Formula One team Aston Martin Racing has recently announced the sale of a minority stake to sports-focused private equity firm Arctos Partners following the racing team’s recent success under billionaire owner Lawrence Stroll. Arctos hopes to leverage its sports industry expertise and connections to improve the team and increase the value of its stake. The deal takes place amid the increasing popularisation of Formula One with investment firms seeing the motorsport as an excellent investment opportunity.

Lawrence Stroll Path to Aston Martin’s F1 Team Ownership

63-year-old Lawrence Stroll’s wealth has sky-rocketed in over the 2000s, with the latest estimate of his fortune ranking him as the 812th richest person in the world. According to Forbes, Stroll’s net worth as of April 2023 is $3.6bn, up from $2.4bn back in 2016.

Stroll's wealth sprouts from the family's fashion legacy in Canada. Under his father's guidance, Stroll began with Pierre Cardin's children's wear license at 17, expanding its reach across the country. His pivotal moment came when, in a twist of fate while bidding against Ralph Lauren for a car, Stroll gained a new license to manage Polo Ralph Lauren in Europe through Poloco S.A.

Teaming up with Silas Chou in 1989, Hong Kong-based textile manufacturer who knew Stroll because of their fathers having worked together in the past, they formed Sportswear Holdings, propelling Ralph Lauren in Europe and investing significantly in Tommy Hilfiger. Their collaboration led to Sportswear Holdings' remarkable turnover growth from $25mm to $2bn by 2000, including the successful acquisition of Michael Kors in 2003. Stroll also indulged in his passion for motorsport, acquiring Montreal’s Mont-Tremblant circuit in 2000.

In early 2020, Lawrence Stroll led a group of investors who injected $250mm into Aston Martin F1, gaining a commanding 16.7% ownership stake and assuming the role of the team's owner and director. He's now pushing forward the development of a cutting-edge Aston Martin factory set to finish in 2023, aimed at producing pioneering models that will shape F1 innovation for the next decade. Notably, Lawrence's son, Lance Stroll, is part of the Aston Martin F1 team, highlighting a tight-knit collaboration between management and drivers.

63-year-old Lawrence Stroll’s wealth has sky-rocketed in over the 2000s, with the latest estimate of his fortune ranking him as the 812th richest person in the world. According to Forbes, Stroll’s net worth as of April 2023 is $3.6bn, up from $2.4bn back in 2016.

Stroll's wealth sprouts from the family's fashion legacy in Canada. Under his father's guidance, Stroll began with Pierre Cardin's children's wear license at 17, expanding its reach across the country. His pivotal moment came when, in a twist of fate while bidding against Ralph Lauren for a car, Stroll gained a new license to manage Polo Ralph Lauren in Europe through Poloco S.A.

Teaming up with Silas Chou in 1989, Hong Kong-based textile manufacturer who knew Stroll because of their fathers having worked together in the past, they formed Sportswear Holdings, propelling Ralph Lauren in Europe and investing significantly in Tommy Hilfiger. Their collaboration led to Sportswear Holdings' remarkable turnover growth from $25mm to $2bn by 2000, including the successful acquisition of Michael Kors in 2003. Stroll also indulged in his passion for motorsport, acquiring Montreal’s Mont-Tremblant circuit in 2000.

In early 2020, Lawrence Stroll led a group of investors who injected $250mm into Aston Martin F1, gaining a commanding 16.7% ownership stake and assuming the role of the team's owner and director. He's now pushing forward the development of a cutting-edge Aston Martin factory set to finish in 2023, aimed at producing pioneering models that will shape F1 innovation for the next decade. Notably, Lawrence's son, Lance Stroll, is part of the Aston Martin F1 team, highlighting a tight-knit collaboration between management and drivers.

Arctos Partners

Arctos Partners was founded in 2020 by Charles, a veteran of Landmark, alongside David O'Connor, who was the chief executive of Madison Square Garden. In 2021, its debut fund was the largest first-time private equity fund ever raised at close to $2.9bn, beating its $ 1.8bn target. From December 2021 to this date, the private equity firm has completed nine transactions, including a stake in Liverpool Football Club and Boston Red Sox.

Arctos aims to apply its expertise in partnering with sports teams and franchises to the alternative asset management industry with the launch of a strategy that will address a wide range of GPs' financing needs. The Dallas-headquartered firm has assembled a team of individuals with experience in the secondaries and GP stakes markets to form Arctos Keystone. The group targets deals between $100mm and $300mm and could invest in deals north of $1bn.

Arctos Partners was founded in 2020 by Charles, a veteran of Landmark, alongside David O'Connor, who was the chief executive of Madison Square Garden. In 2021, its debut fund was the largest first-time private equity fund ever raised at close to $2.9bn, beating its $ 1.8bn target. From December 2021 to this date, the private equity firm has completed nine transactions, including a stake in Liverpool Football Club and Boston Red Sox.

Arctos aims to apply its expertise in partnering with sports teams and franchises to the alternative asset management industry with the launch of a strategy that will address a wide range of GPs' financing needs. The Dallas-headquartered firm has assembled a team of individuals with experience in the secondaries and GP stakes markets to form Arctos Keystone. The group targets deals between $100mm and $300mm and could invest in deals north of $1bn.

Qualitative Analysis: Precedent F1 Transactions

Currently within the Top-5 in Formula 1, Aston Martin has a rich history within this international racing championship. However, what we see on the racing circuits is a mere fraction of what goes into the success of any particular team in the F1. Over the years, Aston Martin has engaged with F1 teams in various forms, including partnerships, sponsorships, and ownership stakes. This section focuses on a few of these deals that Aston Martin has led or been a part of since its first F1 foray in 1959.

Although Aston Martin entered the F1 as a constructor, this initial stint was short-lived to almost two years. However, the company continued its involvement through multiple engine supply deals. Collaborations with Ecurie Amon, Reg Parnell Racing, Lola Technologies, Cooke Racing, March Engineering, and Yardley Team Lotus showcased Aston Martin's engineering prowess and provided valuable data for developing high-performance engines. This was a beginning to the brand’s to-be long and successful story within F1.

Recognizing the immense marketing potential of F1, AM has utilized sponsorship agreements to extensively enhance brand visibility in the past. The company’s first ever ownership stake came in 2006, acquiring a minority stake in the Force India F1 Team. Lawrence Stroll, the current executive chairman of AM, later led a consortium to acquire this team, marking the brand’s direct return as a F1 constructor. In 2021, the Racing Point F1 Team was rebranded as Aston Martin Aramco Cognizant F1 Team, under which it is currently competing with drivers Lance Stroll (son of the company chairman Lawrence Stroll) and Fernando Alonso. The details of this deal, and a few other AM deals are discussed further.

Currently within the Top-5 in Formula 1, Aston Martin has a rich history within this international racing championship. However, what we see on the racing circuits is a mere fraction of what goes into the success of any particular team in the F1. Over the years, Aston Martin has engaged with F1 teams in various forms, including partnerships, sponsorships, and ownership stakes. This section focuses on a few of these deals that Aston Martin has led or been a part of since its first F1 foray in 1959.

Although Aston Martin entered the F1 as a constructor, this initial stint was short-lived to almost two years. However, the company continued its involvement through multiple engine supply deals. Collaborations with Ecurie Amon, Reg Parnell Racing, Lola Technologies, Cooke Racing, March Engineering, and Yardley Team Lotus showcased Aston Martin's engineering prowess and provided valuable data for developing high-performance engines. This was a beginning to the brand’s to-be long and successful story within F1.

Recognizing the immense marketing potential of F1, AM has utilized sponsorship agreements to extensively enhance brand visibility in the past. The company’s first ever ownership stake came in 2006, acquiring a minority stake in the Force India F1 Team. Lawrence Stroll, the current executive chairman of AM, later led a consortium to acquire this team, marking the brand’s direct return as a F1 constructor. In 2021, the Racing Point F1 Team was rebranded as Aston Martin Aramco Cognizant F1 Team, under which it is currently competing with drivers Lance Stroll (son of the company chairman Lawrence Stroll) and Fernando Alonso. The details of this deal, and a few other AM deals are discussed further.

Force India F1 Team (2010-2018)

In 2006, Aston Martin had acquired a minority stake in the Midland F1 Racing team, a newly formed Formula One team. The team was renamed Force India F1 Team in 2008. Over the next few years, Aston Martin gradually increased its ownership stake in the team. In 2010, Aston Martin announced that it had acquired a majority stake in the Force India F1 Team, effectively taking control of the team. This marked a significant step in Aston Martin's involvement in Formula One, as it became the first time the brand had held majority ownership of a Formula One team since its own brief stint as a constructor in the 1950s. Although the exact value of the deal has not been disclosed, it is estimated that Aston Martin paid around $100 million for the controlling share of the team based on the team’s value at the time.

In 2006, Aston Martin had acquired a minority stake in the Midland F1 Racing team, a newly formed Formula One team. The team was renamed Force India F1 Team in 2008. Over the next few years, Aston Martin gradually increased its ownership stake in the team. In 2010, Aston Martin announced that it had acquired a majority stake in the Force India F1 Team, effectively taking control of the team. This marked a significant step in Aston Martin's involvement in Formula One, as it became the first time the brand had held majority ownership of a Formula One team since its own brief stint as a constructor in the 1950s. Although the exact value of the deal has not been disclosed, it is estimated that Aston Martin paid around $100 million for the controlling share of the team based on the team’s value at the time.

Racing Point F1 Team (2020-2021)

Lawrence Stroll’s 16.7% acquisition (led by the Stroll Consortium) of the Racing Point car manufacturing company in 2020 with a subsequent £182 mln investment in Aston Martin helped revive the fortunes of Aston Martin whose profits and share prices had been plummeting since October 2018. This raised Stroll’s stake to over 20% within the company, thus leading the Canadian to join the company’s board as executive chairman. As a by-product of Stroll's investment in Aston, the company terminated its partnership with Red Bull Racing at the end of the 2020 season and received equity in Racing Point F1, which would then become the works of Aston Martin team, at least until the end of 2021 season.

Lawrence Stroll’s 16.7% acquisition (led by the Stroll Consortium) of the Racing Point car manufacturing company in 2020 with a subsequent £182 mln investment in Aston Martin helped revive the fortunes of Aston Martin whose profits and share prices had been plummeting since October 2018. This raised Stroll’s stake to over 20% within the company, thus leading the Canadian to join the company’s board as executive chairman. As a by-product of Stroll's investment in Aston, the company terminated its partnership with Red Bull Racing at the end of the 2020 season and received equity in Racing Point F1, which would then become the works of Aston Martin team, at least until the end of 2021 season.

Aston Martin Aramco Cognizant F1 Team (2022-Present)

This long-term strategic partnership between Aston Martin’s Cognizant Formula One Team and Aramco was primarily kicked off to drive the development of highly efficient internal combustion engines, high-performance sustainable fuels, advanced lubricants and the deployment of non-metallic materials in vehicles. This collaboration also included team sponsorship rights, a licensing agreement, as well as exclusive branding and endorsement rights for Aramco fuels and lubricants. A key component of the deal is for Aramco to own co-title rights to the racing outfit of the AM Aramco Cognizant F1 team. This 10-year-long strategic partnership is reportedly worth more than $450 mln. The exact financial value of the Aramco-Aston Martin-Cognizant joint partnership, however, has not been officially disclosed. However, what’s to be noted more significantly is the fact that this return marked Aston’s return to the F1 as a constructor after a61-year absence.

This long-term strategic partnership between Aston Martin’s Cognizant Formula One Team and Aramco was primarily kicked off to drive the development of highly efficient internal combustion engines, high-performance sustainable fuels, advanced lubricants and the deployment of non-metallic materials in vehicles. This collaboration also included team sponsorship rights, a licensing agreement, as well as exclusive branding and endorsement rights for Aramco fuels and lubricants. A key component of the deal is for Aramco to own co-title rights to the racing outfit of the AM Aramco Cognizant F1 team. This 10-year-long strategic partnership is reportedly worth more than $450 mln. The exact financial value of the Aramco-Aston Martin-Cognizant joint partnership, however, has not been officially disclosed. However, what’s to be noted more significantly is the fact that this return marked Aston’s return to the F1 as a constructor after a61-year absence.

The Transaction:

On the 16th of November, Aston Martin Racing announced Arctos Partners’ acquisition of a minority stake in the Formula One team. Though terms were not disclosed, the Financial Times has reported that the deal reflects a valuation of $1bn, representing a significant increase from Stroll’s initial purchase of a controlling stake for $117mm in 2019.

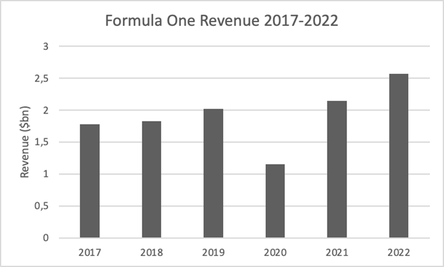

Arctos Partners hopes to grow its investment by employing its expertise and connections in the sports industry to increase Aston Martin Racing’s value and capitalise on the wave of increasing popularity of Formula One. Following its takeover by Liberty Media in 2017 the motorsport has dramatically increased in interest and F1 team have now not only become fashionable assets but also the target of investors seeking to make a profit.

On the 16th of November, Aston Martin Racing announced Arctos Partners’ acquisition of a minority stake in the Formula One team. Though terms were not disclosed, the Financial Times has reported that the deal reflects a valuation of $1bn, representing a significant increase from Stroll’s initial purchase of a controlling stake for $117mm in 2019.

Arctos Partners hopes to grow its investment by employing its expertise and connections in the sports industry to increase Aston Martin Racing’s value and capitalise on the wave of increasing popularity of Formula One. Following its takeover by Liberty Media in 2017 the motorsport has dramatically increased in interest and F1 team have now not only become fashionable assets but also the target of investors seeking to make a profit.

The increased valuations of Aston Martin Racing, and other F1 teams partially stems from the scarce nature of the competition, with only ten teams taking part, offering no opportunity for new entrants. Furthermore, the imposition of financial constraints has made the motorsport more competitive while the Netflix documentary ‘Drive to Survive’ also contributed to popular appeal.

Stroll has said that he is “delighted” by the acquisition and explicitly identified the “deep industry knowledge” that Arctos Partners would bring. Doc O’Connor, Arctos’ leading partner stated that this was “the beginning of a long-term partnership with Lawrence [Stroll] and the entire organisation”.

The deal is expected to close by the end of 2023.

Stroll has said that he is “delighted” by the acquisition and explicitly identified the “deep industry knowledge” that Arctos Partners would bring. Doc O’Connor, Arctos’ leading partner stated that this was “the beginning of a long-term partnership with Lawrence [Stroll] and the entire organisation”.

The deal is expected to close by the end of 2023.

Conclusions

Arctos Partner’s investment in Aston Martin Racing highlights the firm's intent to take advantage of the increasing popularity of Formula One with both parties hoping that Arctos can leverage its expertise in the sports industry to improve the team. Nonetheless, this deal as well as the others that have taken place across F1 have vindicated Lawrence Stroll’s decision to purchase Aston Martin Racing.

Arctos Partner’s investment in Aston Martin Racing highlights the firm's intent to take advantage of the increasing popularity of Formula One with both parties hoping that Arctos can leverage its expertise in the sports industry to improve the team. Nonetheless, this deal as well as the others that have taken place across F1 have vindicated Lawrence Stroll’s decision to purchase Aston Martin Racing.

By Neil Pinto, Prasiddha Rajaure, Joao Vitor Nasorri Beani

Sources

- Bloomberg

- Private Equity International

- Aston Martin

- Arctos Partners

- S&P Capital IQ

- Financial Times

- Statista

- Aramco