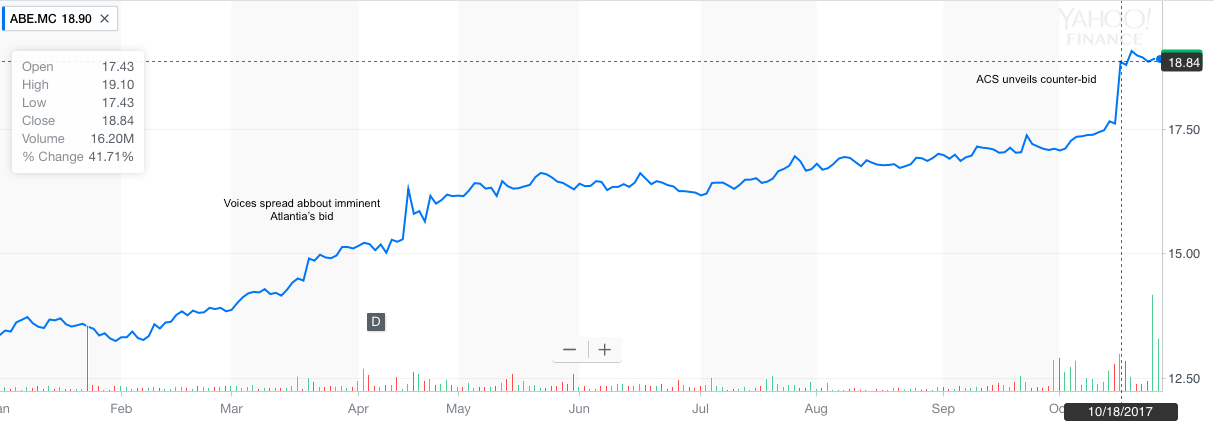

It is October 19 news that Hochtief, the German subsidiary construction group of ACS, Spain-based construction and engineering giant, has made a counteroffer to the €16.3 billion takeover bid for Abertis, launched by Atlantia earlier this year.

On the 15th of May, the Italian toll operator had unveiled its proposals, which consisted in an all-cash offer, valuing the rival company Abertis at €16.50 a share, as well as in a stock alternative.

The latter option, aimed, in particular, at gaining the approval of the Barcelona-headquartered Criteria, holding of the Caixa foundation, and owner of a 22.3 percent stake in Abertis.

On the basis of the share alternative structure, Atlantia would issue unquoted stock, not available for sale until February 2019, at a fixed conversion rate of 0.697 per Abertis share, for up to 23.2 per cent of the total offer, that is, slightly more than Criteria’s stake, then valuing the company at €17.34 per share.

As highlighted by the FT (1), the share-swap offering would not be an attractive solution to the majority of Abertis’s investors, but is instead a clearly ad-hoc strategy to win the endorsement of a long-term financial investor such as Criteria, which, besides retaining its current claim on dividends, projected to increase, would get the right to appoint three directors on Atlantia’s Board, enlarged to 18 members. It is also true, however, that the latter valuation would account for a more generous control premium over the, undisturbed, market value of the Spanish company.

If this scenario were to become reality, Criteria would own around 15 per cent of Atlantia, while Edizione, the investment vehicle of billionaire Benetton family, would suffer a 5 percent dilution of its 30 percent stake in the company.

Moreover, Atlantia promised not to delist Abertis, and is instead planning to transfer its Latin American assets to the latter.

On the 19th of October, according to Spanish takeover law, Abertis should have officially responded to Atlantia’s offer. It was therefore a “coup-de-teatre” the €18.76 per share cash offer made on Wednesday by Hochtief, which also made available a stock-swap option, at a 0.1281 for newly-issued Hochtief share conversion rate.

This latter bid provides a slightly more generous valuation of Abertis, at around €17.1 billion.

While Atlantia, in the words of CEO Giovanni Castellucci, is considering raising the bid, which, according to Abertis’s Board, has “margins of improvement” (2), both options seem more favourable to the bidders than to the seller.

Starting from Atlantia, the Italian company, by means of the acquisition, would reduce its exposure to country-specific risk, being its assets, which also include Ciampino and Fiumicino airports, heavily concentrated in the home market. Furthermore, the low acquisition premium, of around 10 percent, entailed by the offer, although deriving by nearly inexistent room for synergies, is still an appealing investment opportunity.

Finally, by means of the takeover, Atlantia could boost its cash flows by building scale, another reason that advocates for a counter-offer by the Italian company being likely.

As far as Hochtief is concerned, instead, the plan laid out by ACS, whose CEO Florentino Perez is also President of UCL Final 2017 Winner Real Madrid, is more subtle, financially speaking.

The FT (3) explains that, by buying Abertis, besides diversifying its portfolio, particularly subject to the volatility of the construction sector, ACS would also manage in funding the deal with debt, without this appearing on its balance sheet.

Indeed, following the takeover, its 72 percent stake in Hochtief would diminish by more than 22 percent, thus cancelling the effect of the €12 billion loading of net debt, used to finance the cash payment, onto the German subsidiary. The result would, moreover, leave ACS with a strong power in the combined group.

On the side of Abertis instead, despite a soar in market value throughout 2017, the sky looks cloudier.

Apart from the, possible, integration of the assets Atlantia owns in Chile and Brazil into the company, Abertis does not seem to be reaping much benefit from the deal, also considering the fact that the Spanish toll operator is, differently from the former, already well-diversified as far as its EBITDA sources are concerned.

Conversely, accepting ACS’s bid would mean adding to Abertis the volatility of the bidder’s cash flows, which, although being an advantage for ACS’s shareholders, may prove harmful to Abertis creditors.

To make things even more complicated, Abertis has recently moved its headquarters from Barcelona to Madrid, “due to the legal uncertainty generated by the current political situation” (4).

(1) Source: FT

(2) Source: FT

(3) Source: FT

(4) Source: FT

On the 15th of May, the Italian toll operator had unveiled its proposals, which consisted in an all-cash offer, valuing the rival company Abertis at €16.50 a share, as well as in a stock alternative.

The latter option, aimed, in particular, at gaining the approval of the Barcelona-headquartered Criteria, holding of the Caixa foundation, and owner of a 22.3 percent stake in Abertis.

On the basis of the share alternative structure, Atlantia would issue unquoted stock, not available for sale until February 2019, at a fixed conversion rate of 0.697 per Abertis share, for up to 23.2 per cent of the total offer, that is, slightly more than Criteria’s stake, then valuing the company at €17.34 per share.

As highlighted by the FT (1), the share-swap offering would not be an attractive solution to the majority of Abertis’s investors, but is instead a clearly ad-hoc strategy to win the endorsement of a long-term financial investor such as Criteria, which, besides retaining its current claim on dividends, projected to increase, would get the right to appoint three directors on Atlantia’s Board, enlarged to 18 members. It is also true, however, that the latter valuation would account for a more generous control premium over the, undisturbed, market value of the Spanish company.

If this scenario were to become reality, Criteria would own around 15 per cent of Atlantia, while Edizione, the investment vehicle of billionaire Benetton family, would suffer a 5 percent dilution of its 30 percent stake in the company.

Moreover, Atlantia promised not to delist Abertis, and is instead planning to transfer its Latin American assets to the latter.

On the 19th of October, according to Spanish takeover law, Abertis should have officially responded to Atlantia’s offer. It was therefore a “coup-de-teatre” the €18.76 per share cash offer made on Wednesday by Hochtief, which also made available a stock-swap option, at a 0.1281 for newly-issued Hochtief share conversion rate.

This latter bid provides a slightly more generous valuation of Abertis, at around €17.1 billion.

While Atlantia, in the words of CEO Giovanni Castellucci, is considering raising the bid, which, according to Abertis’s Board, has “margins of improvement” (2), both options seem more favourable to the bidders than to the seller.

Starting from Atlantia, the Italian company, by means of the acquisition, would reduce its exposure to country-specific risk, being its assets, which also include Ciampino and Fiumicino airports, heavily concentrated in the home market. Furthermore, the low acquisition premium, of around 10 percent, entailed by the offer, although deriving by nearly inexistent room for synergies, is still an appealing investment opportunity.

Finally, by means of the takeover, Atlantia could boost its cash flows by building scale, another reason that advocates for a counter-offer by the Italian company being likely.

As far as Hochtief is concerned, instead, the plan laid out by ACS, whose CEO Florentino Perez is also President of UCL Final 2017 Winner Real Madrid, is more subtle, financially speaking.

The FT (3) explains that, by buying Abertis, besides diversifying its portfolio, particularly subject to the volatility of the construction sector, ACS would also manage in funding the deal with debt, without this appearing on its balance sheet.

Indeed, following the takeover, its 72 percent stake in Hochtief would diminish by more than 22 percent, thus cancelling the effect of the €12 billion loading of net debt, used to finance the cash payment, onto the German subsidiary. The result would, moreover, leave ACS with a strong power in the combined group.

On the side of Abertis instead, despite a soar in market value throughout 2017, the sky looks cloudier.

Apart from the, possible, integration of the assets Atlantia owns in Chile and Brazil into the company, Abertis does not seem to be reaping much benefit from the deal, also considering the fact that the Spanish toll operator is, differently from the former, already well-diversified as far as its EBITDA sources are concerned.

Conversely, accepting ACS’s bid would mean adding to Abertis the volatility of the bidder’s cash flows, which, although being an advantage for ACS’s shareholders, may prove harmful to Abertis creditors.

To make things even more complicated, Abertis has recently moved its headquarters from Barcelona to Madrid, “due to the legal uncertainty generated by the current political situation” (4).

(1) Source: FT

(2) Source: FT

(3) Source: FT

(4) Source: FT

Spanish regulators are reviewing the deal, in which many premier investment banks are involved: Mediobanca, Credit Suisse and Santander are advising Atlantia, whereas JPMorgan, Key Capital Partners and Lazard are advising ACS.

Finally, Citi and AZ Capital are advising Abertis.

Were a counter-offer by Atlantia to heat-up the bidding war, as probably the strategy of Abertis’s advisers aims at, the deal would become one of the most disputed globally.

In any case, of one thing we can be sure: M&A is still a hot topic in Europe, and, in the words of Luigi de Vecchi, chairman of Citi in Europe, who advised Essilor in its mega-merger with Luxottica in January, and is advising Spain’s Abertis, the ongoing consolidation trend in Europe demonstrates that “European champions” (5) are increasingly relying on cross-border deal making to be competitive and successful on the international stage.

Carlo Daniele Urbano

(5) Source: FT

Finally, Citi and AZ Capital are advising Abertis.

Were a counter-offer by Atlantia to heat-up the bidding war, as probably the strategy of Abertis’s advisers aims at, the deal would become one of the most disputed globally.

In any case, of one thing we can be sure: M&A is still a hot topic in Europe, and, in the words of Luigi de Vecchi, chairman of Citi in Europe, who advised Essilor in its mega-merger with Luxottica in January, and is advising Spain’s Abertis, the ongoing consolidation trend in Europe demonstrates that “European champions” (5) are increasingly relying on cross-border deal making to be competitive and successful on the international stage.

Carlo Daniele Urbano

(5) Source: FT