China's GDP experienced a remarkable recovery in the first quarter of 2023 following the reopening after the Covid 19 pandemic.

The nation's successful containment measures, vaccination campaigns, and easing of restrictions propelled its economic resilience and marked a significant turning point in its post-pandemic recovery.

The nation's successful containment measures, vaccination campaigns, and easing of restrictions propelled its economic resilience and marked a significant turning point in its post-pandemic recovery.

Introduction

The Covid-19 pandemic and subsequent restrictions imposed by the Chinese government have significantly impacted China's retail sales, one of the hardest hit components of the country's GDP. However, the retail industry has made a tremendous recovery, with retail sales surging by 10.6% YoY in March 2023, surpassing analysts' predictions. Gold & Silver jewellery, sports and amusements, clothing, cosmetics, and daily necessities were among the industries that recorded notable growth, while furniture and oil products saw a slowdown in growth. While the resurgence in the retail industry is impressive, it remains somewhat fragile, with a volatile geopolitical landscape resulting in high levels of uncertainty still looming over the global economic outlook. Meanwhile, China's export sector experienced a slowdown in June 2022, following a period of negative growth from October to March. While the Chinese export experienced a significant expansion in Q1 of 2023, many economists predict a weaker outlook for China's exports in the coming months. Furthermore, China's property market has shown signs of stabilizing since the beginning of 2023, benefiting from the continued economic recovery and supportive policy measures. However, concerns remain regarding the risks associated with the enormous debt held by Chinese property developers. If the real estate market was to experience a sudden downturn or crash, it could have significant implications for the broader Chinese economy. Despite the current uncertainties facing China's retail, export, and property sectors, it is evident that the country will continue to experience volatility across its economy.

The Covid-19 pandemic and subsequent restrictions imposed by the Chinese government have significantly impacted China's retail sales, one of the hardest hit components of the country's GDP. However, the retail industry has made a tremendous recovery, with retail sales surging by 10.6% YoY in March 2023, surpassing analysts' predictions. Gold & Silver jewellery, sports and amusements, clothing, cosmetics, and daily necessities were among the industries that recorded notable growth, while furniture and oil products saw a slowdown in growth. While the resurgence in the retail industry is impressive, it remains somewhat fragile, with a volatile geopolitical landscape resulting in high levels of uncertainty still looming over the global economic outlook. Meanwhile, China's export sector experienced a slowdown in June 2022, following a period of negative growth from October to March. While the Chinese export experienced a significant expansion in Q1 of 2023, many economists predict a weaker outlook for China's exports in the coming months. Furthermore, China's property market has shown signs of stabilizing since the beginning of 2023, benefiting from the continued economic recovery and supportive policy measures. However, concerns remain regarding the risks associated with the enormous debt held by Chinese property developers. If the real estate market was to experience a sudden downturn or crash, it could have significant implications for the broader Chinese economy. Despite the current uncertainties facing China's retail, export, and property sectors, it is evident that the country will continue to experience volatility across its economy.

Retail Sales

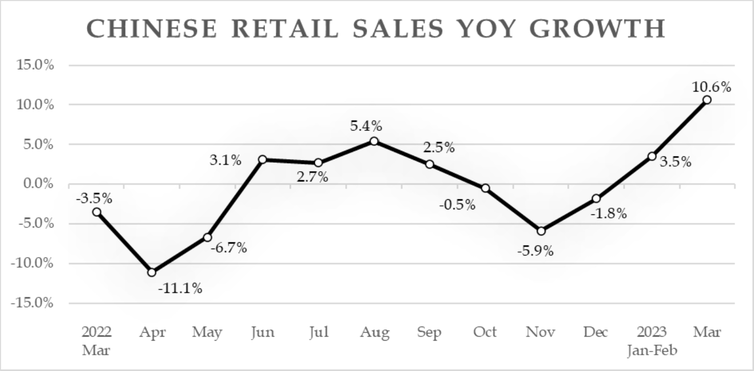

China retail sales, one of the hardest hit GDP components by the Covid-19 pandemic and subsequent restrictions imposed by the Beijing government, have witnessed a remarkable recovery. According to Q1 GDP data, retail sales surged by 10.6% YoY in March, surpassing analysts' predictions of just 7.5% and representing a 5.8% YTD increase. This marks a significant acceleration from a 3.5% gain in January-February and represents the fastest growth in retail trade since June 2021.

China retail sales, one of the hardest hit GDP components by the Covid-19 pandemic and subsequent restrictions imposed by the Beijing government, have witnessed a remarkable recovery. According to Q1 GDP data, retail sales surged by 10.6% YoY in March, surpassing analysts' predictions of just 7.5% and representing a 5.8% YTD increase. This marks a significant acceleration from a 3.5% gain in January-February and represents the fastest growth in retail trade since June 2021.

Source: National Bureau of Statistics of China

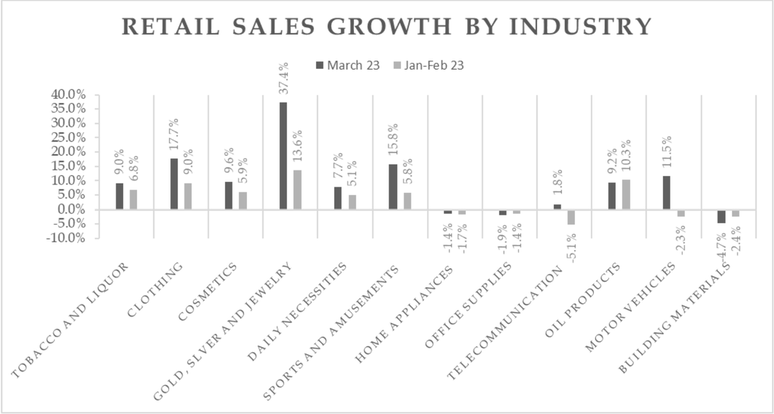

Gold & Silver jewellery placed first in the growth acceleration rankings, posting an abnormous growth rate at 37.4% YoY compared with just 13.6% in January-February, followed by sports and amusements (15.8% vs 5.8%), clothing (17.7% vs 9%), cosmetics (9.6% vs 5.9%) and daily necessities (7.7% vs 5.1%).

Moreover, there has been a strong rebound in some of the industries which posted a sharp decrease in prior months like motor vehicles (11.5% vs –2.3%), telecommunications equipment (1.8% vs –5.1%), and tobacco & alcohol (9.0% vs -6.1%).

On the other hand, growth slowed for both furniture (3.5% vs 4.6%) and oil products (9.2% vs 10.3%), amid further declines in sales of home appliances (-1.4% vs -1.7%), office supplies (-1.9% vs -1.4%), and building materials (-4.7% vs –2.4%).

Moreover, there has been a strong rebound in some of the industries which posted a sharp decrease in prior months like motor vehicles (11.5% vs –2.3%), telecommunications equipment (1.8% vs –5.1%), and tobacco & alcohol (9.0% vs -6.1%).

On the other hand, growth slowed for both furniture (3.5% vs 4.6%) and oil products (9.2% vs 10.3%), amid further declines in sales of home appliances (-1.4% vs -1.7%), office supplies (-1.9% vs -1.4%), and building materials (-4.7% vs –2.4%).

Source: National Bureau of Statistics of China

The retail industry's resurgence can be partially attributed to last year's stringent lockdowns in Shanghai which resulted in a lower base, so Goldman Sachs analysts noted that the YoY figures for April and May are also likely to show further improvement on the wave of the low base effect.

Despite the impressive rebound, the retail industry's recovery remains somewhat fragile, with a volatile geopolitical landscape resulting in a high level of uncertainty still looming over the global economic outlook.

Despite the impressive rebound, the retail industry's recovery remains somewhat fragile, with a volatile geopolitical landscape resulting in a high level of uncertainty still looming over the global economic outlook.

Exports

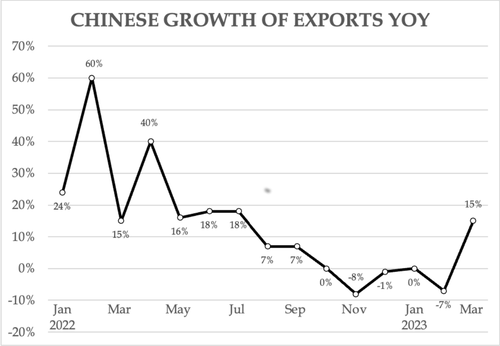

China's export performance has been a topic of much discussion in recent months. After a period of strong growth in early 2022, the country's export sector experienced a slowdown in June of the same year. This followed a period of negative growth from October to March, before a significant expansion in March that surpassed market expectations.

China's exports bounced back strongly in the final month of the last quarter, with an expansion of 14.8% in March. This result was against market expectations, which had predicted a fall of 5%, with much of the growth being driven by electric vehicle sales and exports to Russia.

However, despite the positive growth figures of the last month, many economists are predicting a weaker outlook for China's exports in the coming months. A decline in global demand for Chinese goods, combined with the delayed impact of an interest rate rise in developed markets and the recent banking sector turmoil overseas, is expected to weigh on China’s trade. The pace of growth is expected to go down from now on.

Furthermore, among economists, a debate sparked about whether Beijing will need to boost stimulus spending to reach its 5% growth target for 2023.

While some argue that the Chinese government will need to provide it to spur demand and support jobs, others suggest that there is no immediate need for fiscal stimulus to support consumers. Instead, Beijing is likely to keep its plan of infrastructure investment as a supplementary growth engine, as the external market is expected to deteriorate further in 2023.

In recent years, China has become a major exporter of goods, with its economy relying heavily on international trade. The country's export sector is dominated by electronics, machinery, and textiles, which account for a significant portion of its overall export revenues. In recent years, China has also made significant progress in the development and sale of electric vehicles, which has contributed to the strong export growth in March.

Despite the current uncertainties facing China's export sector, it is clear that the country will continue to play a major role in global trade in the years to come. As China's economy continues to evolve and diversify, its export sector will undoubtedly continue to be a key driver of growth and a major player in the global economy.

Source: Financial Times

Property

China's property market has experienced significant upheaval and volatility since the onset of Covid-19 but has long been considered a cornerstone of its economy. China's property market has shown signs of stabilizing since the beginning of 2023, and Fitch Ratings expects the moderately positive momentum to persist into the second quarter, benefitting from the continued economic recovery and supportive policy measures. Several factors are driving the property market's strength, from a broader economic shift towards services and consumption leading to wealth creation that is then funnelled into real-estate investments. The second factor relates to the Chinese government's restrictions on overseas investments, which have encouraged wealthy citizens to invest domestically. Finally, credit availability within China has also propelled property developers and investors to engage in real-estate activity.

While the current momentum in the property market is moderately positive, there are also concerns about the risks associated with the enormous debt held by Chinese property developers. For example, there was a two trillion yuan ($290 billion) decline in income from land sales last year and continued into the first two months of 2023. Given the challenges faced by China’s property market, such as slower income growth and demographic problems, land sales revenue is expected to continue being under stress down the road. If the real estate market was to experience a sudden downturn or crash, it could have significant implications for the broader Chinese economy.

China's property market has experienced significant upheaval and volatility since the onset of Covid-19 but has long been considered a cornerstone of its economy. China's property market has shown signs of stabilizing since the beginning of 2023, and Fitch Ratings expects the moderately positive momentum to persist into the second quarter, benefitting from the continued economic recovery and supportive policy measures. Several factors are driving the property market's strength, from a broader economic shift towards services and consumption leading to wealth creation that is then funnelled into real-estate investments. The second factor relates to the Chinese government's restrictions on overseas investments, which have encouraged wealthy citizens to invest domestically. Finally, credit availability within China has also propelled property developers and investors to engage in real-estate activity.

While the current momentum in the property market is moderately positive, there are also concerns about the risks associated with the enormous debt held by Chinese property developers. For example, there was a two trillion yuan ($290 billion) decline in income from land sales last year and continued into the first two months of 2023. Given the challenges faced by China’s property market, such as slower income growth and demographic problems, land sales revenue is expected to continue being under stress down the road. If the real estate market was to experience a sudden downturn or crash, it could have significant implications for the broader Chinese economy.

Unemployment

China’s labour market, the largest in the world, is now experiencing multiple scenarios.

According to the National Bureau of Statistics of China, the country’s unemployment rate, on April 18th 2023, was at 5.3%. The rate saw a decrease of a few decimal points, from the previous 5.6%, rate of March 2023. The survey also collected information regarding wages: the yearly wage rose by 9.7% from CYN ¥97379.00 (data of December 2021) to CYN ¥106837.00 (December 2022). Moreover, wages in manufacturing experienced an even higher increase of 11.7%, over the same period, with the yearly wage of December 2022 being at CYN ¥92459.00.

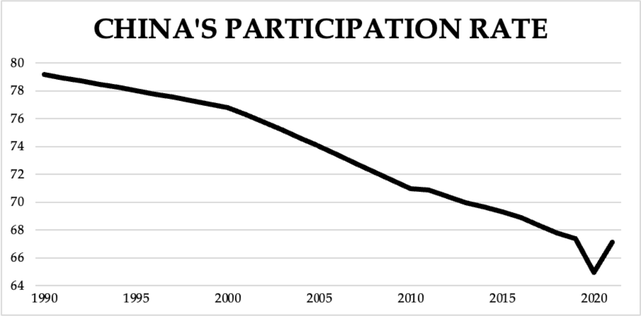

Analyzing the labour force participation, the most recent value provided is the 2021 68.06% participation rate, which, however, still represents a spike from the 2020 65.06%. The country has been seeing a decrease in the labour participation rate ever since the 1990s. The graph below also depicts the average rate of 73.7%.

China’s labour market, the largest in the world, is now experiencing multiple scenarios.

According to the National Bureau of Statistics of China, the country’s unemployment rate, on April 18th 2023, was at 5.3%. The rate saw a decrease of a few decimal points, from the previous 5.6%, rate of March 2023. The survey also collected information regarding wages: the yearly wage rose by 9.7% from CYN ¥97379.00 (data of December 2021) to CYN ¥106837.00 (December 2022). Moreover, wages in manufacturing experienced an even higher increase of 11.7%, over the same period, with the yearly wage of December 2022 being at CYN ¥92459.00.

Analyzing the labour force participation, the most recent value provided is the 2021 68.06% participation rate, which, however, still represents a spike from the 2020 65.06%. The country has been seeing a decrease in the labour participation rate ever since the 1990s. The graph below also depicts the average rate of 73.7%.

Source: National Bureau of Statistics of China

When talking about China’s unemployment, youth unemployment is indeed to be mentioned. Young graduates are subject to an almost all-time high of 19.6% youth unemployment, recorded in March 2023. The year before, China’s labour market experienced an average youth unemployment (workers aged between 16-24) of 17.5%.

In a report jointly published by China Institute for Unemployment Research and the Chinese jobs board Zhaopin, regarding 2022 Q3, the ratio between market demand and job applicants was 0.57. To compare, the 2020 and 2021 Q3 data were respectively 1.38 and 1.24. As indicators of the health of employment in an economy, ratios below 1.00 suggest a highly competitive job market, with fewer job openings, with many applicants.

Furthermore, as reported by Larry Hu, the Macquarie Group’s chief China economist, “Companies are reluctant to hire more workers because consumers are cautious. But without a strong labour market, consumers will be hesitant to spend”.

The high level of youth unemployment puts the economy at risk for “social stability”. In fact, since 2021, the Chinese youth movement Tang Ping (“lying flat”) has been protesting against societal pressure of having a successful career and family. The movement advocated for young citizens who feel alienated and excluded by the economy. What is more, the “moonlight clan” is a self-proclaimed group of young workers who live paycheck-to-paycheck on purpose and without the intention of saving or investing.

These two movements are just a few examples of why this unsustainable youth unemployment poses a threat to social stability. Surely, the Chinese government needs to reflect on these social phenomena.

In a report jointly published by China Institute for Unemployment Research and the Chinese jobs board Zhaopin, regarding 2022 Q3, the ratio between market demand and job applicants was 0.57. To compare, the 2020 and 2021 Q3 data were respectively 1.38 and 1.24. As indicators of the health of employment in an economy, ratios below 1.00 suggest a highly competitive job market, with fewer job openings, with many applicants.

Furthermore, as reported by Larry Hu, the Macquarie Group’s chief China economist, “Companies are reluctant to hire more workers because consumers are cautious. But without a strong labour market, consumers will be hesitant to spend”.

The high level of youth unemployment puts the economy at risk for “social stability”. In fact, since 2021, the Chinese youth movement Tang Ping (“lying flat”) has been protesting against societal pressure of having a successful career and family. The movement advocated for young citizens who feel alienated and excluded by the economy. What is more, the “moonlight clan” is a self-proclaimed group of young workers who live paycheck-to-paycheck on purpose and without the intention of saving or investing.

These two movements are just a few examples of why this unsustainable youth unemployment poses a threat to social stability. Surely, the Chinese government needs to reflect on these social phenomena.

Growth

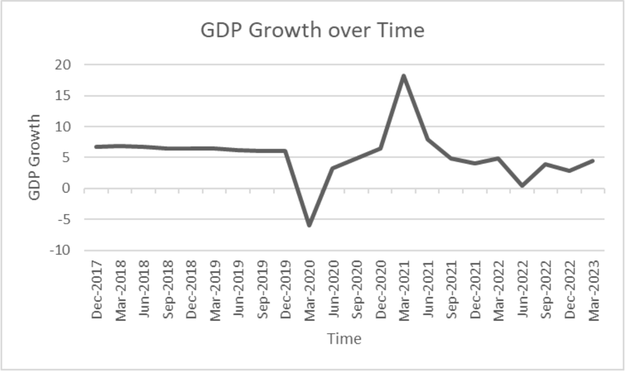

China’s 2023 Q1 GDP growth of 4.5% was above the median economist forecast of 4%. This bodes well for the government’s “around 5%” full-year 2023 growth target, clearly suggesting that China is seeing a very strong growth recovery, albeit an uneven one - it is currently a consumption-driven recovery.

Mixed data shows retail sales and GDP were strong whereas on the downside, there was an unexpected slowdown in fixed-asset investment, weaker industrial output and still negative property investment. Yet, China’s Q1 financial statistics report shows that despite the good retail numbers, consumers are still not spending enough. Indeed, China’s new household deposits reached 9.9 trillion yuan (about $1.4 trillion) in Q1, which is up 27% year over year showing that people are yet still saving much more instead of spending and consuming - pent-up demand is still great. Besides, challenges also remain on fiscal policy as revenue only rose 0.5% in Q1 year over year, while spending was up 6.8%. Additionally, government income from selling land-use rights, which is of large significance, is down 27% year over year over year in Q1.

Overall, this growth stems from a strong rebound in travel-related consumption and services activity, government policy taking a leading role in driving economic recovery, a significant narrowing in real estate investment growth and export performance beating expectations, in part benefiting from near-term resilience of developed market economies but also in part reflecting the government’s efforts to stabilize exports and foreign investment. Major industries and sectors that are at the forefront of this growth include the automobile, software development, online shopping, healthcare and tourism industries.

The future of this growth dynamic depends on a plethora of factors, which could make it shift in any direction in the coming months, particularly with unpredictable marginals that could arise such as more predominantly, a resurgence of the covid pandemic (which China has only recently learned to live with) or geopolitical developments in the region. Additionally, if a global recession does happen and demand for Chinese export remains weak - if not weaker - this could also significantly hinder its growth potential particularly due to the importance of exports within China’s GDP.

Several brokers and banks have recently further increased their 2023 China GDP growth forecasts following the release of Q1 data: J.P. Morgan sees annual growth at 6.4% compared to its previous estimate of 6.0%, UBS forecasts 5.7% versus 5.4% previously, Citi forecast 6.1% versus 5.7% previously. This clearly shows the positive impact of this economic recovery, pushing experts to readapt expectations. Therefore, there is little doubt that China will not reach its government’s annual growth target of 5%, illustrating that it is ultimately acting on the safe side.

China’s 2023 Q1 GDP growth of 4.5% was above the median economist forecast of 4%. This bodes well for the government’s “around 5%” full-year 2023 growth target, clearly suggesting that China is seeing a very strong growth recovery, albeit an uneven one - it is currently a consumption-driven recovery.

Mixed data shows retail sales and GDP were strong whereas on the downside, there was an unexpected slowdown in fixed-asset investment, weaker industrial output and still negative property investment. Yet, China’s Q1 financial statistics report shows that despite the good retail numbers, consumers are still not spending enough. Indeed, China’s new household deposits reached 9.9 trillion yuan (about $1.4 trillion) in Q1, which is up 27% year over year showing that people are yet still saving much more instead of spending and consuming - pent-up demand is still great. Besides, challenges also remain on fiscal policy as revenue only rose 0.5% in Q1 year over year, while spending was up 6.8%. Additionally, government income from selling land-use rights, which is of large significance, is down 27% year over year over year in Q1.

Overall, this growth stems from a strong rebound in travel-related consumption and services activity, government policy taking a leading role in driving economic recovery, a significant narrowing in real estate investment growth and export performance beating expectations, in part benefiting from near-term resilience of developed market economies but also in part reflecting the government’s efforts to stabilize exports and foreign investment. Major industries and sectors that are at the forefront of this growth include the automobile, software development, online shopping, healthcare and tourism industries.

The future of this growth dynamic depends on a plethora of factors, which could make it shift in any direction in the coming months, particularly with unpredictable marginals that could arise such as more predominantly, a resurgence of the covid pandemic (which China has only recently learned to live with) or geopolitical developments in the region. Additionally, if a global recession does happen and demand for Chinese export remains weak - if not weaker - this could also significantly hinder its growth potential particularly due to the importance of exports within China’s GDP.

Several brokers and banks have recently further increased their 2023 China GDP growth forecasts following the release of Q1 data: J.P. Morgan sees annual growth at 6.4% compared to its previous estimate of 6.0%, UBS forecasts 5.7% versus 5.4% previously, Citi forecast 6.1% versus 5.7% previously. This clearly shows the positive impact of this economic recovery, pushing experts to readapt expectations. Therefore, there is little doubt that China will not reach its government’s annual growth target of 5%, illustrating that it is ultimately acting on the safe side.

Source: National Bureau of Statistics of China

Conclusion

In conclusion, the first quarter GDP data of China reveals a mixed picture of its economy. China's retail sales have made a remarkable recovery. The country's exports have also bounced back in the final month of the last quarter, although the outlook for exports in the coming months is predicted to be weaker. The property market, a cornerstone of China's economy, has experienced significant upheaval and volatility since the onset of Covid-19 but has shown signs of stabilizing since the beginning of 2023. However, the threat of unsustainable youth unemployment remains a concern and could pose a threat to social stability. Overall, China's economy continues to face challenges and uncertainties as it navigates its way through the aftermath of the pandemic.

In conclusion, the first quarter GDP data of China reveals a mixed picture of its economy. China's retail sales have made a remarkable recovery. The country's exports have also bounced back in the final month of the last quarter, although the outlook for exports in the coming months is predicted to be weaker. The property market, a cornerstone of China's economy, has experienced significant upheaval and volatility since the onset of Covid-19 but has shown signs of stabilizing since the beginning of 2023. However, the threat of unsustainable youth unemployment remains a concern and could pose a threat to social stability. Overall, China's economy continues to face challenges and uncertainties as it navigates its way through the aftermath of the pandemic.

By Matilde Chiavenato, Cosimo Winchler, Severinas Freigofas, Nicolas Lockhart

SOURCES

- National Bureau of Statistics of China

- FT

- Bloomberg