Non-performing loans are credits deemed uncollectible and thus written off by banks. This procedure causes banks’ capital position to deteriorate and, as a consequence, leverage and risk to pile up in banks’ balance sheets.

This problem is becoming crucial in the Chinese banking system, due to a long period of loose lending, sustained by a steep economic growth that initially fueled loans repayment. For years the government has dealt with balance sheet clean up through state-owned asset management companies (ACMs), shifting risk from the banking system toward so-called shadow banking players. These AMCs bought banks’ NPLs at steep discount (30 to 50%) and then negotiated with debtors to try to get back a part of the initial credit or selling the real estate collateral in case of collateralized credit. Up to this point this seems to be a win-win game, where the bank is able to deleverage its balance sheet thus employing more capital in performing initiatives, while the AMC gets interesting returns. However, this apparent interesting outcome is the result of a risk transfer from the banking system to non-banking financial intermediation, very loosely regulated and thus more sensitive to downturns. The system however works well if the AMCs are able to assess credits in a superior way than banks, then recovering a higher tranche than otherwise possible.

Chinese banks’ NPLs stock quickly increased and the government had to set up many more AMCs than the first originally established 20 years ago, with the total number now surpassing 60, mainly created in the last 5 years. The problem is that these newly created firms may lack the expertise of the so called “Big Four” (the initial AMCs) and may assess poorly the bad debt stock they are buying.

It’s important to underline that this incredible surge in AMC constitution is not enough to deal with mounting distressed debt in Chinese banks. NPL ratios for commercial banks, indeed, range between 0.83% for foreign banks and 4% for rural banks, levels that would not be critical. However, this is based on Chinese classification, when international standards are employed in calculations, these ratios grow to a number that could be between 6% and 20%. Just for the sake of comparison, during the sovereign debt crisis, European banks had NPL ratios standing at the lower end of the above-mentioned range.

This problem is becoming crucial in the Chinese banking system, due to a long period of loose lending, sustained by a steep economic growth that initially fueled loans repayment. For years the government has dealt with balance sheet clean up through state-owned asset management companies (ACMs), shifting risk from the banking system toward so-called shadow banking players. These AMCs bought banks’ NPLs at steep discount (30 to 50%) and then negotiated with debtors to try to get back a part of the initial credit or selling the real estate collateral in case of collateralized credit. Up to this point this seems to be a win-win game, where the bank is able to deleverage its balance sheet thus employing more capital in performing initiatives, while the AMC gets interesting returns. However, this apparent interesting outcome is the result of a risk transfer from the banking system to non-banking financial intermediation, very loosely regulated and thus more sensitive to downturns. The system however works well if the AMCs are able to assess credits in a superior way than banks, then recovering a higher tranche than otherwise possible.

Chinese banks’ NPLs stock quickly increased and the government had to set up many more AMCs than the first originally established 20 years ago, with the total number now surpassing 60, mainly created in the last 5 years. The problem is that these newly created firms may lack the expertise of the so called “Big Four” (the initial AMCs) and may assess poorly the bad debt stock they are buying.

It’s important to underline that this incredible surge in AMC constitution is not enough to deal with mounting distressed debt in Chinese banks. NPL ratios for commercial banks, indeed, range between 0.83% for foreign banks and 4% for rural banks, levels that would not be critical. However, this is based on Chinese classification, when international standards are employed in calculations, these ratios grow to a number that could be between 6% and 20%. Just for the sake of comparison, during the sovereign debt crisis, European banks had NPL ratios standing at the lower end of the above-mentioned range.

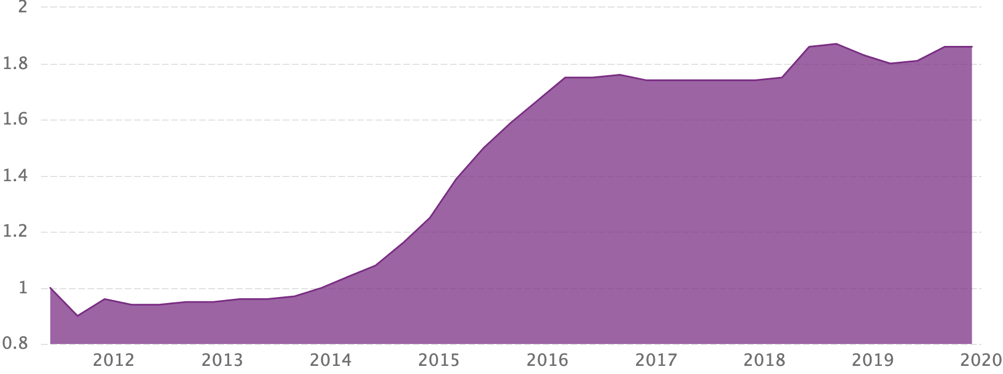

Non-performing loan ratios, quarterly data. Source: WWW.CEICDATA.COM

To deal with the current situation, where distressed loans are mounting and liquidity is drying up, the Chinese government has decided to open the distressed debt market to foreigner, granting US financial services companies with asset management licenses that put them on par with Chinese AMC. Many institutions, like Bain Capital, Goldman Sachs and Oaktree Capital Management have entered into the market, which could be highly rewarding (in case of collateralized loans, returns are in the 20% range). Others, instead, are more hesitant, worried by low transparency on loan collateral and pricing, together with the fact that many NPLs were granted to state owned companies.

This opening to foreign capital could provide relief to the problem and help authorities clean up banks’ balance sheets, offering however a limited solution. In fact, especially with tightening economic conditions and slowing growth, an effective risk reduction in Chinese banking system can only be given by a stricter regulation.

Francesco Curioni

(Cover image by moerschy-Pixabay)

This opening to foreign capital could provide relief to the problem and help authorities clean up banks’ balance sheets, offering however a limited solution. In fact, especially with tightening economic conditions and slowing growth, an effective risk reduction in Chinese banking system can only be given by a stricter regulation.

Francesco Curioni

(Cover image by moerschy-Pixabay)