The use of ChatGPT, the Artificial Intelligence powerful tool developed by Open AI, increased a lot in the last few months and it seems to be the game changer in a lot of sector, including the financial one. The debate is about the advantages and disadvantages of implementing this instrument within banks and financial services companies and how it could help the humans being or, in the worst scenario, replace him.

Introduction

ChatGPT is currently one of the hottest topics in the world of artificial intelligence and natural language processing and the recent release of ChatGPT 4 has generated a significant amount of hype in the fields of artificial intelligence and natural language processing, sparking discussions about the technology's potential applications and advancements.

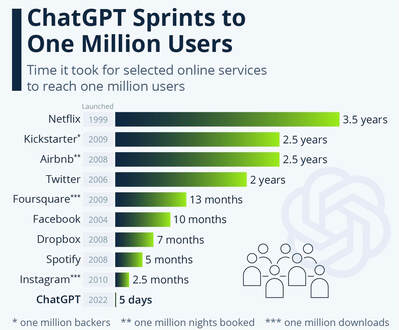

ChatGPT is a language model developed by OpenAI, a renowned artificial intelligence research organization. It utilizes the GPT-3.5 architecture and can generate human-like responses to a wide range of prompts. The recent release of ChatGPT 4 has attracted significant attention from both the technology industry and the general public. The number of users increased exponentially in very few days as shown in the chart below.

Time to reach one million users for the main digital services. Source: Statista

OpenAI has been working for long to the developement of AI technologies that can mimic human-like language and behavior. The development of ChatGPT is part of this effort, and the latest version represents a significant leap forward in the field. ChatGPT 4, the latest version of the language model developed by OpenAI, is a significant improvement over its predecessor, ChatGPT 3.5. It boasts 500 times more power, allowing it to generate even more complex and sophisticated language models. In addition to its language capabilities, ChatGPT 4 can also elaborate on media files, making it a more versatile tool for businesses and individuals.

Moreover, Microsoft has also announced that it will be integrating ChatGPT 4 with two of its most popular productivity tools, Excel and PowerPoint. This integration is expected to bring a whole new level of functionality and efficiency to these applications, making them even more powerful and useful for users. Overall, ChatGPT 4 represents a significant advancement in the field of natural language processing, and its integration with popular software applications like Excel and PowerPoint is sure to be a game-changer for many users, above all for work aims.

Moreover, Microsoft has also announced that it will be integrating ChatGPT 4 with two of its most popular productivity tools, Excel and PowerPoint. This integration is expected to bring a whole new level of functionality and efficiency to these applications, making them even more powerful and useful for users. Overall, ChatGPT 4 represents a significant advancement in the field of natural language processing, and its integration with popular software applications like Excel and PowerPoint is sure to be a game-changer for many users, above all for work aims.

Competitors

ChatGPT is not without competition. There are several other language models in the market that are competing for a share of the AI-powered chatbot space. One of the most significant competitors to ChatGPT is Google's Bard, which is the evolution of Google Meena, released in 2020. Bard is also a conversational AI technology that uses natural language processing and machine learning to generate human-like responses. Google has already invested up to 10 billion in it. Its official launch was on the 21st of March in the US. However, Bard had a rough debut, making a mistake during its presentation to the public.

When Bard came out it was possible to acknowledge that there are significant differences between the two tools, such as the ability to remember past conversations and their knowledge base. The main are:

- Encoding: One of the most important things that has given ChatGPT its fame is the ability to create complex code. It can even debug code. However, Google has stated that Bard is still "learning code," so the feature is not yet available.

- Conversations: According to OpenAI, ChatGPT can remember what was said in previous conversations. Bard's memory capability is "deliberately limited for now," Google has said, but the company claims that it will grow over time.

- Responses: One of the major differences between the two is that Bard can draw responses from the internet, to provide the most up-to-date information. It is also integrated into Google's search engine and can provide direct links to websites when requested. ChatGPT, on the other hand, works GPT-4 and all of its responses come from its knowledge base, which has a expiration date of September 2021, so it is limited in the information and most recent research.

- Language: ChatGPT knows several languages, including Spanish, French, Arabic, Mandarin, Italian, Japanese, and Korean, although the level of proficiency in responses varies depending on the language, and the main one is English. Bard can only speak English.

ChatGPT and other AI tools’ application in the financial sector

Artificial intelligence is becoming a significant part of the financial industry and for banking in particular; in fact, it unlocks new possibilities and automation, promoting a more cost-efficient structure. According to a research released by Mckinsey, “For global banking, McKinsey estimates that AI technologies could potentially deliver up to $1 trillion of additional value each year.” By analyzing the departments in which artificial intelligence has already been implemented, in finance AI is now used more in risk management and fraud detection to ensure information security. However, there are definitely more areas where artificial intelligence can be adopted in the banking industry, including customer service, portfolio management, and compliance.

Customer service: One of the most important areas where AI could be deployed by financial institutions is customer service. Unlike the traditional service that requires a lot of effort to deal with different problems, the strong artificial intelligence function would promote the customer’s experience when using the self-service call or website. Although the function already exists, customers can only do the most basic things, such as searching for bills. In fact, with the strong implication of machine learning, customers will be able to solve more complicated problems with self-service and enjoy 24/7 service. Besides, artificial intelligence has a strong data collection function, which is essential to the banking industry. Implementing AI technology in the platform will allow banks to keep track of the customers’ activity and improve the know-your-customer process, this will deliver highly personalized customer service to the clients, and banks can monitor user behavior to derive valuable insights.

Portfolio management: The powerful function of the AI applied to the banking industry will enable wealth and asset management both from the security and market tracing perspectives. For securities, AI technology enables quick following of activities, while an alert will be sent immediately to the manager if abnormal activities are happening, it would help the manager tracing the account activity more closely to increase efficiency. Furthermore, AI can automate the credit and debit card management system and ease the card authentication process, making transactions safe and secure. From the market tracing perspective, it is always important for the manager to know market sentiments and the change in different asset classes. AI technology can be implemented to analyze the changeable mood of financial markets. Using machine learning functions, AI technology can quickly trace back to similar models, predict market conditions, and provide insight into market trends. To sum up, it will allow banks to manage their portfolio more effectively and prevent mistakes and uncertainty brought by macroeconomics.

Compliance: Compliance has always been a significant part of banking, as institutions must continuously update transactions and processes. The work is mostly done by the compliance team, who manage the internal documents to ensure they fit with current regulations. However, compliance costs considerable time and labour, which could be replaced with artificial intelligence. With the huge database, artificial intelligence products have, they can quickly find the rules that apply to banks and ensure they follow the regulations, saving compliance costs for banks.

In general, artificial intelligence can be implemented in the banking industry to gather data, identify problems, and promote efficiency in the compliance process. However, we are still waiting to see the technology's development level to ensure it is safe to use.

The role of today’s financial professionals, such as an investment bankers or consultants, is now more than ever supported by AI. From searching for market data to meeting a client on an online videocall, banking employees cannot properly work without technology.

Given the features and actions that can be carried out by ChatGPT, it was predictable that people in the industry would soon raise their doubts on the consequences of this AI. While tech-enthusiasts fully support and embrace the implementation, there is no lack of sceptical people, afraid that ChatGPT can eventually replace consultants.

The main arguments are that it could lead to a general loss in human interaction and an overall devaluation of the role that human professionals play in the banking industry.

One of the main cons that were reported by the users is the difficulty that a client can face when trying to contact their advisor. Indeed, ChatGPT aims at facilitating client support by providing fast answers from a database of frequent problems and solutions, but this may not always be the case. In fact, clients might want to reach out to professionals for specific “one-of-a-kind” questions with many unknowns and variables. In front of these problems, ChatGPT is not always able to act, and so the client must undergo a cumbersome and time-consuming process of many steps before the system lets them through and speak with a human professional.

Nevertheless, there are certainly perks for bankers, as well. Automation can increase an employee’s productivity by assisting them in basic routine tasks, such as analyses in financial data. ChatGPT is obviously able to examine a bigger amount of data than a human, in significantly less time. By doing so, financial marketers can focus on more high-value tasks.

An example of financial application directly on ChatGPT. Source: ChatGPT

Conclusion

To conclude, OpenAI's ChatGPT language model represents a significant development in the discipline of natural language processing. Microsoft has also shown its integration with Excel and PowerPoint, two of its most well-liked productivity applications, enhancing their functionality and usefulness for users. However, ChatGPT faces opposition from Google's Bard, one of its biggest rivals in the field of AI-powered chatbots and this competition could be useful to keep the tools improving.

The banking and finance industry has a wide range of potential uses for artificial intelligence. Information security is already protected by AI in areas like risk management and fraud detection, but there are still a wide range of applications for it in industries like customer service, portfolio management, and compliance. When a consumer uses a self-service call or website, for instance, financial institutions can use AI to enhance the customer experience. Customers may be able to do more than simply look up invoices thanks to machine learning's powerful implications.

The application of AI in the financial sector might also have some negative effects. As the algorithms employed by AI systems can occasionally reinforce prejudices or result in discriminatory outcomes, assuring the ethical use of AI in financial decision-making processes is one of the biggest problems. A further difficulty is guaranteeing the security of the sensitive financial data that AI systems need to operate, as data breaches can have disastrous repercussions for financial organizations and their clients.

In conclusion, while the integration of AI technology in the banking and financial industry might open new possibilities and automation, supporting a more cost-efficient structure, it is vital to address the possible ethical and security consequences of AI use. With the quick advancement of AI technology, it is necessary to weigh the advantages and disadvantages of its use in order to maintain its transparency, fairness, and accountability. Overall, ChatGPT and its rivals will continue to progress AI technology, which will influence the financial industry, but how well they do so will depend on how well they are governed and regulated.

However, recently, there has been no lack of action by those who fear that this advanced technology may be dangerous and harmful.

In recent weeks, in fact, an open letter has been published in the USA, signed by prominent personalities such as Elon Musk, Steve Wozniak (co-founder of Apple) and Yuval Noah Harari (historian and essayist) among many.

The letter contains an important request: it asks companies active in the world of Artificial Intelligence to suspend for at least 6 months the training of the most powerful Artificial Intelligence systems of GPT-4

"The most powerful artificial intelligence systems should only be developed when we are sure that their effects will be positive and their risks manageable," it mentions part of the statement.

In addition, a few days later in Italy, the Data Protection Authority, through a precautionary measure, ordered the ChatGPT block in the country, citing three main reasons: the lack of an information on how users' data are collected and processed, The sometimes incorrect information provided by ChatGPT, the absence of a true verification on the age of users. Moreover, Italy is not the only one to raise the problem, given that France, Canada and Germany seem determined to follow the trail and take action.

Meanwhile, OpenAI now seems to have an advantage over its competitors. Why should it stop and allow the pursuers to shorten the lead?

It is clear that the challenges that AI is putting (and will) on the table are and will be countless, even on the policy and security side.

However, stopping its development does not seem to be the right move.

By Matilde Chiavenato, Cosimo Winchler, Yuxi Cheng, Ruben Van Der Lubbe

SOURCES

- Financial Times

- IlSole24Ore

- Forbes

- The Financial Brand

- Bloomberg

- McKinsey

- OpenAI Website