Three years ago, Raghuram Rajan, former IMF Chief Economist and professor at the University of Chicago, became the Governor of the Reserve Bank of India during a critical period. At the time, currency was falling, inflation was surging as well as account deficit. Many commentators believed that the central bank itself had caused the crisis earlier. Low profile bureaucrats, probably under the pressure from Indian Government formerly led RBI, which is the worst scenario for a trustable central bank.

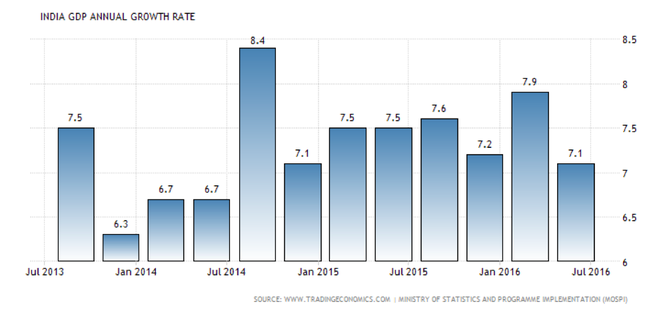

Rajan decided to change dramatically the rules of the game. Firstly, he tried shook up the institutional framework. He set up an inflation-targeting committee to improve the decision-making process during crucial times. He fought aggressively against inflation and sometimes the price to pay was macroeconomic stability. His approach was rather hawkish and public recognition had been hard to achieve. Powerful Indian tycoons often hampered him and even Prime Minister Modi accused him of withholding economic growth. While Exports fell, we should not forget that India has remained the fastest growing major economy in the world (7.4 per cent gross domestic product growth). Will the reforms survive their creator? Rajan believes its workings have changed the situation “we moved the system towards a new equilibrium, momentum cannot be and will not be arrested". An evidence could be the recent issuance, by two Indian companies, of $750 million in bonds in London. On the other hand, he kept a very humble behaviour, "There is a common saying: the cemetery is full of indispensable people”. Finally, Rajan seem to have reached his ultimate goal: building a better institutional structure establishing an independent decision-making process at least for monetary policy. In fact, Interest rates are going to be set by a committee, not by the RBI governor alone. This may prevent political pressure to suggest monetary easing at full blast, which would eventually lead to double-digit inflation.

Rajan decided to change dramatically the rules of the game. Firstly, he tried shook up the institutional framework. He set up an inflation-targeting committee to improve the decision-making process during crucial times. He fought aggressively against inflation and sometimes the price to pay was macroeconomic stability. His approach was rather hawkish and public recognition had been hard to achieve. Powerful Indian tycoons often hampered him and even Prime Minister Modi accused him of withholding economic growth. While Exports fell, we should not forget that India has remained the fastest growing major economy in the world (7.4 per cent gross domestic product growth). Will the reforms survive their creator? Rajan believes its workings have changed the situation “we moved the system towards a new equilibrium, momentum cannot be and will not be arrested". An evidence could be the recent issuance, by two Indian companies, of $750 million in bonds in London. On the other hand, he kept a very humble behaviour, "There is a common saying: the cemetery is full of indispensable people”. Finally, Rajan seem to have reached his ultimate goal: building a better institutional structure establishing an independent decision-making process at least for monetary policy. In fact, Interest rates are going to be set by a committee, not by the RBI governor alone. This may prevent political pressure to suggest monetary easing at full blast, which would eventually lead to double-digit inflation.

What will happen then? Few weeks ago, New Delhi has announced that Urjit Patel, former deputy at RBI in charge of monetary policy, will be the next central bank governor. According to Jahangir Aziz, economist at JPMorgan “they have chosen someone who has never displayed any form of policy adventurism”. New Delhi chose orthodoxy over unconventional thinking as long massive growth and macro stability is an urgent priority for the government and its supporters.

However, there is some trouble ahead. After the Asian financial crisis at the end of the 90s, RBI awarded very few new bank licences. Nevertheless, Mr Rajan last will was to liberalise licensing. He even stated that new bank licences would be available “on tap”. Higher competition between banks could lead to lower interest rates, which could sound like good news to the ears of consumers and firms. Actually basic lending standard has to be maintained in order to prevent further speculation and bubbles in a speed-of-light growing country like India.

Mr Patel must be on guard.

Nicola Maria Fiore