Introduction

Many investors are asking themselves what they can realistically expect from ARK’s funds in 2021. On the one hand, the 12 month return on ARK Innovation ETF is more than positive (+44.6%) but on the other many worries come from the very latest negative performances, an absurd -10.7% through March 29th and the deluded expectations for the ARK's Space Exploration & Innovation ETF debut on Wall Street, which slipped about 1% in its first day of trading.

In this article, we will provide the reader with an analysis of ARK’s performances, investigating its strategies with a specific focus on growth investing, and the factors affecting the return of ARK’s ETFs.

In this article, we will provide the reader with an analysis of ARK’s performances, investigating its strategies with a specific focus on growth investing, and the factors affecting the return of ARK’s ETFs.

ARK - The Big Picture

Ark is a growth fund, in that it follows an investment strategy that revolves around expectations of spectacular growth in the future. In other words, it invests in companies (e.g. TESLA) that show an above-average growth even if the share price is expensive both according to the price-to-earnings (P/E) and price-to-book (P/B) ratios. In traditional terms, we can say that in contrast to value investing, growth funds take more risk by investing in those companies that have not reached yet their full potential but that have all the cards to grow exponentially. Their potential is usually rooted in a unique or advanced idea (or final product) ahead of the competition.

The pillar of ARK’s investment philosophy could be summarized in the expression of disruptive innovation. It corresponds to the implementation of a technologically-driven product, game changer in its industry, by cutting costs and increasing accessibility and ease of use. According to Catherine Wood, the CEO and Chief Investment Officer of the Fund, traditional investment managers lose the big picture by focusing excessively on sectors and short-term stock fluctuations, ignoring those companies which are truly best positioned to capture growth opportunities that come from innovation.

The pillar of ARK’s investment philosophy could be summarized in the expression of disruptive innovation. It corresponds to the implementation of a technologically-driven product, game changer in its industry, by cutting costs and increasing accessibility and ease of use. According to Catherine Wood, the CEO and Chief Investment Officer of the Fund, traditional investment managers lose the big picture by focusing excessively on sectors and short-term stock fluctuations, ignoring those companies which are truly best positioned to capture growth opportunities that come from innovation.

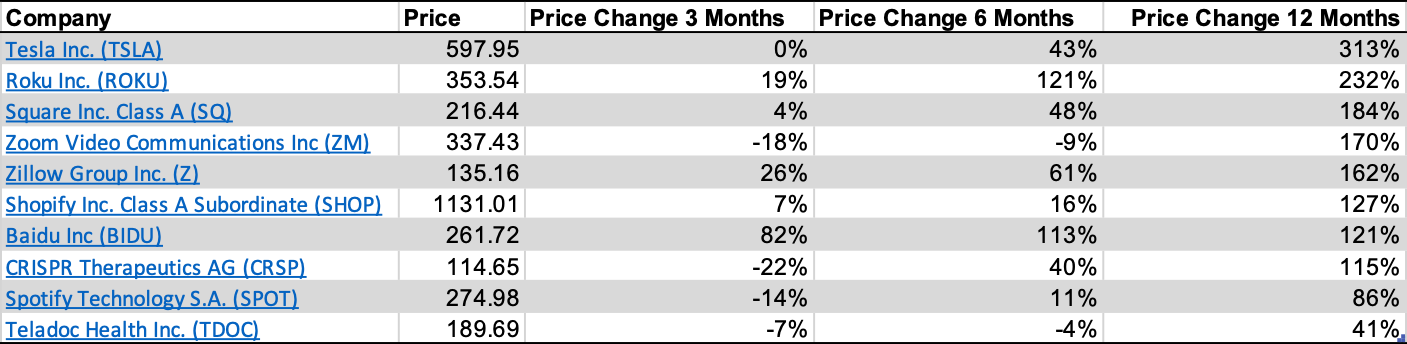

ARK’s top ten holdings. Source: Factset

ARK’s Iterative Investment Process combines Top-Down and Bottom-Up research, allowing for an organized exchange of insights between all the positions of the fund’s hierarchical chain and thus enabling a deeper understanding of disruptive innovations at all levels. A fundamental part of ARK’s investment process is its peculiar scoring system which is based on the following six key metrics:

- The Company, People and Culture: Valuation of the overall governance of the company, with a specific focus on human capital (retention of key employees and talent acquisition policy);

- Execution: A deeper look at R&D spending, target operating model, and sales & marketing execution;

- Moat, barriers to entry: By looking to the product’s industry, barriers to entry are studied;

- Product leadership: Changes in term of market share, vision for future innovation, and KPIs chosen;

- Valuation: The average rate of return for a stock drops below 15% average over five years;

- Thesis Risk: Different categories of risks are explored (Regulatory, Geopolitical, Technology Adoption, and environmental).

Investment Solutions

With regards to accessing its investment expertise, ARK offers a wide range of products: ETFs, Managed Account, Mutual Funds, Model Portfolio, and UCITS. Thematic investing has exponentially grown during these years up to becoming the most popular niche strategy. They do not invest in an entire market but concepts, themes, or trends. According to the most recent data provided by ETFGI, the net inflows of thematic funds (USD 42.6 billion) more than tripled with respect to the same period of last year. Ark Investment Management founder Cathie Wood’s funds led the broader stampede into thematic investing. Between the most popular ETFs, ARK Innovation ETF ARKK shines in terms of performances.

ARK Innovation ETF - ARKK

This ETF is the biggest winner in the thematic ETF space. It is an actively managed fund looking for long-term capital appreciation by choosing firms that gain advantage from the development of new products or services in the field of DNA technologies (Genomic Revolution), industrial innovation in energy, automation, and manufacturing (Industrial Innovation), increased use of shared technology, infrastructure and services (Next Generation Internet), and technologies that make financial services more efficient (Fintech Innovation). In total, the fund holds 56 securities in its basket and charges 75 basis points (bps) in annual fees. The product has an AUM of $24 billion and trades in volume of $12 million shares a day on average.

ARK's holdings characteristics

ARK, according to its own description, uses a thematic investing process that spans market capitalizations, sectors, and geographies to focus on public companies that it expects to be leaders, enablers, and beneficiaries of disruptive innovation. By capitalizing on the long-term trends in disruptive innovation, ARK believes that its thematic strategies can better adjust for rapid change and incorporate a deep understanding of the underlying drivers of long-term value creation and risk.

The benefits of this investing approach, according to ARK are a low correlation of relative returns to traditional growth strategies and a negative correlation of relative returns to traditional value strategies, offering diversification for investors.

However, this being said, it is apparent when looking at ARK’s Flagship Innovation ETF, that the proportion of stocks, traditionally categorized as growth stocks is very high. In fact, the average Price-to-Earnings ratio of the ARK Innovation ETF is 94.74x, whereas it is 40.47x for the S&P500 currently.

The benefits of this investing approach, according to ARK are a low correlation of relative returns to traditional growth strategies and a negative correlation of relative returns to traditional value strategies, offering diversification for investors.

However, this being said, it is apparent when looking at ARK’s Flagship Innovation ETF, that the proportion of stocks, traditionally categorized as growth stocks is very high. In fact, the average Price-to-Earnings ratio of the ARK Innovation ETF is 94.74x, whereas it is 40.47x for the S&P500 currently.

Growth vs Value Stocks

Growth stocks are shares of companies that demonstrated better-than-average returns in earnings in recent years and are expected to continue delivering high levels of profit growth. Typically, growth stocks are characterized by high price-to-earnings multiples (as seen above), as investors are ready to pay premiums for higher expected earnings. A consequence of this relatively high price is that growth stocks are more volatile than the broader market as well.

On the other hand, value stocks are shares of companies that appear to trade at a lower price relative to what their fundamentals justify. Value stocks are priced lower than the broader market, they have low price-to-earnings ratios and low price-to-book ratios. Value investors buy these stocks in hope that they will increase in value when the market realizes their full potential, resulting in a price increase. Consequently, value stocks are somewhat less volatile than the broader market.

Growth stocks have a very high PVGO (present value of growth opportunities). This is one of the components used to value a stock that corresponds to the investors’ expectations of growth in earnings. The total value of a company equals the present value of its no growth earnings (PVNG) plus the PVGO.

\[V_0=PVNG+PVGO\]

The present value of no growth earnings can be represented (using certain assumptions) by a perpetuity whose present value equals next years earnings per share divided by the cost of equity (the minimum rate of return which a company must earn to convince investors to invest in the company’s common stock at the current market price).

\[V_0= \frac{EPS_1}{k_e} +PVGO\]

The proportion of PVGO to the total value of the companies share price is typically very high in growth stocks, thus a large fraction of the market value comes from the NPV of future investment. Conversely, this variable is very small in value stocks, where the PVNG dominates.

Having established that ARK’s investment strategy within its ARK innovation ETF certainly exhibits features of growth investing. We can now have a closer look at the returns that this investment strategy generated in the past. Moreover, we can juxtapose this with an ETF that exclusively invests in value stocks: Vanguards Value Index Fund ETF. This latter index seeks to track the performance of the CRSP US Large Cap Value Index, which measures the investment return of large capitalization value stocks. However, this ETF as opposed to ARK’s innovation ETF is passively managed, it merely replicated the index.

On the other hand, value stocks are shares of companies that appear to trade at a lower price relative to what their fundamentals justify. Value stocks are priced lower than the broader market, they have low price-to-earnings ratios and low price-to-book ratios. Value investors buy these stocks in hope that they will increase in value when the market realizes their full potential, resulting in a price increase. Consequently, value stocks are somewhat less volatile than the broader market.

Growth stocks have a very high PVGO (present value of growth opportunities). This is one of the components used to value a stock that corresponds to the investors’ expectations of growth in earnings. The total value of a company equals the present value of its no growth earnings (PVNG) plus the PVGO.

\[V_0=PVNG+PVGO\]

The present value of no growth earnings can be represented (using certain assumptions) by a perpetuity whose present value equals next years earnings per share divided by the cost of equity (the minimum rate of return which a company must earn to convince investors to invest in the company’s common stock at the current market price).

\[V_0= \frac{EPS_1}{k_e} +PVGO\]

The proportion of PVGO to the total value of the companies share price is typically very high in growth stocks, thus a large fraction of the market value comes from the NPV of future investment. Conversely, this variable is very small in value stocks, where the PVNG dominates.

Having established that ARK’s investment strategy within its ARK innovation ETF certainly exhibits features of growth investing. We can now have a closer look at the returns that this investment strategy generated in the past. Moreover, we can juxtapose this with an ETF that exclusively invests in value stocks: Vanguards Value Index Fund ETF. This latter index seeks to track the performance of the CRSP US Large Cap Value Index, which measures the investment return of large capitalization value stocks. However, this ETF as opposed to ARK’s innovation ETF is passively managed, it merely replicated the index.

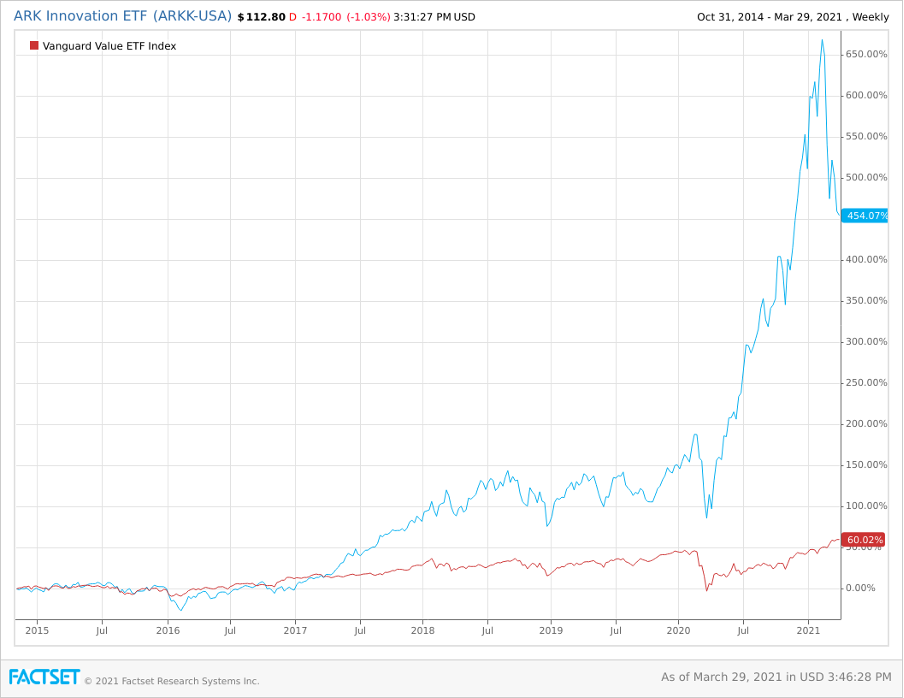

ARK Innovation ETF vs Vanguard Value ETF Perfomances. Source: Factset

It is clear that in absolute terms, ARK’s innovation ETF has outperformed Vanguards Value Index ETF since the 2nd quarter of 2017. It rose by 454.07% since the 31st of October 2014, performing roughly 7.5x better Vanguard’s Value Index ETF which rose by only 60.02%.

However, as noted above, growth stocks typically perform well in a bull market, thus it appears logical that in the context of the current bull market, ARK’s innovation ETF would perform better.

Therefore, deeper analysis is necessary to assess ARK’s innovation ETF’s relative returns compared to the risk it is exposed to, and contrast these with the value ETF. For this, we use the Capital Asset Pricing Model (CAPM). This describes the relationship between systemic risk and the expected return for assets. The CAPM formula is as follows:

\[E(R_i)=R_f+\beta_i\cdot[E(R_m )-R_f]\]

The CAPM describes the expected return of an asset i as the sum of the risk-free rate (Rf) and beta (β) multiplied by the market risk premium (E(Rm)- Rf). The beta of the potential investment is a measure of how much risk the investment will add to the market portfolio (portfolio of all assets within the market). It measures non-diversifiable risk, or systemic risk, as opposed to idiosyncratic risk, which can be diversified away by holding more securities. Investors require compensation for high systemic risk and the size of this compensation depends on the market risk premium. The result of this equation yields the required (or “fair”) return that an investor can use to value an asset.

In simpler terms, the CAPM evaluates whether a stock is fairly valued when its risk and the time value of money (incorporated in the risk-free rate) are taken into account.

We can apply the CAPM to compare the ARK innovation ETF to the Vanguard Value Index ETF. For this, we can use the yield on the 10-year US Treasury Bill (a virtually risk-free asset), which is 1.685%, as the risk-free rate. The next component of the CAPM is the beta, which has the following formula:

\[\beta_i=\frac{Cov(R_i,R_m)}{Var(R_m)}\]

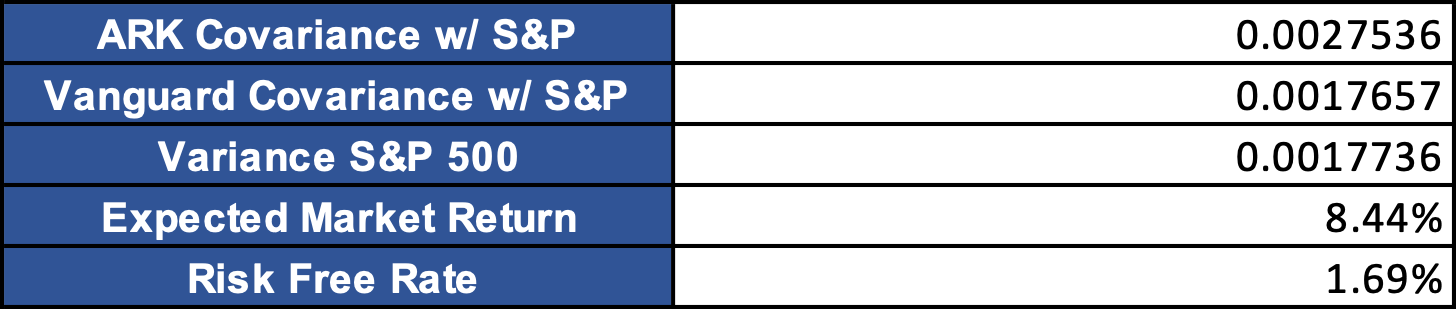

Beta can also be described as the slope of the regression line connecting the securities’ returns and the market’s returns. By analyzing the monthly returns of ARK’s innovation ETF, Vanguard’s Value Index, and the S&P500, since the inception of ARK’s innovation ETF (31/10/2014), the following data was obtained:

However, as noted above, growth stocks typically perform well in a bull market, thus it appears logical that in the context of the current bull market, ARK’s innovation ETF would perform better.

Therefore, deeper analysis is necessary to assess ARK’s innovation ETF’s relative returns compared to the risk it is exposed to, and contrast these with the value ETF. For this, we use the Capital Asset Pricing Model (CAPM). This describes the relationship between systemic risk and the expected return for assets. The CAPM formula is as follows:

\[E(R_i)=R_f+\beta_i\cdot[E(R_m )-R_f]\]

The CAPM describes the expected return of an asset i as the sum of the risk-free rate (Rf) and beta (β) multiplied by the market risk premium (E(Rm)- Rf). The beta of the potential investment is a measure of how much risk the investment will add to the market portfolio (portfolio of all assets within the market). It measures non-diversifiable risk, or systemic risk, as opposed to idiosyncratic risk, which can be diversified away by holding more securities. Investors require compensation for high systemic risk and the size of this compensation depends on the market risk premium. The result of this equation yields the required (or “fair”) return that an investor can use to value an asset.

In simpler terms, the CAPM evaluates whether a stock is fairly valued when its risk and the time value of money (incorporated in the risk-free rate) are taken into account.

We can apply the CAPM to compare the ARK innovation ETF to the Vanguard Value Index ETF. For this, we can use the yield on the 10-year US Treasury Bill (a virtually risk-free asset), which is 1.685%, as the risk-free rate. The next component of the CAPM is the beta, which has the following formula:

\[\beta_i=\frac{Cov(R_i,R_m)}{Var(R_m)}\]

Beta can also be described as the slope of the regression line connecting the securities’ returns and the market’s returns. By analyzing the monthly returns of ARK’s innovation ETF, Vanguard’s Value Index, and the S&P500, since the inception of ARK’s innovation ETF (31/10/2014), the following data was obtained:

Source: Factset

Using this data, all components of the CAPM can be calculated, yielding the following results:

The Annual Returns since the inception of the ARK Innovation ETF were also calculated for either ETF as shown in the table above, using monthly returns. It is clear that due to ARK’s beta being higher, the expected return that an investor requires is much greater than it is for Vanguard.

Using these figures, alpha (α), can also be calculated as the difference between actual returns and expected returns from the CAPM. It is the “abnormal rate of return” and describes an investment strategy’s ability to beat the market (or a benchmark that is considered to represent the market’s movement as a whole).

Using these figures, alpha (α), can also be calculated as the difference between actual returns and expected returns from the CAPM. It is the “abnormal rate of return” and describes an investment strategy’s ability to beat the market (or a benchmark that is considered to represent the market’s movement as a whole).

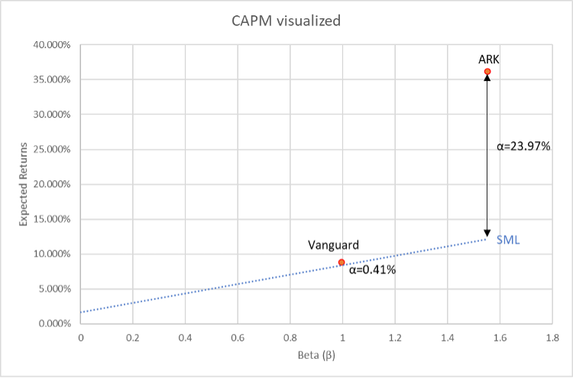

The result of the above calculations can be graphically represented on a plot that depicts the CAPM equation in form of a linear relation called the security market line (SML), which shows the linear relationship of the expected return of an asset and its beta. Effectively the SML shows for a given level of beta how much an investor should be compensated in expectations.

The results of the calculations and the above chart, clearly indicate that the Ark Innovation ETF has outperformed the Vanguard Value Index ETF, despite its higher beta. The alpha generated by Vanguard is very minimal, thus their value strategy has not performed significantly better than the market. On the other hand, the ARK Innovation ETF has significantly outperformed the market, with a return in excess of market movements of 23.97%. Therefore, we can summarize that at least in this case, the growth strategy of ARK has markedly outperformed the value strategy tracked by Vanguard.

Factors affecting ARK’s performance

As we have seen, ARK Innovation ETF has been one of the best-performing ETFs in 2020, delivering a stellar return over the past year and shattering the performance of both market indexes and competing ETFs. But this leads to the question: “is this incredible trend sustainable in the long-term?”.

We will try to answer this question by analysing the different economic and market factors that could potentially affect ARKK’s performance and determine a shift in its leading position.

First of all, it is immediately clear that Cathie Wood’s fund had the ability of being in the right place at the right time and taking advantage of emerging trends. ARKK focuses on the exact assets that tend to outperform in current market conditions: mid-sized tech stocks, tech-oriented health care companies and other stocks that benefit from technological disruption. This trend has been particularly exacerbated by the Coronavirus pandemic: the current shift to home working and online commerce have emphasized the leading trend of growth and momentum-oriented stocks. In an environment where rates, inflation expectations and GDP growth are low, those kinds of companies have performed well, but when market conditions change these are the first ones hit.

This is exactly what happened during the first months of 2021, when the sharp rise in government-bond yields and investors’ massive get-away from growth stocks caused ARKK fund to fall more than 30% from its high of around 160$.

Among the fund’s holdings, high growth tech stocks (Tesla, Zoom, Square) were the hardest hit as rising rates make their future profit less valuable today and thus making investors question if their sky-high valuations are justifiable.

In theory, when interest rates rise all investments suffer because the rate at which future cash flows are discounted increases. So why were growth stocks so highly penalized? Keeping it simple, the longer dated the cash flows, the greater is the decline in the stock’s valuation and consequently in its price. Value stocks tend to have stable cash flows both in the present and in the long term, whereas growth stocks tend to have mostly long term cash flows with few earnings today. This effect is further exacerbated in the companies held by ARKK since most of them actually present negative earnings now and positive ones very deep into the future. In particular, around two-thirds of its current holdings didn’t make a profit in the past year. For this reason, a sudden rise in interest rates have a potential enormous impact on the valuation of these stocks. With 10-year Treasuries yields rising to 1.6% most investors are not willing to wait for future cash flows anymore and therefore flee these stocks in search of more near term profitable ones. This big market rotation into cyclical values stocks caused the ARKK fund to experience a great amount of outflows in sharp contrast with what happened in 2020.

We will try to answer this question by analysing the different economic and market factors that could potentially affect ARKK’s performance and determine a shift in its leading position.

First of all, it is immediately clear that Cathie Wood’s fund had the ability of being in the right place at the right time and taking advantage of emerging trends. ARKK focuses on the exact assets that tend to outperform in current market conditions: mid-sized tech stocks, tech-oriented health care companies and other stocks that benefit from technological disruption. This trend has been particularly exacerbated by the Coronavirus pandemic: the current shift to home working and online commerce have emphasized the leading trend of growth and momentum-oriented stocks. In an environment where rates, inflation expectations and GDP growth are low, those kinds of companies have performed well, but when market conditions change these are the first ones hit.

This is exactly what happened during the first months of 2021, when the sharp rise in government-bond yields and investors’ massive get-away from growth stocks caused ARKK fund to fall more than 30% from its high of around 160$.

Among the fund’s holdings, high growth tech stocks (Tesla, Zoom, Square) were the hardest hit as rising rates make their future profit less valuable today and thus making investors question if their sky-high valuations are justifiable.

In theory, when interest rates rise all investments suffer because the rate at which future cash flows are discounted increases. So why were growth stocks so highly penalized? Keeping it simple, the longer dated the cash flows, the greater is the decline in the stock’s valuation and consequently in its price. Value stocks tend to have stable cash flows both in the present and in the long term, whereas growth stocks tend to have mostly long term cash flows with few earnings today. This effect is further exacerbated in the companies held by ARKK since most of them actually present negative earnings now and positive ones very deep into the future. In particular, around two-thirds of its current holdings didn’t make a profit in the past year. For this reason, a sudden rise in interest rates have a potential enormous impact on the valuation of these stocks. With 10-year Treasuries yields rising to 1.6% most investors are not willing to wait for future cash flows anymore and therefore flee these stocks in search of more near term profitable ones. This big market rotation into cyclical values stocks caused the ARKK fund to experience a great amount of outflows in sharp contrast with what happened in 2020.

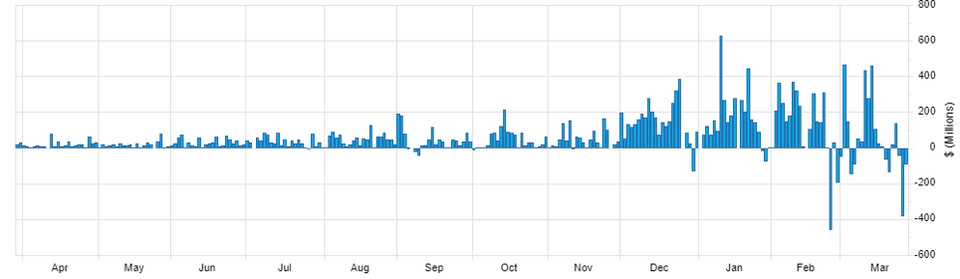

ARK Innovation ETF Fund Flows. Source: Factset

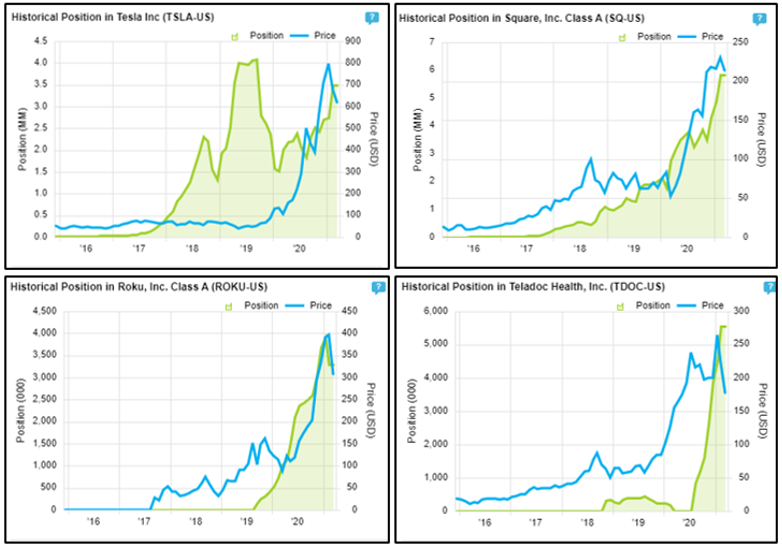

Another cause of concern is that ARKK appears to be riskier compared to other funds and therefore subject to more downside risks in a bear market. In particular, the fund holds about 56 stocks, with roughly a half of its assets concentrated in the top 10 holdings. The fund’s concentrated positions in overvalued (with respect to traditional measures) companies like Tesla, Roku, DocuSign and Square increases both its dependence on these stocks’s performances and its vulnerability to market correction led by tech stocks (like what happened with the Dot com bubble in early 2000s). We also have to take into account the liquidity risk in case these companies fall out of favour, trading volumes dry up and the fund is forced to sell shares to meet large redemptions from investors. Concerns regard not only the fund’s top 10 holdings but also its massive positions in a multitude of smaller – and therefore illiquid – stocks. In particular, after the enormous inflows to the fund in 2020, ARKK now has an increased ownership (>10%) in nearly a dozen small-mid companies. This phenomenon does not represent a problem per se, but it becomes one if these stocks start declining sharply and investors fear the increasing illiquidity of these holdings.

Performance of ARKK’s top 4 holdings: Tesla (10.54%), Square (6.05%), Roku (4.91%), Teladoc Health (4.78%) - price in blue, position in green. Source: Factset

We have seen how ARKK is very vulnerable to shift in market conditions and this is emphasized by the high risk (beta of 1.55, volatility of 30%): if the market overall or some specific stocks decline, the fund can fall really rapidly. Symmetrically, when these same stocks go up, the fund rallies. As demonstrated in the past year, when the market is bullish the fund is able to remarkably outperform the benchmark.

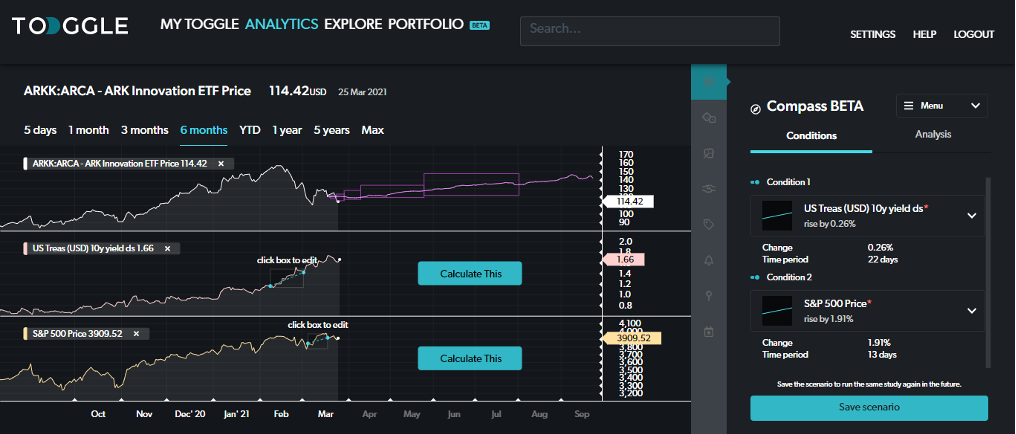

To this extent, how should we interpret the recent drop in February 2021? To try to give an answer to this question, we used TOGGLE platform to analyse the impact of a rise in 10-year US Treasuries yield on ARKK’s future performance. We analyse the effect of a steepening in the interest rates curve in the context of a growing economy, like the one we are currently experiencing after the market fallout one year ago. For this reason, we consider both the impact of an increase in US 10 years treasury yields and a rise in the market (we use the S&P 500 as a proxy of the market). The output of the analysis shows that based on historical data we should look at the recent decline in February as a sudden reaction to the steepening in the yield curve which affects the fund only immediately. In fact, once investors price in the increase in interest rates, the graph forecasts a clear positive return to previous performances in a six months period. It would therefore be a mistake to project the recent decline also in the following months and abandon the ARKK fund in favour of other investments.

What might be the reasons behind the projected increase? First of all, the recent rise in yields is a reflection of the world economy heating up. It is true that higher rates reduce the discounted value of future cash flows (and we have understood the negative consequences especially for growth stocks), but since 2020 we have also experienced a sharp acceleration in earnings’ growth, which positively contribute to stock prices. To this extent, the flourish economic outlook - combined with ARKK’s continuous focus on disruptive innovation - can thus offset the effects of a rising yield curve and determine a positive return for ARKK ETF in the long run. Therefore, Cathie Wood’s fund might still represent the perfect opportunity for investors willing to bear some volatility in the short term.

To this extent, how should we interpret the recent drop in February 2021? To try to give an answer to this question, we used TOGGLE platform to analyse the impact of a rise in 10-year US Treasuries yield on ARKK’s future performance. We analyse the effect of a steepening in the interest rates curve in the context of a growing economy, like the one we are currently experiencing after the market fallout one year ago. For this reason, we consider both the impact of an increase in US 10 years treasury yields and a rise in the market (we use the S&P 500 as a proxy of the market). The output of the analysis shows that based on historical data we should look at the recent decline in February as a sudden reaction to the steepening in the yield curve which affects the fund only immediately. In fact, once investors price in the increase in interest rates, the graph forecasts a clear positive return to previous performances in a six months period. It would therefore be a mistake to project the recent decline also in the following months and abandon the ARKK fund in favour of other investments.

What might be the reasons behind the projected increase? First of all, the recent rise in yields is a reflection of the world economy heating up. It is true that higher rates reduce the discounted value of future cash flows (and we have understood the negative consequences especially for growth stocks), but since 2020 we have also experienced a sharp acceleration in earnings’ growth, which positively contribute to stock prices. To this extent, the flourish economic outlook - combined with ARKK’s continuous focus on disruptive innovation - can thus offset the effects of a rising yield curve and determine a positive return for ARKK ETF in the long run. Therefore, Cathie Wood’s fund might still represent the perfect opportunity for investors willing to bear some volatility in the short term.

Impact of the rise in both US 10 year Treasury yield and S&P 500 on ARKK Innovation ETF. Source: TOGGLE

Conclusions

In our analysis we tried to provide an insight into the ARK funds and specifically into their famous signature, ARKK Innovation ETF. The fund’s strategy focused on disruptive innovation proved to be extremely successful so far, given the exceptional return since its inception date. To dig deeper into it and to assess the solidity of its fundamentals, we performed a CAPM analysis comparing the ARKK fund with Vanguard Value Index ETF. The results show that the former has been able to markedly outperform the value fund, with a return in excess of the market of 23.97%. We then analyzed the factors that could potentially affect this leading performance. Even if a sudden shift in market conditions could have a negative impact on ARKK Innovation ETF, the fund seems to be resilient to the sudden increase in interest rates in 2021, with a projected rise in the longer run. Will this forecast be right and confirm ARKK’s ability to stay ahead of the market or will we experience an opposite scenario? Probably only the time will tell us which is the right answer.

Andrea De Chiro

Maurits Giese

Chiara Zanetello

Maurits Giese

Chiara Zanetello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.