The Middle East has been the biggest beneficiary by some margin of geopolitical turmoil in recent years, driven by price of oil and the search for a relatively safe haven, new money has flowed to the region. The result has been an IPO boom, thanks to the dearth of issuance elsewhere. As the Gulf IPO boom subsides, will better allocations for international investors, dual listing and better secondary-market liquidity be enough to ensure that the region's equity capital markets can mature?

Introduction

The Middle East is quickly becoming a hotbed for Initial Public Offerings (IPOs).

IPOs are a great way for companies to raise capital by issuing new shares to the public. This allows them to grow faster and tap into a wider pool of investors. Additionally, it gives these businesses a chance to refine their products and services before taking them to market.

Investors around the world are looking for opportunities in fast-growing economies, and the Middle East is no exception. With its large population and diversified economies, the Middle East has always been a vibrant region for business expansion. Over the past few years, the region has experienced substantial economic growth, which has led to an increase in external investment.

Indeed, the Middle East's fast-growing economy is leading to an increased demand for stock market products, making it a tempting destination for IPOs. With several high-profile deals in the pipeline, this trend shows no signs of slowing down.

This article will delve into the unique factors and recent changes that are driving the IPO boom in Middle Eastern countries, highlighting the differences between Abu Dhabi, Qatar, and Dubai. Additionally, it will compare the Middle East's IPO boom to Europe's declining trend and explore the unique circumstances contributing to this divergence.

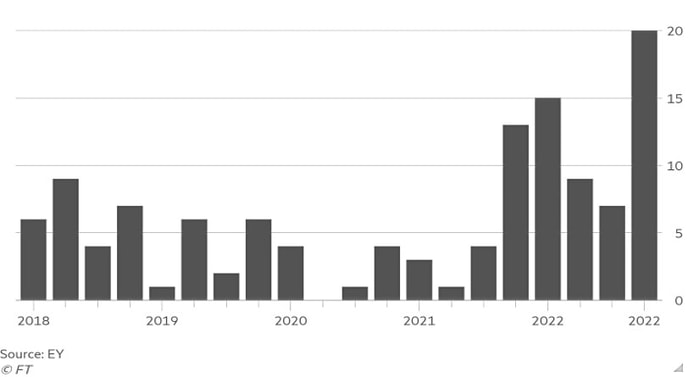

Listing in the Middle East and North Africa (quarterly totals)

The number of IPOs in the Middle East in 2022

Despite a global trend of declining initial public offerings, the Middle East has been experiencing a surge in IPOs, with the trend expected to continue throughout 2023. According to EY, the 51 IPOs across the Middle East and North Africa last year was a record, raising $22bn, a remarkable 179% increase from 2021, accounting for half of all the proceeds in Europe, the Middle East and Africa, as the region benefits from high crude oil prices and increased investor appetite.

This boom has been driven by financial regulatory reforms, a privatization push amid political stability, and rising oil and gas prices from their Covid-19 pandemic lows. Private capital fund managers also deployed $19.8bn in 191 Middle East deals last year, the only place in the world to post a year-on-year increase in investment value in 2022.

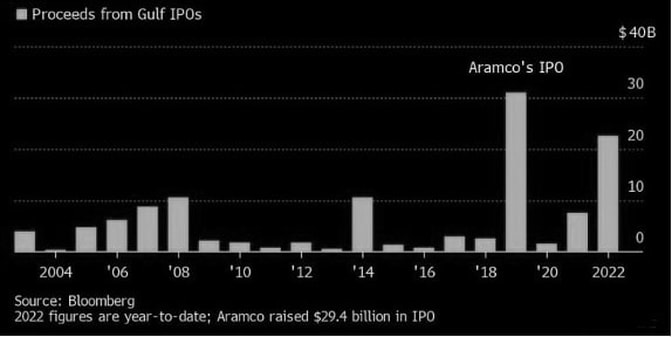

Saudi Arabia's stock market has been most affected by regulatory reforms and high oil prices, with the 2019 $29bn listing of oil supermajor Saudi Aramco kick-starting a surge of IPOs. Over the past five years, market capitalization has surged about 475%, with the market regulator revealing that there are now 269 listed companies compared with 188 at the end of 2017, with another 80 preparing to float. Abu Dhabi and Dubai have also seen a similar surge of listings, driven by attractive dividend yields, the availability of leverage, and a lack of deals elsewhere.

Booming in the Gulf: IPOs in this region have raised the most money after 2019 as the graph shows

Despite the region's stock markets giving up many of last year's gains fueled by rising oil prices, the IPO boom is expected to extend into next year as demand for regional assets grows. Governments in the Gulf region are listing assets to help diversify their economies away from fossil fuels and bring in more international investors.

As the region's leading global financial center and largest ecosystem of financial services-related companies, Dubai International Financial Centre (DIFC) is at the center of the region's IPO boom. DIFC's ecosystem of 4,031 registered companies includes the world's leading commercial and investment banks, asset managers, hedge funds, private equity and venture capital, as well as top legal, advisory, and consulting firms.

The Nasdaq First North Growth Market, based in DIFC, is a market formed in 2020 under the umbrella of Nasdaq Dubai that assists young businesses and small and medium-sized companies (SMEs) in raising capital through an IPO. Companies that list benefit by accessing diverse new sources of capital and by acquiring a more global profile. The booming IPO market is also providing the impetus for leading banks to expand their regional operations, which is funneling more talent into Dubai and resulting in new jobs and greater economic growth.

Therefore, the rush of deals is showing no sign of slowing.

As the region's leading global financial center and largest ecosystem of financial services-related companies, Dubai International Financial Centre (DIFC) is at the center of the region's IPO boom. DIFC's ecosystem of 4,031 registered companies includes the world's leading commercial and investment banks, asset managers, hedge funds, private equity and venture capital, as well as top legal, advisory, and consulting firms.

The Nasdaq First North Growth Market, based in DIFC, is a market formed in 2020 under the umbrella of Nasdaq Dubai that assists young businesses and small and medium-sized companies (SMEs) in raising capital through an IPO. Companies that list benefit by accessing diverse new sources of capital and by acquiring a more global profile. The booming IPO market is also providing the impetus for leading banks to expand their regional operations, which is funneling more talent into Dubai and resulting in new jobs and greater economic growth.

Therefore, the rush of deals is showing no sign of slowing.

Comparison of different countries in the Middle East

It is important to look more closely at the differences between Abu Dhabi, Qatar and Dubai; particularly as to what factors and recent changes can explain this boom within the respective locations.

With regards to Abu Dhabi, the oil sector is playing a major part. Indeed, as seen with the recent Adnoc IPO raising $2.5bn and becoming the largest listing thus far this year. It is clear that investors across all branches see great value with the overall increase in energy prices but also with the much-needed transition from fossil fuels which is actively being pursued by the UAE government.

Since the beginning of the Russian invasion of Ukraine, one country emerged as a clear economic winner: Qatar. This is mainly due to its very significant increase in liquified natural gas (LNG) exports to Europe where the demand soared over the past year. For example, the state-owned energy company Qatar Energy has largely increased its investments around the world particularly in various LNG terminals, further reinforcing the overall economy, leading to greater demand of investors in potential IPOs across many different industries.

Dubai contributed to this IPO boom in great part due to the privatization campaign of state-owned companies. The listing of the Dubai Electricity and Water Authority (Dewa) with a AED2.4 per share, is one of the many part-privatizations of previously government owned companies on the Dubai Financial Market. These privatizations have a clear aim of reviving and expanding capital markets in this rapidly growing region of the world.

Ultimately, given that around 90% of private owned companies are family owned in the Middle East, there has been a sharp increase of new heirs succeeding to the founders deciding to make their companies go public. This is mainly to have effective corporate governance, but also a method to avoid familial conflicts linked to successions. All of this, once again reinforcing the amount and value of IPOs in the respective stock exchanges.

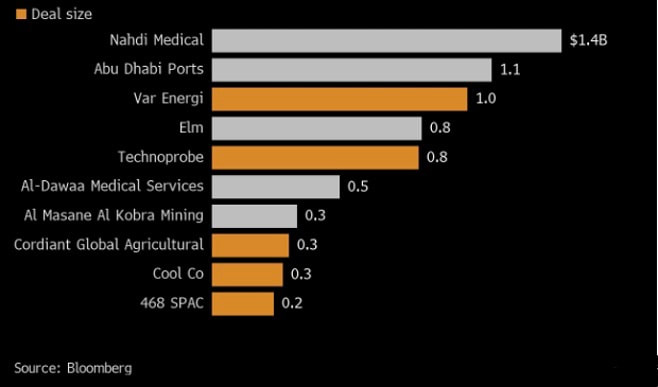

The chart shows that Middle East represents half of the biggest listings in EMEA priced in 2022-2023

Comparison with Europe

The IPO boom in the Middle East is largely the consequence of multiple specific factors that distinguish the gulf countries from other developed regions such as Europe. The trend of declining offerings seems to be a global phenomenon, as the number of IPOs have fallen from 2682 in 2021 to 1154 in 2022, so the case of the Middle East is definitely the outlier as opposed to the norm.

Most of the current wealth of the gulf countries comes from the sale of natural resources, namely oil and gas. The companies extracting and selling these resources are for the most part currently not private companies but managed by the states or the countries’ sovereign wealth funds. With the current push for privatization of these enterprises and the rising oil and gas prices, the economies of these countries are experiencing strong growth, a consequence of which is the rapid growth in the number of IPOs in the region, a record of 51.

In contrast to the Middle Eastern IPO boom, public offering activity has died down in Europe. Although there were some high-profile IPOs throughout the year such as Porsche’s listing on the Frankfurt Stock Exchange, both the volume and the value of IPOs in the region have significantly diminished. This decrease can be attributed to a number of different factors that have slowed down economic activity in the region at large, like the global economic slowdown, the war in Ukraine, increasing energy prices and rising interest rates. The uncertainty caused by these factors can be seen in the volatility of European stocks (VSTOXX50) which has been consistently above 20 in 2022, the number that is the maximum ideal value for this index, to support IPO activity.

Another sign of Europe’s weak IPO activity is the low number of high profile and volume IPOs. Of the ten largest offerings in 2022 globally, only one, the aforementioned Porsche IPO happened in Europe, and overall, eight out of the top ten took place in Asia, three in the United Arab Emirates.

Conclusion

In conclusion, the Middle East has seen a significant increase in IPOs, with the trend likely to continue through 2023. Financial regulatory changes, a privatization push amid political stability, and rising oil and gas prices from Covid-19 epidemic lows have all contributed to the noteworthy uptick in IPO activity.

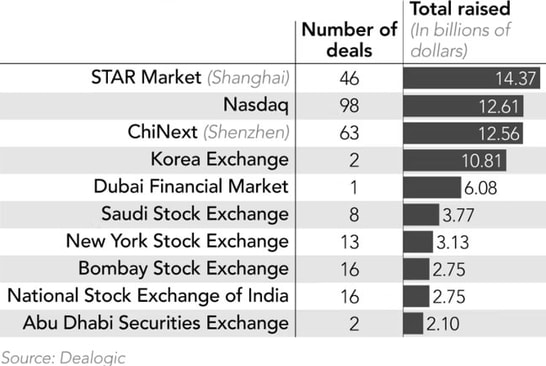

Top 2022 IPO markets

Despite the great figures, it is crucial to point out that the quality of these IPOs and their long-term profitability remain to be seen. Furthermore, it will be interesting to watch whether the region can prolong its IPO boom in the face of global economic issues such as inflation and geopolitical concerns.

Overall, while the increase in IPOs in the Middle East is a positive indicator of economic development and diversification, it is critical for investors and market authorities to ensure that the boom is sustainable and beneficial to all parties involved.

Overall, while the increase in IPOs in the Middle East is a positive indicator of economic development and diversification, it is critical for investors and market authorities to ensure that the boom is sustainable and beneficial to all parties involved.

By Vittoria Palmieri, Severinas Freigofas, Mate Mangoff, Ruben Van Der Lubbe

SOURCES

- Global Capital

- Arabian Business

- Bloomberg

- DIFC.ae

- Financial Times