Finance enthusiasts undoubtedly know the meaning and the basic function behind glamorous expressions like “Investment Banking Division TMT Group” or “Global Markets Division Equity Trading desk”. However, the Prime Brokerage Team is not as well-known for fresh grads breaking into Canary Wharf or Wall Street: its role is to specialise in offering custodian and trustee functions as well as cash and stock lending to hedge funds, to support them in their business development with consulting and capital introduction services.

Prime brokerage deals with institutional clients with more complex financial needs: notably, it helps hedge funds borrowing securities and increasing their leverage, eventually acting as an intermediary between counterparties such as pension funds and commercial banks. Recently, PB has become one of the most profitable businesses for large investment banks. In addition, its profits come from the activity of lending to hedge funds, which allows them to take short positions. PB borrows at a rate lower to the one quoted to clients, it can borrow stocks from clients in exchange for a fee on the transaction or, similarly, charge a fee to hedge funds to borrow stocks. Plain and simple. Cap Intro desk gives a good overview into the business landscape: preparing offering documents for the largest hedge funds and launching a fund certainly allow learn something about industry dynamics.

Prime brokerage deals with institutional clients with more complex financial needs: notably, it helps hedge funds borrowing securities and increasing their leverage, eventually acting as an intermediary between counterparties such as pension funds and commercial banks. Recently, PB has become one of the most profitable businesses for large investment banks. In addition, its profits come from the activity of lending to hedge funds, which allows them to take short positions. PB borrows at a rate lower to the one quoted to clients, it can borrow stocks from clients in exchange for a fee on the transaction or, similarly, charge a fee to hedge funds to borrow stocks. Plain and simple. Cap Intro desk gives a good overview into the business landscape: preparing offering documents for the largest hedge funds and launching a fund certainly allow learn something about industry dynamics.

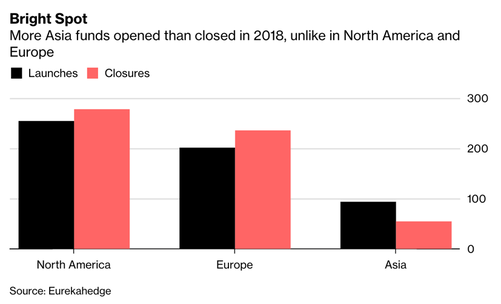

According to Bloomberg News, Goldman Sachs is now planning to add workforce to its Prime Services Team in Asia, after having experienced a 15% growth last year. In Asia, investors stay inquisitive and hope to increase their allocations in the area: with challenging global market conditions, they oversee increasing opportunities to generate alpha in the region. This represents an exciting opportunity for college graduates who aim at working in a sector with strong growth perspectives. Despite the fact that Asia-focused hedge funds lost an average of 8.9 percent last year, many of them are still opening in Hong Kong and Japan and about one over three was profitable. In fact, in 2017, Goldman Sachs predicted a 20% increase in investor queries from its Asia fund clients in the second half of 2018.

The losses at GF Holdings stem from the foreign-exchange wagers of one of its hedge funds. Its trades hurt Citigroup, which suffered a $180-million loss on a loan to the hedge fund. GF reported to the China Securities Regulatory Commission that its Hong Kong fund suffered massive trading losses, prompting the regulator to request for more information about the case, including whether there had been any missteps in the risk management process, and Citigroup to reorganise its prime brokerage business. The ultimate losses for Citigroup could end up being smaller, depending on how the trades are going to be unwound.

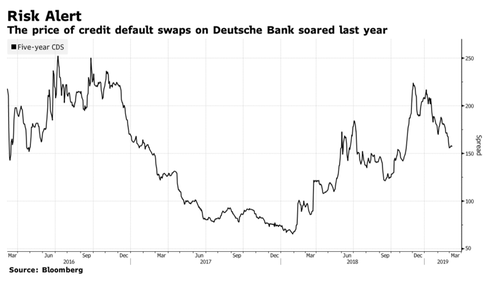

Deutsche Bank’s revenues from its prime services declined for a third straight year in 2018, while its rivals Morgan Stanley, Goldman Sachs, and JPMorgan all saw upsurges. DB’s decline in the business is problematic, given the broader revenue slide that has brought the firm to question itself on the best ways to improve its profitability and to consider a merger with fellow German bank Commerzbank. DB saw a rise in its funding costs and the risk of a potential credit rating downgrade is making its lending activity less profitable. Ultimately, hedge funds are looking for prime brokers with healthy balance sheets and sufficient flexibility to provide customised services.

The losses at GF Holdings stem from the foreign-exchange wagers of one of its hedge funds. Its trades hurt Citigroup, which suffered a $180-million loss on a loan to the hedge fund. GF reported to the China Securities Regulatory Commission that its Hong Kong fund suffered massive trading losses, prompting the regulator to request for more information about the case, including whether there had been any missteps in the risk management process, and Citigroup to reorganise its prime brokerage business. The ultimate losses for Citigroup could end up being smaller, depending on how the trades are going to be unwound.

Deutsche Bank’s revenues from its prime services declined for a third straight year in 2018, while its rivals Morgan Stanley, Goldman Sachs, and JPMorgan all saw upsurges. DB’s decline in the business is problematic, given the broader revenue slide that has brought the firm to question itself on the best ways to improve its profitability and to consider a merger with fellow German bank Commerzbank. DB saw a rise in its funding costs and the risk of a potential credit rating downgrade is making its lending activity less profitable. Ultimately, hedge funds are looking for prime brokers with healthy balance sheets and sufficient flexibility to provide customised services.

In today’s challenging regulatory environment, where Basel III has given an increasing relevance to banks’ short-term and long-term liquidity, the prime brokerage relationship with their hedge fund counterparts has become crucial: reducing inefficiencies and being able to generate returns is key. Many big-size hedge funds in Asia tend to select more than one prime broker in order to be able to find a good mix of complementary offerings: recently, on the offer side, there has been a strong need not for a longstanding history and a strong balance sheet profile, hence, credit rating, but also to diversify between the different functions.

Nick Zuwei Cheng

Nick Zuwei Cheng