K-Pop has never been more popular. How valuable is K-pop to the South Korean economy is a little tricky to quantify but surely it is playing an increasingly important role. It contributes to the so-called “Korean culture export” that values 10 billion dollars annually according to local economists, but this figure is a little bit skewed because includes gaming and movies but it does not include around 5 billion dollars in annual sales of consumer goods like make-up and cosmetics which are getting a real boost from the k-pop style popularity particularly in Asia.

Big Hit Entertainment, the music label of South Korean boy band BTS, has chosen JPMorgan, NH Investment and Securities and others to handle its initial public offering (IPO), according to media reports. The IPO could be one of the largest in years in the country’s entertainment industry, with its total valuation expected to be as high as 6 trillion won ($5 billion), the reports said, citing industry sources. Big Hit Entertainment has chosen three local brokerage firms - NH Investment & Securities, Korea Investment & Securities, and Mirae Asset Daewoo for the IPO, sources with direct knowledge of the matter.

Founded in 2005, the South Korean talent agency behind global sensation BTS has helped the South Korean superstar boy band score megahits globally and sell out U.S. stadiums. BTS also performed at the Grammy Awards in Los Angeles last month.

BTS broke into the U.S. market in 2017 and was the first Korean group to win a Billboard music award. The band is set to launch a new world tour in April 2020.

Founder Bang Si-hyuk held the biggest stake of about 43.06% in Big Hit Entertainment as of the end of 2018, followed by gaming company Netmarble Corp’s 25.22%, according to a regulatory filing by the music label. In March 2019, the company announced its 2018 audit report. They experienced a 132% increase in sales compared to 2017 making approximately 214.2 billion won, or about US$189.38 million. They had a 97% percent increase in operating profit for the year making 64.1 billion won (US$56.72 million) and a 105% percent increase in net profit, making 50.2 billion won (US$44.41 million).

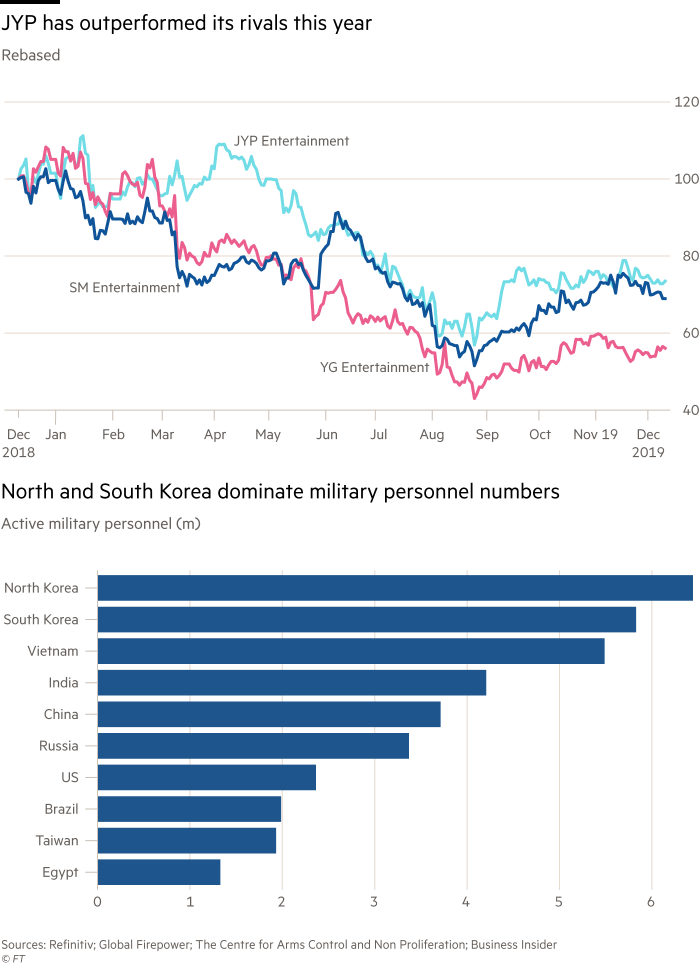

Let us now focus on the business model of these Korean entertainment companies. Looking at the already listed main competitors of Big Hits Entertainment we notice that returns on some entertainment stocks have been phenomenal. Shares in JYP Entertainment, one of the top three music businesses, rose by about 3,000 percent in the eight years to its peak last October. Anyway, their business model is flawed. A couple of K-pop groups may bring in most of a company’s revenues. For JYP, revenues from a single boy band, 2PM, were once over half its total. A new hit band can triple the previous year’s revenues. A flop means years of investment is lost. Idols, as the stars are called, spend up to a decade training at the company’s expense. There is no in-between.

Luck plays an outsized role, making it difficult to predict or replicate successes. For boy bands that do find fame, a further problem awaits them in their 20s, at the peak of their popularity: up to 24 months of mandatory military service. For larger groups, staggered enlisting times can mean up to a decade out of the public eye. By the time stars switch back from camouflage to make-up, younger rivals abound.

Stocks generally start declining a year ahead of the date the oldest band member is slated to enlist. Shares in YG Entertainment, which represents singing sensations Big Bang, fell 38 percent during this period. Operating profits slid by a quarter after the band members’ service started.

Almost two-thirds of all revenues come from concerts and TV ad appearances. These require artists to be present. Entertainment companies have, nevertheless, diversified into restaurant chains, cosmetics, and even private equity. The failure of such ventures has dogged earnings in the past year.

Big Hit Entertainment, the music label of South Korean boy band BTS, has chosen JPMorgan, NH Investment and Securities and others to handle its initial public offering (IPO), according to media reports. The IPO could be one of the largest in years in the country’s entertainment industry, with its total valuation expected to be as high as 6 trillion won ($5 billion), the reports said, citing industry sources. Big Hit Entertainment has chosen three local brokerage firms - NH Investment & Securities, Korea Investment & Securities, and Mirae Asset Daewoo for the IPO, sources with direct knowledge of the matter.

Founded in 2005, the South Korean talent agency behind global sensation BTS has helped the South Korean superstar boy band score megahits globally and sell out U.S. stadiums. BTS also performed at the Grammy Awards in Los Angeles last month.

BTS broke into the U.S. market in 2017 and was the first Korean group to win a Billboard music award. The band is set to launch a new world tour in April 2020.

Founder Bang Si-hyuk held the biggest stake of about 43.06% in Big Hit Entertainment as of the end of 2018, followed by gaming company Netmarble Corp’s 25.22%, according to a regulatory filing by the music label. In March 2019, the company announced its 2018 audit report. They experienced a 132% increase in sales compared to 2017 making approximately 214.2 billion won, or about US$189.38 million. They had a 97% percent increase in operating profit for the year making 64.1 billion won (US$56.72 million) and a 105% percent increase in net profit, making 50.2 billion won (US$44.41 million).

Let us now focus on the business model of these Korean entertainment companies. Looking at the already listed main competitors of Big Hits Entertainment we notice that returns on some entertainment stocks have been phenomenal. Shares in JYP Entertainment, one of the top three music businesses, rose by about 3,000 percent in the eight years to its peak last October. Anyway, their business model is flawed. A couple of K-pop groups may bring in most of a company’s revenues. For JYP, revenues from a single boy band, 2PM, were once over half its total. A new hit band can triple the previous year’s revenues. A flop means years of investment is lost. Idols, as the stars are called, spend up to a decade training at the company’s expense. There is no in-between.

Luck plays an outsized role, making it difficult to predict or replicate successes. For boy bands that do find fame, a further problem awaits them in their 20s, at the peak of their popularity: up to 24 months of mandatory military service. For larger groups, staggered enlisting times can mean up to a decade out of the public eye. By the time stars switch back from camouflage to make-up, younger rivals abound.

Stocks generally start declining a year ahead of the date the oldest band member is slated to enlist. Shares in YG Entertainment, which represents singing sensations Big Bang, fell 38 percent during this period. Operating profits slid by a quarter after the band members’ service started.

Almost two-thirds of all revenues come from concerts and TV ad appearances. These require artists to be present. Entertainment companies have, nevertheless, diversified into restaurant chains, cosmetics, and even private equity. The failure of such ventures has dogged earnings in the past year.

With BTS at the height of its popularity, it would be the right time to go public for Big Hit Entertainment, analysts said. But some are skeptical about the lofty valuation because of the aforementioned characteristic of the business. “The band members who are in their 20s must enlist for compulsory military service in a few years,” said Yoo Sung-man, an analyst at Hyundai Motor Securities. Big Hit Entertainment’s “valuable assets in their prime will be out of business for a while in the foreseeable future”.

Other analysts raised questions about the potential impact of the spiraling viral outbreak. There are clearly some risks. The virus can disrupt the band’s concerts worldwide, denting the company’s earnings this year.

The coronavirus epidemic has already derailed listings and disrupted deal-making in China, where the outbreak originated, and bankers have warned of an impact on activity more broadly across Asia. The Kospi Composite index fell 3.9 percent on the 24th of February as markets around the globe slumped in response to new evidence that the virus was spreading globally, before recovering some poise on the day after to post slight gains.

Daniele Notarnicola

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here: http://eepurl.com/gXkWpf

Cover image by Sebastian Ervi (Pexels).

Other analysts raised questions about the potential impact of the spiraling viral outbreak. There are clearly some risks. The virus can disrupt the band’s concerts worldwide, denting the company’s earnings this year.

The coronavirus epidemic has already derailed listings and disrupted deal-making in China, where the outbreak originated, and bankers have warned of an impact on activity more broadly across Asia. The Kospi Composite index fell 3.9 percent on the 24th of February as markets around the globe slumped in response to new evidence that the virus was spreading globally, before recovering some poise on the day after to post slight gains.

Daniele Notarnicola

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here: http://eepurl.com/gXkWpf

Cover image by Sebastian Ervi (Pexels).