Introduction

A world shaken by war, soaring inflation and economic uncertainty is not a particularly investment-friendly environment. Nevertheless, this year may see one of the biggest and most significant public-to-private transactions in the history of a sector which prides itself in stability, which is infrastructure. On April 14, private equity group Blackstone and Edizione, the holding company of the billionaire family behind Italian fashion brand Benetton, have submitted an offer to take Italian infrastructure group Atlantia private at a valuation of €54bn. If executed, this transaction would mark Europe’s largest private equity deal ever.

History / Atlantia

Atlantia is an Italian infrastructure group listed on the Italian stock exchange. It is active across three main business lines: toll motorways in 24 countries worldwide; airports, including Aeroporti di Roma; and mobility services, primarily running the Italian Telepass tolling system. In 2021, the firm posted operating revenues of €6.4bn, EBITDA of €4bn and an operating cash flow of €2.9bn. The company has its origins in post-war Italy, where in 1950 Autostrade Concessioni e Costruzioni SpA was established by the Institute for Industrial Reconstruction to build and operate multiple motorways across Italy. In 1999, Autostrade was privatized, with Edizione as the leading core shareholder. Other non-motorway businesses were subsequently separated, and the resulting Autostrade per l’Italia (Aspi) became a core pillar of Atlantia’s business. In the late 2000s, the group started to diversify geographically by managing motorways in Brazil, Chile, India and Poland. Atlantia entered the airport infrastructure sector in 2013 with the acquisitions of the two airports of Rome, and acquisitions of airports in Southern France following in 2016.

Atlantia gained sad prominence in 2018 as the owner of the Morandi bridge in Genoa, which collapsed and killed 43 people. Since then, the Benetton family has been under pressure to sell its stake in Atlantia amid a public backlash on alleged poor maintenance of the toll roads and the leaders of the Five Star Movement repeatedly threatening to strip Atlantia of its concessions to operate Italian highways. However, this drastic step would have forced the Italian government to pay Atlantia billions of euros in compensation, which is why this option was never enforced. In 2021, Atlantia agreed to sell Aspi for €9.3bn to a group of investors led by Cassa Depositi e Prestiti (CDP), a state-owned lender and including Blackstone and Macquarie. However, Aspi has also attracted the interest of other deep-pocketed investors, as the news had spread that Florentino Pérez, chair of Group ACS and president of Real Madrid football club, was working on an alternative bid to acquire Atlantia’s toll road business together with Brookfield Asset Management and Global Infrastructure Partners.

Pérez has reportedly considered partnering with the Benetton family but also signaled his willingness to pursue a hostile approach given the failure to reach an agreement with them. In the end, this alternative offer never materialized, and Aspi was sold to the CDP-led consortium. The process was less than smooth given major disagreements about the valuation. Atlantia shareholders only backed the sale after the Italian government amended the terms of the concession to operate toll roads, making the business less profitable going forward.

Blackstone

The Blackstone Group Inc. was founded in 1985 by two former Lehman Brothers colleagues, Peter G. Peterson and Stephen A. Schwarzman (currently chairman and CEO). Initially a mergers and acquisition advisory boutique, Blackstone is now focusing its activities on Private Equity, Real Estate, and marketable alternative asset management. Since its IPO in 2017, Blackstone has been trading on Wall Street (NYSE: BX) and currently has a market capitalization of $130.39bn.

In the first quarter of FY2022, Blackstone generated revenues of $5.12bn, with a 3.24% year-on-year decrease due to a fall in the global dealmaking level. Dealmaking activity slowed because of uncertainty from geopolitical tension, lower GDP growth, and inflation. The company's Total Assets Under Management were approximately $915.5bn (up 41% year-on-year). The group also increased its quarterly dividend to $1.32 a share, a 61% raise over the previous year.

Blackstone is currently particularly interested in infrastructure investment. The group mainly operates in the US and has around $27bn in Assets Under Management. The firm focuses on different sectors, namely energy infrastructure, transportation, and digital infrastructure. Last year Blackstone took part in the consortium led by the Italian state-controlled Cassa Depositi e Prestiti (CDP) that bought Atlantia's Italian road arm, Autostrade per l'Italia (Aspi). The company was valued at €9.3bn, and Blackstone will own a 24.5% stake in the new vehicle created after the deal's closure.

On April 7, 2022, Blackstone Group's interest in a takeover bid for Italian infrastructure group Atlantia became public. On April 14, Blackstone and the billionaire family behind Italian fashion brand Benetton made a takeover bid for Atlantia, which values the company at about €54bn. The €23-a-share offer would mark the largest ever take-private deal for a European listed company.

Deal Rationale

As infrastructure assets are usually operated under some sort of agreement with government authorities, cashflows are either contractually fixed or linked to some index or actual usage, which tends to be stable in the case of most assets like motorways. Therefore, returns on infrastructure investments are generally considered to be well predictable, and such predictability is in high demand in such an uncertain and inflationary environment as the current one. The private equity industry is under pressure to invest the unprecedented amounts of money flowing into infrastructure funds, with Blackstone having reopened its flagship infrastructure fund to new money last year. Both the Benetton family and Blackstone said they support the company’s current business plan. For the Benettons, it is important to

preserve the integrity of the organization and its Italian identity. In addition, Blackstone explained this doubling down on Italian infrastructure with the underlying strength of the economy and its future opportunities.

Deal Structure

On April 14, 2022, Edizione, the Benetton family's holding company, and Blackstone, launched an offer to acquire all the outstanding ordinary shares of Atlantia S.p.A. to delist the company from the Italian Stock Exchange. The takeover bid values the Italian infrastructure group at about €54bn, with a €23-a-share offer that would mark the largest-ever take-private deal for a European company. The price embodies a premium equal to 24.4% to the share price on April 5, before public speculation about the offer started. The premium also rises if taking into account that investors will still receive a proposed dividend of €0.74 a share.

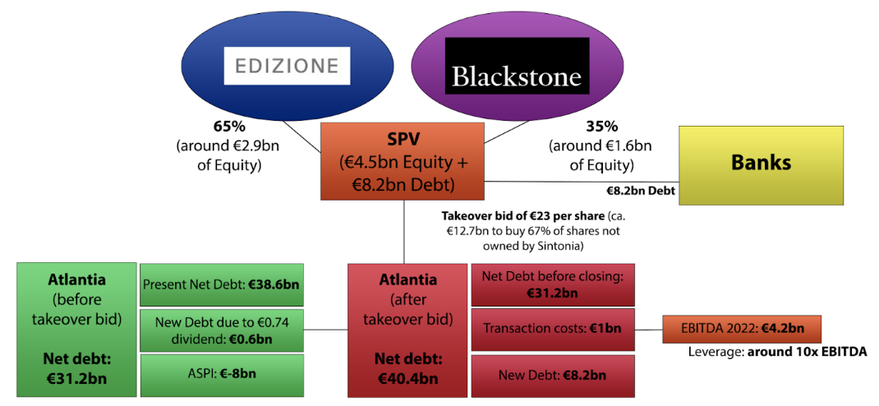

The offer has been launched by an investment vehicle, Schemaquarantatrè S.p.A., controlled by Edizione and Blackstone. In particular, the Benetton family will hold 65% of it, providing around €2.9bn of Equity. In contrast, through its two funds, Blackstone, "Investor SPV 1" and "Investor SPV 2" will control respectively 35% of the company, with €1.6bn of Equity.

Moreover, the company will raise €8.2bn of debt from a pool of different banks to finance the offer. After the deal, Atlantia will have a total debt outstanding of €40.4bn from the actual €31.2bn (considering the €8bn reduction due to the Aspi sales agreement), with a Leverage (Net Debt / EBITDA) of 10x EBITDA (which in 2022 was of €4.2bn).

A world shaken by war, soaring inflation and economic uncertainty is not a particularly investment-friendly environment. Nevertheless, this year may see one of the biggest and most significant public-to-private transactions in the history of a sector which prides itself in stability, which is infrastructure. On April 14, private equity group Blackstone and Edizione, the holding company of the billionaire family behind Italian fashion brand Benetton, have submitted an offer to take Italian infrastructure group Atlantia private at a valuation of €54bn. If executed, this transaction would mark Europe’s largest private equity deal ever.

History / Atlantia

Atlantia is an Italian infrastructure group listed on the Italian stock exchange. It is active across three main business lines: toll motorways in 24 countries worldwide; airports, including Aeroporti di Roma; and mobility services, primarily running the Italian Telepass tolling system. In 2021, the firm posted operating revenues of €6.4bn, EBITDA of €4bn and an operating cash flow of €2.9bn. The company has its origins in post-war Italy, where in 1950 Autostrade Concessioni e Costruzioni SpA was established by the Institute for Industrial Reconstruction to build and operate multiple motorways across Italy. In 1999, Autostrade was privatized, with Edizione as the leading core shareholder. Other non-motorway businesses were subsequently separated, and the resulting Autostrade per l’Italia (Aspi) became a core pillar of Atlantia’s business. In the late 2000s, the group started to diversify geographically by managing motorways in Brazil, Chile, India and Poland. Atlantia entered the airport infrastructure sector in 2013 with the acquisitions of the two airports of Rome, and acquisitions of airports in Southern France following in 2016.

Atlantia gained sad prominence in 2018 as the owner of the Morandi bridge in Genoa, which collapsed and killed 43 people. Since then, the Benetton family has been under pressure to sell its stake in Atlantia amid a public backlash on alleged poor maintenance of the toll roads and the leaders of the Five Star Movement repeatedly threatening to strip Atlantia of its concessions to operate Italian highways. However, this drastic step would have forced the Italian government to pay Atlantia billions of euros in compensation, which is why this option was never enforced. In 2021, Atlantia agreed to sell Aspi for €9.3bn to a group of investors led by Cassa Depositi e Prestiti (CDP), a state-owned lender and including Blackstone and Macquarie. However, Aspi has also attracted the interest of other deep-pocketed investors, as the news had spread that Florentino Pérez, chair of Group ACS and president of Real Madrid football club, was working on an alternative bid to acquire Atlantia’s toll road business together with Brookfield Asset Management and Global Infrastructure Partners.

Pérez has reportedly considered partnering with the Benetton family but also signaled his willingness to pursue a hostile approach given the failure to reach an agreement with them. In the end, this alternative offer never materialized, and Aspi was sold to the CDP-led consortium. The process was less than smooth given major disagreements about the valuation. Atlantia shareholders only backed the sale after the Italian government amended the terms of the concession to operate toll roads, making the business less profitable going forward.

Blackstone

The Blackstone Group Inc. was founded in 1985 by two former Lehman Brothers colleagues, Peter G. Peterson and Stephen A. Schwarzman (currently chairman and CEO). Initially a mergers and acquisition advisory boutique, Blackstone is now focusing its activities on Private Equity, Real Estate, and marketable alternative asset management. Since its IPO in 2017, Blackstone has been trading on Wall Street (NYSE: BX) and currently has a market capitalization of $130.39bn.

In the first quarter of FY2022, Blackstone generated revenues of $5.12bn, with a 3.24% year-on-year decrease due to a fall in the global dealmaking level. Dealmaking activity slowed because of uncertainty from geopolitical tension, lower GDP growth, and inflation. The company's Total Assets Under Management were approximately $915.5bn (up 41% year-on-year). The group also increased its quarterly dividend to $1.32 a share, a 61% raise over the previous year.

Blackstone is currently particularly interested in infrastructure investment. The group mainly operates in the US and has around $27bn in Assets Under Management. The firm focuses on different sectors, namely energy infrastructure, transportation, and digital infrastructure. Last year Blackstone took part in the consortium led by the Italian state-controlled Cassa Depositi e Prestiti (CDP) that bought Atlantia's Italian road arm, Autostrade per l'Italia (Aspi). The company was valued at €9.3bn, and Blackstone will own a 24.5% stake in the new vehicle created after the deal's closure.

On April 7, 2022, Blackstone Group's interest in a takeover bid for Italian infrastructure group Atlantia became public. On April 14, Blackstone and the billionaire family behind Italian fashion brand Benetton made a takeover bid for Atlantia, which values the company at about €54bn. The €23-a-share offer would mark the largest ever take-private deal for a European listed company.

Deal Rationale

As infrastructure assets are usually operated under some sort of agreement with government authorities, cashflows are either contractually fixed or linked to some index or actual usage, which tends to be stable in the case of most assets like motorways. Therefore, returns on infrastructure investments are generally considered to be well predictable, and such predictability is in high demand in such an uncertain and inflationary environment as the current one. The private equity industry is under pressure to invest the unprecedented amounts of money flowing into infrastructure funds, with Blackstone having reopened its flagship infrastructure fund to new money last year. Both the Benetton family and Blackstone said they support the company’s current business plan. For the Benettons, it is important to

preserve the integrity of the organization and its Italian identity. In addition, Blackstone explained this doubling down on Italian infrastructure with the underlying strength of the economy and its future opportunities.

Deal Structure

On April 14, 2022, Edizione, the Benetton family's holding company, and Blackstone, launched an offer to acquire all the outstanding ordinary shares of Atlantia S.p.A. to delist the company from the Italian Stock Exchange. The takeover bid values the Italian infrastructure group at about €54bn, with a €23-a-share offer that would mark the largest-ever take-private deal for a European company. The price embodies a premium equal to 24.4% to the share price on April 5, before public speculation about the offer started. The premium also rises if taking into account that investors will still receive a proposed dividend of €0.74 a share.

The offer has been launched by an investment vehicle, Schemaquarantatrè S.p.A., controlled by Edizione and Blackstone. In particular, the Benetton family will hold 65% of it, providing around €2.9bn of Equity. In contrast, through its two funds, Blackstone, "Investor SPV 1" and "Investor SPV 2" will control respectively 35% of the company, with €1.6bn of Equity.

Moreover, the company will raise €8.2bn of debt from a pool of different banks to finance the offer. After the deal, Atlantia will have a total debt outstanding of €40.4bn from the actual €31.2bn (considering the €8bn reduction due to the Aspi sales agreement), with a Leverage (Net Debt / EBITDA) of 10x EBITDA (which in 2022 was of €4.2bn).

After the delisting, the company's board will be made of nine members, six representing the Benetton family and three from The Blackstone Group. It might also become of ten members, with a member of Fondazione CRT if it will reinvest in 3% of Atlantia's Equity. The chairman and CEO will be designed by Edizione, whereas the CFO by the American fund. Moreover, only after five years will the company possibly be listed again.

Advisors

Edizione and Blackstone are advised by Goldman Sachs Group Inc., Mediobanca SpA, Bank of America Corp., J.P. Morgan Securities Plc, UBS Group AG, and Unicredit SpA. as financial advisors, and by Gatti Pavesi Bianchi Ludovici, Legacy – Avvocati Associati and Simpson, Thacher & Bartlett LLP as legal advisors.

Conclusion

Even if many analysts agree about the likelihood of the deal's closure, the financial operation seems to be complicated from the point of view of sustainability. The Debt of Atlantia will incredibly rise from the €23bn attended after the sale of Aspi to €43bn. Moreover, it will be interesting how Florentino Perez's ACS will react to this defensive offer. Perez has always been interested in acquiring the Spanish infrastructure group Abertis from Atlantia, even though the beginning of a price competition looks unlikely since the two companies are still recovering from the pandemic. It will be crucial to follow the development of this deal since it concerns one of the leading Italian companies that has been on the news in the last few years after the Ponte Morandi tragedy. We will see whether the delisting will be able to drive value creation for the group.

Written by Giulio Pampaloni and Martin Stockel

Advisors

Edizione and Blackstone are advised by Goldman Sachs Group Inc., Mediobanca SpA, Bank of America Corp., J.P. Morgan Securities Plc, UBS Group AG, and Unicredit SpA. as financial advisors, and by Gatti Pavesi Bianchi Ludovici, Legacy – Avvocati Associati and Simpson, Thacher & Bartlett LLP as legal advisors.

Conclusion

Even if many analysts agree about the likelihood of the deal's closure, the financial operation seems to be complicated from the point of view of sustainability. The Debt of Atlantia will incredibly rise from the €23bn attended after the sale of Aspi to €43bn. Moreover, it will be interesting how Florentino Perez's ACS will react to this defensive offer. Perez has always been interested in acquiring the Spanish infrastructure group Abertis from Atlantia, even though the beginning of a price competition looks unlikely since the two companies are still recovering from the pandemic. It will be crucial to follow the development of this deal since it concerns one of the leading Italian companies that has been on the news in the last few years after the Ponte Morandi tragedy. We will see whether the delisting will be able to drive value creation for the group.

Written by Giulio Pampaloni and Martin Stockel