicine focuses on cardiovascular, oncology, bone health, neuroscience, nephrology, and inflammation diseases, while that of Horizon therapeutics’ focuses on rare, autoimmune, nephrology and severe inflammatory diseases.

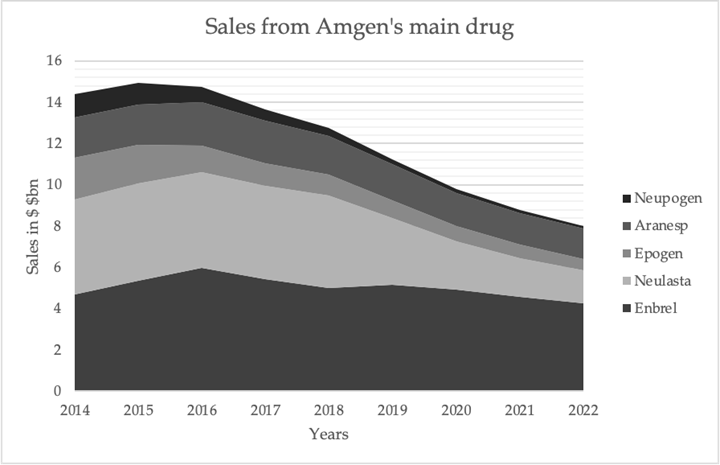

With the acquisition, Amgen plans to expand its inflammatory, nephrology medicine portfolio, while further intensifying its ventures in medicine targeting rare diseases, which it has started with ChemoCentryx’s acquisition last year. Amgen’s best-selling drug, treating rheumatoid arthritis, Enbrel® (etanercept) begins its loss of exclusivity (total patent expiration in 2037), hence the past acquisition and this of Horizon Therapeutic’s are a way to replace over $3bn yearly sales from that drug alone. Prolia® (denosumab), treating high risk osteoporosis, is the next best-selling drug, making over $2.5bn yearly sales for Amgen. Horizon’s best-selling medicine portfolio includes a thyroid eye medicine Tepezza®(teprotumumab-trbw) and Krystexxa® (pegloticase), chronic gout medicine, together generating over $2bn in sales.

Amgen’s portfolio of medicine focuses on cardiovascular, oncology, bone health, neuroscience, nephrology, and inflammation diseases, while that of Horizon therapeutics’ focuses on rare, autoimmune, nephrology and severe inflammatory diseases.

With the acquisition, Amgen plans to expand its inflammatory, nephrology medicine portfolio, while further intensifying its ventures in medicine targeting rare diseases, which it has started with ChemoCentryx’s acquisition last year. Amgen’s best-selling drug, treating rheumatoid arthritis, Enbrel® (etanercept) begins its loss of exclusivity (total patent expiration in 2037), hence the past acquisition and this of Horizon Therapeutic’s are a way to replace over $3bn yearly sales from that drug alone. Prolia® (denosumab), treating high risk osteoporosis, is the next best-selling drug, making over $2.5bn yearly sales for Amgen. Horizon’s best-selling medicine portfolio includes a thyroid eye medicine Tepezza®(teprotumumab-trbw) and Krystexxa® (pegloticase), chronic gout medicine, together generating over $2bn in sales.

Source: The Wall Street Journal

As seen from the graph above representing sales of some of Amgen’s main drugs, each drugs’ sales have been declining steadily over the years, with the most dramatic decrease seen in Neulasta and Neruopgen. Hence a replenishment of a portfolio can help create a steady flow of revenues from well-performing Horizon Theuraptics’ drugs.

Alongside enhancing its portfolio, Amgen estimates that it can greatly benefit through cost synergies, reducing its pre-tax costs by $500mm within the upcoming years. It will be achieved through savings costs within inflammatory and nephrology medicine, alongside its growing focus on rare disease medicines. Furthermore, alongside saving costs Amgen will have greater cash flows to further invest in R&D for any ongoing developments and new projects.

However, it is important to mention FTC’s active interest within this acquisition. Amgen is restricted from bundling Horizon Therapeutics’ drugs with its own for favourable sales, alongside purchasing similar drugs to that of Horizon Therapeutics’ portfolio without the permission of FTC, limiting the success of other potential synergies.

Alongside enhancing its portfolio, Amgen estimates that it can greatly benefit through cost synergies, reducing its pre-tax costs by $500mm within the upcoming years. It will be achieved through savings costs within inflammatory and nephrology medicine, alongside its growing focus on rare disease medicines. Furthermore, alongside saving costs Amgen will have greater cash flows to further invest in R&D for any ongoing developments and new projects.

However, it is important to mention FTC’s active interest within this acquisition. Amgen is restricted from bundling Horizon Therapeutics’ drugs with its own for favourable sales, alongside purchasing similar drugs to that of Horizon Therapeutics’ portfolio without the permission of FTC, limiting the success of other potential synergies.

Acquisition analysis

Upon the announcement of the acquisition, Horizon's shares experienced a notable increase of 14.2%, while Amgen (NASDAQ: AMGN) saw a more modest rise of 1.93%. By September 30, 2023, when the FTC dismissed the lawsuit related to the acquisition, Horizon and Amgen witnessed slight upticks of 2.3% and 0.1% respectively. This indicated that the market had already factored in the acquisition, regardless of the FTC's legal proceedings. During Amgen's latest quarterly release, its stock faced a decline of 2.8%, reaching $255.7, despite the company's positive earnings report. Analysts from William Blair suggested that the upward revision in guidance was attributed to the impending closure of the Horizon deal rather than relying solely on organic growth.

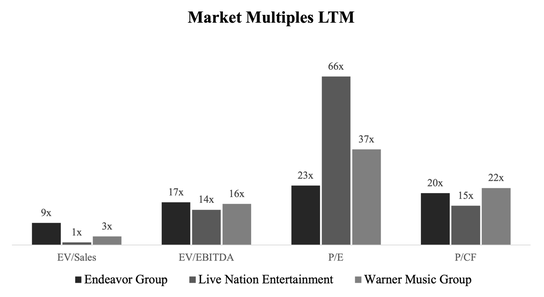

From an industry perspective, Amgen's acquisition exceeded comparable transactions by 49.2% in terms of EV/EBITDA. Much of this premium over industry peers can be attributed to Tepezza. As a rare disease drug used in the treatment of thyroid eye disease, its commercial performance over the past years was remarkably impressive, making it one of the most successfully marketed rare disease drugs. According to Business Wire, Horizon generated $1.97bn in sales from Tepezza in 2022.

Upon the announcement of the acquisition, Horizon's shares experienced a notable increase of 14.2%, while Amgen (NASDAQ: AMGN) saw a more modest rise of 1.93%. By September 30, 2023, when the FTC dismissed the lawsuit related to the acquisition, Horizon and Amgen witnessed slight upticks of 2.3% and 0.1% respectively. This indicated that the market had already factored in the acquisition, regardless of the FTC's legal proceedings. During Amgen's latest quarterly release, its stock faced a decline of 2.8%, reaching $255.7, despite the company's positive earnings report. Analysts from William Blair suggested that the upward revision in guidance was attributed to the impending closure of the Horizon deal rather than relying solely on organic growth.

From an industry perspective, Amgen's acquisition exceeded comparable transactions by 49.2% in terms of EV/EBITDA. Much of this premium over industry peers can be attributed to Tepezza. As a rare disease drug used in the treatment of thyroid eye disease, its commercial performance over the past years was remarkably impressive, making it one of the most successfully marketed rare disease drugs. According to Business Wire, Horizon generated $1.97bn in sales from Tepezza in 2022.

Source: Mergermarket

Amgen offered a substantial premium of approximately 47.9% on the closing share price of $78.76 per Horizon share and a premium of approximately 19.7% compared to the closing price of $97.29 per share on December 9, 2022. JP Morgan suggests that Horizon's acquisition will bolster Amgen's growth trajectory from 2025 to 2030 and estimates that Horizon is expected to generate $4.2bn in sales, contributing modestly to Amgen's EPS in 2024. Amgen’s revenue is anticipated to increase to around $8bn by 2030, resulting in an EPS accretion of approximately $4.50/share. This growth is largely attributed to the resurgence of Tepezza. Similarly, Barclays views total revenues of $31.8bn and EPS of $20.50 - reflecting $1.75/share of accretion. Overall, despite the sizable premium paid, the market views that Horizon will provide a near-term boost to Amgen’s topline and EPS.

Aside from the pre-tax synergies and long-term growth prospects with Tepezza, Amgen's interest in Horizon was significantly driven by Horizon's pipeline of drugs. Amgen sees a unique synergy between its expertise and Horizon's mid-stage pipeline assets. Horizon has consistently shown a strong focus on inflammation and rare diseases, evident from major acquisitions like Viela Bio for $3.05bn, which aimed to expand its inflammatory drug portfolio. Amgen recognizes the value in Horizon's assets, particularly its expertise in the inflammatory field. Healthcare equity strategist Jared Holz, former strategist at Jefferies, highlighted that Amgen views this acquisition as an opportunity to boost immediate revenue while aligning with its long-term strengths. Amgen plans to leverage its scale and resources to accelerate the development and global market entry of Horizon's drugs, with a specific focus on conditions such as myasthenia gravis, lupus erythematosus, and Sjögren's syndrome

Aside from the pre-tax synergies and long-term growth prospects with Tepezza, Amgen's interest in Horizon was significantly driven by Horizon's pipeline of drugs. Amgen sees a unique synergy between its expertise and Horizon's mid-stage pipeline assets. Horizon has consistently shown a strong focus on inflammation and rare diseases, evident from major acquisitions like Viela Bio for $3.05bn, which aimed to expand its inflammatory drug portfolio. Amgen recognizes the value in Horizon's assets, particularly its expertise in the inflammatory field. Healthcare equity strategist Jared Holz, former strategist at Jefferies, highlighted that Amgen views this acquisition as an opportunity to boost immediate revenue while aligning with its long-term strengths. Amgen plans to leverage its scale and resources to accelerate the development and global market entry of Horizon's drugs, with a specific focus on conditions such as myasthenia gravis, lupus erythematosus, and Sjögren's syndrome

Implications

Breaking down the implications of Amgen's purchase of Horizon Therapeutics shows a clear strategy to grow and adapt to the pharma market. The deal, valued at $27.8bn, not only marks Amgen’s move into treating rare diseases but is also part of a bigger trend where big pharma companies merge or buy others to keep growing, particularly as old drug patents run out. The deal is expected to contribute to Amgen's adjusted earnings starting next year with extra revenue coming from Horizon’s key products, Tepezza and Krystexxa. In fact, Tepezza, which treats thyroid eye disease, is especially seen as a big win for Amgen as it is expected to be a “core driver” bringing in $3.9bn in peak sales. Overall, some analysts believe that the revenue from Horizon's drugs could partially offset Amgen's maturing product line.

On the legal side, this acquisition had to clear some hurdles set by the FTC on anticompetition concerns. In the end, a settlement was reached where Amgen is prevented from using anti-competitive tactics to extend the market dominance of Horizon’s main drugs. This part of the deal highlights the legal challenges that big buyouts such as Amgen’s face, and it serves as a model for how future buyouts in the pharma sector could be handled to ensure the market remains competitive and driven by innovation. Some analysts think that the FTC’s decision to settle may help mitigates regulatory headwinds and is a favourable outcome for other current and future big pharma deals. Although, it is worth noting that the FTC Chair signalled that the agency would maintain its antitrust scrutiny and oversight in the pharmaceutical industry.

Breaking down the implications of Amgen's purchase of Horizon Therapeutics shows a clear strategy to grow and adapt to the pharma market. The deal, valued at $27.8bn, not only marks Amgen’s move into treating rare diseases but is also part of a bigger trend where big pharma companies merge or buy others to keep growing, particularly as old drug patents run out. The deal is expected to contribute to Amgen's adjusted earnings starting next year with extra revenue coming from Horizon’s key products, Tepezza and Krystexxa. In fact, Tepezza, which treats thyroid eye disease, is especially seen as a big win for Amgen as it is expected to be a “core driver” bringing in $3.9bn in peak sales. Overall, some analysts believe that the revenue from Horizon's drugs could partially offset Amgen's maturing product line.

On the legal side, this acquisition had to clear some hurdles set by the FTC on anticompetition concerns. In the end, a settlement was reached where Amgen is prevented from using anti-competitive tactics to extend the market dominance of Horizon’s main drugs. This part of the deal highlights the legal challenges that big buyouts such as Amgen’s face, and it serves as a model for how future buyouts in the pharma sector could be handled to ensure the market remains competitive and driven by innovation. Some analysts think that the FTC’s decision to settle may help mitigates regulatory headwinds and is a favourable outcome for other current and future big pharma deals. Although, it is worth noting that the FTC Chair signalled that the agency would maintain its antitrust scrutiny and oversight in the pharmaceutical industry.

Conclusion

As highlighted by Goldman Sachs, buying Horizon Therapeutics may be a smart move to “add multiple growth assets” and “expand its rare disease portfolio” as Amgen will be able to “leverage its development, commercial, and manufacturing scale to add value”; while regulatory bodies like the FTC have expressed antitrust concerns, arguing that the deal might result in elevated prices for prescription medications and hinder the introduction of more cost-effective generic drugs in the market. But one thing is certain: this acquisition is part of a bigger trend where big pharma companies merge or buy others to keep growing and counterbalance the effects of their maturing product lines.

As highlighted by Goldman Sachs, buying Horizon Therapeutics may be a smart move to “add multiple growth assets” and “expand its rare disease portfolio” as Amgen will be able to “leverage its development, commercial, and manufacturing scale to add value”; while regulatory bodies like the FTC have expressed antitrust concerns, arguing that the deal might result in elevated prices for prescription medications and hinder the introduction of more cost-effective generic drugs in the market. But one thing is certain: this acquisition is part of a bigger trend where big pharma companies merge or buy others to keep growing and counterbalance the effects of their maturing product lines.

By Orestas Freigofas, Vasara Silininkaite, Joao Vitor Nasorri Beani, Federica Guirguis

Sources

- FTC.gov

- Amgen.com

- CNBC

- Bloomberg

- Goldman Sachs

- BioSpace

- Horizontherapeutics.com

- Wsj.com

- Genengnews.com

- JPMorgan

- Barclays

- Business Wire

- Mergermarket