In these weeks, the entire world is going through a challenging time facing this bulletproof virus, COVID-19. Among the many out of the ordinary phenomena that we are witnessing, it might be interesting to highlight the case of Blue Apron.

Blue Apron is an American company specialized in food delivery. Looking at the details, the company offers a service that consist of the delivery of a kit that should provide clients with all the tolls, ingredients and instructions necessary to prepare at home and by their own a real gourmet meal. The service is by subscription, offering between two and four meals per week for at least two people. The business started in early 2012 with the first 30 boxes sent to clients from a commercial kitchen. Since then the enterprise has grown and expanded its operations, up to the point of pricing an IPO in June 2017. However, the trend was not always positive, as one can see from the situation early this year, when, for the second time in the history of the firm, the stock or Blue Apron was approaching the “penny-stock” status. Due to the continuous decline, last June a 1-for-15 reverse stock split was initiated, unfortunately this did nothing to change the inclination or to prevent another decline. In early March the stock had fallen to as low as $2.01 per share. The idea was not particularly appreciated by the customers that favoured other ways and apps to order and receive food at their domiciles.

Nevertheless, in the last month, tables have turned; as we know there has been a heavy increase in the number of people infected in the USA, the country is now the first in the world for number of contagions. With this lockdown, in which much of the country is forced to stay home and restaurants or other eating places had to close their doors, the meal kit provider saw a sudden surge in orders and the business reached an unanticipated turning point. In a moment in which the majority of companies have laid off millions of workers due to lack of work or the impossibility to remain open, Blue Apron ramped up hiring new employees.

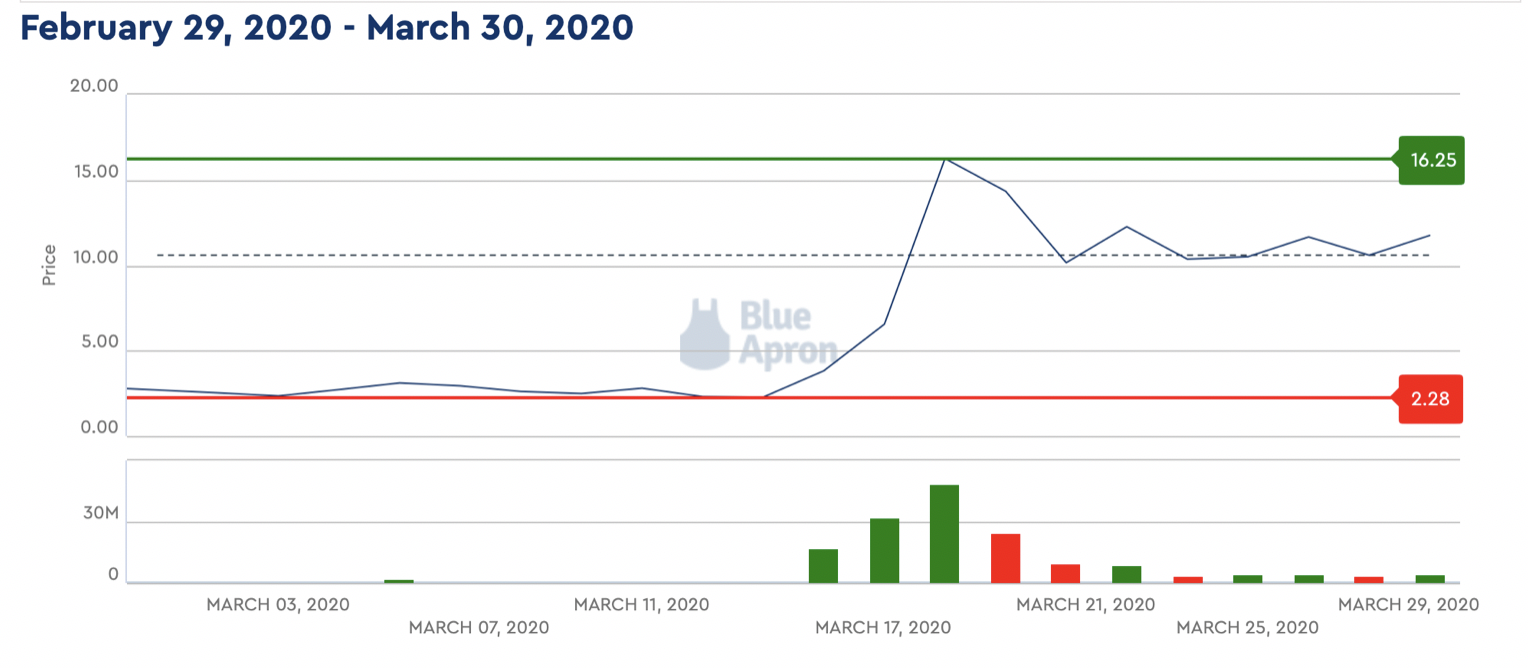

Many investors saw an excellent investment opportunity in this company, so they continued to buy shares until they more than doubled their value: the stock went from a price of $2.25 per share, on the 16th of March, to a maximum of $16.25 three days later. On the markets, this kind of movement falls pretested, because investors always try to evaluate the effective validity of the forecast. In fact, on the 19th of March the stock closed at $14.34, representing a decrease of around -12% in a single day. From then on, the trend fluctuated between $10 and $14 and closed the month of March with a value of approximately $11 per share. The doubling of the value is however an extraordinary event; it means that the market agents could evaluate the company's future earnings two times higher than before, while in the case of last week even 10 times as much.

Blue Apron is an American company specialized in food delivery. Looking at the details, the company offers a service that consist of the delivery of a kit that should provide clients with all the tolls, ingredients and instructions necessary to prepare at home and by their own a real gourmet meal. The service is by subscription, offering between two and four meals per week for at least two people. The business started in early 2012 with the first 30 boxes sent to clients from a commercial kitchen. Since then the enterprise has grown and expanded its operations, up to the point of pricing an IPO in June 2017. However, the trend was not always positive, as one can see from the situation early this year, when, for the second time in the history of the firm, the stock or Blue Apron was approaching the “penny-stock” status. Due to the continuous decline, last June a 1-for-15 reverse stock split was initiated, unfortunately this did nothing to change the inclination or to prevent another decline. In early March the stock had fallen to as low as $2.01 per share. The idea was not particularly appreciated by the customers that favoured other ways and apps to order and receive food at their domiciles.

Nevertheless, in the last month, tables have turned; as we know there has been a heavy increase in the number of people infected in the USA, the country is now the first in the world for number of contagions. With this lockdown, in which much of the country is forced to stay home and restaurants or other eating places had to close their doors, the meal kit provider saw a sudden surge in orders and the business reached an unanticipated turning point. In a moment in which the majority of companies have laid off millions of workers due to lack of work or the impossibility to remain open, Blue Apron ramped up hiring new employees.

Many investors saw an excellent investment opportunity in this company, so they continued to buy shares until they more than doubled their value: the stock went from a price of $2.25 per share, on the 16th of March, to a maximum of $16.25 three days later. On the markets, this kind of movement falls pretested, because investors always try to evaluate the effective validity of the forecast. In fact, on the 19th of March the stock closed at $14.34, representing a decrease of around -12% in a single day. From then on, the trend fluctuated between $10 and $14 and closed the month of March with a value of approximately $11 per share. The doubling of the value is however an extraordinary event; it means that the market agents could evaluate the company's future earnings two times higher than before, while in the case of last week even 10 times as much.

Source: NYSE

However, what can be observed is that earnings forecasts of Blue Apron still do not point to profitability; there are different motives to explain it. First of all, the main reason is that, hopefully, at some point in time, conditions will return to normality and people will start again to exit and to go to restaurants, therefore the demand for this kit might return to previous level.

Another major justification is that investors know that Blue Apron stock launched its IPO at a split-adjusted price of $150 per share and the company, from the beginning, faced intense headwinds.

The problem faced by the company is not related to Blue Apron itself but is broader and has always concerned meal kit services, the issue is the lack of a competitive moat. There in nothing that makes the service special or unique, any firm can launch a competing meal-kit business that can be better or as good as this one. It is true that coronavirus has temporarily increased the size of the market by scaling back the restaurant industry, but we must not to forget that very soon the outbreak will subside and eateries will reopen. At that point, consumers are likely to again lose interest in Blue Apron meal kits just as they did previously.

If we look into details, another interesting point to consider is that the comeback for Blue Apron stock is not as it appears. At first glance, it seems incredible, it rose about fourteen-fold from trough to peak. However, we have to consider that since the reverse split never occurred, right now the stock would be trading at not more than $0.75 per share.

In conclusion, the stock looks like an overreaction. Before this unexpected situation, Blue Apron was considering the possibility of selling itself or of merging with another companies. For the moment the virus has postponed that discussion. However, even with some increased business, the company still faces wide losses. The firm has already failed to show resilience in the face of competition. There is a high probability that once client’s habits return to normal the company might have to talk again about those exit strategies: meaning Blue Apron shares back to penny-stock status again. Given this risk, investors should consider the idea of modifying their strategy about Blue Apron as soon as possible.

Laura Garzino

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Another major justification is that investors know that Blue Apron stock launched its IPO at a split-adjusted price of $150 per share and the company, from the beginning, faced intense headwinds.

The problem faced by the company is not related to Blue Apron itself but is broader and has always concerned meal kit services, the issue is the lack of a competitive moat. There in nothing that makes the service special or unique, any firm can launch a competing meal-kit business that can be better or as good as this one. It is true that coronavirus has temporarily increased the size of the market by scaling back the restaurant industry, but we must not to forget that very soon the outbreak will subside and eateries will reopen. At that point, consumers are likely to again lose interest in Blue Apron meal kits just as they did previously.

If we look into details, another interesting point to consider is that the comeback for Blue Apron stock is not as it appears. At first glance, it seems incredible, it rose about fourteen-fold from trough to peak. However, we have to consider that since the reverse split never occurred, right now the stock would be trading at not more than $0.75 per share.

In conclusion, the stock looks like an overreaction. Before this unexpected situation, Blue Apron was considering the possibility of selling itself or of merging with another companies. For the moment the virus has postponed that discussion. However, even with some increased business, the company still faces wide losses. The firm has already failed to show resilience in the face of competition. There is a high probability that once client’s habits return to normal the company might have to talk again about those exit strategies: meaning Blue Apron shares back to penny-stock status again. Given this risk, investors should consider the idea of modifying their strategy about Blue Apron as soon as possible.

Laura Garzino

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.