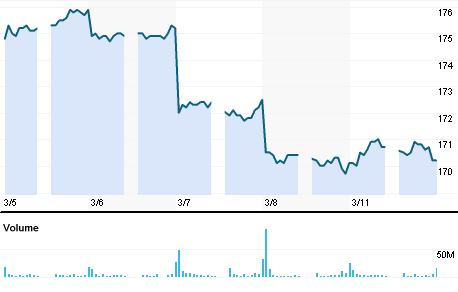

On March 6th, Mizuho Bank announced a $6 bn impairment loss, in part deriving from a 1.5 Billion loss registered in its fixed income securities portfolio. Mizuho stocks plummeted from ¥175 to ¥172 (-1.7%) the following day and it is currently trading around ¥170 (figure 1). This write-down announcement has anticipated the release of 2018 final financial figures and it will slash 85% the bank’s previous net income estimates, now attesting around ¥80 Billion ($700 Million).

Figure 1: Mizuho Financial Group (MHFG) Quote on Tokyo Stock Exchange (TSE)

Figure 1: Mizuho Financial Group (MHFG) Quote on Tokyo Stock Exchange (TSE)

The biggest part of the write-down derives from its internal software. The company has, in fact, heavily invested in its software package both for its retail customers and its internal trading platform. Lately, Mizuho has seriously struggled to create an effective ground-breaking trading platform in order to remain one of the main global players in derivatives products. Unfortunately, this renovation has already caused several breakdowns of its ATMs and brokerage systems, and the foreseen investments in coming years will result in higher operational risks without taking into consideration the side effects that could emerge.

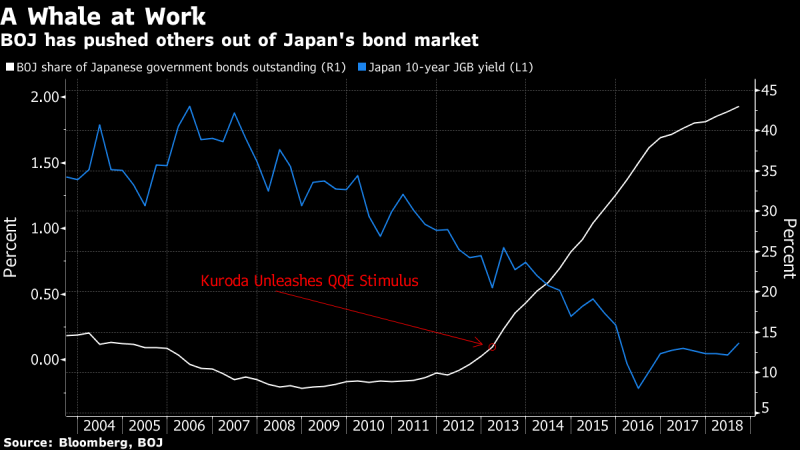

Figure 2: BOJ QQE Stimulus

Figure 2: BOJ QQE Stimulus

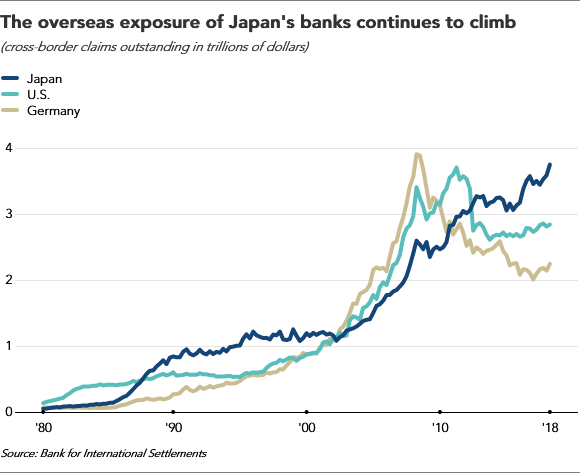

Mizuho Bank is the second largest lender in Japan after Mitsubishi UFJ Financial Group, with 205¥ (1.9$) trillion assets, counting on 60,000 employees in 38 countries around the world. Mizuho Bank is facing a crucial restructuring of its domestic business, with many branches which has become unprofitable and it is planning to cut its workforce by a quarter of its employees in the next 8 years, embracing a global trend which sees Global Banks heavily investing in technology in order to serve its clients in a faster and cost-efficient way. On the same time, Mizuho Bank is embracing information technology in order to reach Japanese SME in the last attempt to erode market share in a struggling domestic market which has been overlooked by major competitors given the constantly low yields that characterize the Japanese economy (figure 2). The biggest Japanese banks has, in fact, tried to shift their resources to more profitable businesses, taking more risks and benefiting in the fast-growing corporate debt supply overseas (figure 3).

Figure 3: Increasing overseas exposure of Japan’s Banks

Figure 3: Increasing overseas exposure of Japan’s Banks

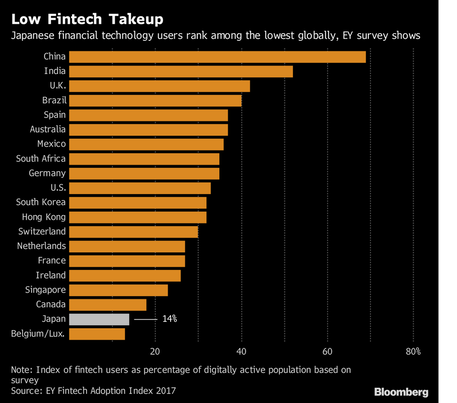

In figure 4, it can be seen a strong evidence of a lack financial innovation in the Japanese domestic market where the percentage of fintech take up is particularly low for such a technology driven economy. In the last year, the CEO of Mizuho Bank, Mr. Sakai, has brought at the center of the strategic vision its domestic business. It has declared its intention to defend the Japanese enterprises know-how and it has launched an invite to listed Japanese corporations in order to exploit the positive new tax and legal framework which came into play from April 2018 and will allow them to buy strategic SME not only with cash but also with stocks.

Figure 4: Low Fintech Takeup in Japan

Figure 4: Low Fintech Takeup in Japan

This renovated focus of such a Global Bank for its domestic business is due to the nature of the bank, which has always been more risk averse than its two main competitors, MUFJ and Sumimoto Financial Group. It has been more conservative and pursuing a lower ROE strategy for their shareholder. this could result in a stronger control of its domestic business relationships using its own resources expanding its reach in the corporate banking industry, which is a relationship driven business which requires a higher Regulatory capital with respect to other business lines in the investment banking sphere.

Riccardo Nocita

Riccardo Nocita