Introduction

The recent rise of cryptocurrencies has been at the centre of the debates in the financial world. From the surge of more well-known currencies, like Bitcoin and Ethereum, to the IPO of Coinbase, to the unlikely rise of Dogecoin (and Elon Musk’s support), it has become really hard to ignore the asset class. One of the most important application of cryptocurrencies and blockchain technology has been the one of cross-border payments, which have for long been flawed by an old, slow infrastructure and high commissions. In this context we will analyse how Stellar, one of the most importance cryptocurrency platform, aims to revolutionise international payments and how potential regulatory threats may put its future in danger.

The SWIFT Infrastructure

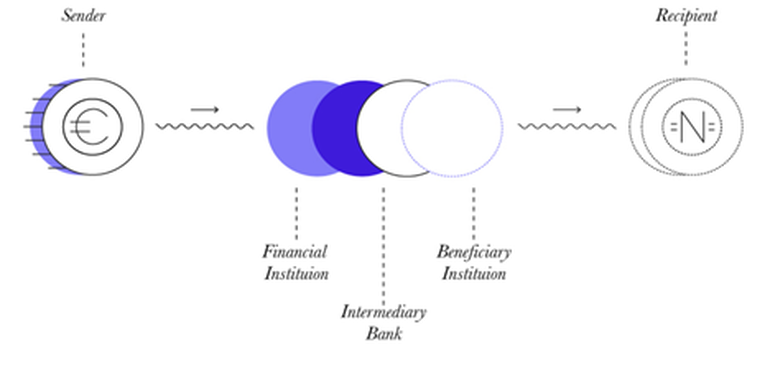

Most international money transfers pass through the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system. Even though the system was founded in 1973, to this day it is still really slow and expensive to operate. The system does not send money, but just securely sends messages of transfers from one bank to another, making therefore the overall process reliant on additional steps involving human intervention and therefore requiring higher fees. If the transfer is to be done between two banks that are not in direct relationship, the process relies on an intermediary institution which needs to have contact with the sender’s and recipient’s banks. This intermediary is awarded a fee, which contributes to make the process even more expensive. Overall, it may require 3-5 working days for the funds to be available to the recipient. The system is substantially quicker when the two banks involved have an existing direct relationship[1].

Stellar

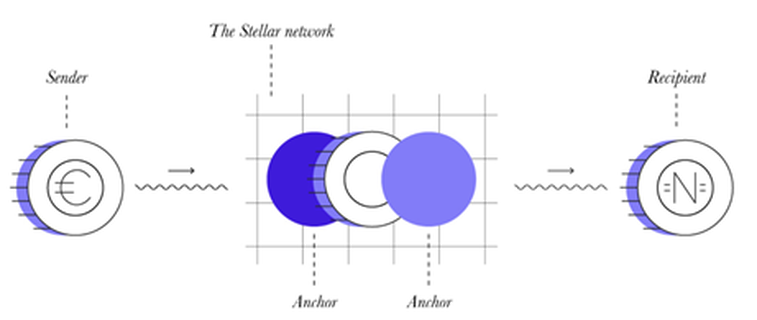

Stellar has been one of the cryptocurrencies with the highest market capitalisation in the latest years, with a market cap of USD 8 Billion on the 24th of April 2021. Stellar’s main aim is to facilitate cross-border payments, mostly for SMEs and individuals, through a complex system involving depository institutions, stablecoins and the ability to transact with counterparties, aiming therefore to replace SWIFT[2]. The whole platform is built using blockchain technology, which does neither use the energy-consuming proof-of-work protocol, nor Ethereum’s proof-of-stake, but the bespoke Stellar Consensus Protocol in order to guarantee the well-functioning of the infrastructure. Potential users of the platform would first need to deposit some money at a local depository institution, which needs to be certified by Stellar as an “anchor”. The user then obtains the digital representation of the currency he has deposited in his/her portfolio (a stablecoin, whose value is linked to the currency it represents 1:1). Done this, users can exchange their own currencies with the ones available on the platform’s decentralized exchange (DEX), which also includes cryptocurrencies. In this task, Stellar operates in a similar way to traditional trading platforms.

Furthermore, the user is free to send a given currency and have the recipient receive another one, which is the feature that could prove helpful to many, including immigrants sending money home to their loved ones. This kind of transactions, named remittances, usually amount to USD 200-300 each, and are imposed between a 7% and 8% fee to run through the traditional system. The last step of the transaction is the redemption of the tokens in the desired currency. Only at this point the amount deposited at the anchor institution is adjusted according to the previous transactions.

Stellar’s revolutionary technology has been embraced by some established firms, like IBM, and has received international recognition as Ukraine announced that it will collaborate with the platform to develop its own digital currency[3].

[1] https://blog.revolut.com/swift-sepa-how-international-money-transfers-actually-work/

[2] GREYSCALE INVESTMENTS LLC, “An Introduction to Stellar Lumens”, Greyscale Building Blocks, 2019

[3] https://www.coindesk.com/ukraine-government-picks-stellar-to-help-build-national-digital-currency

The recent rise of cryptocurrencies has been at the centre of the debates in the financial world. From the surge of more well-known currencies, like Bitcoin and Ethereum, to the IPO of Coinbase, to the unlikely rise of Dogecoin (and Elon Musk’s support), it has become really hard to ignore the asset class. One of the most important application of cryptocurrencies and blockchain technology has been the one of cross-border payments, which have for long been flawed by an old, slow infrastructure and high commissions. In this context we will analyse how Stellar, one of the most importance cryptocurrency platform, aims to revolutionise international payments and how potential regulatory threats may put its future in danger.

The SWIFT Infrastructure

Most international money transfers pass through the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system. Even though the system was founded in 1973, to this day it is still really slow and expensive to operate. The system does not send money, but just securely sends messages of transfers from one bank to another, making therefore the overall process reliant on additional steps involving human intervention and therefore requiring higher fees. If the transfer is to be done between two banks that are not in direct relationship, the process relies on an intermediary institution which needs to have contact with the sender’s and recipient’s banks. This intermediary is awarded a fee, which contributes to make the process even more expensive. Overall, it may require 3-5 working days for the funds to be available to the recipient. The system is substantially quicker when the two banks involved have an existing direct relationship[1].

Stellar

Stellar has been one of the cryptocurrencies with the highest market capitalisation in the latest years, with a market cap of USD 8 Billion on the 24th of April 2021. Stellar’s main aim is to facilitate cross-border payments, mostly for SMEs and individuals, through a complex system involving depository institutions, stablecoins and the ability to transact with counterparties, aiming therefore to replace SWIFT[2]. The whole platform is built using blockchain technology, which does neither use the energy-consuming proof-of-work protocol, nor Ethereum’s proof-of-stake, but the bespoke Stellar Consensus Protocol in order to guarantee the well-functioning of the infrastructure. Potential users of the platform would first need to deposit some money at a local depository institution, which needs to be certified by Stellar as an “anchor”. The user then obtains the digital representation of the currency he has deposited in his/her portfolio (a stablecoin, whose value is linked to the currency it represents 1:1). Done this, users can exchange their own currencies with the ones available on the platform’s decentralized exchange (DEX), which also includes cryptocurrencies. In this task, Stellar operates in a similar way to traditional trading platforms.

Furthermore, the user is free to send a given currency and have the recipient receive another one, which is the feature that could prove helpful to many, including immigrants sending money home to their loved ones. This kind of transactions, named remittances, usually amount to USD 200-300 each, and are imposed between a 7% and 8% fee to run through the traditional system. The last step of the transaction is the redemption of the tokens in the desired currency. Only at this point the amount deposited at the anchor institution is adjusted according to the previous transactions.

Stellar’s revolutionary technology has been embraced by some established firms, like IBM, and has received international recognition as Ukraine announced that it will collaborate with the platform to develop its own digital currency[3].

[1] https://blog.revolut.com/swift-sepa-how-international-money-transfers-actually-work/

[2] GREYSCALE INVESTMENTS LLC, “An Introduction to Stellar Lumens”, Greyscale Building Blocks, 2019

[3] https://www.coindesk.com/ukraine-government-picks-stellar-to-help-build-national-digital-currency

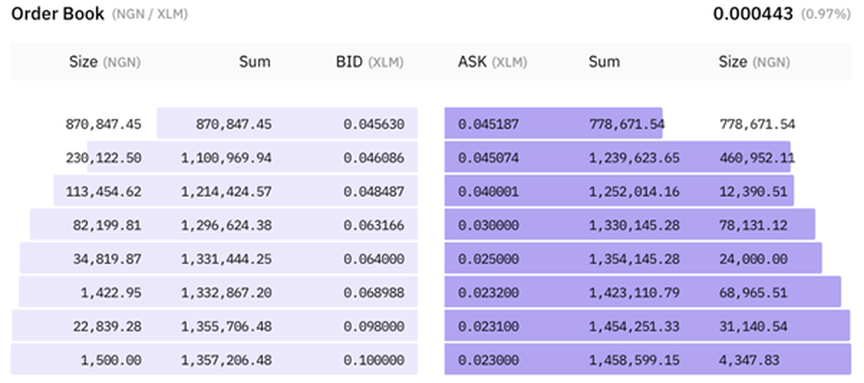

Example of Stellar’s order book

Source: Stellar website

Stellar and the traditional transfer system

Source: Stellar website

Regulatory threats

Regulation may soon become a problem for digital innovators in this field. The most important jurisdictions have been active lately, and the outlook for Stellar may soon become problematic. China has started the circulation of its own central bank digital currency at the start of the year, and its adoption has been picking up quickly[1]. This, in addition with the previously imposed ban of Bitcoin, is a worrying sign for other cryptocurrency providers, that may end up like Bitcoin or see reduced usage. In the meantime, the SEC is waging war to Ripple, claiming that it improperly sold its XRP digital tokens without registering them as a security.[2] The lawsuit may threaten the future of cryptocurrencies in the world’s largest economy, that would see issuer’s costs increase remarkably if tokens were to be considered financial instruments.

Lastly, the European Union is in the initial phase of drafting a regulation of crypto-asset markets (MiCAR), which may potentially generate troubles for coin issuers[3]. This new regulation could be really dangerous for stablecoins, especially if they were to be classified as “significant stablecoins”. This may lead to own funds and reserve requirements for the issuer of these tokens, alongside enhanced consumer protection. These kinds of requirements tend to be more expensive to comply with for smaller institution[4], and ones like Stellar may face adversity in the implementation phase.

Conclusions

The crypto world has come up with many innovative ideas, and among these the one of improving the efficiency of cross-border payments. The existing infrastructure is obsolete, slow, and expensive. Stellar had been a player in this segment, creating options for individuals and SMEs. However, the regulatory threat is growing, and if the most important jurisdictions were to take a strong approach, the two providers may be severely impaired.

[1] https://www.wsj.com/articles/china-creates-its-own-digital-currency-a-first-for-major-economy-11617634118

[2] https://www.bloomberg.com/news/articles/2021-04-21/sec-presses-ahead-with-ripple-lawsuit-with-gensler-at-the-helm

[3] ZETZSCHE, D.A., F. ANNUNZIATA, D.W. ARNER and R.P. BUCKLEY, “The Markets in Crypto-Assets Regulation (MiCA) and the EU Digital Finance Strategy”, EBI Working Paper Series no. 77, 2020

[4] ARNER D.W., R. AUER and J. FROST, “Stablecoins: risks, potential and regulation”, BIS Working Papers No. 905, 2020.

Tommaso Pirozzi

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here

Regulation may soon become a problem for digital innovators in this field. The most important jurisdictions have been active lately, and the outlook for Stellar may soon become problematic. China has started the circulation of its own central bank digital currency at the start of the year, and its adoption has been picking up quickly[1]. This, in addition with the previously imposed ban of Bitcoin, is a worrying sign for other cryptocurrency providers, that may end up like Bitcoin or see reduced usage. In the meantime, the SEC is waging war to Ripple, claiming that it improperly sold its XRP digital tokens without registering them as a security.[2] The lawsuit may threaten the future of cryptocurrencies in the world’s largest economy, that would see issuer’s costs increase remarkably if tokens were to be considered financial instruments.

Lastly, the European Union is in the initial phase of drafting a regulation of crypto-asset markets (MiCAR), which may potentially generate troubles for coin issuers[3]. This new regulation could be really dangerous for stablecoins, especially if they were to be classified as “significant stablecoins”. This may lead to own funds and reserve requirements for the issuer of these tokens, alongside enhanced consumer protection. These kinds of requirements tend to be more expensive to comply with for smaller institution[4], and ones like Stellar may face adversity in the implementation phase.

Conclusions

The crypto world has come up with many innovative ideas, and among these the one of improving the efficiency of cross-border payments. The existing infrastructure is obsolete, slow, and expensive. Stellar had been a player in this segment, creating options for individuals and SMEs. However, the regulatory threat is growing, and if the most important jurisdictions were to take a strong approach, the two providers may be severely impaired.

[1] https://www.wsj.com/articles/china-creates-its-own-digital-currency-a-first-for-major-economy-11617634118

[2] https://www.bloomberg.com/news/articles/2021-04-21/sec-presses-ahead-with-ripple-lawsuit-with-gensler-at-the-helm

[3] ZETZSCHE, D.A., F. ANNUNZIATA, D.W. ARNER and R.P. BUCKLEY, “The Markets in Crypto-Assets Regulation (MiCA) and the EU Digital Finance Strategy”, EBI Working Paper Series no. 77, 2020

[4] ARNER D.W., R. AUER and J. FROST, “Stablecoins: risks, potential and regulation”, BIS Working Papers No. 905, 2020.

Tommaso Pirozzi

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here