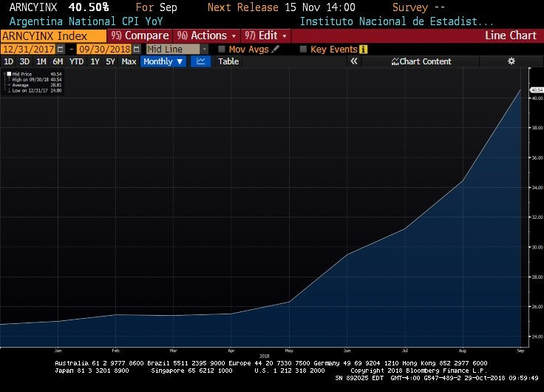

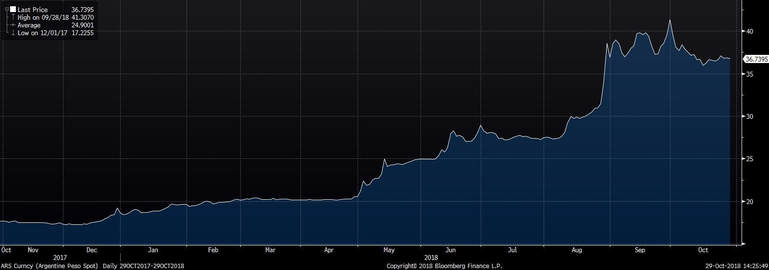

On September 26, 2018, Argentina and the IMF agreed to increase the bailout program to $57.1 bn, the biggest multilateral lender program ever. The IMF Standby Credit Facility program provides financial assistance to troubled countries with short-term balance of payments needs. The aim of this financial plan is to give a way out to Argentina for its incredibly high inflation with an annualized rate of 40% (Exhibit 1). This program started on March 6th after a considerable slide of the Argentinian pesos which has been the worst performing currency in 2018 so far, depreciating by 53% of its value against the US dollar (Exhibit 2). After the third resignation in the last three years of the Central Bank governor Luis Caputo, Guido Sandleris is managing the strict monetary policy conditions that lenders have requested to Argentina to stop the sky-rocketing inflation. It consists in a floating exchange rate within a range between 34 to 44 pesos to the dollar with an allowed intervention up to $150 Million of reserves each day in case the pesos will continue its depreciation.

Exhibit 1 – CPI Argentina 2018 YoY

Exhibit 2 – US dollar to Argentinian pesos (spot)

It is useful to understand the dynamics that have led to the Argentinian economy in this downturn. The last two populist governments have used wide budget deficits to maintain their welfare campaign promises, creating a temporary boost of the GDP and an artificially high inflation after the financial crisis. Macri’s election in 2015 has been a return to normal with more cautious fiscal policies.

Unfortunately, this has not been enough to stop the strong depreciation following FED rate hike of US$ during 2017. The consequent move to less risky assets by global investors due to some concerns about the repayment of Argentinian US dollar denominated debt has, in fact, resulted not only in a depreciation of pesos but also inflationary pressures creating a hostile economic environment for businesses. This is resulting in an estimated shortfall of GDP about 3% during 2018.

Argentina is the first nation that will be promptly backed by the IMF also in Macri’s fiscal plan to relaunch Argentinian economy throughout its “zero poverty” plan and reducing the unemployment rate. Christine Lagarde, in fact, has assured that the return back to normal for Argentina will come from the implementation of lower-income households that have been hit the most from this crisis, reassuring investor that Argentina will restart its economy with structural reforms and welfare measures.

Mr. Sandleris is convinced that the tight monetary policy will stop the volatility with whom is struggling the Argentinian economy. The central bank has started to offer short-term notes, called “Leliqs” to Argentinian Banks as an alternative in investing in safe US dollar assets with a 70% annualized interest rate, promising new issuances down to 60% until the end of this year (Exhibit 3). In his opinion, the uncertainty of the last months is for sure more damaging than a liquidity squeeze. Another concern is that an interest rate as high as 70% could be deleterious for CBRA balance sheet as it has been strongly criticized by investors when the liabilities has hit the 12% of the GDP in April. The backfire risk of this maneuver is that the debt of CBRA would grow faster than the depreciation of the pesos, resulting in a high level of indebtedness of the CB. Now liabilities has halved to 6% due to the depreciation of pesos and are projected to increase around 9% after the short-term notes issuance.

Unfortunately, this has not been enough to stop the strong depreciation following FED rate hike of US$ during 2017. The consequent move to less risky assets by global investors due to some concerns about the repayment of Argentinian US dollar denominated debt has, in fact, resulted not only in a depreciation of pesos but also inflationary pressures creating a hostile economic environment for businesses. This is resulting in an estimated shortfall of GDP about 3% during 2018.

Argentina is the first nation that will be promptly backed by the IMF also in Macri’s fiscal plan to relaunch Argentinian economy throughout its “zero poverty” plan and reducing the unemployment rate. Christine Lagarde, in fact, has assured that the return back to normal for Argentina will come from the implementation of lower-income households that have been hit the most from this crisis, reassuring investor that Argentina will restart its economy with structural reforms and welfare measures.

Mr. Sandleris is convinced that the tight monetary policy will stop the volatility with whom is struggling the Argentinian economy. The central bank has started to offer short-term notes, called “Leliqs” to Argentinian Banks as an alternative in investing in safe US dollar assets with a 70% annualized interest rate, promising new issuances down to 60% until the end of this year (Exhibit 3). In his opinion, the uncertainty of the last months is for sure more damaging than a liquidity squeeze. Another concern is that an interest rate as high as 70% could be deleterious for CBRA balance sheet as it has been strongly criticized by investors when the liabilities has hit the 12% of the GDP in April. The backfire risk of this maneuver is that the debt of CBRA would grow faster than the depreciation of the pesos, resulting in a high level of indebtedness of the CB. Now liabilities has halved to 6% due to the depreciation of pesos and are projected to increase around 9% after the short-term notes issuance.

Exhibit 3 – Leliqs Notes YTM

What is for sure is that Argentina has still a long way before reaching a less volatile economy. It is really interesting to notice how a national struggle has been faced by a multilateral lender organization like the IMF. The solution provided by the IMF could redesign its role as a vital institution to limit systemic risk within countries which are affected by the same macroeconomic environment, monitoring the implementation of the multilateral loan. On one side, it could stop concerns about a systemic crisis in emerging market economies which are experiencing capital outflows. On the other side, it could create a moral hazard problem if more countries would be willing to follow risky fiscal policies programs then backed by a possible bailout of the IMF in the worst case scenario, causing an unmanageable situation.

Riccardo Nocita

Riccardo Nocita