Beyond Meat Inc., the plant-based meat start-up from California, debut on NASDAQ on the 2nd of May under the symbol “BYND”. The Initial public offering price was set at $25 a share, at the high hand of its expected range ($23-$25), and with 9.63 million shares sold the company raised $240.6 million, reaching a $1.5 billion valuation.

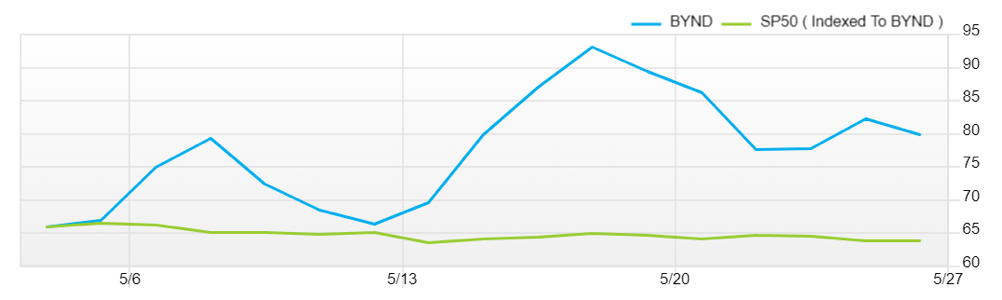

The stock opened at $46, picking at $73 and closed the first day with a 163% rise, at $65.75 a share. That, besides marking Beyond Meat as the first alternative meat company to go public, it was also the best first-day open for an IPO raising more than $200 million since 2000, according to dialogic. The positive trend was sustained also during the following days, by exceeding $90 a share, while is now traded at $80.

The stock opened at $46, picking at $73 and closed the first day with a 163% rise, at $65.75 a share. That, besides marking Beyond Meat as the first alternative meat company to go public, it was also the best first-day open for an IPO raising more than $200 million since 2000, according to dialogic. The positive trend was sustained also during the following days, by exceeding $90 a share, while is now traded at $80.

Beyond Meat was founded in 2009 by Ethan Brown, currently the CEO of the company, with the aim of revolutionizing the food industry by reproducing meat in a greener and more efficient way. “For 12,000 years the population growth has been enabled by using science and technology to get more output per acre of land and more meat livestock, however costs in terms of wasted land, energy and water, with huge greenhouse gas emissions and health problems, are increasing”, wrote Ethan Brown in its letter to investors. For these reasons, Beyond Meat is trying to extrapolate the meat production process from the animal by using the same inputs (plants and water) and by directly organizing amino acids, lipids, trace minerals, vitamins, and water woven together to form meat. In fact, in the classical production process, animals can be considered as a big bottleneck, that Beyond Meat wants to bypass with great benefits in terms of efficiency and health (90% fewer greenhouse gas emissions, 99% less water, 93% less land, and 46% less energy).

The company is aggressively entering this new but already highly competitive market, composed by other plant-based protein makers (including Boca Foods, Field Roast Grain Meat Co., Gardein, Impossible Foods, Lightlife, Morningstar Farms and Tofurky) and also some big traditional meat companies (including Cargill, Hormel Foods Corp., JBS, Tyson Foods Inc. and WH Group), with a marketing strategy that places its portfolio of products directly against their animal-based equivalents and that creates a great brand awareness through successful social marketing campaigns, with 9.9 billion media impressions earned in 2018. In fact, Beyond Meat is aiming to expand the number of consumers not only to vegans and vegetarian people - that are only less than 5% of the population -, but also to all animal meat consumers, targeting a $1.4 trillion market worldwide ($260 billion in the US). This strategy is similar to the successful story of plant-based milk, that after being merchandised adjacent to their dairy equivalents, it has reached a total market share in the milk industry of 13% (almost $2 billion in 2017).

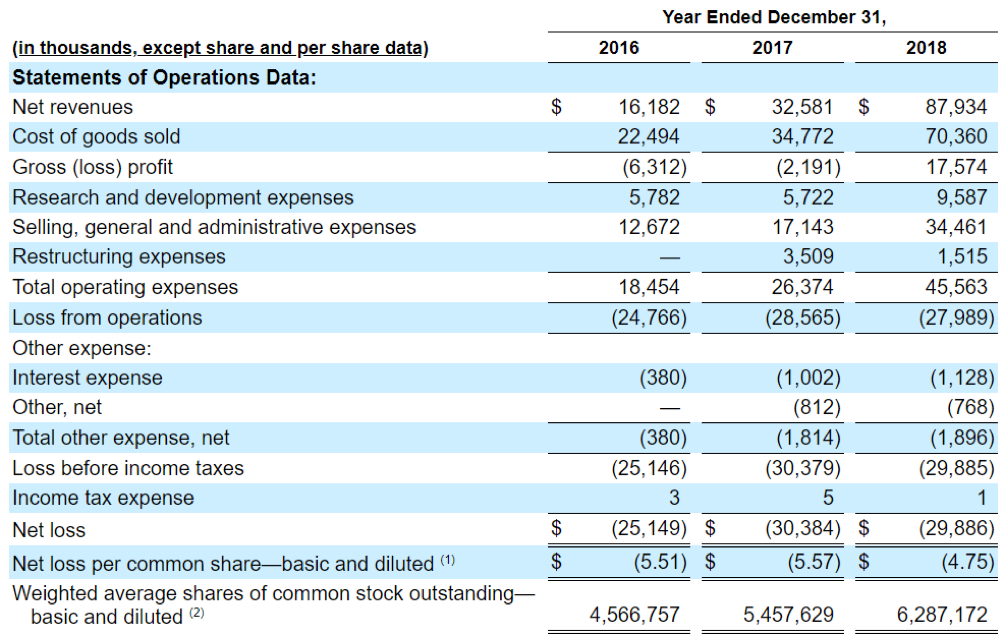

Beyond Meat’s efforts are starting to pay off as demonstrated by an analysis on one of the biggest US grocers, where 93% of Beyond Burger consumers are also animal protein buyers. Moreover, as disclosed in its S-1 filing, Beyond Meat is one of the fastest growing US food company, with a 133% annual growth rate in net revenues over the last 3 years, that in 2018 achieved $87.9 million. However, it has not managed to reach profitability yet, with a net loss of $29.9 million in 2018 (and $30.4 million in 2017).

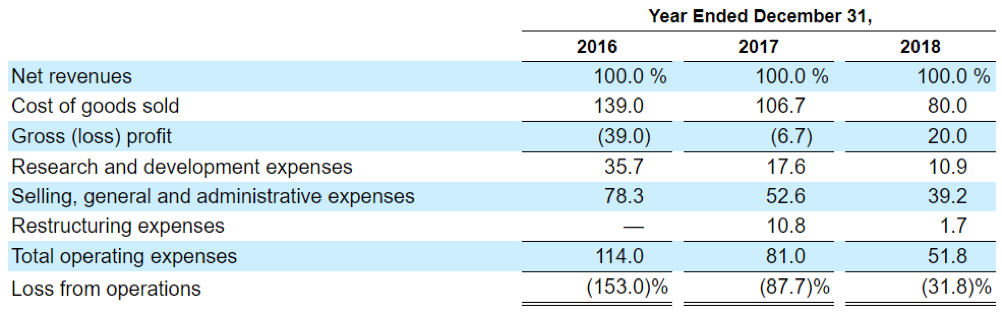

In 2018 margins are improving. Higher economies of scale and a greater proportion of fresh products sold, that have a higher net selling price, are helping the company to reduce net loss and start to make some gross profits.

The company is aggressively entering this new but already highly competitive market, composed by other plant-based protein makers (including Boca Foods, Field Roast Grain Meat Co., Gardein, Impossible Foods, Lightlife, Morningstar Farms and Tofurky) and also some big traditional meat companies (including Cargill, Hormel Foods Corp., JBS, Tyson Foods Inc. and WH Group), with a marketing strategy that places its portfolio of products directly against their animal-based equivalents and that creates a great brand awareness through successful social marketing campaigns, with 9.9 billion media impressions earned in 2018. In fact, Beyond Meat is aiming to expand the number of consumers not only to vegans and vegetarian people - that are only less than 5% of the population -, but also to all animal meat consumers, targeting a $1.4 trillion market worldwide ($260 billion in the US). This strategy is similar to the successful story of plant-based milk, that after being merchandised adjacent to their dairy equivalents, it has reached a total market share in the milk industry of 13% (almost $2 billion in 2017).

Beyond Meat’s efforts are starting to pay off as demonstrated by an analysis on one of the biggest US grocers, where 93% of Beyond Burger consumers are also animal protein buyers. Moreover, as disclosed in its S-1 filing, Beyond Meat is one of the fastest growing US food company, with a 133% annual growth rate in net revenues over the last 3 years, that in 2018 achieved $87.9 million. However, it has not managed to reach profitability yet, with a net loss of $29.9 million in 2018 (and $30.4 million in 2017).

In 2018 margins are improving. Higher economies of scale and a greater proportion of fresh products sold, that have a higher net selling price, are helping the company to reduce net loss and start to make some gross profits.

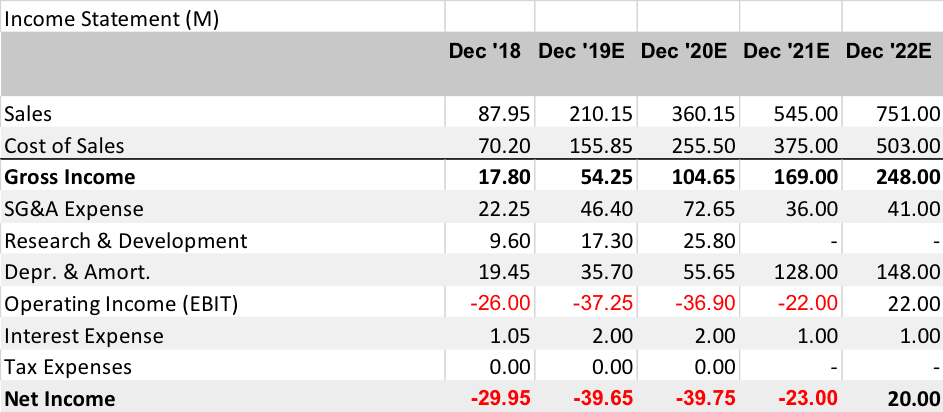

This positive trend can be stressed and can be also found in analysts’ consensus on future earnings.

On the other hand, costs are rising steady, with a huge increase in absolute terms for selling, general and administrative expenses, due to higher marketing costs and to a 111% increase in headcount. Moreover, costs are expected to rise even more in the next period, and the $240.6 million raised by the company during the IPO will be invested mainly in research, marketing and to increase production capabilities, that during 2018 has already tripled.

The path to profitability is not expected to be short but neither riskless. Indeed, risks related to the market, to the development of new products, to manufacturing and supply chain might have a strong impact on Beyond Meat activity.

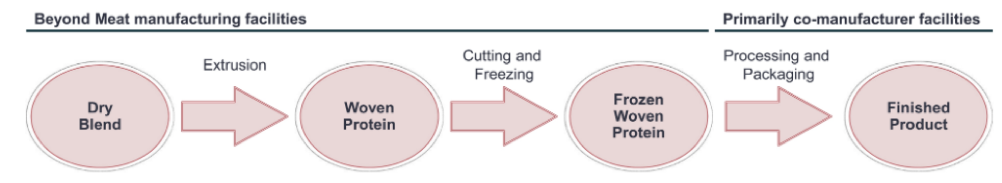

First of all, one of the biggest issues is that Beyond Meat relies on two only pea protein supplier and revenues related to products containing this element reached 79% of net revenues in 2018. For this reason, any problem related to pea protein production, as already happened in the past, or to the relationship between the company and the supplier could highly damage Beyond Meat business. In addition, Beyond Meat does not hold any written contract with its co-manufacturers, causing a possible future instability if any manufacturing problem arises. The result of these two elements is a fragile production chain that the company should aim to stabilize in the near future.

The path to profitability is not expected to be short but neither riskless. Indeed, risks related to the market, to the development of new products, to manufacturing and supply chain might have a strong impact on Beyond Meat activity.

First of all, one of the biggest issues is that Beyond Meat relies on two only pea protein supplier and revenues related to products containing this element reached 79% of net revenues in 2018. For this reason, any problem related to pea protein production, as already happened in the past, or to the relationship between the company and the supplier could highly damage Beyond Meat business. In addition, Beyond Meat does not hold any written contract with its co-manufacturers, causing a possible future instability if any manufacturing problem arises. The result of these two elements is a fragile production chain that the company should aim to stabilize in the near future.

Secondly, the company depends highly on the performance of its best-selling product, The Beyond Burger, that accounted respectively 48% and 70% of gross revenues in 2017 and 2018. Therefore, even this revenue concentration is not beneficial to a stable growth, and for this reason the company is already investing strongly on his research department to diversify its portfolio and to increase innovation.

These two main risks factors have already been identified by Beyond Meat’s management, that is working to find solutions, while they are already planning to diversify the business internationally, starting from Europe in 2020.

As demonstrated by the stock rally, investors trust this new market and are also confident that Beyond Meat will be able to keep growing at this fast pace for a while.

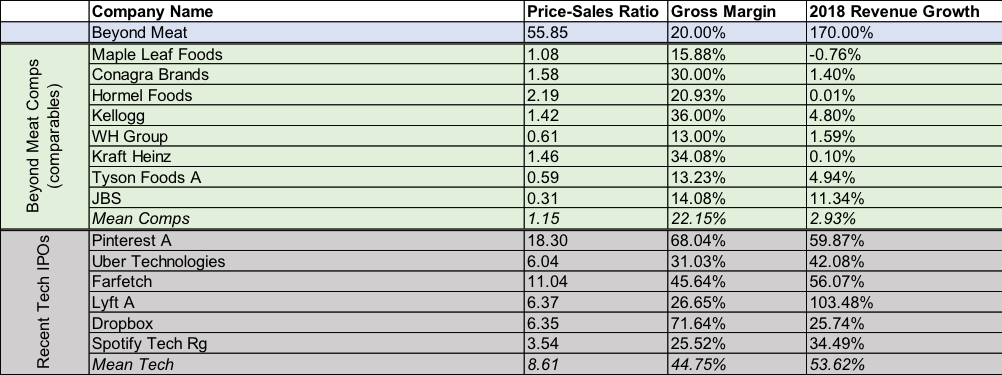

However, from the price-sales ratio below, it seems that investors are treating the company more as a Silicon Valley start-up, even thought we should not forget that Beyond Meat is still a food company. Indeed, the plant-based meat start-up has a far slimmer gross profit margin than the typical tech company, and, at the same time, Beyond Meat is operating in an already highly competitive market, with profitability margins that are expected to narrow even more.

These two main risks factors have already been identified by Beyond Meat’s management, that is working to find solutions, while they are already planning to diversify the business internationally, starting from Europe in 2020.

As demonstrated by the stock rally, investors trust this new market and are also confident that Beyond Meat will be able to keep growing at this fast pace for a while.

However, from the price-sales ratio below, it seems that investors are treating the company more as a Silicon Valley start-up, even thought we should not forget that Beyond Meat is still a food company. Indeed, the plant-based meat start-up has a far slimmer gross profit margin than the typical tech company, and, at the same time, Beyond Meat is operating in an already highly competitive market, with profitability margins that are expected to narrow even more.

The offer was led by Goldman Sachs & Co., J.P. Morgan and Credit Suisse, that acted as underwriters’ representatives, with Merrill Lynch, Jefferies and William Blair & Co as co-managers, and they hold an option to access an additional 1.44 million shares for over-allotments, that could drive the capital raised even higher.

Lorenzo Gimigliano

Lorenzo Gimigliano