Donald Trump’s election on November 8th brought about dramatic reactions in the global markets. With reference to Asia, the major concerns are about Trump’s protectionist moves, pushed by aggressive fiscal policy combined with the likely raise of interest rates by FED. The threat of the US boasting both high yields and relatively weak dollar shook both Asian markets and authorities.

Among the others, the Taiwanese Stock Exchange’s weighted index and the Hong Kong’s Hang Seng fell by around 2,98%, while the Singapore’s Straits Times Index and the Korean Kospi lost approximately 1,1% and 2.7%, respectively. The Australian S&P/ASX200 index fell by 1,9%, although the country could benefit from the 3,8% rise of gold prices, considered safe assets in case of high market volatility, which is also confirmed by the 3,3% spike of the VIX index, known also as “fear index”.

The Japanese yen has historically been regarded as a “safe haven” for investors, just as gold and US T-bills. These three assets incurred in a sudden spike after Trump’s election, due to general uncertainty about the futures and the presumably bearish attitude of traders.

Markets expectations were for a weaker yen as long as the polls predicted Hilary Clinton’s victory and they were for a stronger yen in case of Donald Trump’s. As soon as Donald Trump actually started to gain strong consensus across key states in the US, the markets followed the same pattern triggered by polls outcomes. According to Reuters, on November 9th, the US dollar depreciated from 105,14 to 103, 28, which accounts for a 1,86% decrease.

If Janet Yellen eventually decides to raise US fed funds rates, this trend is likely to continue and perhaps to enhanced. However, the decision is yet to be confirmed, though the outcome should be confirmed by the end of 2016. There is now uncertainty on Japanese future monetary policy. Bank of Japan relied on relaunching Japanese economy though low interest rates, which are currently on a negative base (-0,1% to 0%).

Among the others, the Taiwanese Stock Exchange’s weighted index and the Hong Kong’s Hang Seng fell by around 2,98%, while the Singapore’s Straits Times Index and the Korean Kospi lost approximately 1,1% and 2.7%, respectively. The Australian S&P/ASX200 index fell by 1,9%, although the country could benefit from the 3,8% rise of gold prices, considered safe assets in case of high market volatility, which is also confirmed by the 3,3% spike of the VIX index, known also as “fear index”.

The Japanese yen has historically been regarded as a “safe haven” for investors, just as gold and US T-bills. These three assets incurred in a sudden spike after Trump’s election, due to general uncertainty about the futures and the presumably bearish attitude of traders.

Markets expectations were for a weaker yen as long as the polls predicted Hilary Clinton’s victory and they were for a stronger yen in case of Donald Trump’s. As soon as Donald Trump actually started to gain strong consensus across key states in the US, the markets followed the same pattern triggered by polls outcomes. According to Reuters, on November 9th, the US dollar depreciated from 105,14 to 103, 28, which accounts for a 1,86% decrease.

If Janet Yellen eventually decides to raise US fed funds rates, this trend is likely to continue and perhaps to enhanced. However, the decision is yet to be confirmed, though the outcome should be confirmed by the end of 2016. There is now uncertainty on Japanese future monetary policy. Bank of Japan relied on relaunching Japanese economy though low interest rates, which are currently on a negative base (-0,1% to 0%).

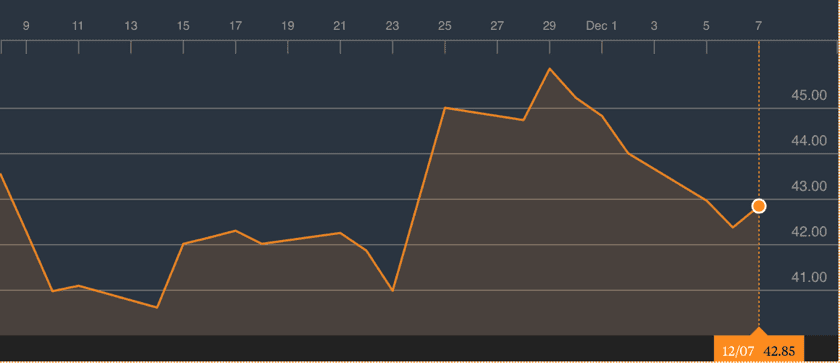

Figure 1 - USD/JPN forex trend in November 2016. Source: Yahoo!Finance

As for Japanese stocks, the market closed with a 5,36% decrease after Trump’s definitive election, which is not surprising as compared to the currency dynamic. This situation can be dangerous for the Japanese economy, which strongly relies on export and a stronger yen discourages foreign investments. For instance, Toyota lost 8% right after the US elections. The main issue here is whether Trump’s protectionist policy will actually take place and whether it will lead to satisfying returns for investors. If does not or if major doubts start arising, these trend might reverse.

Overall, these outcomes are comparable to the Japanese currency’s reaction to the Brexit vote, when the yen gained 7,2% against the US Dollar and the Nikkei decreased by 8%.

Trump’s elections did not have as a dramatic as an impact on the Chinese yuan as compare to the Japanese yen. Indeed, the yuan appreciated only 0,1% against the dollar, while the Shanghai Composite lost 0,8%. Presumably, the yuan appreciation is attributable to the depreciation of the dollar rather than on country specific issues.

Of course, there is again uncertainty in the Chinese relationship with the US. The Chinese markets are tightly regulated. Although according to figures China does not appear to be the worst performer among Asian countries, the Chinese economy might well suffer remarkably if Trump actually performs the protectionist moves he announced. According to Kevin Lai, chief Asia economist at Daiwa Capital Markets, if the new US President implements a 45% tax on Chinese imported goods, there would be an 87% decline in Chinese exports to the US and, consequently, a 4,82% fall in Chinese GDP. How might the Chinese authorities hedge against this threats? Generally speaking, the tight Chinese regulations tend to prevent capital outflows from China and therefore they also discourage inflows.

As an example, I would recall Chinese pressures for including A-shares in the MSCI Emerging market index, which were rejected again last summer.

As for Japanese stocks, the market closed with a 5,36% decrease after Trump’s definitive election, which is not surprising as compared to the currency dynamic. This situation can be dangerous for the Japanese economy, which strongly relies on export and a stronger yen discourages foreign investments. For instance, Toyota lost 8% right after the US elections. The main issue here is whether Trump’s protectionist policy will actually take place and whether it will lead to satisfying returns for investors. If does not or if major doubts start arising, these trend might reverse.

Overall, these outcomes are comparable to the Japanese currency’s reaction to the Brexit vote, when the yen gained 7,2% against the US Dollar and the Nikkei decreased by 8%.

Trump’s elections did not have as a dramatic as an impact on the Chinese yuan as compare to the Japanese yen. Indeed, the yuan appreciated only 0,1% against the dollar, while the Shanghai Composite lost 0,8%. Presumably, the yuan appreciation is attributable to the depreciation of the dollar rather than on country specific issues.

Of course, there is again uncertainty in the Chinese relationship with the US. The Chinese markets are tightly regulated. Although according to figures China does not appear to be the worst performer among Asian countries, the Chinese economy might well suffer remarkably if Trump actually performs the protectionist moves he announced. According to Kevin Lai, chief Asia economist at Daiwa Capital Markets, if the new US President implements a 45% tax on Chinese imported goods, there would be an 87% decline in Chinese exports to the US and, consequently, a 4,82% fall in Chinese GDP. How might the Chinese authorities hedge against this threats? Generally speaking, the tight Chinese regulations tend to prevent capital outflows from China and therefore they also discourage inflows.

As an example, I would recall Chinese pressures for including A-shares in the MSCI Emerging market index, which were rejected again last summer.

Figure 2- MSCI EM, MSCI China, Shanghai Composite 1 year performance. Source: Thomas Reuters

The MSCI decision is comprehensible in the light of two main complaints raised by their investors. Firstly, according to MSCI, “they were not yet able to benefit from daily capital repatriation despite the fact that policy changes went into effect in early February of this year”. Secondly, they are still subject to a monthly repatriation cap worth 20% of the A-shares net value. Trump’s election might eventually urge Chinese authorities to eventually put into practice some deregulatory policies in order to align to the peer markets and relieve prospective investors from liquidity and mobility risk.

Irene Pilla

The MSCI decision is comprehensible in the light of two main complaints raised by their investors. Firstly, according to MSCI, “they were not yet able to benefit from daily capital repatriation despite the fact that policy changes went into effect in early February of this year”. Secondly, they are still subject to a monthly repatriation cap worth 20% of the A-shares net value. Trump’s election might eventually urge Chinese authorities to eventually put into practice some deregulatory policies in order to align to the peer markets and relieve prospective investors from liquidity and mobility risk.

Irene Pilla