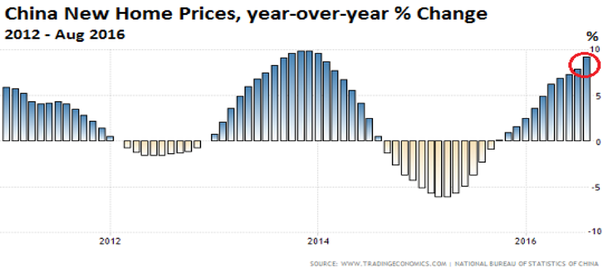

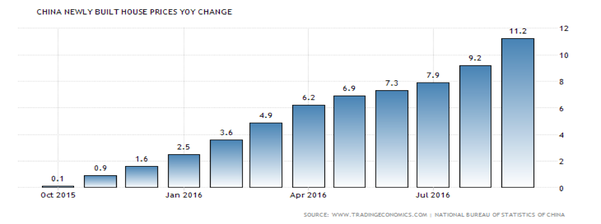

Over the past years housing markets in China have been moving in clear up and down cycles, as a result of a combination of monetary and housing policies which had a significant impact on house prices and sales volumes. A National Bureau of Statistics survey showed that China’s new home prices rose in September 2016 at the fastest rate on record: in China’s 70 major cities rising by 11.2% YoY, accelerating from a 9.2% increase in August.

There are two main reasons behind the booming house market. First, China’s economy decelerated in 2015 and in order "To maintain GDP growth at 6.5 per cent next year, the Chinese government will continue to take supportive measures for the real estate sector," said Standard & Poor's credit analyst Dennis Lee. Some of the measures of the government were to reduce the minimum down payment for second-home buyers and exempt the property sellers from paying transaction tax if they had owned the property for at least two years.

Second, the boom in sales and prices was evident in mortgage lending, with new housing loans to individuals totaling 475.9 billion yuan in September alone, some 76% higher than the same month last year, central bank official Ruan Jianhong said in a news release. The main reason for the increase was when the People’s Bank of China cut the key interest rate by 25 basis points to 4.35% in October 2015, its sixth rate cut since November 2014.

Second, the boom in sales and prices was evident in mortgage lending, with new housing loans to individuals totaling 475.9 billion yuan in September alone, some 76% higher than the same month last year, central bank official Ruan Jianhong said in a news release. The main reason for the increase was when the People’s Bank of China cut the key interest rate by 25 basis points to 4.35% in October 2015, its sixth rate cut since November 2014.

The rapid rise in house prices in big Chinese cities may mean a real estate bubble is inflating to bursting point, warned UBS Economist Tao Wang, Deutsche Bank Group AG and Goldman Sachs Group AG, seeing growing risks across the real estate industry. Spiraling leverage and implicit state support are among the common denominators of a bursting bubble, a situation already seen last year’s equity boom. “Today, an alarming sign is that leverage is also building in the property market", said Jing Ulrich, vice chairman of Asia Pacific at JPMorgan Chase & Co.

However, more than 20 cities have adopted restrictive measures to tame fast-rising price in the first week of October. Half of them put out effective measures, such as raising the down payment ratio for second-home purchases to as high as 70 percent. In most big Chinese cities local governments rush to cool overheated property markets by restricting new purchases or even arresting real estate agents suspected of “rumor-mongering”. Singapore-based Tim Condon of ING said in a note ahead of the data release: “We view China’s authorities as more like Singapore’s and we think it’s a matter of time before macro prudential policy slows sales growth.”

“The main concern about China is that it has reverted back to the old model in terms of stimulating growth by monetary and credit side," said Philipp Baertschi, Zurich-based chief investment officer at Bank J. Safra Sarasin Ltd.

Andrea Gluscevic