On February 10 Li Shufu, founder and chairman of the Chinese carmaker Geely (officially Zhejiang Geely Holding Group), communicated the intention of merging two of its businesses, Volvo Cars and Geely Automobile, in order to create China’s first and only global automotive company.

Geely Automobile is China’s third greatest car maker with 1.5 million vehicles sold in 2019. At the moment its cars are designed and sold only in the Chinese market, but the chairman Li Shufu has been implementing an ambitious strategy of expansion, investing in electric and hybrid technology (whose market is expected to grow five-fold by 2025 according to Allied Market Research) and in markets outside China through a number of acquisitions. It has stakes in Malaysia’s car maker Proton, truck maker Volvo, British sport car maker Lotus and London Electric Vehicle Company (which produces the black taxicabs in London) and 9,7% of the shares in Daimler, owner of Mercedes Benz. In 2010, in its biggest move yet, it acquired Volvo Cars from Ford for 1.5 billion dollars and invested around 8 billion dollars to revive the Swedish company, which had closed the previous year with a loss of $653 million. Since then, Volvo has been performing well, also due to a new access to the Chinese market and to Geely’s electric technology. In 2019 Volvo Cars reported selling over 700.000 cars, a record-high figure in the history of the Swedish brand and a 13.9% growth in comparison with 2018. Revenues in the Chinese market grew 10% and, while fossil-fuelled SUVs still represent the most popular models for Volvo, the sales of electrified vehicles grew 20% in 2019.

Mr Shufu’s strategy allowed the Chinese car maker to record all-time high revenues in 2019 in all its businesses, both in China and in Europe, with a 70% increase in electrified vehicles sales. The acquisition of Volvo allowed for a fruitful exchange of information and expertise between the Swedish and Chinese brands, with the former benefiting of Geely’s electric technology and the latter of Volvo’s engines and design. In 2016, a Geely-Volvo joint Venture, Lynk&Co, was set up to offer electrified luxury vehicles to both the Chinese and European market. It registered 120 thousand sales in China in 2018 and it is planning to open its first stores in Europe and in the US by 2021.

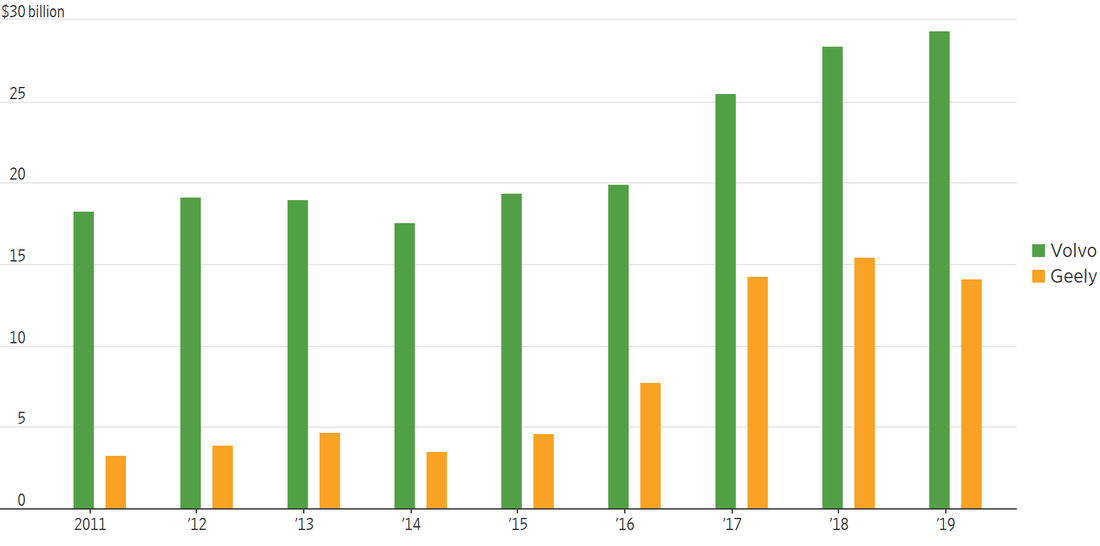

The merge between Geely Automobile and Volvo Cars will create the first Chinese global player in the automotive industry. With 2.6 Million combined sales and a fast-growing electric and hybrid fleet, the new company will have access to a broader international stage. Moreover, the merger could protect Geely from the downturn of Chinese economy; as a proof of that, while the automotive sector shrank 4.16% in 2018, Geely’s revenues increased 18.04% year over year. Volvo Cars failed in its attempt of listing in Stockholm 18 months ago, with the hope of raising as much as $30 million. The new company will have access to the Hong Kong market, where it is already listed, and possibly to Stockholm as well.

The merge could also result in synergies: while most technology has already been shared between the two companies, production facilities both in Europe and China and consequently many components will be shared, for example Volvo info and entertainment system as well as car frame.

A possible obstacle will be the effect of the new COVID-19 virus on the Chinese automotive industry. If the situation continues to escalate, the deal could face a serious risk of not happening or being postponed to next year.

Currently, Geely has a market share of 6.5% in China and 2% worldwide and an enterprise value of 15.7 billion dollars according to S&P Global Intelligence.

Geely is currently financially stable and has been growing in revenues and profits steadily in the past five years (in 2018 EBITDA grew 26.9%, the year before 98.8%). In 2019 its debt-to-equity ratio was 0.08 and recorded a 28% ROE. The Chinese company would likely have to pay between 7.5 and 9 billion dollars for Volvo Cars, according to the analysts at Bernstein. The new conglomerate will be listed in Honk Kong and secondarily in Stockholm. Håkan Samuelsson, the 68-year-old Volvo CEO in office since 2012, will likely retain its role in the company at least until his contract expires in 2022, according to executives at Geely. Spokespeople from Geely have reportedly announced that Volvo will work under the same management as Geely Automobile but with separate objectives, focusing on building a fleet of electrified vehicles using the technology of the Chinese company. The deal is supposed to be finalised by the end of 2020.

Geely’s share were up 8.5% to 14.72 HKD on the news, and have since gained value to 15.10 HKD, a 10.2% increase since February 10.

Carlo Geat