South Korea, Asia’s fourth largest economy, has lately experienced a significant political scandal: president-elect Park Geun-hye has been arrested for impeachment. She is accused of accepting bribes, abuse of power and leakage of important reserved information. In the wrongdoing are involved some of the most important chaebols of the country.

Chaebols are the industrial conglomerates that have led South Korea’s economic development after the Korean war of 1950. These, were family run business which thanks to the cheap loans and proctectionist measures of the government succeeded in building domestic and international sprawling groups.

The main chaebols of the country are:

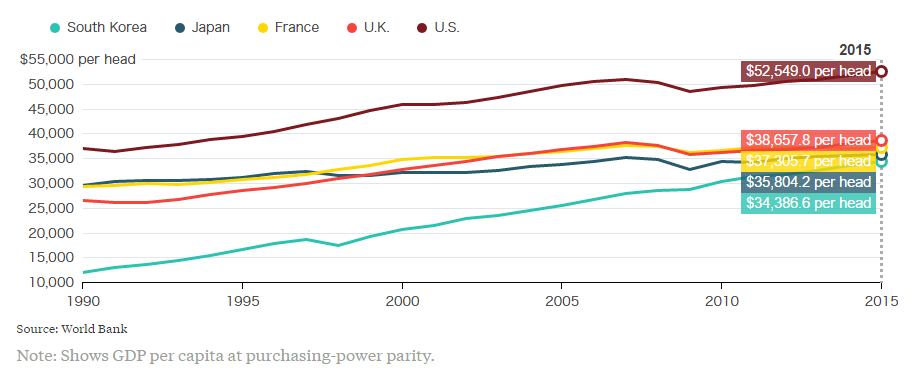

All these represent approximately half of the KOSPI, the Korean stock exchange main index. They led South Korea through its economic development path making it the fourth largest Asian economy today. Chaebols account for almost 85% of the county’s GDP, employing 13% of the workforce which is a small number considering their economic relevance. Moreover, thanks to their success, today, South Korea is the fifth biggest carmaker by internal production of vehicles and it has the world’s three biggest shipbuilders.

Chaebols are the industrial conglomerates that have led South Korea’s economic development after the Korean war of 1950. These, were family run business which thanks to the cheap loans and proctectionist measures of the government succeeded in building domestic and international sprawling groups.

The main chaebols of the country are:

- Samsung: founded in 1938 by Lee Byung-chul in Taegu as a food retailer. During the years the family widely diversified their investments. In the 1980s it started producing TVs and personal computers, expanding more and more in the electronic field. Today, it is the biggest chaebol in the country, operating in many fields, spanning from chemical, mechanic and electronic industry to entertaining, financial and engineering services. Samsung accounts for a fifth of South Korea exports.

- Hyunday Motor: established in 1947 by Chung Ju-yung as a construction company, later on it started operating in the car and ship manufacturing business. It expanded rapidly in numerous other fields and in the late 1990s the Group restructured itself breaking the conglomerate in five independent groups. Nowadays, Hyunday Motor Group is the second largest chaebol and in 2015 it was the fourth world’s largest car manufacturer.

- SK: founded in the 1950s, the company was involved in the textile industry. At present the company operates through 95 subsidiaries and affiliated companies in several sectors such as: chemical, petroleum, energy industries, mobile service provider and semiconductors.

- LG: it started as a chemical industrial corporation in 1947, today it is the fourth largest chaebol. It is organised in a group structure with a holding, LG Corporation, and many subsidiaries which operate in the electronic, telecommunication and chemical industries. It is controlled by the Koo family.

- Lotte: established in 1948 in Tokyo by Shin Kyuk-ho, today it is the fifth largest chaebol in the country and it has a highly diversified business, from food products and shopping to finance and IT.

All these represent approximately half of the KOSPI, the Korean stock exchange main index. They led South Korea through its economic development path making it the fourth largest Asian economy today. Chaebols account for almost 85% of the county’s GDP, employing 13% of the workforce which is a small number considering their economic relevance. Moreover, thanks to their success, today, South Korea is the fifth biggest carmaker by internal production of vehicles and it has the world’s three biggest shipbuilders.

These conglomerates are closely related with politics. There is a two-way relationship between the government and chaebols: the former receives political and financial support while assuring sort of “favours” in concluding business deals.

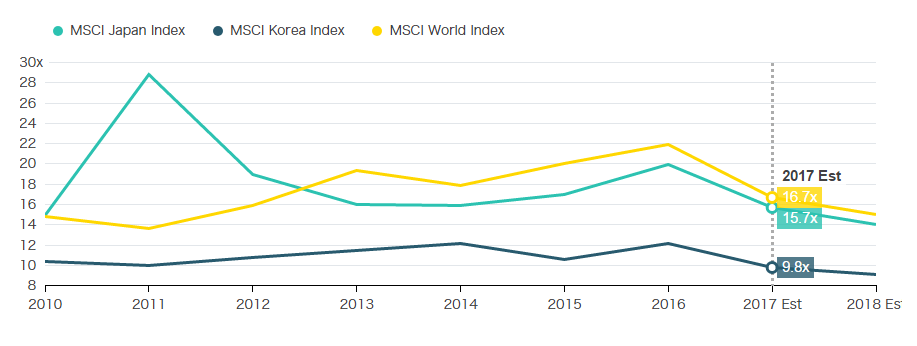

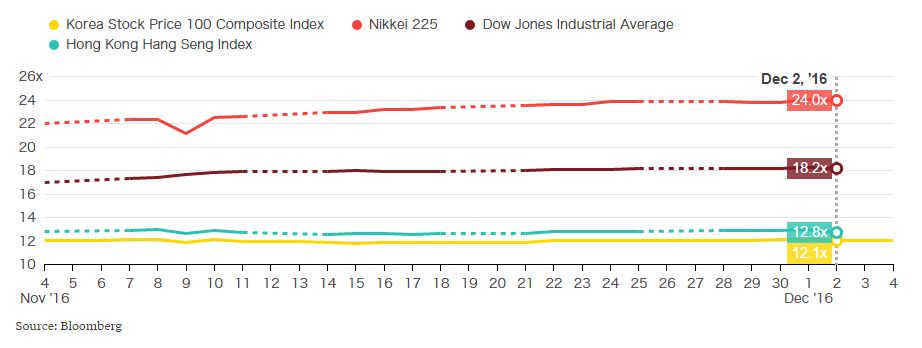

Chaebols are also considered responsible for the country’s growing inequality due to the high protection they benefit from the government. Opacity as well as corruption issues are related to chaebols because of their poor corporate governance. Circular holding structures and family-led-successions are typical features of the sprawling conglomerates. Consequently, boards are not independent and minority shareholders are inadequately protected. These circumstances are the reasons why the country’s equity is affected by the “Korea discount”: the KOSPI trades 3 times lower forward earnings than the benchmark MSCI Asia Pacific index, which has a multiple of 13. In other words, Korean companies receive lower valuations with respect to comparable companies in other emerging markets. A 40% lower valuation is estimated in comparison with companies of developed countries.

Chaebols are also considered responsible for the country’s growing inequality due to the high protection they benefit from the government. Opacity as well as corruption issues are related to chaebols because of their poor corporate governance. Circular holding structures and family-led-successions are typical features of the sprawling conglomerates. Consequently, boards are not independent and minority shareholders are inadequately protected. These circumstances are the reasons why the country’s equity is affected by the “Korea discount”: the KOSPI trades 3 times lower forward earnings than the benchmark MSCI Asia Pacific index, which has a multiple of 13. In other words, Korean companies receive lower valuations with respect to comparable companies in other emerging markets. A 40% lower valuation is estimated in comparison with companies of developed countries.

Politicians and citizens have been requesting for a “chaebol reform” in order to regulate and simplify the corporate governance of the conglomerates. This is one of the top priorities the running candidate for presidency Moon Jae-in has promised.

Another issue is whether these conglomerates are anachronistic and might not be any longer the leaders of further economic growth as both macro and micro conditions have changed.

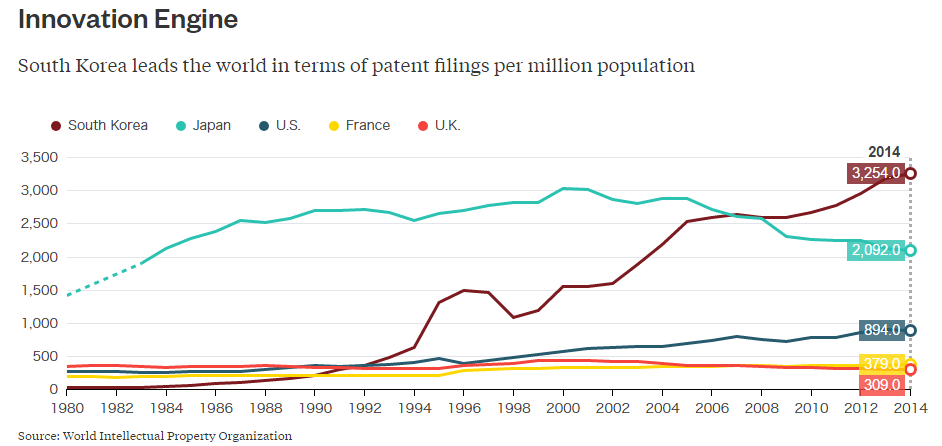

Firstly, the country has to face the increasing competition of China, which is able to produce similar advanced technological devices at lower costs. Secondly, exports which account for 35.5% of GDP as of 2016, have as major counterparties China, the US and the EU, exposing the country to a certain level of risk. However, South Korea has a good education system, a “Stakhanovite” attitude and a unique industrial creativity. The country benefits of the highest number of patents filed per head of population.

Another issue is whether these conglomerates are anachronistic and might not be any longer the leaders of further economic growth as both macro and micro conditions have changed.

Firstly, the country has to face the increasing competition of China, which is able to produce similar advanced technological devices at lower costs. Secondly, exports which account for 35.5% of GDP as of 2016, have as major counterparties China, the US and the EU, exposing the country to a certain level of risk. However, South Korea has a good education system, a “Stakhanovite” attitude and a unique industrial creativity. The country benefits of the highest number of patents filed per head of population.

Then, small-medium enterprises and start-ups might be the future growth engines of the country. In the past, these could not emerge and develop successfully due to the powerful and protected role of chaebols. However, today they might have a chance and finally the extraordinary innovation potential could be exploited.

Vittoria Roà

Vittoria Roà