Brexit! June 23rd! Referendum! These are the three big words that are shocking financial markets these days. Since UK Prime Minister David Cameron announced the UK’s EU referendum, volatility has spiked across markets and the increase in implied volatility (a measure of volatility which can be backed out from traded option prices) has reflected increasing investors’ uncertainty over the future.

What generally makes investors feel comfortable when major events are going to occur is the past. That is, past realizations of similar events are benchmarked by investors to gauge how the market will react this time. Unfortunately, however, in this case market participants are faced with an unprecedented event. The biggest concern for investors, regulators, rating agencies is that no country has ever left the EU before, even though many have tried in the past and will continue to try in the future.

That said, although some straightforward points can be raised both in favor and against Brexit, it is really hard to come to a definitive conclusion on whether it will positively or negatively affect the future of the UK. Therefore, from a trading perspective, it would be too risky to take exposure either by shorting or going long the UK stock market.

On the one hand, while it is true the UK joined the trade block in the early 1970s, when such block accounted for 36% of world GDP and that now accounts for 15% only, it is also true that more than 50 % of UK’s exports go to EU countries, which play an important role in fueling UK’s growth. A Brexit event would decrease Britain’s negotiating power with the EU and, in turn, would cause a sharp fall in the nominal value of exported goods. Pro-EU campaigners also point out that tax income would significantly drop if firms that carry out large transactions with the EU moved their headquarters back into the EU again.

JP Morgan CEO Jamie Deamon himself could not be clearer about the upheaval he thinks the City and his bank would suffer in case of a “Brexit”. In an interview released to the Financial Times, he warns of a “massive dislocation” to the financial hub that could wash away decades of growth and scatter international banks all across Europe.

For the reasons above, it is evident that many jobs are linked to the EU and that the labor market would be negatively affected if the outcome of the referendum was “no”. Indeed, up to 3 million jobs would be lost if Britain decides to leave the union, according to recent studies.

On the other hand, it is worthwhile mentioning that Britain pays direct ‘membership’ costs of £17.4bn and that, therefore, a decision to leave would free up important capital to be invested in profitable investment opportunities elsewhere. Furthermore, Eurosceptics argue that leaving the EU will allow the City to thrive. It would be freed from Bruxelles burocracy and from stringent rules that limit Britain’s growth potential, bounding the future of the country to that of slower nations.

After such considerations, there is no clear-cut conclusion on whether the majority of voters will opt for a “yes” rather than a “no”. Neither outcome can be ruled out. Also, we are not able to predict how markets will perceive the outcome of the referendum, whatever it is. All we know for sure is that Brexit referendum is adding volatility to financial markets and that the FTSE 100 might enjoy wide swings in the run-up to the referendum on June 23. Therefore, it is hard for investors to make directional trades on the UK stock market (i.e. FTSE 100) in such an environment.

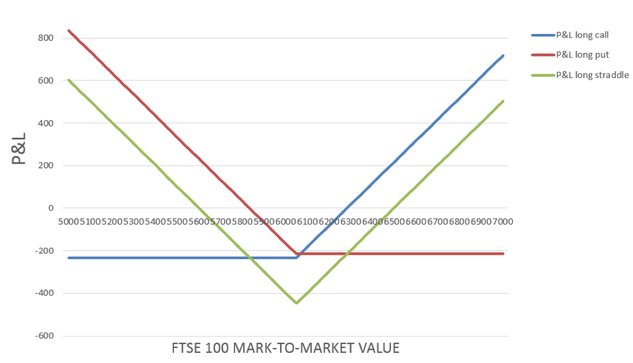

As a general principle, setting up a long straddle on the FTSE 100 would help profit from wide swings in the price of the underlying, the FTSE 100 itself. A long straddle is made up by a long call position and a long put position with same strike price and maturity.

It is important to remark that this trading strategy is not betting on implied volatility increasing or decreasing (which might as well justify a long straddle position) but rather on the price of the underlying being either well above or well below its current value upon maturity. The strategy is indeed intended to be liquidated at maturity and, for this reason, is developed with European options rather than American ones. Keep in mind that the absence of early exercise makes European options cheaper than their American counterparty!

The possibility of benefiting from both a fall or a rise in the UK markets comes at a cost: the typical price paid to set up this strategy is higher compared to other long-short trading strategies as it is the plain sum of two option premiums (that of the call and that of the put).

What generally makes investors feel comfortable when major events are going to occur is the past. That is, past realizations of similar events are benchmarked by investors to gauge how the market will react this time. Unfortunately, however, in this case market participants are faced with an unprecedented event. The biggest concern for investors, regulators, rating agencies is that no country has ever left the EU before, even though many have tried in the past and will continue to try in the future.

That said, although some straightforward points can be raised both in favor and against Brexit, it is really hard to come to a definitive conclusion on whether it will positively or negatively affect the future of the UK. Therefore, from a trading perspective, it would be too risky to take exposure either by shorting or going long the UK stock market.

On the one hand, while it is true the UK joined the trade block in the early 1970s, when such block accounted for 36% of world GDP and that now accounts for 15% only, it is also true that more than 50 % of UK’s exports go to EU countries, which play an important role in fueling UK’s growth. A Brexit event would decrease Britain’s negotiating power with the EU and, in turn, would cause a sharp fall in the nominal value of exported goods. Pro-EU campaigners also point out that tax income would significantly drop if firms that carry out large transactions with the EU moved their headquarters back into the EU again.

JP Morgan CEO Jamie Deamon himself could not be clearer about the upheaval he thinks the City and his bank would suffer in case of a “Brexit”. In an interview released to the Financial Times, he warns of a “massive dislocation” to the financial hub that could wash away decades of growth and scatter international banks all across Europe.

For the reasons above, it is evident that many jobs are linked to the EU and that the labor market would be negatively affected if the outcome of the referendum was “no”. Indeed, up to 3 million jobs would be lost if Britain decides to leave the union, according to recent studies.

On the other hand, it is worthwhile mentioning that Britain pays direct ‘membership’ costs of £17.4bn and that, therefore, a decision to leave would free up important capital to be invested in profitable investment opportunities elsewhere. Furthermore, Eurosceptics argue that leaving the EU will allow the City to thrive. It would be freed from Bruxelles burocracy and from stringent rules that limit Britain’s growth potential, bounding the future of the country to that of slower nations.

After such considerations, there is no clear-cut conclusion on whether the majority of voters will opt for a “yes” rather than a “no”. Neither outcome can be ruled out. Also, we are not able to predict how markets will perceive the outcome of the referendum, whatever it is. All we know for sure is that Brexit referendum is adding volatility to financial markets and that the FTSE 100 might enjoy wide swings in the run-up to the referendum on June 23. Therefore, it is hard for investors to make directional trades on the UK stock market (i.e. FTSE 100) in such an environment.

As a general principle, setting up a long straddle on the FTSE 100 would help profit from wide swings in the price of the underlying, the FTSE 100 itself. A long straddle is made up by a long call position and a long put position with same strike price and maturity.

It is important to remark that this trading strategy is not betting on implied volatility increasing or decreasing (which might as well justify a long straddle position) but rather on the price of the underlying being either well above or well below its current value upon maturity. The strategy is indeed intended to be liquidated at maturity and, for this reason, is developed with European options rather than American ones. Keep in mind that the absence of early exercise makes European options cheaper than their American counterparty!

The possibility of benefiting from both a fall or a rise in the UK markets comes at a cost: the typical price paid to set up this strategy is higher compared to other long-short trading strategies as it is the plain sum of two option premiums (that of the call and that of the put).

In our specific case, the underlying of both the call and the put would be the FTSE 100 and the strike price of such options would be the same, set for simplicity at the current market value of the underlying index (around 6050). It is important to highlight that we are buying at the money options, as the strike prices of both options is equal to the current market value of the underlying asset.

Given that the 6050 FTSE 100 call with maturity June 2016 trades at 232 while the 6050 FTSE 100 put, with same maturity, trades at 215, it is clear two breakeven points can be identified: one at 5603 and the other at 6497. The former value represents the value of the FTSE 100 Index below which the strategy yields a gain, while the latter one indicates the value of the index above which our P&L turns positive. As we can see, these values are not randomly selected but are the results of a rather intuitive consideration. Our position will start making money when the cost of setting up the strategy, represented by the sum of the two premiums, is offset by realized gains on the strategy.

In our case, we would need the underlying index to oscillate up or down by roughly 8% for our strategy to deliver a net profit upon maturity, which is reasonable in periods of market uncertainty. Finally, it is worthwhile pointing out that in case our intuition were wrong and the FTSE 100 Index remained at current levels, the strategy would lead to huge losses due to the payment of two premiums.

Federico Rendina

Given that the 6050 FTSE 100 call with maturity June 2016 trades at 232 while the 6050 FTSE 100 put, with same maturity, trades at 215, it is clear two breakeven points can be identified: one at 5603 and the other at 6497. The former value represents the value of the FTSE 100 Index below which the strategy yields a gain, while the latter one indicates the value of the index above which our P&L turns positive. As we can see, these values are not randomly selected but are the results of a rather intuitive consideration. Our position will start making money when the cost of setting up the strategy, represented by the sum of the two premiums, is offset by realized gains on the strategy.

In our case, we would need the underlying index to oscillate up or down by roughly 8% for our strategy to deliver a net profit upon maturity, which is reasonable in periods of market uncertainty. Finally, it is worthwhile pointing out that in case our intuition were wrong and the FTSE 100 Index remained at current levels, the strategy would lead to huge losses due to the payment of two premiums.

Federico Rendina