Disclaimer: Information as of November 8, 2022.

Introduction

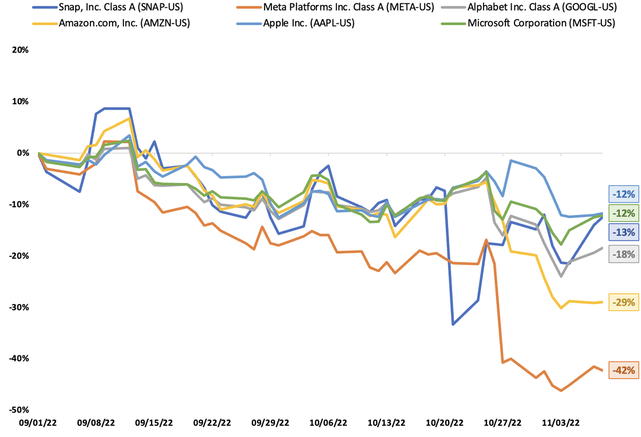

Like most others across the S&P 500, tech companies have been dealing with some major issues throughout 2022. Macroeconomic slowdown, higher costs due to an inflationary setting, rising interest rates, and the strengthening of the U.S. Dollar, have all contributed to a disappointing year for tech stocks.

On one hand, the downturn in stock prices is a consequence of poor financial results throughout the year’s quarters, mainly driven by a decline in advertising revenue and a substantial decrease in demand after aggressive consumer spending during the pandemic.

On the other hand, the Big Tech industry has been affected by the slowing of one of its most important sectors, cloud computing. For instance, Amazon’s AWS and Microsoft’s Azure saw their revenue growth decelerate in the recent quarter and Google Cloud began experiencing it in 2021. This event is the result of business deceleration, expense cuts related to the current macroeconomic environment, and a slowdown in the transition to the cloud for certain industries. Despite the underperformance of the tech sector, not all technology stocks performed equally bad, some even managed to positively surprise analysts. While Meta’s stock price slid even further after a rough year for the company, Apple’s quarterly earnings report had a positive effect on its value.

Macroeconomic Effects & Outlook on Big Tech

As previously stated, many companies faced financial challenges which were reflected in their earnings reports. Some of the most affected industries of this economic downturn were the technology and social media sectors. Companies in these spaces lost a combined USD $800 billion in market capitalization during earnings week. Many companies in this space including Amazon, TikTok and Meta rely on online advertising as their main source of revenue. As the global economy slows down, many companies which previously spent fortunes on online advertising are cutting costs in their marketing departments. This does not mean that the digital advertising space is going to shrink this year, as big spenders such as Coca-Cola and Nestlé are still increasing their marketing spending, but others like fast consumer goods conglomerate Colgate-Palmolive have signaled they would temper marketing spending. As a result, the online advertising space’s growth is likely to fall to the level of other means of advertising like cable television and radio.

Introduction

Like most others across the S&P 500, tech companies have been dealing with some major issues throughout 2022. Macroeconomic slowdown, higher costs due to an inflationary setting, rising interest rates, and the strengthening of the U.S. Dollar, have all contributed to a disappointing year for tech stocks.

On one hand, the downturn in stock prices is a consequence of poor financial results throughout the year’s quarters, mainly driven by a decline in advertising revenue and a substantial decrease in demand after aggressive consumer spending during the pandemic.

On the other hand, the Big Tech industry has been affected by the slowing of one of its most important sectors, cloud computing. For instance, Amazon’s AWS and Microsoft’s Azure saw their revenue growth decelerate in the recent quarter and Google Cloud began experiencing it in 2021. This event is the result of business deceleration, expense cuts related to the current macroeconomic environment, and a slowdown in the transition to the cloud for certain industries. Despite the underperformance of the tech sector, not all technology stocks performed equally bad, some even managed to positively surprise analysts. While Meta’s stock price slid even further after a rough year for the company, Apple’s quarterly earnings report had a positive effect on its value.

Macroeconomic Effects & Outlook on Big Tech

As previously stated, many companies faced financial challenges which were reflected in their earnings reports. Some of the most affected industries of this economic downturn were the technology and social media sectors. Companies in these spaces lost a combined USD $800 billion in market capitalization during earnings week. Many companies in this space including Amazon, TikTok and Meta rely on online advertising as their main source of revenue. As the global economy slows down, many companies which previously spent fortunes on online advertising are cutting costs in their marketing departments. This does not mean that the digital advertising space is going to shrink this year, as big spenders such as Coca-Cola and Nestlé are still increasing their marketing spending, but others like fast consumer goods conglomerate Colgate-Palmolive have signaled they would temper marketing spending. As a result, the online advertising space’s growth is likely to fall to the level of other means of advertising like cable television and radio.

- Tech Stock’s Performance since September 2022

** Information as of November 8, 2022

Source: FactSet, own elaboration

Source: FactSet, own elaboration

Apart from the economic decline in the US, there are also other, arguably more far-reaching, macroeconomic circumstances that depressed earnings economy-wide in this quarter. Due to the Russia-Ukraine war, energy prices in Europe soared in the last year, leading to high levels of inflation and bleak outlooks on the continent. On the other hand, the United States has been economically relatively unscathed by the invasion with only a slight drop in GDP growth. The invasion, coupled with the ECB’s slow reaction to runaway inflation, allowed the USD to gain significant value against the Euro and other global currencies. As US companies converted foreign revenue to USD for their quarterly financial statements, the strong dollar wiped off a combined USD $10 billion from companies’ earnings. Relatively weaker foreign currencies in other continents also mean that local companies that charge customers in euros are now more competitive compared to their US counterparts.

Overview of Q3 Big Tech Earnings

Throughout 2022, the Big Tech companies have taken a heavy loss in terms of Market Capitalization. After the Q3 reports, the five tech giants - Meta, Amazon, Apple, Microsoft and Alphabet - have now lost over USD $3 trillion throughout the year, showing that this industry is not exempt from the current macroeconomic and market turmoil.

Even though these five tech companies generated over a combined USD $360 billion in revenue for the third quarter – representing a 9.1% increase from the previous quarter – it is still a significant market drop when compared to earnings from past periods. For example, in 2021 Q3, the companies posted an increase of 25.6%, mostly due to the extraordinary year stocks had as a whole. However, the most concerning figure at the moment was the steep fall in net income. The 5 companies reported a net income of USD $59.5 billion, which is 17.8% under the USD $72.3 billion reported one year ago.

Nonetheless, Apple was the only company in Q3 to register a post-earnings bump in its stock price. The stock was up 7%, which was the largest single-day percentage growth since July 31, 2020, when the stock increased by 10.5%.

Meta, formerly Facebook, was the only company to post a revenue decline, -4.5%. Furthermore, the company's losses in its Reality Labs business area grew to over USD $10 billion over the year. It recorded its lowest average revenue per user in two years, the Net Income for the quarter suffered a 50% decrease, its stock price has sunk to the lowest level in six years, resulting in a decrease of the Market Cap to under USD $300 billion post earnings. It is important to note that at its peak last year, the Market Cap was over USD $1 trillion. Furthermore, the company announced that sales in the Q4 are likely to decline for the third straight period. Meta’s ongoing financial challenges may continue as CEO, Mark Zuckerberg, has pledged to invest more money into the Metaverse with Reality Labs’ projects expenses expected to increase considerably next year again.

Regarding Amazon, its Q3 revenue felt short of Wall Street estimates, resulting in a decrease in its share price, at one point reaching its lowest value since April 2020. Its revenue came in at USD $127.1 billion, a 15% bump from last year's Q3; however, it was still less than the expected USD $127.46 billion. Additionally, their AWS results reported the smallest quarterly growth since 2014. Consequently, analysts have lowered their price target for the company from USD $164 to $130.

Alphabet (Google) reported its fifth consecutive quarter of slowing sales growth. For the first time ever, the company also reported a decrease in advertising revenue from YouTube since the company began tracking this unit’s performance.

Finally, Microsoft had a small decline after their earnings report. Although the company was able to surpass expectations, their cloud services revenue was lower than expected, and combined with an apparent weak guidance for Q4, the stock price took a small hit.

As a consequence of the negative reports, and possibly forecasting the upcoming recession, Amazon, Alphabet and Microsoft are taking action. Alphabet executives announced to analysts that the company was going to slow hiring levels for the fourth quarter to just half of the hires of the third quarter. And both Amazon and Microsoft executives also announced that their companies were going to tighten expenses and that operating-expense growth should moderate.

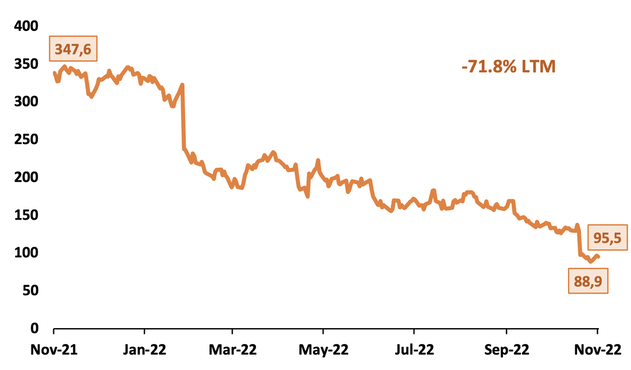

Meta Earnings Analysis

Meta’s earnings were one of the most disappointing out of all big tech companies. Analysts expected net income to fall to USD $5 billion but Meta’s net income fell USD $600 million further, a full 52% below the previous quarter’s numbers. Meta’s lacking performance wiped out USD $89 billion of the company’s investors’ wealth. Though this decline may seem large on its own, it is only the latest downturn in Meta’s stock price, which has shrunk to less than one third of its value one year ago.

Overview of Q3 Big Tech Earnings

Throughout 2022, the Big Tech companies have taken a heavy loss in terms of Market Capitalization. After the Q3 reports, the five tech giants - Meta, Amazon, Apple, Microsoft and Alphabet - have now lost over USD $3 trillion throughout the year, showing that this industry is not exempt from the current macroeconomic and market turmoil.

Even though these five tech companies generated over a combined USD $360 billion in revenue for the third quarter – representing a 9.1% increase from the previous quarter – it is still a significant market drop when compared to earnings from past periods. For example, in 2021 Q3, the companies posted an increase of 25.6%, mostly due to the extraordinary year stocks had as a whole. However, the most concerning figure at the moment was the steep fall in net income. The 5 companies reported a net income of USD $59.5 billion, which is 17.8% under the USD $72.3 billion reported one year ago.

Nonetheless, Apple was the only company in Q3 to register a post-earnings bump in its stock price. The stock was up 7%, which was the largest single-day percentage growth since July 31, 2020, when the stock increased by 10.5%.

Meta, formerly Facebook, was the only company to post a revenue decline, -4.5%. Furthermore, the company's losses in its Reality Labs business area grew to over USD $10 billion over the year. It recorded its lowest average revenue per user in two years, the Net Income for the quarter suffered a 50% decrease, its stock price has sunk to the lowest level in six years, resulting in a decrease of the Market Cap to under USD $300 billion post earnings. It is important to note that at its peak last year, the Market Cap was over USD $1 trillion. Furthermore, the company announced that sales in the Q4 are likely to decline for the third straight period. Meta’s ongoing financial challenges may continue as CEO, Mark Zuckerberg, has pledged to invest more money into the Metaverse with Reality Labs’ projects expenses expected to increase considerably next year again.

Regarding Amazon, its Q3 revenue felt short of Wall Street estimates, resulting in a decrease in its share price, at one point reaching its lowest value since April 2020. Its revenue came in at USD $127.1 billion, a 15% bump from last year's Q3; however, it was still less than the expected USD $127.46 billion. Additionally, their AWS results reported the smallest quarterly growth since 2014. Consequently, analysts have lowered their price target for the company from USD $164 to $130.

Alphabet (Google) reported its fifth consecutive quarter of slowing sales growth. For the first time ever, the company also reported a decrease in advertising revenue from YouTube since the company began tracking this unit’s performance.

Finally, Microsoft had a small decline after their earnings report. Although the company was able to surpass expectations, their cloud services revenue was lower than expected, and combined with an apparent weak guidance for Q4, the stock price took a small hit.

As a consequence of the negative reports, and possibly forecasting the upcoming recession, Amazon, Alphabet and Microsoft are taking action. Alphabet executives announced to analysts that the company was going to slow hiring levels for the fourth quarter to just half of the hires of the third quarter. And both Amazon and Microsoft executives also announced that their companies were going to tighten expenses and that operating-expense growth should moderate.

Meta Earnings Analysis

Meta’s earnings were one of the most disappointing out of all big tech companies. Analysts expected net income to fall to USD $5 billion but Meta’s net income fell USD $600 million further, a full 52% below the previous quarter’s numbers. Meta’s lacking performance wiped out USD $89 billion of the company’s investors’ wealth. Though this decline may seem large on its own, it is only the latest downturn in Meta’s stock price, which has shrunk to less than one third of its value one year ago.

- META’s Stock - LTM

** Information as of November 8, 2022

Source: FactSet, own elaboration

Source: FactSet, own elaboration

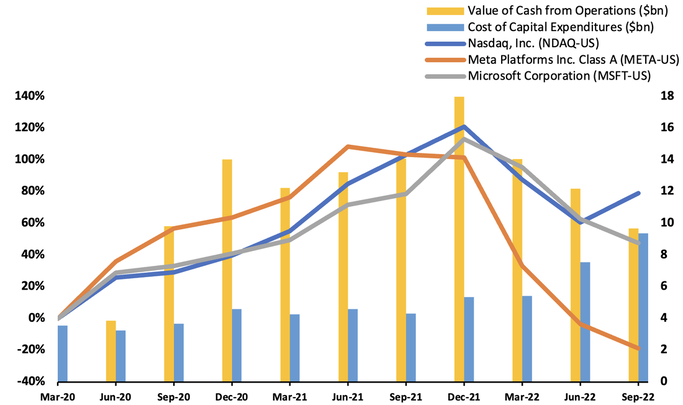

Investor Concerns

The decline in the company’s value follows Mark Zuckerberg’s decision to pursue long-term strategies, which, for many investors, will not lead to adequate payout. These long-term visions include creating a platform that could compete with TikTok, developing a business messaging application and, perhaps most notoriously, developing the Metaverse. The company has been spending increasing amounts of money on capital expenditure even in the face of investor disapproval. Currently, Meta plans to spend a whopping USD $39 billion in 2023. This spending spree comes as competition in the online advertising space tightens with TikTok and companies announcing marketing spending cuts. Meta’s rationale for pumping money into its Reality Labs division is that individual consumers will eventually catch-on to the Metaverse. As for now, that is not the case as the division has amassed a USD $27 billion operating loss in the past three years.

The Future of the Metaverse

Whether the popularity of the Metaverse will ever come to fruition is ambiguous for several reasons. First, there seems to be an industry consensus that the initial profits will come from marketing the technology to companies and enterprises. Meta’s current intention is to develop the technology for regular consumers. Secondly, following high-profile scandals such as the Cambridge Analytica scandal, there is a level of consumer distrust towards Meta. Thus, it’s likely that many consumers would shy away from using such immersive and intrusive technology developed by the same company. Finally, government regulation might prohibit Meta from

gaining a monopoly position in the space in spite of being the technology’s creators.

The decline in the company’s value follows Mark Zuckerberg’s decision to pursue long-term strategies, which, for many investors, will not lead to adequate payout. These long-term visions include creating a platform that could compete with TikTok, developing a business messaging application and, perhaps most notoriously, developing the Metaverse. The company has been spending increasing amounts of money on capital expenditure even in the face of investor disapproval. Currently, Meta plans to spend a whopping USD $39 billion in 2023. This spending spree comes as competition in the online advertising space tightens with TikTok and companies announcing marketing spending cuts. Meta’s rationale for pumping money into its Reality Labs division is that individual consumers will eventually catch-on to the Metaverse. As for now, that is not the case as the division has amassed a USD $27 billion operating loss in the past three years.

The Future of the Metaverse

Whether the popularity of the Metaverse will ever come to fruition is ambiguous for several reasons. First, there seems to be an industry consensus that the initial profits will come from marketing the technology to companies and enterprises. Meta’s current intention is to develop the technology for regular consumers. Secondly, following high-profile scandals such as the Cambridge Analytica scandal, there is a level of consumer distrust towards Meta. Thus, it’s likely that many consumers would shy away from using such immersive and intrusive technology developed by the same company. Finally, government regulation might prohibit Meta from

gaining a monopoly position in the space in spite of being the technology’s creators.

- The Cost of Ambition

** Information as of Q3 Reports, 2022

Source: FactSet, own elaboration

Source: FactSet, own elaboration

These recent failures might have been enough to oust the common executive from their office, but Mark Zuckerberg has managed to cement his position as chief executive officer with the use of class B super voting shares that give him effective control of the company. This structure has called into question investors’ confidence in the governance of the company itself. As a result, Meta’s earnings for the next quarter look bleak. Not only does the larger macroeconomic condition pose a concern, but it’s clear that there are prominent internal challenges Meta faces that other big tech companies do not.

Earnings Overview

Unlike its competitors, Apple posted surprisingly positive earnings for its Q4 on October 27, 2022 (Apple’s Q4 September quarter runs from June 26 to September 24). Following its earnings release, Apple stock jumped to USD $155.74 from the previous day’s close (USD $144.80). While yet to see significant downturn from inflationary pressures, recessionary fears, and reduced demand, Apple beat analysts’ by slim margins and is forecasting a deceleration in growth, especially in the upcoming December quarter (Q1 2023) and the holiday season.

Apple reported revenues of USD $90.1 billion, just slightly beating analysts’ expectations of USD $89 billion and marking an 8% increase compared to the September 2021 quarter. Revenues for the year are also up 8% year over year at USD $394.3 billion. Quarterly earnings per diluted share were USD $1.29 (USD $0.02 better than analysts’ expectations). Apple also declared a USD $0.23 dividend, consistent with dividends paid to shareholders in the previous two quarters and up from the USD $0.22 dividend in the September quarter last year.

This quarter, Apple cited its all time revenue records for Mac (USD 11.5 billion), iPhone (USD 42.6 billion), Wearables, Home, & Accessories (10% year-over-year revenue growth), and Services (USD 19.2 billion and 900 million paid subscriptions) product lines. However, Luca Maestri, Apple’s CFO said Apple expects Mac revenue specifically to “decline substantially” on a year-over-year basis in the next quarter. Last year, Mac sales were boosted by the launch of a new MacBook Pro model. Updates to the current MacBook Pro are not expected until early 2023. In addition to the strong performance of the Mac, Apple attributed demand for its iPhone, which accounts for approximately 47% of all revenue, to significant growth in the number of “switchers'' from other phone brands.

And while the Americas region still accounts for 44% of revenue, Tim Cook reported that Apple has seen notable growth in its Indian, Southeast Asian, and Latin American markets.

Investor Concerns

Prior to its earnings call, investors and analysts were weary of how the larger macroeconomic downturn would affect Apple. In another positive note, Apple reported that silicon related supply constraints were not significant in hindering demand.

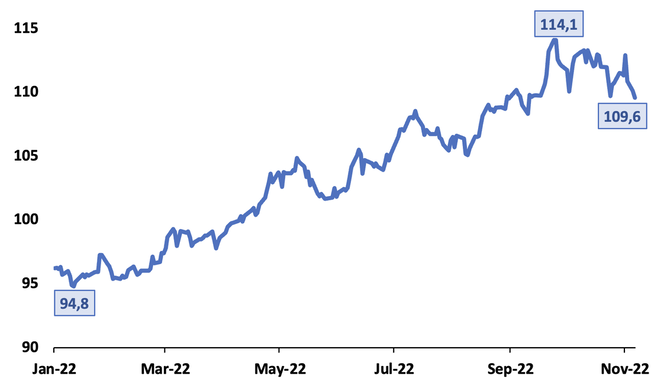

However, like other companies, Apple did confirm that foreign exchange headwinds were partially to blame for its weakened growth. The dollar’s acceleration (as shown by the DXY Index) indicates that Apple products became relatively more expensive to purchase in foreign markets, With a strong dollar and foreign exchange headwinds coming in over 600 bp for the quarter, Tim Cook told CNBC that Apple “would have grown in double digits” otherwise.

Earnings Overview

Unlike its competitors, Apple posted surprisingly positive earnings for its Q4 on October 27, 2022 (Apple’s Q4 September quarter runs from June 26 to September 24). Following its earnings release, Apple stock jumped to USD $155.74 from the previous day’s close (USD $144.80). While yet to see significant downturn from inflationary pressures, recessionary fears, and reduced demand, Apple beat analysts’ by slim margins and is forecasting a deceleration in growth, especially in the upcoming December quarter (Q1 2023) and the holiday season.

Apple reported revenues of USD $90.1 billion, just slightly beating analysts’ expectations of USD $89 billion and marking an 8% increase compared to the September 2021 quarter. Revenues for the year are also up 8% year over year at USD $394.3 billion. Quarterly earnings per diluted share were USD $1.29 (USD $0.02 better than analysts’ expectations). Apple also declared a USD $0.23 dividend, consistent with dividends paid to shareholders in the previous two quarters and up from the USD $0.22 dividend in the September quarter last year.

This quarter, Apple cited its all time revenue records for Mac (USD 11.5 billion), iPhone (USD 42.6 billion), Wearables, Home, & Accessories (10% year-over-year revenue growth), and Services (USD 19.2 billion and 900 million paid subscriptions) product lines. However, Luca Maestri, Apple’s CFO said Apple expects Mac revenue specifically to “decline substantially” on a year-over-year basis in the next quarter. Last year, Mac sales were boosted by the launch of a new MacBook Pro model. Updates to the current MacBook Pro are not expected until early 2023. In addition to the strong performance of the Mac, Apple attributed demand for its iPhone, which accounts for approximately 47% of all revenue, to significant growth in the number of “switchers'' from other phone brands.

And while the Americas region still accounts for 44% of revenue, Tim Cook reported that Apple has seen notable growth in its Indian, Southeast Asian, and Latin American markets.

Investor Concerns

Prior to its earnings call, investors and analysts were weary of how the larger macroeconomic downturn would affect Apple. In another positive note, Apple reported that silicon related supply constraints were not significant in hindering demand.

However, like other companies, Apple did confirm that foreign exchange headwinds were partially to blame for its weakened growth. The dollar’s acceleration (as shown by the DXY Index) indicates that Apple products became relatively more expensive to purchase in foreign markets, With a strong dollar and foreign exchange headwinds coming in over 600 bp for the quarter, Tim Cook told CNBC that Apple “would have grown in double digits” otherwise.

- DXY Index

** Information as of November 8, 2022

Source: FactSet, own elaboration

Source: FactSet, own elaboration

Furthermore, investors were disappointed by Apple’s Services, which grew by just under 5% in the quarter. Comparably, it grew 12% in the last quarter. As the iPhone matures and perhaps consumers grow more resistant to spending upwards of $900 on a new phone, investors and Apple will look more towards its recurring revenue streams. The report of this quarter’s performance coincides with Apple’s recent increase in the price of Apple TV, Apple Music and the Apple One subscription bundle. Apple TV+ is now USD $2 more per month at USD $6.99, and Apple Music is now USD $10.99 per month. Cook cites an increase in licensing fees as the blame, but we may expect to see a boost to revenues from these price hikes in the next quarter.

With Amazon projecting its weakest holiday season to date and Apple also reporting a decreased demand for online advertising and gaming, the next quarter will likely also reflect a deceleration in growth. Investors are interested to see how declines in consumer demand will affect Apple’s newest products. While announced in September 2022, Apple’s new products were only available for a few days at the end of Q4, with the bulk of sales and demand to be seen in the upcoming quarter. Tim Cook relayed confidence in Apple’s new product line and is hopeful about the holiday season, but some Morgan Stanley analysts are particularly concerned about Apple’s Wearables, which are common holiday gifts and may be the first to experience a decline in demand.

What Investors Like: Share Buybacks

With Amazon projecting its weakest holiday season to date and Apple also reporting a decreased demand for online advertising and gaming, the next quarter will likely also reflect a deceleration in growth. Investors are interested to see how declines in consumer demand will affect Apple’s newest products. While announced in September 2022, Apple’s new products were only available for a few days at the end of Q4, with the bulk of sales and demand to be seen in the upcoming quarter. Tim Cook relayed confidence in Apple’s new product line and is hopeful about the holiday season, but some Morgan Stanley analysts are particularly concerned about Apple’s Wearables, which are common holiday gifts and may be the first to experience a decline in demand.

What Investors Like: Share Buybacks

- Apple Stock Buybacks Quarterly (2022)

** Information as of Q3 Report, 2022

Source: FactSet, own elaboration

Source: FactSet, own elaboration

Investors are attracted to Apple’s willingness to return capital to investors, which it has pursued through its aggressive share buybacks. For investors, this helps boost the value of Apple stock in addition to its earnings per share. Doing so, shows Apple’s consistent ability to generate free cash flows and return value to shareholders, making it an attractive investment. This commitment dates back to 2018, when Apple’s CFO, Luca Maestri, pledged to pursue a net-zero cash position. In fact, this quarter, Apple’s stock buyback hit a record of USD $24.43 billion. For its 2022 fiscal year, Apple bought back USD $90.2 billion shares, up from USD $85.5 billion in fiscal 2021. Apple’s buyback pace is evident in the reduction of outstanding shares, which are down 22% over the last 5 years.

Conclusion

While somewhat predictable, it is evident that big tech is finally taking a hit. While once considered a haven and fast-growing industry, the names that brought in significant returns during the pandemic period, are now struggling to keep-up with declining demand and other macroeconomic activity. In spite of a larger downward trend, there are some notable distinctions that can be made between companies themselves. From this analysis, Apple’s resilience is primarily attributed to its strong fundamentals whereas Meta’s lack thereof can be traced to its centralized governance and, most concerningly, its investment into the Metaverse. As investors look towards the upcoming quarter and 2023, big tech stocks will most likely still continue to struggle. However, as investors adjust their expectations, perhaps a new “normal” will not be nearly as surprising as the last few months.

Written by Mate Mangoff, Alejandro Morales, and Ava Trahan

Sources:

Conclusion

While somewhat predictable, it is evident that big tech is finally taking a hit. While once considered a haven and fast-growing industry, the names that brought in significant returns during the pandemic period, are now struggling to keep-up with declining demand and other macroeconomic activity. In spite of a larger downward trend, there are some notable distinctions that can be made between companies themselves. From this analysis, Apple’s resilience is primarily attributed to its strong fundamentals whereas Meta’s lack thereof can be traced to its centralized governance and, most concerningly, its investment into the Metaverse. As investors look towards the upcoming quarter and 2023, big tech stocks will most likely still continue to struggle. However, as investors adjust their expectations, perhaps a new “normal” will not be nearly as surprising as the last few months.

Written by Mate Mangoff, Alejandro Morales, and Ava Trahan

Sources:

- 9TO5MAC

- Apple

- Barron’s

- CNBC

- Financial Times

- Forbes

- MarketWatch

- Meta

- WSJ