The healthcare industry is a crucial sector of the global economy, with healthcare spending accounting for over 10 per cent of the GDP of most developed nations. One of the key components of the healthcare industry is the pharmaceutical sector, which is responsible for developing, manufacturing, and distributing drugs and medications. This industry is highly regulated and requires significant investment in research and development to create new medicines, treatments, and therapies.

What are CDMOs?

Within the pharmaceutical industry, Contract Development and Manufacturing Organizations (CDMOs) have emerged in recent years. These companies offer end-to-end services for pharmaceutical development, from drug discovery to manufacturing. As a result, CDMOs have become a popular choice for pharmaceutical companies looking to outsource their drug development and manufacturing processes, allowing them to focus on core competencies and reduce costs.

The CDMO market is expected to continue to grow in the coming years, driven by factors such as the growing demand for complex and specialized drugs. In this article, we will take a closer look at the CDMO industry, its growth prospects, and the key players in the market. The value chain consists of several key players, including Contract Research Organizations (CROs) and Contract Commercial Organizations (CCOs). CROs provide clinical trial services, such as conducting trials, collecting data, and analyzing results. CCOs, on the other hand, provide services for commercial manufacturing and distribution, including packaging, labelling, and logistics. Meanwhile, CDMOs offer contract services for drug development and manufacturing, including everything from early-stage development to commercial manufacturing and distribution.

The pharmaceutical CDMO market, which provides contract services to the pharmaceutical industry, has seen significant developments in recent months. Some of the major players in this market include Thermo Fisher Scientific, Charles River Laboratories, Catalent Inc., Recipharm AB, Jubilant Pharmova Ltd, Patheon Inc., and Boehringer Ingelheim Group.

In recent years, the CDMO market has seen significant developments as pharmaceutical companies increasingly seek more integrated solutions for drug development. The trend towards a "one-stop-shop" service portfolio in the CDMO industry has led to an expansion of the value chain. This means that CDMOs are now offering a comprehensive range of services to pharmaceutical companies, including clinical trial services, preclinical research, and even packaging.

By offering a broad range of services under one roof, CDMOs can provide a more streamlined and efficient service to their customers. This one-stop-shop approach allows pharmaceutical companies to work with a single CDMO for all their needs, rather than having to coordinate with multiple service providers. This can help to reduce costs and improve efficiency, as it minimizes the need for coordination between different service providers. It also provides greater continuity throughout the drug development process, as the same provider is responsible for all stages of development.

One of the advantages of working with a CDMO is their ability to provide packaging services. Packaging is a critical aspect of drug development, as it is the last step before a drug is shipped to the customer. CDMOs have the expertise and experience to provide a range of packaging services, including primary packaging, secondary packaging, and labelling. They can also provide logistics services to ensure that drugs are shipped safely and efficiently.

Role of CDMOs before, during and after the pandemic

The COVID-19 pandemic caused significant growth in the CDMO market, particularly in the production of COVID-19 vaccines and expanding biological pipelines. CDMOs played a vital role in scaling up vaccine production and signed contract manufacturing agreements at an unprecedented rate. To maintain a competitive edge, CDMOs need to proactively assess potential risks to pharma supply chains, strengthen digital capabilities, expand production capabilities, and adopt a wider range of contracting models. Emerging technologies are facilitating changes in the pharmaceutical industry's supply chain, and investment firms are increasingly interested in becoming active players in the CDMO market. These trends are expected to persist throughout the next several years.

Governments around the world are demanding quick solutions to the pandemic involving new medicines and rapid scalability. CDMOs have taken center stage as vaccine manufacturers, which has led to more opportunities for smaller CDMOs that perform well as vaccine suppliers. With the pipeline of injectable drugs growing rapidly and record levels of funding flowing to emerging bio/pharma companies, there is a growing need for capacity at the smaller project end of the market. In the long term, capacity committed to or built for the pandemic response may be available at attractive valuations.

M&A in the CDMO market

Main drivers of transactions are still CDMOs, but investment firms are catching up

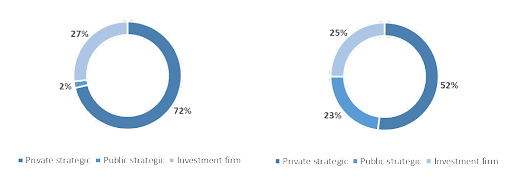

In the field of M&A, there has been a significant shift in the traditional approach to CDMO transactions in recent years. While strategic CDMO players still account for the majority of such transactions by acquiring privately held targets, investment firms are beginning to recognize the potential of the CDMO market. The percentage of total CDMO transactions involving investment firms has increased fivefold from 5% during the period of 2012-2016 to 25% during 2017-2021.

As this interest from investment firms in the CDMO market is relatively recent, it is noteworthy that 92% of all deals involving investment firms on the buyer side do not involve a target that is held by another investment firm. This trend is likely to continue as several factors are contributing to the increasing appeal of CDMOs to investment firms, which we will investigate further in the next section..

Within the pharmaceutical industry, Contract Development and Manufacturing Organizations (CDMOs) have emerged in recent years. These companies offer end-to-end services for pharmaceutical development, from drug discovery to manufacturing. As a result, CDMOs have become a popular choice for pharmaceutical companies looking to outsource their drug development and manufacturing processes, allowing them to focus on core competencies and reduce costs.

The CDMO market is expected to continue to grow in the coming years, driven by factors such as the growing demand for complex and specialized drugs. In this article, we will take a closer look at the CDMO industry, its growth prospects, and the key players in the market. The value chain consists of several key players, including Contract Research Organizations (CROs) and Contract Commercial Organizations (CCOs). CROs provide clinical trial services, such as conducting trials, collecting data, and analyzing results. CCOs, on the other hand, provide services for commercial manufacturing and distribution, including packaging, labelling, and logistics. Meanwhile, CDMOs offer contract services for drug development and manufacturing, including everything from early-stage development to commercial manufacturing and distribution.

The pharmaceutical CDMO market, which provides contract services to the pharmaceutical industry, has seen significant developments in recent months. Some of the major players in this market include Thermo Fisher Scientific, Charles River Laboratories, Catalent Inc., Recipharm AB, Jubilant Pharmova Ltd, Patheon Inc., and Boehringer Ingelheim Group.

In recent years, the CDMO market has seen significant developments as pharmaceutical companies increasingly seek more integrated solutions for drug development. The trend towards a "one-stop-shop" service portfolio in the CDMO industry has led to an expansion of the value chain. This means that CDMOs are now offering a comprehensive range of services to pharmaceutical companies, including clinical trial services, preclinical research, and even packaging.

By offering a broad range of services under one roof, CDMOs can provide a more streamlined and efficient service to their customers. This one-stop-shop approach allows pharmaceutical companies to work with a single CDMO for all their needs, rather than having to coordinate with multiple service providers. This can help to reduce costs and improve efficiency, as it minimizes the need for coordination between different service providers. It also provides greater continuity throughout the drug development process, as the same provider is responsible for all stages of development.

One of the advantages of working with a CDMO is their ability to provide packaging services. Packaging is a critical aspect of drug development, as it is the last step before a drug is shipped to the customer. CDMOs have the expertise and experience to provide a range of packaging services, including primary packaging, secondary packaging, and labelling. They can also provide logistics services to ensure that drugs are shipped safely and efficiently.

Role of CDMOs before, during and after the pandemic

The COVID-19 pandemic caused significant growth in the CDMO market, particularly in the production of COVID-19 vaccines and expanding biological pipelines. CDMOs played a vital role in scaling up vaccine production and signed contract manufacturing agreements at an unprecedented rate. To maintain a competitive edge, CDMOs need to proactively assess potential risks to pharma supply chains, strengthen digital capabilities, expand production capabilities, and adopt a wider range of contracting models. Emerging technologies are facilitating changes in the pharmaceutical industry's supply chain, and investment firms are increasingly interested in becoming active players in the CDMO market. These trends are expected to persist throughout the next several years.

Governments around the world are demanding quick solutions to the pandemic involving new medicines and rapid scalability. CDMOs have taken center stage as vaccine manufacturers, which has led to more opportunities for smaller CDMOs that perform well as vaccine suppliers. With the pipeline of injectable drugs growing rapidly and record levels of funding flowing to emerging bio/pharma companies, there is a growing need for capacity at the smaller project end of the market. In the long term, capacity committed to or built for the pandemic response may be available at attractive valuations.

M&A in the CDMO market

Main drivers of transactions are still CDMOs, but investment firms are catching up

In the field of M&A, there has been a significant shift in the traditional approach to CDMO transactions in recent years. While strategic CDMO players still account for the majority of such transactions by acquiring privately held targets, investment firms are beginning to recognize the potential of the CDMO market. The percentage of total CDMO transactions involving investment firms has increased fivefold from 5% during the period of 2012-2016 to 25% during 2017-2021.

As this interest from investment firms in the CDMO market is relatively recent, it is noteworthy that 92% of all deals involving investment firms on the buyer side do not involve a target that is held by another investment firm. This trend is likely to continue as several factors are contributing to the increasing appeal of CDMOs to investment firms, which we will investigate further in the next section..

Why are CDMO companies so interesting for investment firms

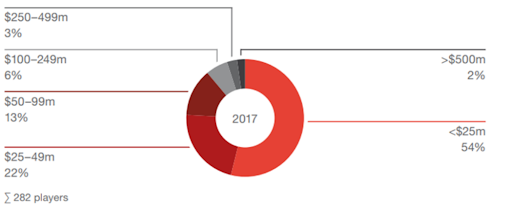

The increase in transaction activity by investment firms in recent years in the CDMO market can be attributed to several concurrent trends. One of the primary drivers is the desire of large pharmaceutical companies to outsource their CDMO, CRO, and CCO services. Additionally, the large pharmaceuticals seek to consolidate their outsourcing needs through a few well-diversified "one-stop-shop" providers. However, the market for such services remains highly fragmented, with the top five players in the CDMO market accounting for only 15% of the market share. Moreover, 75% of the players generate revenues below US $50 million, creating attractive opportunities for investment firms to pursue buy-and-build strategies to build these one-stop-shop solutions the market is looking for.

The stable cash flows generated by CDMOs, as a result of long-term contracts with pharmaceutical companies, further enhance the appeal of such investments for investment firms. In addition, investment firms can deploy capital into organic growth opportunities, and are not solely reliant on inorganic growth. This is particularly attractive given that the expected compound annual growth rate (CAGR) of the CDMO markets is estimated to be around 7%, offering significant potential for value creation

The increase in transaction activity by investment firms in recent years in the CDMO market can be attributed to several concurrent trends. One of the primary drivers is the desire of large pharmaceutical companies to outsource their CDMO, CRO, and CCO services. Additionally, the large pharmaceuticals seek to consolidate their outsourcing needs through a few well-diversified "one-stop-shop" providers. However, the market for such services remains highly fragmented, with the top five players in the CDMO market accounting for only 15% of the market share. Moreover, 75% of the players generate revenues below US $50 million, creating attractive opportunities for investment firms to pursue buy-and-build strategies to build these one-stop-shop solutions the market is looking for.

The stable cash flows generated by CDMOs, as a result of long-term contracts with pharmaceutical companies, further enhance the appeal of such investments for investment firms. In addition, investment firms can deploy capital into organic growth opportunities, and are not solely reliant on inorganic growth. This is particularly attractive given that the expected compound annual growth rate (CAGR) of the CDMO markets is estimated to be around 7%, offering significant potential for value creation

North America dominates the CDMO market in all categories

The CDMO market is one of the few industries where transaction activity is significantly dominated by one region. According to a study by EY, which evaluated data from 2017-2021, the Americas region represented 46% of the total number of transactions and 81% of the transaction values. This is largely due to the presence of many of the largest CDMO companies, such as Thermo Fisher Scientific and Charles River Laboratories, which are located in the Americas. Additionally, 32% of the number of transactions and 59% of the transaction values were internal transactions, where both buyer and seller were from the Americas.

From an international investor's perspective, the Americas region is the most attractive market, as evidenced by the primary stream of funds flowing between the Americas and Europe. Specifically, US $18 billion flows from Europe to the Americas, while only US $11 billion flows the other way.

The CDMO market is experiencing significant consolidation, with the top 10 most active CDMOs in M&A accounting for 27% of the total transactions. Among these top 10, four companies are based in the US, and they account for 90% of the transaction value of the top 10 most active CDMOs.

Pemira - Cambrex acquisition, a CDMO transaction example

A relevant transaction for our analysis is the acquisition of Cambrex, an American pharmaceutical CDMO company, by Permira Advisers, a private equity firm based in London. The deal, which involved the purchase of the entire share capital, amounted to $2.26 billion, implying a 47% premium over the last closing price. Cambrex provides development services across the drug lifecycle, starting from investigational and pre-trial testing, as well as manufacturing services from small batches for lab use to commercial scale.

It is very likely that Cambrex and Permira are looking for a buy-and-build strategy, in which Cambrex acquires other companies to complement its platform. In June 2022, the firm announced the acquisition of Q1 Scientific (provider of specialized storage services for pharmaceuticals), followed by that of Snapdragon (provider of chemical development and analytics for drugs), in November 2022. These add-on transactions have a clear rationale: positioning Cambrex to offer integrated services to their pharmaceutical clients, creating an ecosystem which increases customer retention and stabilizes revenues.

Aside from the growth through acquisitions, Cambrex is also investing in facilities to expand organically. After spending $50 million to develop four new plants in Iowa, the firm committed a further $30 million to expand a manufacturing facility in South Carolina, as well as $16.5 million for a research and development site in Minnesota.

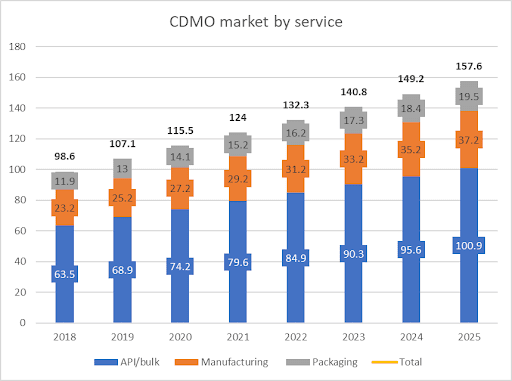

According to a study by Grand View Research synthesized by PwC, the CDMO market is expected to reach $157.6 billion in 2025, with an overall CAGR or 6.9%, as implied by the graph below.

The CDMO market is one of the few industries where transaction activity is significantly dominated by one region. According to a study by EY, which evaluated data from 2017-2021, the Americas region represented 46% of the total number of transactions and 81% of the transaction values. This is largely due to the presence of many of the largest CDMO companies, such as Thermo Fisher Scientific and Charles River Laboratories, which are located in the Americas. Additionally, 32% of the number of transactions and 59% of the transaction values were internal transactions, where both buyer and seller were from the Americas.

From an international investor's perspective, the Americas region is the most attractive market, as evidenced by the primary stream of funds flowing between the Americas and Europe. Specifically, US $18 billion flows from Europe to the Americas, while only US $11 billion flows the other way.

The CDMO market is experiencing significant consolidation, with the top 10 most active CDMOs in M&A accounting for 27% of the total transactions. Among these top 10, four companies are based in the US, and they account for 90% of the transaction value of the top 10 most active CDMOs.

Pemira - Cambrex acquisition, a CDMO transaction example

A relevant transaction for our analysis is the acquisition of Cambrex, an American pharmaceutical CDMO company, by Permira Advisers, a private equity firm based in London. The deal, which involved the purchase of the entire share capital, amounted to $2.26 billion, implying a 47% premium over the last closing price. Cambrex provides development services across the drug lifecycle, starting from investigational and pre-trial testing, as well as manufacturing services from small batches for lab use to commercial scale.

It is very likely that Cambrex and Permira are looking for a buy-and-build strategy, in which Cambrex acquires other companies to complement its platform. In June 2022, the firm announced the acquisition of Q1 Scientific (provider of specialized storage services for pharmaceuticals), followed by that of Snapdragon (provider of chemical development and analytics for drugs), in November 2022. These add-on transactions have a clear rationale: positioning Cambrex to offer integrated services to their pharmaceutical clients, creating an ecosystem which increases customer retention and stabilizes revenues.

Aside from the growth through acquisitions, Cambrex is also investing in facilities to expand organically. After spending $50 million to develop four new plants in Iowa, the firm committed a further $30 million to expand a manufacturing facility in South Carolina, as well as $16.5 million for a research and development site in Minnesota.

According to a study by Grand View Research synthesized by PwC, the CDMO market is expected to reach $157.6 billion in 2025, with an overall CAGR or 6.9%, as implied by the graph below.

Conclusions

In conclusion, based on the transactions examined and the broader sector evaluation, it is evident that the pharmaceutical Contract Development and Manufacturing Organization (CDMO) market is expanding and increasingly appealing to investors seeking financially stable and growing companies with attractive value creation opportunities. The trend of outsourcing specific production processes by major pharmaceutical firms enables them to concentrate their resources on research and development, resulting in beneficial outcomes for the entire industry.

By Domenico Destito, Teodor Matei, David Overbeck

Sources

- PWC, “Current trends and strategic options in the pharma CDMO market”

- EY, “How Contract Development and Manufacturing Organizations (CDMOs) are leading innovation for

- pharmaceutical parties”

- Financial Times

- Bloomberg

- The Economist