On February 19, 2024, US banking giant Capital One announced its acquisition of Discover Financial Services, in an all-stock $35.3bn deal. If approved, Capital One would become the 6th largest US bank by assets while effectively forming the most extensive US credit card issuing firm with over 300 million cardholders.

Capital One Overview

Founded in 1994 as a mere subsidiary in the credit card division of Signet Financial Corp, Capital One has since become America’s 9th largest bank, boasting an immense $468.5bn in assets and $348.4bn in deposits as of December 31st, 2023. The Fortune 500 company offers a multitude of financial services to various types of clients ranging from individual consumers to large commercial companies. Capital One is divided into three divisions: credit cards, consumer banking, and commercial banking. The bank is also a leading auto loan provider with over $75bn in auto loans receivable. Currently, Capital One is traded on the NYSE for roughly $140 a share, with a market capitalization of $55.22bn.

Discover Financial Services Overview

Introduced by the now-bankrupt retailer Sears in 1985, Discover Financial Services is the owner of Discover Bank, an online bank that offers various financial services, including checking and savings accounts, diverse consumer loans, and most importantly the Discover credit card, the US’s third-largest credit card brand with over 60 million cardholders. Discover is notorious for inventing the concept of “cashback” on purchases, which became a huge driver of the firm’s growth, helping it build its immense customer base. Discover Financial Services operates the Discover Global Network, which is composed of the Discover Network and the acquired companies PULSE and Diners Club International, a leading electronic funds transfer and global payments network respectively. Discover Financial Services is currently traded on the NYSE for around $120 a share with a market capitalization of $32.07bn.

Deal Structure

Capital One’s acquisition of Discover Financial Services, the largest FIG deal of the year so far, was an all-stock transaction worth $35.3bn consisting of 257,340,768 new Capital One shares valued at its one-day prior price. Each Discover Financial shareholder would receive 1.0192 shares of Capital One common stock.

Capital One paid a fairly considerable premium, namely 43.70% one month before the announcement, which further decreased to 26.59% the day before. The two companies have similar Debt/Equity and Profit Margin ratios, namely 47.43% vs 46.77% and 22.75% vs 18.54%. However, the Return on Equity for Discover Financial is significantly superior, 19.83% vs 8.41%, making it a more attractive opportunity for investors.

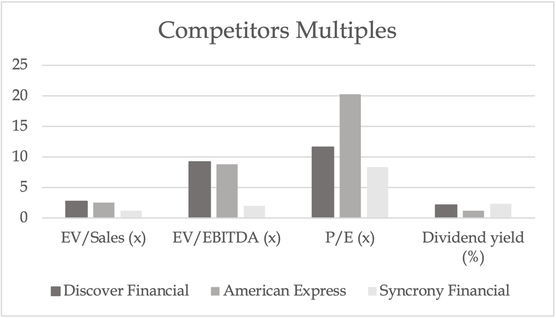

At the moment of the transaction, Discover Financial’s most important multiples were the following: Enterprise Value/Sales of 2.7x, Enterprise Value/EBITDA of 9.2x, Price/Earnings of 11.6x, and Dividend Yield of 2.1%. The two main competitors of Capital One and Discover Financial Services are American Express Company and Synchrony Financial. AMEX has an Enterprise Value/Sales of 2.5x, Enterprise Value/EBITDA of 8.8x, Price/Earnings of 20.3x, and Dividend Yield of 1.2% showing similar ratios with Discover Financial, although a higher Price/Earnings ratio due to its established position in the credit cards industry. On the other hand, Synchrony Financial has Enterprise Value/Sales of 1.2x, Enterprise Value/EBITDA of 2.0x, Price/Earnings of 8.3x, and a Dividend Yield of 2.3% showing potential risks, uncertainty, and concerns about future growth prospects.

Strategic Rationale

The acquisition of Discover Financial Services by Capital One–if approved by regulators– would create the biggest U.S. credit-card issuer by loans, with around $250bn in outstanding balances and a market share of 19%, ahead of current market leader JPMorgan Chase’s 16%. This would allow Capital One to compete more effectively in the lucrative realm of payment networks, alongside industry titans Visa, Mastercard, and American Express. By transitioning some of its current Visa and Mastercard customers to the Discover network, the acquisition would lead to a "realignment" of the credit card industry and overall more competition.

The deal would turn Capital One into a globally competitive payments network, by acquiring Discover’s 70 million merchant acceptance points in over 200 countries. This deal would also accelerate the company's long-standing journey to work directly with merchants. Leveraging its customer base, technology, and data ecosystem, it would generate more sales for merchants and greater deals for consumers and small businesses.

Capital One Bank is the only major bank with no fees, no minimums, and no overdraft fees. Adding Discover's fast-growing national direct savings bank will increase Capital One’s scale, allowing it to compete with the nation's largest banks and accelerating its growth in domestic banking. Furthermore, the acquisition of Discover’s eleven-year technology would bring innovations to Capital One, including faster speed to market and better underwriting.

The increase in scale would allow Capital One to be more competitive against Visa and Mastercard, which currently control a combined 83% of the credit card processing business and have a combined market capitalization of over $1tn.

Beyond scale, the acquisition is expected to create significant synergies. Both Capital One and Discover are established players within the banking industry and share a focus on customer satisfaction. Analysts expect this compatibility to result in streamlined processes and cost savings of up to $1.5bn (26% of Discover operating expenses plus 10% of Discover marketing expenses) and revenue synergies of up to $1.2bn by 2027. The acquisition would deliver a predicted return on invested capital (ROIC) of 16% and is expected to be more than 15% accretive to adjusted non-GAAP EPS. The balance sheet of Capital One would be significantly strengthened, with a CET1 ratio of around 14% and 84% of company deposits insured as of 2023.

Bank M&A Regulations

Shortly after Capital One’s acquisition of Discover Financial Services, an important US banking regulator proposed new rules, still subject to a 60-day comment period, intending to increase the difficulty of large bank mergers, after a group of lenders with more than $100bn in assets ran into difficulties.

The restriction will be directly applicable to any merger resulting in a bank with more than $50bn in assets and will be even stricter for those with over $100bn in assets. The new regulations consist of public hearings for merger applications, forward-looking representations, and commitments around prices, fees, banking services, or facility locations, which will result in a slower transaction approval and a potential decrease in the number of proposed transactions.

It would be the first time that the size of a bank after a merger will be a factor in deciding which deals receive in-depth inspection from the FDIC. This is the effect of regulators’ concerns about the rapid growth of banks after the insolvency of Silicon Valley Bank, whose assets tripled in the two years before it failed.

The new FDIC regulation was critiqued by several industry specialists, who highlighted that large transactions in the financial sector would be significantly harder to execute. The rule change comes at a time when the Biden administration has been more heavily enforcing rules seeking to stop big corporate deals that risk throttling competition. Considering that 47 banks in the US have more than $50bn in assets, of which 32 have more than $100bn, the current

FDIC and government controls may raise potential questions about future large bank M&A deals in the US.

Conclusions

This deal has massive implications for banking and if approved will undoubtedly change the industry’s future. Capital One would greatly expand its banking services, build a globally competitive payments network, and transform its technological capabilities, substantially strengthening Capital One’s position in the payment and banking industries as a whole while lowering costs. If approved, the deal will be finalised between the end of 2024 to early 2025.

Deal Advisors

The financial advisors for Discover are PJT Partners and Morgan Stanley, while Centerview Partners is the advisor of Capital One.

By: Francesco Bianchi, Laurian Pop, Sal Vassallo

Sources

- Capital One

- Everest Group

- Factset

- Fortune

- Financial Times

- Kellog Northwestern

- Mergermarket