Over the last 20 years the insurance industry has experienced many bankruptcies due to natural disasters. Indeed, estimating natural disasters’ occurrence probability is highly complicated and even with widely-adopted financial tools such as reinsurance systems, insurance companies will be very likely to be insolvent when the natural peril occurs as they have to pay a great amount of money to policyholders. However, in the aftermath of Andrew Hurricane (1992) and Northridge earthquake (1994), Swiss Re, the most important Swiss reinsurer, developed a new financial tool, named CAT Bonds (Catastrophic Bonds), to mitigate this risk.

Cat bonds are a standardized method for transferring insurance risk to capital markets. Their mechanism is the following:

Cat bonds are a standardized method for transferring insurance risk to capital markets. Their mechanism is the following:

- The insurance company implements a special purpose vehicle (SPV);

- The SPV establishes a “reinsurance agreement” with the insurance company;

- The SPV issues CAT bonds to investors, whose maturity are in general 3 years, in exchange of periodic payments (usually quarterly);

- If a covered catastrophe exceeding the “trigger” point, defined in the bond’s contract, occurs during the period before maturity, then the bond defaults and a portion or all the principal paid for the bonds by the investors may not be returned, going to cover the issuer’s indemnities. On the other hand, if no catastrophe occurs then the invested capital is returned to the investors.

CAT bonds are generally issued by reinsurers but also by insurers, government entities, corporations, pension funds, or even no-profit organizations.

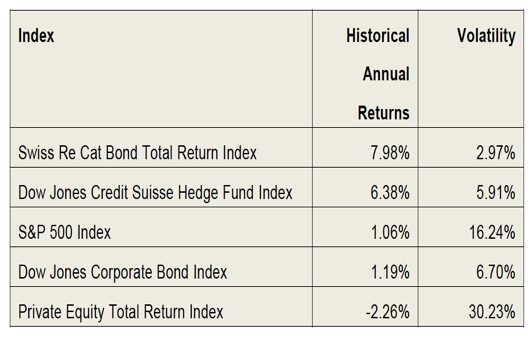

On the other side, investors are represented in general by fund managers, which absorb approximately 70% of new issuance, institutional investors, money managers and pension funds. CAT bonds keep attracting investors since the risk of the latter is virtually uncorrelated with the other risks that investors assume, such as the risk of equity market fluctuations, credit risk, and interest rate risk and because the return rate is extremely high. Recent CAT bonds’ spreads have been approximately 2-3% higher than those of comparably rated high-yield corporate bonds, and the rates of return have averaged 7-9% annually since 2002 with small volatility.

On the other side, investors are represented in general by fund managers, which absorb approximately 70% of new issuance, institutional investors, money managers and pension funds. CAT bonds keep attracting investors since the risk of the latter is virtually uncorrelated with the other risks that investors assume, such as the risk of equity market fluctuations, credit risk, and interest rate risk and because the return rate is extremely high. Recent CAT bonds’ spreads have been approximately 2-3% higher than those of comparably rated high-yield corporate bonds, and the rates of return have averaged 7-9% annually since 2002 with small volatility.

However, as Cat Bonds are a less risky financial investment due to the lack of correlations with other assets, their return rate should be inferior to the one of the corporate bond for a given rating. Therefore, Investors in CAT bonds seems to earn a liquidity and novelty premium as the average return is typically in the range of 5%-15% above Libor

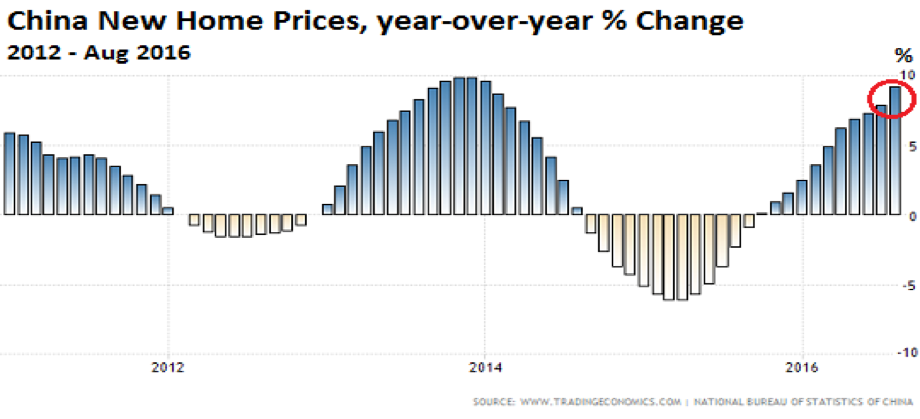

It’s also interesting to notice in the graph above, CAT bonds return rate was not affected by Lehman brother bankruptcy as well as by natural disasters. The price of CAT bonds is mainly driven by the reinsurance pricing which heavily depends on catastrophe occurrence and severity. The attractiveness of CAT Bonds finds evidence also in the words of Judith Klugman, managing director of Swiss Re Capital Markets, who states: “Demand for cat bonds is far outstripping the supply. There is only so much natural catastrophe risk to go around. And the bid/ask spread on the bonds [the trading costs] is extremely tight, as in only 10 or 20 % per trade.” Although these bonds are not directly correlated with financial assets, there are some indirect links. Indeed, if reinsurers experience a downturn, the insurance rate will tend to increase as well as the CAT bond rate, which will put pressure on the CAT bonds already issued.

Emanuele Fabbri