Plug-in electric vehicles (PEVs) are generally divided into two categories: all-electric or battery electric vehicles (BEVs), that run only on batteries, and plug-in hybrids, that combine battery power with internal combustion engines (PHEVs).

Consumer demand for electric cars varies worldwide as it is affected by prices and government incentives. The popularity of electric vehicles has been expanding rapidly due to government subsidies and environmental sensitivity, but, however, at the end of 2016, electric cars represented just the 0.15% (2 millions) of the 1.4 billion motor vehicles in the world. At the end of 2017, China had the largest stock of electric cars with over 1.2 million domestically built passenger cars, while about 943,600 had been registered in Europe, 765,000 in the United States and 207,200 in Japan.

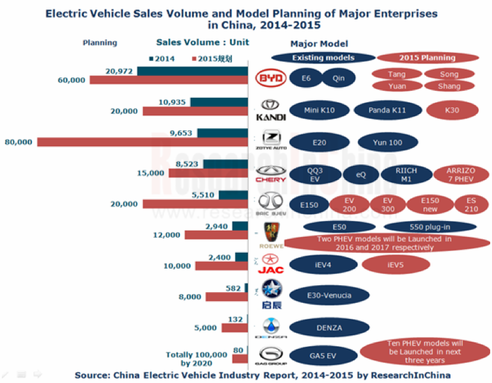

Hence, Chinese new-energy car market represents the largest portion of global plug-in car sales. Today, the electric vehicles stock consists of about 1,385,088 all-electric vehicles (80.1%) and 343,359 plug-in hybrid vehicles (19.9%). Chinese sales of domestically-built new energy vehicles in 2017 totalled 777,000 units, up 53% from 2016 and consisting of 652,000 all-electric vehicles (up 59.4%) and 125,000 plug-in hybrid vehicles (up 27.6%). Sales of domestically-produced new energy passenger vehicles totalled 579,000 units, consisting of 468,000 all-electric cars and 111,000 plug-in hybrids. Accounting for foreign brands, plug-in car sales rose to about 600,000 in 2017. The plug-in segment achieved a record market share of 2.1% of new car sales.

Three BYD Auto (the biggest Chinese electric car producer) models topped the Chinese ranking of best-selling new energy passenger cars in 2016: the BYD Tang PHEV SUV was the top selling plug-in car (31,405), followed by the BYD Qin (21,868) and the BYD e6 (20,605). BYD Auto was again the world's top selling plug-in manufacturer with over 100,000 units sold in 2016. However, in terms of sales revenue, Tesla vehicle sales of US$6.35 billion topped BYD at US$3.88 billion.

Consumer demand for electric cars varies worldwide as it is affected by prices and government incentives. The popularity of electric vehicles has been expanding rapidly due to government subsidies and environmental sensitivity, but, however, at the end of 2016, electric cars represented just the 0.15% (2 millions) of the 1.4 billion motor vehicles in the world. At the end of 2017, China had the largest stock of electric cars with over 1.2 million domestically built passenger cars, while about 943,600 had been registered in Europe, 765,000 in the United States and 207,200 in Japan.

Hence, Chinese new-energy car market represents the largest portion of global plug-in car sales. Today, the electric vehicles stock consists of about 1,385,088 all-electric vehicles (80.1%) and 343,359 plug-in hybrid vehicles (19.9%). Chinese sales of domestically-built new energy vehicles in 2017 totalled 777,000 units, up 53% from 2016 and consisting of 652,000 all-electric vehicles (up 59.4%) and 125,000 plug-in hybrid vehicles (up 27.6%). Sales of domestically-produced new energy passenger vehicles totalled 579,000 units, consisting of 468,000 all-electric cars and 111,000 plug-in hybrids. Accounting for foreign brands, plug-in car sales rose to about 600,000 in 2017. The plug-in segment achieved a record market share of 2.1% of new car sales.

Three BYD Auto (the biggest Chinese electric car producer) models topped the Chinese ranking of best-selling new energy passenger cars in 2016: the BYD Tang PHEV SUV was the top selling plug-in car (31,405), followed by the BYD Qin (21,868) and the BYD e6 (20,605). BYD Auto was again the world's top selling plug-in manufacturer with over 100,000 units sold in 2016. However, in terms of sales revenue, Tesla vehicle sales of US$6.35 billion topped BYD at US$3.88 billion.

There are many ways for a country to achieve international prestige and one of them is becoming a leader in a particular industry. China is trying to achieve global leadership by becoming the world’s “green” leader and this is why Xi Jinping says that China will become an “ecological nation”.

In particular, he wants to take advantage of the fact that the American president is not keen on green economy: China has the task of giving a solid response to climate change and it is going to do so by investing around 360 billions of dollars in new energy forms until 2020, also creating 13 millions new jobs.

However, China is not only looking for international prestige: its strategy has an impressive impact on the renewable energy market. Today, five of the six main producers of solar panels as well as five of the biggest makers of wind turbines and six of the ten most important electric cars producers are Chinese and, furthermore, Beijing dominates the lithium industry, which is fundamental for electric cars battery.

So, thanks to the dimension of its economy, China’s response to climate change brought it to gain global leadership in the renewable technology industry. In the near future China will be the undisputed leader of the new energetic sector and it will acquire more power in international affairs at the expense of the nations which have not extensively tackled the problem.

In order to understand which are China’s intention, we could imagine, in a not so far future, solar parks in the Sahara desert and wind farms in the most windy zones of the Artic environment. Furthermore, we could also imagine that in 2050 90% of the world energy will be produced by renewable sources. All this is not unlikely to happen, but projections say that only 20% of China’s electricity will come from non-carbon sources until 2030.

As Tesla scrambles to maintain its position as the world’s foremost electric-vehicle brand, traditional automakers in the U.S. and Europe have invested billions of dollars to advance the technology. But the biggest problem for Tesla comes from China where many companies are churning out hundreds of thousands of electric vehicles a year.

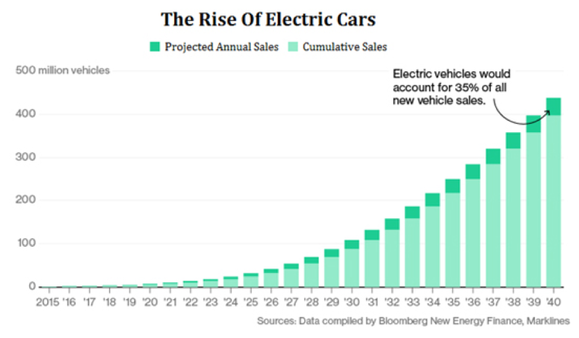

The battle between China and Tesla will determine which country will dominate the global market for electric vehicles, which are forecasted to be a third of all passenger vehicles on the road by 2040, up from less than 1% today.

Nowadays China seems to be better situated to develop the electric vehicle of the future. Despite top design, engineering and marketing talent, Tesla has struggled with basic manufacturing. Automated processes have failed on the factory floor and the company has struggled to secure the supply chain needed to operate on the scale it needs to produce a mass-market electric vehicle.

China has invested heavily in policies to develop its electric-vehicle industry. It has offered subsidies to buyers to the tune of $15,000 per vehicle, threatened to block automakers that do not make electric vehicles from selling traditional cars, and funded electric-vehicle infrastructure like charging stations across the country’s highway network. China is expected to spend some $60 billion in electric-vehicle subsidies in the years preceding 2020.

Chinese automakers are expected to produce more than 4.5 million electric vehicles annually in 2020, compared with about a million from Tesla, according to data from the International Energy Agency.

To date, Chinese electric vehicles have largely remained a product for the developing world, while Tesla has thrived in the European market. But Chinese automakers recently ramped up efforts to expand their global reach, and at least one company plans to sell cars in the U.S. as soon as next year.

Roberto Di Stefano

In particular, he wants to take advantage of the fact that the American president is not keen on green economy: China has the task of giving a solid response to climate change and it is going to do so by investing around 360 billions of dollars in new energy forms until 2020, also creating 13 millions new jobs.

However, China is not only looking for international prestige: its strategy has an impressive impact on the renewable energy market. Today, five of the six main producers of solar panels as well as five of the biggest makers of wind turbines and six of the ten most important electric cars producers are Chinese and, furthermore, Beijing dominates the lithium industry, which is fundamental for electric cars battery.

So, thanks to the dimension of its economy, China’s response to climate change brought it to gain global leadership in the renewable technology industry. In the near future China will be the undisputed leader of the new energetic sector and it will acquire more power in international affairs at the expense of the nations which have not extensively tackled the problem.

In order to understand which are China’s intention, we could imagine, in a not so far future, solar parks in the Sahara desert and wind farms in the most windy zones of the Artic environment. Furthermore, we could also imagine that in 2050 90% of the world energy will be produced by renewable sources. All this is not unlikely to happen, but projections say that only 20% of China’s electricity will come from non-carbon sources until 2030.

As Tesla scrambles to maintain its position as the world’s foremost electric-vehicle brand, traditional automakers in the U.S. and Europe have invested billions of dollars to advance the technology. But the biggest problem for Tesla comes from China where many companies are churning out hundreds of thousands of electric vehicles a year.

The battle between China and Tesla will determine which country will dominate the global market for electric vehicles, which are forecasted to be a third of all passenger vehicles on the road by 2040, up from less than 1% today.

Nowadays China seems to be better situated to develop the electric vehicle of the future. Despite top design, engineering and marketing talent, Tesla has struggled with basic manufacturing. Automated processes have failed on the factory floor and the company has struggled to secure the supply chain needed to operate on the scale it needs to produce a mass-market electric vehicle.

China has invested heavily in policies to develop its electric-vehicle industry. It has offered subsidies to buyers to the tune of $15,000 per vehicle, threatened to block automakers that do not make electric vehicles from selling traditional cars, and funded electric-vehicle infrastructure like charging stations across the country’s highway network. China is expected to spend some $60 billion in electric-vehicle subsidies in the years preceding 2020.

Chinese automakers are expected to produce more than 4.5 million electric vehicles annually in 2020, compared with about a million from Tesla, according to data from the International Energy Agency.

To date, Chinese electric vehicles have largely remained a product for the developing world, while Tesla has thrived in the European market. But Chinese automakers recently ramped up efforts to expand their global reach, and at least one company plans to sell cars in the U.S. as soon as next year.

Roberto Di Stefano