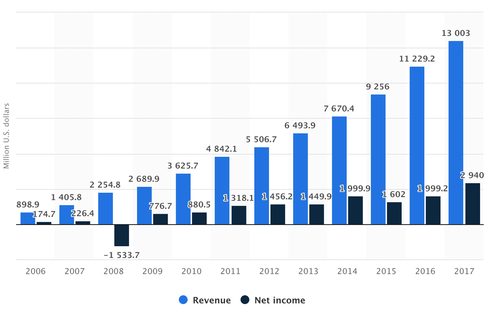

Revenue and net income of Celgene from 2006 to 2017 (in millions of U.S. Dollars)

Revenue and net income of Celgene from 2006 to 2017 (in millions of U.S. Dollars)

In January, the pharmaceutical company Bristol-Myers Squibb announced a $74 billion deal to acquire Celgene. The agreement, if signed-off by antitrust regulators, would become one of the largest pharmaceutical acquisitions in history and marks a significant development in cancer research efforts.

The Celgene Corporation, a New Jersey based biotechnology company, focuses on the development of medicines for cancer and inflammatory disorders. Since its foundation in 1986, it has become a leader in cancer research initiatives and seen significant growth, with annual revenues of $13 billion in 2017. As a result, the takeover by Bristol-Myers Squibb does not come as a surprise, but is much rather a strategic step to gain a frontrunner position within the industry. Mark Alles, Celgene’s CEO, explains that the agreement seeks to exploit “long-term growth opportunities created by the combined company”, with cost synergies of $2.5 billion to be generated by 2022.

The takeover itself takes the form of a cash and stock agreement, wherein Celgene shareholders receive $50 in cash compensation per share and are entitled to one share of Bristol-Myers Squibb, accounting to a takeover price of $102.43 per share. The deal is therefore valued at $74 billion and renders a 51% premium to shareholders. Additionally, at least $16 billion of debt is factored into the agreement, making the overall value just over $90 billion. In order to finance the deal, Bristol-Myers Squibb will take out one of the largest bridge loans ever, at an estimated $33.5 billion. For the investment banks advising the deal, the takeover ranks similarly among the largest payouts for advisory services, with an expected $304 million being paid to five banks. Most notably, Morgan Stanley will receive in excess of $125 million and JP Morgan another $100 million for their advisory and financing roles.

Looking ahead, it will be critical to see whether integration and debt payments can be overcome without the loss of potential synergies. From a medical perspective, the combined research units of the two firms will surely have increased capabilities and therefore establish a promising platform for growth and discovery. There is short-term revenue potential of up to $15 billion and since the product portfolios are said to complement each other, the combined company can look optimistically towards the coming years.

Nevertheless, the agreement has also sparked significant controversy and does not come without flaws. On one hand, the acquisition would give Bristol-Myers Squibb a truly dominant market position, especially with cancer treatment drugs. This could however mean increased costs for consumers and several US politicians have raised awareness of the consequences, with Democratic Presidential candidate Elizabeth Warren stating that “patients pay the price”. Furthermore, Celgene is involved in several patent suits, which if lost, could have devastating consequences and dramatically hit revenues. As such, more than half of Celgene’s revenue comes from the sale of a single drug, Revlimid, which may indicate an overreliance on that product.

Despite the hurdles that this agreement brings, antitrust regulators are expected to sign-off on the largest pharmaceutical agreement in recent history and it will be up to Bristol-Myers Squibb to make their expensive acquisition payoff, eventually.

Maximilian Lessing

The Celgene Corporation, a New Jersey based biotechnology company, focuses on the development of medicines for cancer and inflammatory disorders. Since its foundation in 1986, it has become a leader in cancer research initiatives and seen significant growth, with annual revenues of $13 billion in 2017. As a result, the takeover by Bristol-Myers Squibb does not come as a surprise, but is much rather a strategic step to gain a frontrunner position within the industry. Mark Alles, Celgene’s CEO, explains that the agreement seeks to exploit “long-term growth opportunities created by the combined company”, with cost synergies of $2.5 billion to be generated by 2022.

The takeover itself takes the form of a cash and stock agreement, wherein Celgene shareholders receive $50 in cash compensation per share and are entitled to one share of Bristol-Myers Squibb, accounting to a takeover price of $102.43 per share. The deal is therefore valued at $74 billion and renders a 51% premium to shareholders. Additionally, at least $16 billion of debt is factored into the agreement, making the overall value just over $90 billion. In order to finance the deal, Bristol-Myers Squibb will take out one of the largest bridge loans ever, at an estimated $33.5 billion. For the investment banks advising the deal, the takeover ranks similarly among the largest payouts for advisory services, with an expected $304 million being paid to five banks. Most notably, Morgan Stanley will receive in excess of $125 million and JP Morgan another $100 million for their advisory and financing roles.

Looking ahead, it will be critical to see whether integration and debt payments can be overcome without the loss of potential synergies. From a medical perspective, the combined research units of the two firms will surely have increased capabilities and therefore establish a promising platform for growth and discovery. There is short-term revenue potential of up to $15 billion and since the product portfolios are said to complement each other, the combined company can look optimistically towards the coming years.

Nevertheless, the agreement has also sparked significant controversy and does not come without flaws. On one hand, the acquisition would give Bristol-Myers Squibb a truly dominant market position, especially with cancer treatment drugs. This could however mean increased costs for consumers and several US politicians have raised awareness of the consequences, with Democratic Presidential candidate Elizabeth Warren stating that “patients pay the price”. Furthermore, Celgene is involved in several patent suits, which if lost, could have devastating consequences and dramatically hit revenues. As such, more than half of Celgene’s revenue comes from the sale of a single drug, Revlimid, which may indicate an overreliance on that product.

Despite the hurdles that this agreement brings, antitrust regulators are expected to sign-off on the largest pharmaceutical agreement in recent history and it will be up to Bristol-Myers Squibb to make their expensive acquisition payoff, eventually.

Maximilian Lessing