As an established leader of the Big Tech industry, Apple has built a reputation as a game changer in all the industries it has entered. First came the Macintosh in 1984, then was the turn of the iPhone in 2007. But, among many other breakthroughs, the launch of Apple Card in 2019 has marked the entrance in the fintech industry as well. Now, Apple Savings seems to keep pushing in this direction, and the partnership with Goldman is pivotal in this move. What’s next?

Apple entering the Fintech Industry

Apple is one of the most successful companies in history and is well-known for its track record of disrupting industries, from desktop computers to digital music to smartphones and many more. Apple has put a differentiating stamp on its products, enabling the company to have a market cap of over 2 trillion dollars and a cult following. The Fintech industry is a new target of Apple. The latest of its many disruptive fintech offerings is a high-yield savings account for Apple card holders offered through Goldman Sachs.

Apple made the first move in the digital wallet world with Passbook in 2012. With Passbook, users could store coupons, boarding passes, identification and gift or store cards. Passbook was Apple's first foray into the financial technology industry, although it did not support credit or debit cards at launch. Today Passbook is called Wallet.

In 2014, Tim Cook introduced Apple Pay, which supports credit and debit card transactions. The electronic Wallet should represent an alternative to the vulnerable magnetic interface of traditional credit cards. Apple Pay enables users to make payments with their iPhone, iPad, Mac, or Apple Watch. Today, Apple has a market share of around 48% of mobile wallets with two billion active devices. Apple has capitalized on its wallet market leadership position by offering more accessible alternatives to traditional bank-offered financial services. In 2019 Apple launched its Apple Card, which has a range of security features besides its for Apple typical sleek design, such as a one-time-use card number for online purchases or biometric authentication for in-store transactions. It was Apple's first credit card product. The customer base of the Apple Card goes beyond the typical financial services' traditional targets. Apple Card Family, for example, allows sharing financials with five other people in the Family Sharing group or features such as Family Spending, which enables one to see the whole spending activity of the group.

This March, Apple entered the BNPL (buy now, pay later) space with Apple Pay Later. Users can pay for purchases in four equal installments over six weeks without interest or fees. Apple profited from the rising cost of living, which boosted the BNPL usage among other areas, also in grocery or small purchases, which are precisely the purchases most customers perform with Apple Pay. High-interest rates will probably weed out some BNPL players who can no longer afford to underwrite the zero-interest loan, but Apple is well-positioned due to its enormous cash reserves. To increase in-store payments, Apple scaled up Tap to Pay. Their first rollout of Tap to Pay was with Stripe, Adyen and GoDaddy followed. Tap to Pay enhances the in-person commerce experience of customers with a fast and secure checkout.

The latest offering of Apple in the Fintech area is their savings account which pays a 4.15% annual percentage yield, more than ten times the national average (0.35%), with no fees or minimums but with a maximum deposit of 250,000 $. Furthermore, users must have an Apple Card to open the savings account and withdrawals must be communicated seven days in advance, representing a minor restriction for customers needing immediate liquidity. Apple announced that all Daily cash rewards earned through the Apple Card reward program, which offers up to 3% cash back on purchases, will automatically be deposited to the savings account. The savings account is offered through Goldman Sachs, and funds are insured by the Federal Deposit Insurance Corporation (FDIC). The insurance represents a significant customer advantage, especially in light of recent collapses such as Silicon Valley and Signature Bank. The intention of Apple with the savings account is to offer customers the possibility to save more and earn more interest. The aspects and developments above show that Apple is a potential threat to traditional and neo-banks. Due to Apple's high number of devices of around two billion, even smaller fractions of the transaction amounts can generate massive revenues for the company. It stays interesting how Apple will continue to disrupt the Fintech industry with faster, cheaper and more accessible banking alternatives.

Apple and Goldman Sachs: an unexpected, yet game-changing, partnership

For years, the tech giant Apple has been striving to convince US banks to allow their customers to view deposit-account balances on their digital wallet. The majority of the banks were not delighted about this proposal, considering that in this way they would cede a significant part of their customer experience to Apple and thus becoming the financial plumbing behind the scenes.

Surprisingly Goldman Sachs, one of the most prestigious investment banks and a relatively new competitor in the consumer banking sector, has been happy to oblige with Apple's innovative idea. The partnership between these two leading corporations began a few years ago when they launched Apple’s first credit card.

This partnership highlights the current trend of creating a financial super app, one that offers banking, payment and investing services. Moreover, it also reflects Goldman's revamped approach to consumer banking, abandoning their initiative to build a full service consumer bank in favor of offering banking services to wealth-management customers and through partnerships with companies such as Apple. On the other side, Apple is trying to pull ahead of its competitors, building a technology ecosystem that satisfies people's many daily financial needs all in one place.

In October 2022, the companies unveiled their first plans for the high-yield savings account where Apple Card customers would be able to deposit funds and earn interest on their cash-back rewards. Apple also sees big potential in buy now, pay later plans, whose popularity has increased significantly in recent years. Thus, Apple wants to connect to merchants through the Mastercard Inc. network. Goldman Sachs' role is serving as a sponsor, issuing a card number that merchants will receive when consumers pay using the service. Thus, Goldman is expanding into the payments sector, willing to position itself as a technology player behind the scene.

That is exactly what Apple was looking for since the beginning. The tech giant wanted more control over some of the main aspects of this project. For example, applying for the card only through Apple: the application is not available on Goldman's website (although the bank is responsible for evaluating potential borrowers), and this was the main reason why Apple was refused by the vast majority of other banks.

At the end of the day, this partnership seems to bring the promised benefits to customers, offering them a product flywheel, a suite of financial products that includes Apple Card, Apple Pay, Buy Now Pay Later, and now 'Savings.' Apple is offering currently unmatched benefits, namely 4.15% Annual Percentage Yield to store deposits with them, nearly 400x more than the 0.01-0.03% APY offered by J.P. Morgan Chase. But it's not just Apple that is making waves in the consumer banking industry. Other competitors such as Sofi, Ally and Chime, who offer APY higher than 2%, which is still more than 60x of what traditional banking Chase gives to its best customers.

Even though J.P. Morgan announced record revenue and profits reaching 52% for the first quarter of 2023, Chase may be sitting on the high horse today. The traditional model on which so many banks still operate today with physical branches, endless fees, implicit government guarantees and one-sided economics, might be quickly becoming obsolete.

Besides technology enthusiasts, tech startup founders and CFOs also want digital-first banking experiences that work as well as the apps they use in their everyday lives. This is why Apple's and Goldman Sachs's partnership brought a significant innovation in the consumer banking sector, giving their customers a meaningful share of the economics, the safety of their deposits and most importantly, the feeling that they are valued and that they're not just another account number. With Apple entering the banking ring, J.P. Morgan may have finally met its match. The iBank revolution has begun.

Navigating the Crowded and Competitive Fintech Landscape

In a world becoming more inclined to digital-only solutions, several fintech products and solutions cover a key role in our everyday life and radically change how we apply for a loan, pay for goods, and log in to our bank accounts. Moreover, financial institutions are constantly investing in acing their expertise in preventing fraud, satisfying their customers, and predicting their needs. It follows that being always updated on the trends that will shape the future of FinTech is of the utmost importance.

An environment characterized by high inflation, rising interest rates, and persistent volatility presents significant risks for growth sectors such as fintech, which have thrived in recent years in part due to the absence of these dynamics. These factors have the potential to slow down fintech industry growth and create dispersion across the sector.

Apple is one of the most successful companies in history and is well-known for its track record of disrupting industries, from desktop computers to digital music to smartphones and many more. Apple has put a differentiating stamp on its products, enabling the company to have a market cap of over 2 trillion dollars and a cult following. The Fintech industry is a new target of Apple. The latest of its many disruptive fintech offerings is a high-yield savings account for Apple card holders offered through Goldman Sachs.

Apple made the first move in the digital wallet world with Passbook in 2012. With Passbook, users could store coupons, boarding passes, identification and gift or store cards. Passbook was Apple's first foray into the financial technology industry, although it did not support credit or debit cards at launch. Today Passbook is called Wallet.

In 2014, Tim Cook introduced Apple Pay, which supports credit and debit card transactions. The electronic Wallet should represent an alternative to the vulnerable magnetic interface of traditional credit cards. Apple Pay enables users to make payments with their iPhone, iPad, Mac, or Apple Watch. Today, Apple has a market share of around 48% of mobile wallets with two billion active devices. Apple has capitalized on its wallet market leadership position by offering more accessible alternatives to traditional bank-offered financial services. In 2019 Apple launched its Apple Card, which has a range of security features besides its for Apple typical sleek design, such as a one-time-use card number for online purchases or biometric authentication for in-store transactions. It was Apple's first credit card product. The customer base of the Apple Card goes beyond the typical financial services' traditional targets. Apple Card Family, for example, allows sharing financials with five other people in the Family Sharing group or features such as Family Spending, which enables one to see the whole spending activity of the group.

This March, Apple entered the BNPL (buy now, pay later) space with Apple Pay Later. Users can pay for purchases in four equal installments over six weeks without interest or fees. Apple profited from the rising cost of living, which boosted the BNPL usage among other areas, also in grocery or small purchases, which are precisely the purchases most customers perform with Apple Pay. High-interest rates will probably weed out some BNPL players who can no longer afford to underwrite the zero-interest loan, but Apple is well-positioned due to its enormous cash reserves. To increase in-store payments, Apple scaled up Tap to Pay. Their first rollout of Tap to Pay was with Stripe, Adyen and GoDaddy followed. Tap to Pay enhances the in-person commerce experience of customers with a fast and secure checkout.

The latest offering of Apple in the Fintech area is their savings account which pays a 4.15% annual percentage yield, more than ten times the national average (0.35%), with no fees or minimums but with a maximum deposit of 250,000 $. Furthermore, users must have an Apple Card to open the savings account and withdrawals must be communicated seven days in advance, representing a minor restriction for customers needing immediate liquidity. Apple announced that all Daily cash rewards earned through the Apple Card reward program, which offers up to 3% cash back on purchases, will automatically be deposited to the savings account. The savings account is offered through Goldman Sachs, and funds are insured by the Federal Deposit Insurance Corporation (FDIC). The insurance represents a significant customer advantage, especially in light of recent collapses such as Silicon Valley and Signature Bank. The intention of Apple with the savings account is to offer customers the possibility to save more and earn more interest. The aspects and developments above show that Apple is a potential threat to traditional and neo-banks. Due to Apple's high number of devices of around two billion, even smaller fractions of the transaction amounts can generate massive revenues for the company. It stays interesting how Apple will continue to disrupt the Fintech industry with faster, cheaper and more accessible banking alternatives.

Apple and Goldman Sachs: an unexpected, yet game-changing, partnership

For years, the tech giant Apple has been striving to convince US banks to allow their customers to view deposit-account balances on their digital wallet. The majority of the banks were not delighted about this proposal, considering that in this way they would cede a significant part of their customer experience to Apple and thus becoming the financial plumbing behind the scenes.

Surprisingly Goldman Sachs, one of the most prestigious investment banks and a relatively new competitor in the consumer banking sector, has been happy to oblige with Apple's innovative idea. The partnership between these two leading corporations began a few years ago when they launched Apple’s first credit card.

This partnership highlights the current trend of creating a financial super app, one that offers banking, payment and investing services. Moreover, it also reflects Goldman's revamped approach to consumer banking, abandoning their initiative to build a full service consumer bank in favor of offering banking services to wealth-management customers and through partnerships with companies such as Apple. On the other side, Apple is trying to pull ahead of its competitors, building a technology ecosystem that satisfies people's many daily financial needs all in one place.

In October 2022, the companies unveiled their first plans for the high-yield savings account where Apple Card customers would be able to deposit funds and earn interest on their cash-back rewards. Apple also sees big potential in buy now, pay later plans, whose popularity has increased significantly in recent years. Thus, Apple wants to connect to merchants through the Mastercard Inc. network. Goldman Sachs' role is serving as a sponsor, issuing a card number that merchants will receive when consumers pay using the service. Thus, Goldman is expanding into the payments sector, willing to position itself as a technology player behind the scene.

That is exactly what Apple was looking for since the beginning. The tech giant wanted more control over some of the main aspects of this project. For example, applying for the card only through Apple: the application is not available on Goldman's website (although the bank is responsible for evaluating potential borrowers), and this was the main reason why Apple was refused by the vast majority of other banks.

At the end of the day, this partnership seems to bring the promised benefits to customers, offering them a product flywheel, a suite of financial products that includes Apple Card, Apple Pay, Buy Now Pay Later, and now 'Savings.' Apple is offering currently unmatched benefits, namely 4.15% Annual Percentage Yield to store deposits with them, nearly 400x more than the 0.01-0.03% APY offered by J.P. Morgan Chase. But it's not just Apple that is making waves in the consumer banking industry. Other competitors such as Sofi, Ally and Chime, who offer APY higher than 2%, which is still more than 60x of what traditional banking Chase gives to its best customers.

Even though J.P. Morgan announced record revenue and profits reaching 52% for the first quarter of 2023, Chase may be sitting on the high horse today. The traditional model on which so many banks still operate today with physical branches, endless fees, implicit government guarantees and one-sided economics, might be quickly becoming obsolete.

Besides technology enthusiasts, tech startup founders and CFOs also want digital-first banking experiences that work as well as the apps they use in their everyday lives. This is why Apple's and Goldman Sachs's partnership brought a significant innovation in the consumer banking sector, giving their customers a meaningful share of the economics, the safety of their deposits and most importantly, the feeling that they are valued and that they're not just another account number. With Apple entering the banking ring, J.P. Morgan may have finally met its match. The iBank revolution has begun.

Navigating the Crowded and Competitive Fintech Landscape

In a world becoming more inclined to digital-only solutions, several fintech products and solutions cover a key role in our everyday life and radically change how we apply for a loan, pay for goods, and log in to our bank accounts. Moreover, financial institutions are constantly investing in acing their expertise in preventing fraud, satisfying their customers, and predicting their needs. It follows that being always updated on the trends that will shape the future of FinTech is of the utmost importance.

An environment characterized by high inflation, rising interest rates, and persistent volatility presents significant risks for growth sectors such as fintech, which have thrived in recent years in part due to the absence of these dynamics. These factors have the potential to slow down fintech industry growth and create dispersion across the sector.

However, it's essential to note that fintech is still powered by long-term secular tailwinds, and this market environment will serve to differentiate winners from losers in the industry. Looking ahead to 2023, the fintech industry is predicted to continue evolving and improving, with the fintech space set to reach a value of $174 billion. Despite the potential challenges presented by market conditions, the industry is poised for growth and will continue to be driven by long-term trends and innovations.

The global fintech market is expected to exceed a total value of $305 billion by 2025 and is currently overcrowded, with most FinTechs being loss-making, facing fierce competition to reach the same customer base and increasingly challenged by the current macroeconomic and fundraising environment. For this reason, the sector is expected to undergo consolidation and see a rise in M&A activity, especially in the verticals of embedded finance and Banking-as-a-Service, as banks and mature FinTechs may be interested in acquiring their technologies or even entire companies. The consolidation of the FinTech industry is expected to increase shareholder liquidity and make talent from acquired companies more willing to seek out new opportunities, enabling the emergence of the next generation of FinTechs.

In addition to this trend, is likely to expect the growth of products that address a broad range of financial well-being aspects, such as debt avoidance, bill management, and identity theft protection, as customers increasingly seek personalized financial solutions. While the last decade saw the emergence of FinTechs like N26, Monzo, and Revolut which enhanced financial inclusion by providing easy access to bank accounts and financial services through user-friendly experiences, personal finance cannot be managed through an undifferentiated approach. The expansion of specialized FinTechs will continue to grow as they focus on assisting customers with specific affinities and demographic segments, rather than emulating traditional banks. Examples of such specialized FinTechs in Europe include Alpher, which helps women close the gender financial education gap, Kestrl, which provides financial management for Muslims, and Bloom Money, which serves diaspora communities. FinTechs will play an increasingly important role in meeting the diverse financial needs of customers across different segments and demographics as the industry continues to evolve.

The global fintech market is expected to exceed a total value of $305 billion by 2025 and is currently overcrowded, with most FinTechs being loss-making, facing fierce competition to reach the same customer base and increasingly challenged by the current macroeconomic and fundraising environment. For this reason, the sector is expected to undergo consolidation and see a rise in M&A activity, especially in the verticals of embedded finance and Banking-as-a-Service, as banks and mature FinTechs may be interested in acquiring their technologies or even entire companies. The consolidation of the FinTech industry is expected to increase shareholder liquidity and make talent from acquired companies more willing to seek out new opportunities, enabling the emergence of the next generation of FinTechs.

In addition to this trend, is likely to expect the growth of products that address a broad range of financial well-being aspects, such as debt avoidance, bill management, and identity theft protection, as customers increasingly seek personalized financial solutions. While the last decade saw the emergence of FinTechs like N26, Monzo, and Revolut which enhanced financial inclusion by providing easy access to bank accounts and financial services through user-friendly experiences, personal finance cannot be managed through an undifferentiated approach. The expansion of specialized FinTechs will continue to grow as they focus on assisting customers with specific affinities and demographic segments, rather than emulating traditional banks. Examples of such specialized FinTechs in Europe include Alpher, which helps women close the gender financial education gap, Kestrl, which provides financial management for Muslims, and Bloom Money, which serves diaspora communities. FinTechs will play an increasingly important role in meeting the diverse financial needs of customers across different segments and demographics as the industry continues to evolve.

On this side of the ocean, in 2022 the European fintech industry also experienced significant growth. It accounted for 22% of European unicorns in the financial sector, and fintech companies raised a total of $22.2 billion, making it the most well-funded sector of the year.

Trends in the American market

The fintech market in the US benefits from enormous growth potential in addition to the rise of the e-commerce sector. Online payment solutions that provide better degrees of security are continually supported and improved by financial technology. Consumers that are more engaged and informed about the digital space are more receptive to using fintech in their daily life.

According to analysis, the total transaction value in the digital payment industry was US$ 940 billion in 2021, reflecting the sharp increase in the number of individuals utilizing online mobile phone payments and digital-only institutions. Several fintech firms, including PayPal, Square, Stripe, and Venmo, are providing digital payment services for both users and businesses.

Stripe is a leading online payment processing company and one of the largest VC-backed companies in the US. Its current valuation is over $70 billion, and it generated a gross revenue of $12 billion in 2021, a 62% increase compared to 2020. Its possible IPO is one of the most anticipated events in the industry. Stripe's service is used by more than 1.14 million websites to accept payments and by businesses in 47 countries.

Venmo is a "peer-to-peer" mobile payment network that enables the transfer of money between authorized parties, as well as paying for goods and services purchased through merchant partners. It allows users to message each other and use emojis, with an interface similar to Facebook Messenger. PayPal acquired the company for $800 million in 2013, and it currently has over 78 million users. In 2022, the total payment volume processed by Venmo was $244 billion, a 6% increase YoY. The digitization of Americans' daily lives has led to the expansion of the fintech sector, with more people relying on e-commerce platforms to buy goods, particularly in the wake of the COVID-19 pandemic.

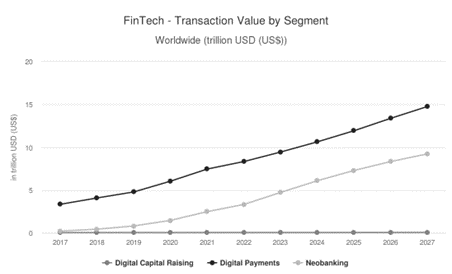

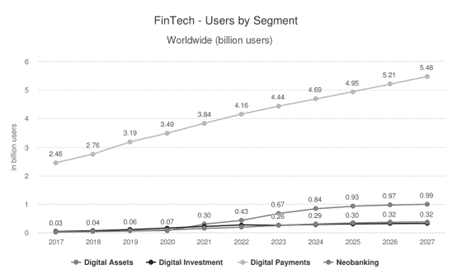

Digital payments are now the leading segment in the fintech industry, with a transaction value projected to reach $1,801,103 million and an estimated user base of 307 million by 2026. NEO banking is expected to see revenue growth of 36% in 2023. The future of the fintech sector will be driven by disruptive innovations such as embedded finance, buy-now-pay-later, and the evolution of cryptocurrencies and digital assets, which are expected to be the next big opportunities. It is reasonable to expect that the industry's future leaders will emerge from these areas of innovation.

What this means for the markets

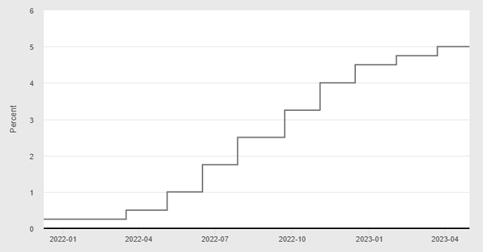

If the current fintech industry environment surely plays a role in Apple’s choice to enter the market, we also have to face the fact that macroeconomic conditions also played a paramount role in the timing. In fact, central banks have been tightening their monetary policies substantially. The Federal Reserve has been increasing the rates for the past year, bringing the Federal Funds Rate all the way to 5. This rate hike was an inevitable policy response to the hastening inflation we have seen over the past months.

Trends in the American market

The fintech market in the US benefits from enormous growth potential in addition to the rise of the e-commerce sector. Online payment solutions that provide better degrees of security are continually supported and improved by financial technology. Consumers that are more engaged and informed about the digital space are more receptive to using fintech in their daily life.

According to analysis, the total transaction value in the digital payment industry was US$ 940 billion in 2021, reflecting the sharp increase in the number of individuals utilizing online mobile phone payments and digital-only institutions. Several fintech firms, including PayPal, Square, Stripe, and Venmo, are providing digital payment services for both users and businesses.

Stripe is a leading online payment processing company and one of the largest VC-backed companies in the US. Its current valuation is over $70 billion, and it generated a gross revenue of $12 billion in 2021, a 62% increase compared to 2020. Its possible IPO is one of the most anticipated events in the industry. Stripe's service is used by more than 1.14 million websites to accept payments and by businesses in 47 countries.

Venmo is a "peer-to-peer" mobile payment network that enables the transfer of money between authorized parties, as well as paying for goods and services purchased through merchant partners. It allows users to message each other and use emojis, with an interface similar to Facebook Messenger. PayPal acquired the company for $800 million in 2013, and it currently has over 78 million users. In 2022, the total payment volume processed by Venmo was $244 billion, a 6% increase YoY. The digitization of Americans' daily lives has led to the expansion of the fintech sector, with more people relying on e-commerce platforms to buy goods, particularly in the wake of the COVID-19 pandemic.

Digital payments are now the leading segment in the fintech industry, with a transaction value projected to reach $1,801,103 million and an estimated user base of 307 million by 2026. NEO banking is expected to see revenue growth of 36% in 2023. The future of the fintech sector will be driven by disruptive innovations such as embedded finance, buy-now-pay-later, and the evolution of cryptocurrencies and digital assets, which are expected to be the next big opportunities. It is reasonable to expect that the industry's future leaders will emerge from these areas of innovation.

What this means for the markets

If the current fintech industry environment surely plays a role in Apple’s choice to enter the market, we also have to face the fact that macroeconomic conditions also played a paramount role in the timing. In fact, central banks have been tightening their monetary policies substantially. The Federal Reserve has been increasing the rates for the past year, bringing the Federal Funds Rate all the way to 5. This rate hike was an inevitable policy response to the hastening inflation we have seen over the past months.

Aside from the tautological consequences of a rate hike on the market as a whole, what does this entail for the consumers and the retail savers? The first and most important consequence is the fact that, as the risk-free rate increases, investors start demanding higher returns. Another consequence that the rate hike has had on the market as a whole is that, as on one side lending money becomes more profitable for creditors, on the other borrowing money has become more expensive for prospective debtors. If on the one side this negatively impacts the accessibility of capital for firms seeking to invest, which is negatively impacted, on the other higher rates allow to provide decently high rates on savings accounts, without the need to undertake excessively risky investments to obtain such returns.

Regulatory framework and opportunities

The unconventional partnership between Apple and GS is however also due to another paramount, purely regulatory, factor. Namely GS decision to obtain a Commercial Banking Charter instead on top of the Investment Banking one. The decision for American banks to operate under a commercial bank charter versus an investment bank charter has important implications for their funding stability and regulatory oversight. A commercial bank charter provides access to a stable source of funding in the form of customer deposits, which can be used to make loans and generate interest income on top of the usual revenues form the S&T, IB and AM divisions (as in these departments, revenue tends to show greater volatility). Additionally, commercial banks have access to the Federal Reserve's discount window, which can provide a valuable safety net during times of financial distress.

Furthermore, operating under a commercial bank charter also subjects banks to a range of regulatory requirements aimed at ensuring their safety and soundness. These requirements can be costly to comply with, but they can also provide a valuable layer of protection for banks and their customers. The regulations include regular capital adequacy assessments, stress tests, and restrictions on risky activities like proprietary trading.

Goldman Sachs and JPMorgan have chosen to become commercial banks due to the benefits associated with a stable funding source and access to the Federal Reserve's discount window. Additionally, becoming a commercial bank allows them to diversify their revenue streams and access new customer segments, such as retail depositors in this case.

It may be too early to tell whether Goldman’s entrance in the commercial banking sector will be beneficial or not in the long run; but so far, we have all the premises to state that GS is ready to step beyond the conventional concepts of banking, and possibly revolutionize savings for as many as 135 million people in the US alone.

The decision for American banks to operate under a commercial bank charter versus an investment bank charter has important implications for their funding stability and regulatory oversight. A commercial bank charter provides access to a stable source of funding in the form of customer deposits, which can be used to make loans and generate interest income on top of the usual revenues form the S&T, IB and AM divisions (as in these departments, revenue tends to show greater volatility). Additionally, commercial banks have access to the Federal Reserve's discount window, which can provide a valuable safety net during times of financial stress.

Furthermore, operating under a commercial bank charter also subjects banks to a range of regulatory requirements aimed at ensuring their safety and soundness. These requirements can be costly to comply with, but they can also provide a valuable layer of protection for banks and their customers. The regulations include regular capital adequacy assessments, stress tests, and restrictions on risky activities like proprietary trading.

Goldman Sachs and JPMorgan have chosen to become commercial banks due to the benefits associated with a stable funding source and access to the Federal Reserve's discount window. Additionally, becoming a commercial bank allows them to diversify their revenue streams and access new customer segments, such as retail depositors in this case.

It may be too early to tell whether Goldman’s entrance in the commercial banking sector will be beneficial or not in the long run; but so far, we have all the premises to state that GS is ready to step beyond the conventional concepts of banking, and possibly revolutionize savings for as many as 135 million people in the US alone.

To wrap up

Apple has always been an elephant in the room in all the markets it has entered. And it seems it is going to do so also in Fintech, which is per se an industry that is going to encounter more consolidation around a few key players in the next few years. This is favored by macroeconomic conditions that in turn are shaping the world economy after about a decade of zero interest rates. The fact that this is done with such a prestigious partnership adds up to the already high expectations for this project. What remains to be seen is how this is going to shape the banking industry in the next decades: should we expect commercial banking to become the infrastructure behind someone else’s customer experience? Or is the deposits and lending panorama going to survive unchanged?

By Lukas Brendel, Laurian David Pop, Federico Tita and Stefano Graziosi

SOURCES:

Regulatory framework and opportunities

The unconventional partnership between Apple and GS is however also due to another paramount, purely regulatory, factor. Namely GS decision to obtain a Commercial Banking Charter instead on top of the Investment Banking one. The decision for American banks to operate under a commercial bank charter versus an investment bank charter has important implications for their funding stability and regulatory oversight. A commercial bank charter provides access to a stable source of funding in the form of customer deposits, which can be used to make loans and generate interest income on top of the usual revenues form the S&T, IB and AM divisions (as in these departments, revenue tends to show greater volatility). Additionally, commercial banks have access to the Federal Reserve's discount window, which can provide a valuable safety net during times of financial distress.

Furthermore, operating under a commercial bank charter also subjects banks to a range of regulatory requirements aimed at ensuring their safety and soundness. These requirements can be costly to comply with, but they can also provide a valuable layer of protection for banks and their customers. The regulations include regular capital adequacy assessments, stress tests, and restrictions on risky activities like proprietary trading.

Goldman Sachs and JPMorgan have chosen to become commercial banks due to the benefits associated with a stable funding source and access to the Federal Reserve's discount window. Additionally, becoming a commercial bank allows them to diversify their revenue streams and access new customer segments, such as retail depositors in this case.

It may be too early to tell whether Goldman’s entrance in the commercial banking sector will be beneficial or not in the long run; but so far, we have all the premises to state that GS is ready to step beyond the conventional concepts of banking, and possibly revolutionize savings for as many as 135 million people in the US alone.

The decision for American banks to operate under a commercial bank charter versus an investment bank charter has important implications for their funding stability and regulatory oversight. A commercial bank charter provides access to a stable source of funding in the form of customer deposits, which can be used to make loans and generate interest income on top of the usual revenues form the S&T, IB and AM divisions (as in these departments, revenue tends to show greater volatility). Additionally, commercial banks have access to the Federal Reserve's discount window, which can provide a valuable safety net during times of financial stress.

Furthermore, operating under a commercial bank charter also subjects banks to a range of regulatory requirements aimed at ensuring their safety and soundness. These requirements can be costly to comply with, but they can also provide a valuable layer of protection for banks and their customers. The regulations include regular capital adequacy assessments, stress tests, and restrictions on risky activities like proprietary trading.

Goldman Sachs and JPMorgan have chosen to become commercial banks due to the benefits associated with a stable funding source and access to the Federal Reserve's discount window. Additionally, becoming a commercial bank allows them to diversify their revenue streams and access new customer segments, such as retail depositors in this case.

It may be too early to tell whether Goldman’s entrance in the commercial banking sector will be beneficial or not in the long run; but so far, we have all the premises to state that GS is ready to step beyond the conventional concepts of banking, and possibly revolutionize savings for as many as 135 million people in the US alone.

To wrap up

Apple has always been an elephant in the room in all the markets it has entered. And it seems it is going to do so also in Fintech, which is per se an industry that is going to encounter more consolidation around a few key players in the next few years. This is favored by macroeconomic conditions that in turn are shaping the world economy after about a decade of zero interest rates. The fact that this is done with such a prestigious partnership adds up to the already high expectations for this project. What remains to be seen is how this is going to shape the banking industry in the next decades: should we expect commercial banking to become the infrastructure behind someone else’s customer experience? Or is the deposits and lending panorama going to survive unchanged?

By Lukas Brendel, Laurian David Pop, Federico Tita and Stefano Graziosi

SOURCES:

- Forbes

- CNBC

- WSJ

- Statista