In recent years, the sports betting industry has undergone a radical change following major deregulation in the United States. With capital flowing into the industry and players attempting to gain a share in the new promising market, DraftKings emerged to become the sector leader. Following years of highly volatile market performance, the stock rallied +140% in the last twelve months. Given the high risk associated with such a regulation-dependent and unethically perceived industry, one would expect strong fundamentals to back DraftKings’ impressive performance, but this does not seem to be the case. Naturally, the question arises as to whether DraftKings’ growth prospects are enough to justify the enthusiasm around the company, or if investors will gradually begin to put more weight on the risks of the stock

The Sports Betting and Gambling Industry at a Glance – Key Developments

For many years, sports betting and gambling were heavily restricted in the US; people travelled to isolated places around the country, such as Las Vegas and Atlantic City, in order to gamble on sports legally. In the past five years, however, the landscape has dramatically changed, as venture capitalists have invested billions into mobile-first gambling startups like FanDuel and DraftKings.

In the early 2010s, while casinos were burying themselves in long-term projects and campaigns to attract traditional gamblers, FanDuel and DraftKings appeared on the scene. The two East Coast-based startups tapped into fantasy sports where players assemble their own team of real-life athletes. Players’ teams earn points based on the actual on-field performance of the athletes over the course of a season and those who collect the most points win a portion of the prize pool pot. At that time there was no legal or political consensus if fantasy sports was considered gambling; it was basically legal by omission and anyone in any state could wager money on DraftKings and FanDuel via their smartphones.

By the mid-2010s, DraftKings and FanDuel each fundraised hundreds of millions of dollars from notable investors such as KRR, Shamrock Capital, The Raine Group, and Redpoint Ventures. While both startups were the clear market leaders, they were also financially and operationally unsustainable. The fantasy sports market was simply too small, and the pots were not big enough to justify their billion-dollar valuations.

In 2018, a unique opportunity emerged for DraftKings and FanDuel as the Supreme Court suddenly repealed a 1992 federal law, the Professional and Amateur Sports Protection Act (PASPA), that banned sports betting in most U.S. states. Each state was to determine whether to legalize sports betting, so FanDuel and DraftKings quickly pivoted to sports betting as their primary focus, in the hopes of its legalization across all 50 states.

Since the 2018 Court decision, sports betting has transformed into a high-growth tech business, with over $12bn in revenue in 2022 and advertising that is quickly becoming engrained in American cultural life (parlays etc.). With the aim of capitalizing on the sudden lifting of the federal ban, Flutter Entertainment, the world’s largest listed gambling company, agreed to buy majority control of FanDuel. A phase of explosive growth on regulatory underpinnings soon began, that boosted FanDuel’s value, as assumed by analysts, to approximately $18bn. Even Disney is making its way into the US sports betting industry, tying its ESPN cable network to the casino and online gambling company Penn Entertainment in a $2bn deal.

However, FanDuel and DraftKings’ expectations were not actually met. Regardless of the publicity, the online sports betting market in the U.S. did not perform as well as both companies hoped. They were unable to reach a high volume of bets, on which they both strongly relied, despite misspending hundreds of millions of dollars each year on bonuses, incentives and advertising to increase the number of active users. This is obvious in DraftKings’s numbers, where the top line has grown substantially since the 2018 pivot to sports betting. Yet, 50-80% of each dollar earned is spent on advertising in order to maintain retention and drive expansion, while the losses have only gotten worse, despite the fact that player counts have dramatically increased over the years.

DraftKings pivoted once again in 2019, by investing in the creation of an online casino platform. At the end of that same year, it announced a merger with Diamond Eagle Acquisition Corp., a special purpose acquisition company (SPAC) with a market cap of roughly $500 million, and SBTech, a betting and gaming technology company. This allowed DraftKings to become public while forgoing the typical IPO process. Crucially, the acquisition by Diamond Eagle provided DraftKings, which lost $136 million in 2019 (an increase from its losses of $77m in 2018), approximately $700 million in extra funding to finance its expansion towards online casinos.

The company rolled out virtual tables, slots, and custom games that people could play in 30 seconds or less, cultivating a new type of gambler - someone who does not normally gamble or go to casinos, who does not have ingrained habits or superstitions like traditional gamblers, but has the time and money to play for the sake of unwinding, instead of the casino resort experience and “winning big”. The narrative that DraftKings and FanDuel tell is that with the right type of products, they can turn non-gamblers and fantasy players into gamers and gamblers and vice versa.

The U.S online gambling market is constantly expanding, and it is expected to reach €53bn in gross win (i.e., stakes or bets less player wins) volume by 2028 from €15bn in 2022, reflecting a compound annual growth rate (CAGR) of 24%. As proof of this, Flutter recently (29 January 2024) announced the listing of the company's ordinary shares on the New York Stock Exchange. The company is also planning to cease its inclusion on the UK’s FTSE 100 index in moving its primary listing to New York, thus gaining access to much deeper capital markets as well as new investors across the Atlantic.

Evolution of the US Regulatory Framework and the Issue of Liberalisation

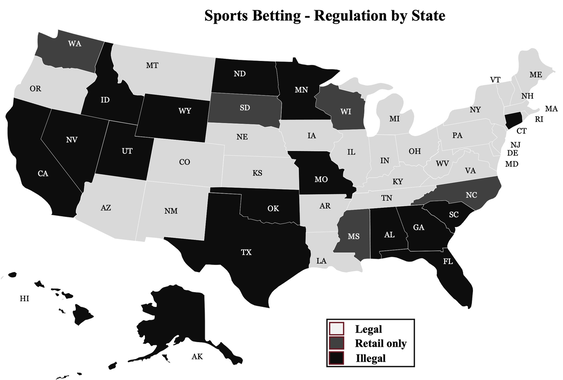

The overturning of the 1992 Professional and Amateur Sports Protection Act (PASPA) legalised sports betting in the U.S., and since then more than 30 states now allow it. As increasingly more states are set to legalize and regulate these activities, the sports betting market can only expand.

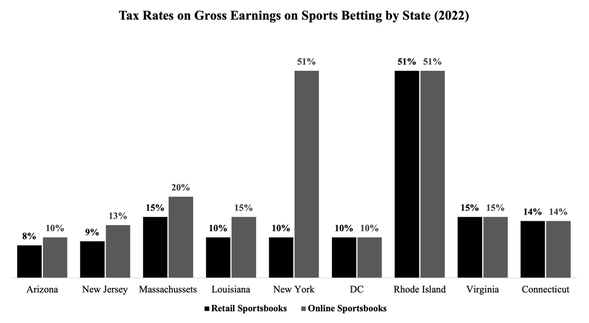

Industry lobbyists have had a major role in the rise of sports betting in the U.S., with legislators being coaxed by overinflated projections of tax revenues that states might receive. The American Gaming Association stated that Virginia could expect to receive $55 million a year in tax revenue in 2018, but until 2022 the maximum tax revenue collected in a year was only $38 million. Since 2016, FanDuel and DraftKings have donated more than $3 million to state politicians and political parties, according to a campaign finance watchdog. The reason for this can partly be explained by the potential of the U.S. market for sports betting compared to its counterpart in Europe, along with the majority market share that both these companies have in fantasy sports, comprising over 50% of the market. This clearly enables them to greatly influence state ballot measures. These measures then result in substantial tax cuts and other tax breaks on gambling companies’ revenue, with the state of Kansas nearly halving them.

However, lobbying to this extent has come at the expense of consumer protection. DraftKings paid millions of dollars in fines in several states, mainly due to advertisements aimed at under 21s which were also labelling some bets as ‘risk-free’. The relatively recent emergence of the sports betting market means that at the state level, regulators are unsure of what limits should be placed, considering that the already complex yet sketchy legal framework certainly has not helped.

As issues are on the rise, the U.S. market could emulate the more mature UK one, where liberalisation of British gambling laws, coupled with the rising popularity of smartphones, led to the world’s biggest regulated gambling market, but also contributed to the rise in gambling addiction. As a result, there has been a regulatory crackdown in operators, who have been punished with over £200 million in fines since 2017. If U.S. regulators follow this example, balance sheets and stock market performances could be impacted. Regulation changes are reliant on future attitudes and stances taken by both the government and the public against sports betting, and given the tender age of the industry, they are quite liable to evolve. This could be a point of contention within the upcoming U.S. presidential campaign, as it was under the Trump presidency that sports betting was legalized, while Biden has called for more unified laws on gambling at the federal level. While neither of them has recently made statements or promises concerning the sports betting market, companies like FanDuel and DraftKings will back the candidate who promises greater liberalisation.

Exhibit 1 - online sports betting is still heavily penalized in many states

While the sports betting market will undoubtedly become more regulated over time, since its legalisation in the U.S. in 2018, there has been little regulation initiated, with the market resembling that of South America of recent years. ‘Risk-free’ wagers, which are banned in some countries because of their potential to promote gambling addictions, are publicity stunts where customers are reimbursed for losing bets. Not only are these legal in the U.S., but they are also tax-deductible, essentially implying that state governments are subsidizing these wagers. This is just one example of how unregulated the sports betting market is currently in the U.S., and partly explains the near tripling of DraftKings stock in the last 5 years.

Focus on DraftKings – Fundamentally-Sound Investment or Meme Stock?

DraftKings Inc. (Nasdaq: DKNG), a leader in the U.S. sports betting and gaming industry, offers its users a comprehensive suite of online betting, casino games, and daily fantasy sports products.

In the past few years, a pivotal factor contributing to DraftKings' revenue surge has been the progressive legalization of sports betting across new jurisdictions in the United States. Indeed, the pivotal 2018 Supreme Court ruling resulted in more states opening their markets to sports betting, which broadened the total addressable market and catalyzed a staggering 1280% increase in DraftKings’ revenue up to the end of 2023.

Recently, DraftKings has overtaken FanDuel, securing the forefront position in the U.S. online gambling market. While the two companies are the symbol of the growth of the sports betting sector, the question arises as to whether their abnormally positive stock market performances are backed by strong fundamentals or whether they are merely sustained by speculative positions on the industry’s ascending trend.

DraftKings made its public debut in April 2020, following a complex three-way SPAC merger at the end of which DraftKings’ shares began trading at $20.49 per share. By year’s end, the stock had soared over 200% and sustained its upward trend throughout the first few months of 2021, reaching an all-time high of $72 per share. However, starting in September 2021, a steep and prolonged decline began with the share price plummeting to a low of $9.77, below the SPAC’s initial trading value, by mid-2022. The stock stabilized until early 2023, after which it engaged in a 290% rally to the current price of $44.

Exhibit 2 – DraftKings’ stock price ($) evolution with significant events

Needless to say, DraftKings' shares are highly volatile, and the company’s lack of strong fundamentals is the main reason why its stock tends to overreact to high-impact news.

The 2020 surge can largely be attributed to the resumption of sporting events, which in turn stimulated an increase in sports betting nationwide. Essentially, the post-COVID-19 period revealed the true potential of the industry, triggering a wave of optimism that was reflected in DraftKings' stock appreciation. This positive sentiment persisted into 2021, supported by the company's strategic M&A campaigns which strengthened its industry dominance. Notable acquisitions included Vegas Sports Information Network, Inc. in March, Blue Ribbon Software Ltd. in April, and Golden Nugget Online Gaming, Inc. in August of 2021. Inorganic growth via acquisitions in a still-fragmented industry, coupled with technological improvements and growing experience, represented the real value driver in past years and was the fastest way to consolidate the firm’s position in the market. However, a downward shift in DraftKings' stock valuation occurred in late 2021, which reflected investors' realignment from a growth-centric outlook to a focus on fundamental financial health of the firm. Despite consistently posting double-digit annual revenue growth, the company faced considerable operational losses due to the strong marketing and R&D efforts, as well as forced adherence to state-specific regulatory standards. For instance, DraftKings posted losses of $1.54bn and $1.49bn in 2021 and 2022 respectively. These losses, previously overlooked, were finally priced into DraftKings' valuation in 2022, resulting in a bearish investor stance that contributed to the stock's sharp decline. Entering 2023, a major comeback in the firm’s market performance was observed, culminating in a high of $49.27 by March 2024, largely driven by a significant uptick in user base and revenue inflow.

The industry is currently undergoing consolidation, and DraftKings' established leadership and first-mover advantage pose significant obstacles to market entry for potential competitors, especially given the large investment in marketing and technology required to be competitive. This is not only true for small, companies trying to capture a niche in the sector, but also for large, well-established firms which are also finding market entry challenging, as exemplified by Fox Corporation's decision to cease its Fox Bet online sports betting operations. Whether actions like this are due to the industry’s barriers to entry or merely to the unattractiveness of the industry on a risk-reward basis, however, is still uncertain.

What is clear, instead, is that a bullish stance on DraftKings is a bet on the prosperity of the U.S. online sports betting and iGaming industry, and that the firm will secure the #1 spot in this market.

This belief is strong on the street, reflected by the stock’s recovery since the poor market performance of 2020 and 2021, where DraftKings had previously reached highs of $71 before tumbling. Now the stock is up 136% LTM, trading at $44.94, despite still posting negative earnings. However, guidance from DraftKings suggests that the company is expecting to turn FCF-positive in FY24 and that profitability remains projected for FY25.

The 2020 surge can largely be attributed to the resumption of sporting events, which in turn stimulated an increase in sports betting nationwide. Essentially, the post-COVID-19 period revealed the true potential of the industry, triggering a wave of optimism that was reflected in DraftKings' stock appreciation. This positive sentiment persisted into 2021, supported by the company's strategic M&A campaigns which strengthened its industry dominance. Notable acquisitions included Vegas Sports Information Network, Inc. in March, Blue Ribbon Software Ltd. in April, and Golden Nugget Online Gaming, Inc. in August of 2021. Inorganic growth via acquisitions in a still-fragmented industry, coupled with technological improvements and growing experience, represented the real value driver in past years and was the fastest way to consolidate the firm’s position in the market. However, a downward shift in DraftKings' stock valuation occurred in late 2021, which reflected investors' realignment from a growth-centric outlook to a focus on fundamental financial health of the firm. Despite consistently posting double-digit annual revenue growth, the company faced considerable operational losses due to the strong marketing and R&D efforts, as well as forced adherence to state-specific regulatory standards. For instance, DraftKings posted losses of $1.54bn and $1.49bn in 2021 and 2022 respectively. These losses, previously overlooked, were finally priced into DraftKings' valuation in 2022, resulting in a bearish investor stance that contributed to the stock's sharp decline. Entering 2023, a major comeback in the firm’s market performance was observed, culminating in a high of $49.27 by March 2024, largely driven by a significant uptick in user base and revenue inflow.

The industry is currently undergoing consolidation, and DraftKings' established leadership and first-mover advantage pose significant obstacles to market entry for potential competitors, especially given the large investment in marketing and technology required to be competitive. This is not only true for small, companies trying to capture a niche in the sector, but also for large, well-established firms which are also finding market entry challenging, as exemplified by Fox Corporation's decision to cease its Fox Bet online sports betting operations. Whether actions like this are due to the industry’s barriers to entry or merely to the unattractiveness of the industry on a risk-reward basis, however, is still uncertain.

What is clear, instead, is that a bullish stance on DraftKings is a bet on the prosperity of the U.S. online sports betting and iGaming industry, and that the firm will secure the #1 spot in this market.

This belief is strong on the street, reflected by the stock’s recovery since the poor market performance of 2020 and 2021, where DraftKings had previously reached highs of $71 before tumbling. Now the stock is up 136% LTM, trading at $44.94, despite still posting negative earnings. However, guidance from DraftKings suggests that the company is expecting to turn FCF-positive in FY24 and that profitability remains projected for FY25.

Exhibit 3 - in FY23, DraftKings managed to significantly improve its margins

In the past few years, a key challenge DraftKings has faced was balancing rapid growth while keeping margins under control, which proved to be quite hard in FY 2020 and 2021, as the firm reported negative EBITDA margins exceeding 100% (i.e., below -100%) in both years.

The turnaround occurred with the 2023 earnings release, as DraftKings managed to achieve a 64% year-on-year revenue growth, while improving its deeply negative EBITDA margin to -15%. Such improvement has been noted by investors and led to most equity analysts either maintaining an overweight stance or revising their rating upwards. This was reinforced by DraftKings' management guidance of $310 to $410mn FCF projected for FY24, which is not entirely priced in and could put upward pressure on the DraftKings’ stock price. Additionally, research analysts are currently predicting revenues to increase by 30% and 20% in FY24 and FY25 respectively, with operating income expected to turn positive in 2025, as economies of scale gradually lead to less-than-proportional increases in opex relative to revenue, resulting in margin improvements. As of today, the consensus EPS forecast for Q1 earnings release scheduled on May 2nd, 2024, stands at $-0.87. Given the historical tendency of amplified stock price movements following unexpected news, should the firm post better-than-expected results then the market reaction will be anything but contained, as that would be a key sign that fundamentals are there to support persistent rise in DraftKings’ share price.

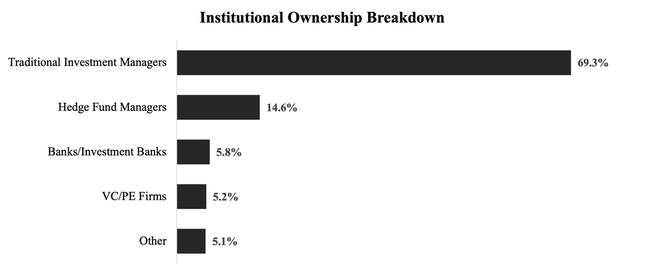

One last aspect to touch upon is the breakdown of DraftKings’ equity ownership. It is common knowledge that the presence of active investors such as hedge funds in a company’s shares can serve as a bullish/bearish indicator. In the case of DraftKings, Hedge Funds represent 14.6% of Institutional Ownership, corresponding to 9.9% of the total common stock, which signals that some of the most knowledgeable and aggressive investors had noticed DraftKings’ potential and most likely gained from last year’s rally. Among these, Cathie Wood’s ARK Investment Management has the largest holding, with roughly 2.6% of outstanding shares. Other large multi-managers such as, D.E. Shaw & Co and Davidson Kempner maintain a minor share of the float, though they notably reduced their shareholding recently. This bearish signal, paired with the decreasing exposure to DraftKings from other major funds including Citadel, Two Sigma, and Point72, could be interpreted as a diminishing confidence in the company's prospects. However, it is essential to consider the investment strategy of hedge funds, which often emphasizes high-risk, speculative ventures. Thus, their withdrawal may not necessarily indicate a bearish outlook for the company in the long term but could be either a tactical decision to capitalize on a short-term speculative gain or, merely a matter of portfolio rebalancing.

The turnaround occurred with the 2023 earnings release, as DraftKings managed to achieve a 64% year-on-year revenue growth, while improving its deeply negative EBITDA margin to -15%. Such improvement has been noted by investors and led to most equity analysts either maintaining an overweight stance or revising their rating upwards. This was reinforced by DraftKings' management guidance of $310 to $410mn FCF projected for FY24, which is not entirely priced in and could put upward pressure on the DraftKings’ stock price. Additionally, research analysts are currently predicting revenues to increase by 30% and 20% in FY24 and FY25 respectively, with operating income expected to turn positive in 2025, as economies of scale gradually lead to less-than-proportional increases in opex relative to revenue, resulting in margin improvements. As of today, the consensus EPS forecast for Q1 earnings release scheduled on May 2nd, 2024, stands at $-0.87. Given the historical tendency of amplified stock price movements following unexpected news, should the firm post better-than-expected results then the market reaction will be anything but contained, as that would be a key sign that fundamentals are there to support persistent rise in DraftKings’ share price.

One last aspect to touch upon is the breakdown of DraftKings’ equity ownership. It is common knowledge that the presence of active investors such as hedge funds in a company’s shares can serve as a bullish/bearish indicator. In the case of DraftKings, Hedge Funds represent 14.6% of Institutional Ownership, corresponding to 9.9% of the total common stock, which signals that some of the most knowledgeable and aggressive investors had noticed DraftKings’ potential and most likely gained from last year’s rally. Among these, Cathie Wood’s ARK Investment Management has the largest holding, with roughly 2.6% of outstanding shares. Other large multi-managers such as, D.E. Shaw & Co and Davidson Kempner maintain a minor share of the float, though they notably reduced their shareholding recently. This bearish signal, paired with the decreasing exposure to DraftKings from other major funds including Citadel, Two Sigma, and Point72, could be interpreted as a diminishing confidence in the company's prospects. However, it is essential to consider the investment strategy of hedge funds, which often emphasizes high-risk, speculative ventures. Thus, their withdrawal may not necessarily indicate a bearish outlook for the company in the long term but could be either a tactical decision to capitalize on a short-term speculative gain or, merely a matter of portfolio rebalancing.

Exhibit 4 - Institutional Investors own 67.75% of DraftKings’ outstanding shares – source: FactSet

As of today, signals from both the market and the firm’s operating performance are mixed, and a proper valuation model should strongly rely on future company results, as the current financial statements feature negative profitability and free cash flow. This, however, is nothing to be surprised of. DraftKings is most definitely a growth, rather than a value stock, hence, focusing on getting the price right is as easy as finding a needle in a haystack. For now, trading with the trend, while keeping a vigilant eye on future high-impact industry and firm-specific news, might be a good choice for an investor who believes that both internal and external catalysts will be tailwinds for DraftKings’ growth.

Outlook, Opportunities and Risks Behind the Potentially Shady Sports Betting Industry

Looking forward to 2024, further evolution is anticipated following the major developments of 2023. As of today, experts are expecting a downshift in new state legalizations for the year ahead, which would reflect the maturing market environment. While states such as California and Texas, where sports betting is still illegal, represent substantial potential markets, it is unclear whether liberalisation may occur in 2024, since previous ballot measures failed to gain sufficient traction in congress. In this context, the upcoming U.S. elections could potentially be a major catalyst, although sports betting is a sensitive topic and is unlikely to become a matter of political debate, as candidates would most likely not take a clear stance on the topic. Still, there are currently a series of bills on file across the U.S., along with new laws in execution, and some states which are closing the gap in legalising online sports betting.

Exhibit 5 - online sports betting is still illegal in key U.S. states

However, simply waiting for deregulation to occur cannot be DraftKings’ sole growth strategy. Hence, as an alternative to organic and M&A-driven growth, the company has actively been seeking strategic partnerships with major players both inside and outside the industry.

The recent release of Apple Sports, a free app designed to provide real-time scores and stats, has sparked interest across various sectors, including the sportsbook industry. DraftKings managed to secure a partnership with the Cupertino-based tech giant, which consists of the integration of DraftKings' odds into the app and marks a significant and promising partnership between the tech giant and the leading online betting platform. Eddy Cue, Apple’s senior vice president of services, hints at a potential for further partnerships with sports betting platforms in the future, providing a ray of hope amid uncertainties.

Liberalisation in U.S. sports betting legislation, news of accretive M&A and announcements of profitable partnerships, are all strong catalysts which would potentially lead to double-digit returns for DraftKings’ stock price. However, the decision to invest in this company must account for the potentially asymmetric distribution of outcomes, as the large number of risks a firm in such a highly regulated industry faces could sweep away months of gains.

DraftKings was recently faced with controversies that questioned its integrity and commitment to consumer welfare. These questionable events were brought up by short-seller Hindenburg Research in its June 2021 report “DraftKings: A $21 Billion SPAC Betting It Can Hide Its Black Market Operations”.

Central to these concerns is the three-way merger between the SPV Diamond Eagle Acquisition Corp, DraftKings and SBTech, which exposed the company to allegations of involvement in illicit activities, including black-market gambling and money laundering, naturally raising questions about DraftKings' ethical conduct.

A further issue recently raised by the U.S. Treasury Department concerns the increasing risk of money laundering associated with online sports betting, which pointed another major issue in the sector, that is, the lack of uniform regulations. While traditional casinos have long been subject to financial crime oversight, online sports betting operations face rapidly evolving regulations, which makes monitoring and enforcement much more challenging. The Treasury highlighted the risk posed by illegal offshore platforms, which account for an estimated 40% of sports betting activity and are harmful to U.S. consumers.

Furthermore, federal lawmakers have recently begun investigating online gambling companies' marketing tactics, particularly their targeting of high spenders and VIPs, amid concerns about promoting gambling addiction and financial harm among vulnerable demographics. Again, this exemplifies how, as the online gambling industry continues its rapid expansion, it will draw increasingly more attention from regulators, with the inevitable risk of negative catalysts eventually materializing.

The recent release of Apple Sports, a free app designed to provide real-time scores and stats, has sparked interest across various sectors, including the sportsbook industry. DraftKings managed to secure a partnership with the Cupertino-based tech giant, which consists of the integration of DraftKings' odds into the app and marks a significant and promising partnership between the tech giant and the leading online betting platform. Eddy Cue, Apple’s senior vice president of services, hints at a potential for further partnerships with sports betting platforms in the future, providing a ray of hope amid uncertainties.

Liberalisation in U.S. sports betting legislation, news of accretive M&A and announcements of profitable partnerships, are all strong catalysts which would potentially lead to double-digit returns for DraftKings’ stock price. However, the decision to invest in this company must account for the potentially asymmetric distribution of outcomes, as the large number of risks a firm in such a highly regulated industry faces could sweep away months of gains.

DraftKings was recently faced with controversies that questioned its integrity and commitment to consumer welfare. These questionable events were brought up by short-seller Hindenburg Research in its June 2021 report “DraftKings: A $21 Billion SPAC Betting It Can Hide Its Black Market Operations”.

Central to these concerns is the three-way merger between the SPV Diamond Eagle Acquisition Corp, DraftKings and SBTech, which exposed the company to allegations of involvement in illicit activities, including black-market gambling and money laundering, naturally raising questions about DraftKings' ethical conduct.

A further issue recently raised by the U.S. Treasury Department concerns the increasing risk of money laundering associated with online sports betting, which pointed another major issue in the sector, that is, the lack of uniform regulations. While traditional casinos have long been subject to financial crime oversight, online sports betting operations face rapidly evolving regulations, which makes monitoring and enforcement much more challenging. The Treasury highlighted the risk posed by illegal offshore platforms, which account for an estimated 40% of sports betting activity and are harmful to U.S. consumers.

Furthermore, federal lawmakers have recently begun investigating online gambling companies' marketing tactics, particularly their targeting of high spenders and VIPs, amid concerns about promoting gambling addiction and financial harm among vulnerable demographics. Again, this exemplifies how, as the online gambling industry continues its rapid expansion, it will draw increasingly more attention from regulators, with the inevitable risk of negative catalysts eventually materializing.

Final Remarks

Was any of this enough to stop DraftKings’ rally? Aside from temporary negative fluctuations, the bull run for the sports betting firm proceeded quite smoothly since 2022. DraftKings is improving in terms of operating performance and proved to be resilient to multiple shocks, including the attack by short-seller Hindenburg Research. Still, the highly non-harmonized regulatory framework and the perceived unethical nature of the industry represent major investment risks which are not easy to hedge. The company is well positioned to exploit future opportunities; however, the key question at this point is whether investors will continue to prioritize DraftKings’ improving fundamentals over the uncertainty surrounding this regulation-sensitive sector.

By Giacomo Gulmini, Ginevra Ferraioli, Maxime Vallot, Pietro Vascotto Vidal, Kabir Wali

Sources

- FactSet

- Capital IQ

- Yahoo!Finance

- Reuters

- FT

- WSJ

- SBCAmericas - “State regulators divided over Draftkings palp”

- Draftkings Webpage – Quartely Results and Press Release

- MarketScreener

- Sports Handle - Apple-DraftKings Partnership Could Prove To Be Game-Changer

- Forbes – Where is Sports Betting Legal? A Guide To All 50 States

- Modern MBA