Beijing warned the US that it is "not afraid of a trade war". after tariffs on over a hundred American products for about 3 billion dollars have been threatened. This happened a few hours after Donald Trump opened trade hostilities against the second largest economy in the world by signing an order that imposes duties on a value of 60 billion imports for about 1,300 Chinese products.

A first category of 120 products, corresponding to imports from the US equal to just under a billion dollars, could be hit by 15 percent duties: they include wine, fresh fruit and steel tubes. To this list 8 products - including pork and recycled aluminum – were added, with an expected rate of 25 percent, equivalent to 2 billion Chinese imports from the US. So far neither soybeans nor planes, the two major categories of American exports, appear. However, the duty on pork meat has its weight because China and Hong Kong represent the second largest market for this American industry. The American Council of pork producers said: "Nobody wins in this series of reprisals, least of all farmers and consumers".

The measures threatened by Beijing hit a mere 2.3% of American exports, against 10% targeted by the United States. These tariffs will be established if Beijing does not reach a negotiated solution with the United States, as warned by the Chinese Ministry of Commerce.

The specter of the commercial war between the two giants had a significant impact on stock markets around the world. Wall Street closed down almost 3% on Thursday (on which day?), Tokyo fell down by 4.5%, Hong Kong by 2.5% and Shanghai 3.6%, while European stock exchanges travel at a rate below one percentage point.

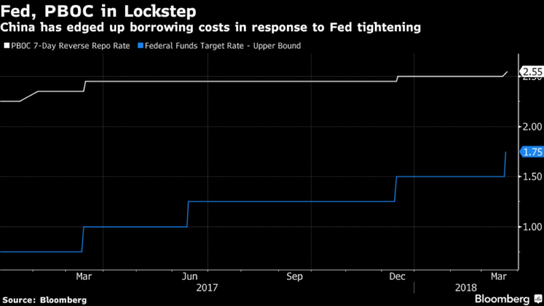

China did not remain neutral. Indeed, Chinese Central Bank, People’s Bank of China, increased the cost of short-term loans to commercial lenders by five basis points, tightening the monetary policy in step with the U.S. Federal Reserve. The PBOC stated that the move is "in line with market expectations and a normal reaction to the Fed’s rate hike”.

Source: Bloomberg

Analysts expect the central bank to make modest increases in money-market rates in 2018 as, according to a survey by Bloomberg, it aims to keep up the pressure on deleveraging and prevent too much divergence with U.S. monetary policy. The PBOC hasn’t changed the benchmark one-year lending rate since October 2015.

It’s a "symbolic" move and it’ll have limited impact, Jiang Chao, a Shanghai-based bond analyst at Haitong Securities Co., wrote in a report following the announcement. "The monetary policy stance hasn’t changed" he said "with the yuan staying stable, the central bank will pay more attention to domestic economic conditions."

Isabella Costa

A first category of 120 products, corresponding to imports from the US equal to just under a billion dollars, could be hit by 15 percent duties: they include wine, fresh fruit and steel tubes. To this list 8 products - including pork and recycled aluminum – were added, with an expected rate of 25 percent, equivalent to 2 billion Chinese imports from the US. So far neither soybeans nor planes, the two major categories of American exports, appear. However, the duty on pork meat has its weight because China and Hong Kong represent the second largest market for this American industry. The American Council of pork producers said: "Nobody wins in this series of reprisals, least of all farmers and consumers".

The measures threatened by Beijing hit a mere 2.3% of American exports, against 10% targeted by the United States. These tariffs will be established if Beijing does not reach a negotiated solution with the United States, as warned by the Chinese Ministry of Commerce.

The specter of the commercial war between the two giants had a significant impact on stock markets around the world. Wall Street closed down almost 3% on Thursday (on which day?), Tokyo fell down by 4.5%, Hong Kong by 2.5% and Shanghai 3.6%, while European stock exchanges travel at a rate below one percentage point.

China did not remain neutral. Indeed, Chinese Central Bank, People’s Bank of China, increased the cost of short-term loans to commercial lenders by five basis points, tightening the monetary policy in step with the U.S. Federal Reserve. The PBOC stated that the move is "in line with market expectations and a normal reaction to the Fed’s rate hike”.

Source: Bloomberg

Analysts expect the central bank to make modest increases in money-market rates in 2018 as, according to a survey by Bloomberg, it aims to keep up the pressure on deleveraging and prevent too much divergence with U.S. monetary policy. The PBOC hasn’t changed the benchmark one-year lending rate since October 2015.

It’s a "symbolic" move and it’ll have limited impact, Jiang Chao, a Shanghai-based bond analyst at Haitong Securities Co., wrote in a report following the announcement. "The monetary policy stance hasn’t changed" he said "with the yuan staying stable, the central bank will pay more attention to domestic economic conditions."

Isabella Costa