China is currently struggling to keep up with the global developments in the semiconductor industry due to its dependence on imported technology and recent U.S. sanctions. Nevertheless, state-backed investments such as the ‘Big Fund’ underline China’s determination to boost domestic supply and succeed in the chips race, but will these efforts be enough?

Macroeconomic Backdrop – structural decline

China ranks as the world's second-largest economy in nominal terms, trailing behind the United States, but claims the top spot when adjusting for purchasing power parity, which factors in the cost of living.

The economic data is currently mixed: the country's economy had been growing rapidly since the 1980s, with annual growth rates exceeding 8%, but the Covid-19 pandemic, a trade war with the U.S. and a property sector downturn have complicated its growth trajectory, assessed at 5% in 2023. Despite these shocks, the slowdown in China’s economy is considered to be structural, caused by the end of an unprecedented expansion in credit and investment over the past decade.

China’s figures are struggling to regain momentum: the country is facing a phase of deflation reaching -0.8% in January 2024, caused by industrial overcapacity and real estate recession; the consequence of falling asset prices and negative wealth is a reduction in consumption, investment and unemployment (especially for young workers).

Semiconductors – the solution to boost domestic output

The economy was strongly affected by the huge property slowdown of the last 2 years: investment in this sector fell by 24% by December 2023. Property in China was estimated to be worth $60 trillion at its peak, making it the biggest asset class in the world, so this market meltdown is weighing on the world’s second-largest economy.

When it comes to industries, Xi Jinping is attempting to move away from debt-fueled sectors such as property, and to move towards strategically critical industries. The terms it uses are “high-quality development” and “new productive forces,” which include electric vehicles, climate tech, life sciences, and artificial intelligence. Beijing’s real focus is reshaping the economy with state-led investment: the government would increase spending for science and technology research by 10%, for a total of 371 billion yuan (US$52 billion).

In the international market, China has established itself as one of the leaders in the semiconductors’ sector. As a matter of fact, when it comes to this industry, the Chinese market is as of now the world's largest consumer of semiconductors, purchasing more than 50 percent of the chips manufactured globally. There has been a major transition in semiconductor market share from American and European countries to Asian countries in the past two decades.

Semiconductors are today's most valuable and contested piece of innovative technology: they are at the core of most technical devices. Integrated circuits represent the brains of modern electronics, powering everything from smartphones and medical devices to factory machinery and artificial intelligence. In fact, the semiconductor market is greatly influenced by several end markets, such as automotive, consumer electronics, telecommunication, and industrial equipment markets. The value chain of a semiconductor is one of the most complex ever conceived: from design to production, more than 1,000 steps across 70 different countries are required.

More than 1,000 billion chips are sold annually, with the sector's global value projected to reach $1,400 billion by the end of the decade. In 2022, the revenue of the global semiconductor market was $610 billion, and it is forecasted to rise to around $736 billion by 2027. Notably, China is expected to generate the highest revenue, reaching $198.90 billion in 2024, in comparison to other regions worldwide.

The trade war with the US though, is hindering Chinese expansion in this sector: US policymakers have enacted export controls on various types of semiconductors and technologies to China, since policymakers argue that they have a military application. These sanctions are influencing trade and encouraging some firms to move production away from China.

Trade wars and regulatory environment

In the intricate tapestry of China's political and economic landscape, seismic shifts have recently unfolded, profoundly influencing, among other sectors, the semiconductor industry. China's leaders have therefore strategically recalibrated their focus towards bolstering domestic consumption, a central element in President Xi Jinping's view for a more self-reliant and resilient economy.

The semiconductor industry emerges as a light of growth and strategic importance for China's economic ambitions. With its ascent as a global manufacturing powerhouse, the semiconductor sector has experienced exponential growth, positioning itself in the nation's drive for technological self-sufficiency. Industry metrics, as reported by Reuters, highlight China's remarkable strides in semiconductor manufacturing, reflecting not only significant revenue growth but also substantial advancements in technology.

However, China's ambitions extend beyond mere economic expansion; they encompass a comprehensive strategy to fortify domestic supply chains and reduce vulnerabilities to external disruptions. This approach is intricately brought on with initiatives such as "Made in China 2025," a flagship program aimed at promoting innovation and domestic production across critical industries, including semiconductors. Such initiatives signal China's intent to transition from being the world's factory to becoming a global innovation hub, driving technological innovation and shaping the future of the economy.

China has also implemented a multifaceted approach encompassing various policy measures and incentives to catalyze domestic consumption. Tax incentives and subsidies stimulate consumer spending and foster domestic demand. Additionally, efforts to enhance social safety nets and improve income distribution aim to boost purchasing power and nurture a vibrant consumer culture.

Moreover, China's quest for technological sovereignty extends beyond domestic shores, manifesting in ambitious endeavors such as the Belt and Road Initiative (BRI). As China invests in infrastructure development and digital connectivity across participating nations, it not only strengthens economic ties but also promotes the export of Chinese technologies, including semiconductors. This strategic outreach enhances China's influence in shaping global technological standards and fosters greater interconnectivity in the digital age.

In the realm of geopolitics, China's emphasis on domestic consumption and technological self-sufficiency serves as a bulwark against external pressures and geopolitical tensions. By reducing reliance on foreign markets and critical technologies, China seeks to isolate itself from external disruptions and gain more autonomy in decision-making. This strategic autonomy, underscored by initiatives such as the "dual circulation" strategy, represents a paradigm shift in China's economic thinking, emphasizing resilience and adaptability in an increasingly volatile global landscape.

Chinese chips – late to the party?

Lying at the center of the semiconductor industry are the Integrated Circuits (IC), also known as chips. A chip, as small as a fingernail, is made up of around 100 layers with billions of transistors. The demand for ICs is growing rapidly due to their indispensable role in processing and storing information on electronic devices such as computers and smartphones. Memory chips are ICs used for data storage, which can either be temporary to perform immediate tasks or permanent (or non-volatile, i.e. can store information even when power is off) which allows a processor to access but not modify the data.

How are they produced?

The process takes 26 weeks on average and requires the utmost precision along with state-of-the-art technology. Hundreds of chips are fabricated in a grid pattern on a silicon plate called a wafer. Silicon is easily accessible in nature and as a semiconductor, its conductivity can be modified by adding impurities, or doping, to meet specific needs of electronic devices. A wafer diameter ranges from 1 inch to 12 inches; the larger the wafer, the more chips can be produced. Several procedures are then carried out in an extremely sterile environment (also called a fab). One of the most critical steps is photolithography, the same mechanism as a film in cameras, which uses UV lights to shape the chips according to the 3D blueprints. Each chip is then run through thorough tests to detect malfunctions and qualified chips are extracted from the wafers, ready to be used.

As of 2024, China is only able to mass-produce 14 nanometer chips. They have also been able to manufacture 7nm chips on a small scale and plan to produce 5nm chips on a minor scale soon. Yet, the 7nm fabrication lines of the Semiconductor Manufacturing International Corporation (SMIC) are primarily based on the U.S. machinery (imported before the restrictions came into power in 2022) as well as ASML’s lithography technology (imported in 2023). According to the Financial Times, SMIC is charging 40-50% more on these 7nm fabrication nodes compared Taiwan’s TSMC. Furthermore, SMIC’s number of chips deemed to meet the requirements to ship to customer over the total, or yield, is less than one third of TSMC’s.

China is lagging in the “Chip War” due to the lack of advanced equipment, with many other global players 10 years ahead in production technology. This factor, combined with the global restrictions imposed on chip technology imported by China, further aggravates the situation. For perspective, TSMC and Samsung were able to manufacture a high-volume of 3nm chips in 2022. The two powerhouses plan to mass produce 2nm chips in 2025, with the latter having ambitions of making 1.4nm chips in 2027.

China has attempted to solve this issue by moving production domestically. The efforts started much before the global restrictions on the country’s chip technology imports. These efforts can be seen through its “Made in China” plan by 2025 announced in 2015, as well as through setting up the China Integrated Circuit Industry Investment Fund (the “Big Fund”) in 2014. Particularly, autonomy in chip production increased from approximately 5% in 2018 to 17% in 2022 and is expected to have reached 30% in 2023.

China’s semiconductor industry and Integrated Circuits (IC) segment growth

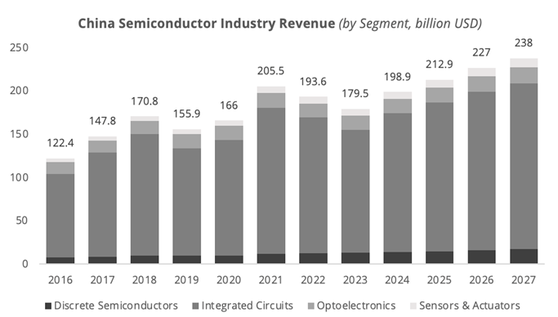

The Chinese semiconductor industry has experienced important growth in the past years and is projected to further increase. Industry revenues grew from $122.4 billion in 2016 and are projected to reach $238 billion in 2027, representing a 6.23% CAGR over the 2016-2027 period. In 2024, the Chinese semiconductor industry is expected to generate revenues of $198.9 billion, and to further expand at a CAGR of 6.16% from 2024 until 2027. (Figure 1)

Integrated circuits (IC) generally concern semiconductors possessing a specific functionality, and today represent a key element behind the development of a sizeable amount of modern electronics. More specifically, the demand and growth for ICs is driven by the demand in the automotive electronics and consumer electronics sectors. For this reason, China is also expected to remain the largest consumer of integrated circuits, as a considerable amount of consumer, automotive, and industrial electronics parts are currently produced in the country. The Chinese IC segment is further boosted by China’s recent decision to phase out microprocessors from Intel and AMD from government PCs and servers, aiming at replacing foreign technology with domestic solutions.

Figure 1: China Semiconductor Industry Revenue (Statista)

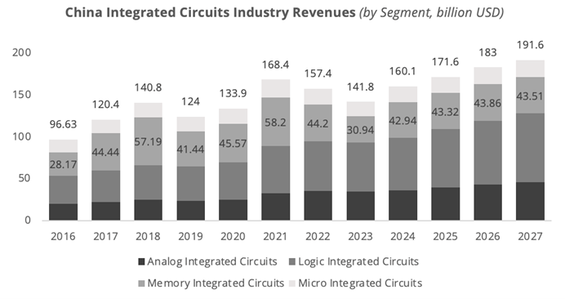

Throughout the period from 2016-2023, the Integrated Circuits segment has constantly represented approximately 80% of the Chinese industries’ revenues and is expected to maintain this elevated share from 2024-2027. (Figure 2) The IC segment’s revenues were $96.63 billion in 2016, and are expected to reach $191.6 billion by 2027, constituting a significant 7.78% CAGR throughout the period.

Figure 2: China IC Industry Revenues (Statista)

Revenues coming from memory Integrated Circuits (memory chips) fluctuated from 2016-2021 but still witnessed an overall increase of approximately 107%. In the period from 2021 to 2023, China suffered from the consequences of Covid-19 as well as the U.S. sanctions valid from December 2022, with memory chips sales almost halving to $30.94bn. Since China has been trying to move production domestically, sales are expected to rise and remain at around $43bn until 2027 as the second-largest economy needs time to adapt to the new production line and catch up with competitors.

The “Big Fund”

With the objective of achieving self-sufficiency and accelerating the domestic semiconductor industry, China launched the state-run China Integrated Circuit Industry Investment Fund in 2014, with one of its main investment areas being in equipment for chip manufacturing. The launch of the fund was considered vital to avoid lagging behind the United States, Taiwan, and South Korea in semiconductor technology. Also known as the “Big Fund”, it has currently set up 3 different funds over the past decade. The organization raised 138.7 billion yuan ($22.5 billion) for its first fund in 2014, 204 billion yuan ($33 billion) for its second fund in 2019, and it has set a target of 300 billion yuan ($41 billion) in its third fund announced in 2023. Investors in its first two funds include state-owned entities such as the China Development Bank Capital, the Chinese Finance Ministry, China National Tobacco Corporation and China Telecom. The initial 2014 fund is a shareholder in 74 companies and startups, whereas the second fund currently holds stakes in 48 local chip firms, according to corporate database Tianyancha.

These funds have acted as a key source of capital for many domestic semiconductor firms, consistent with China’s efforts to build a more autonomous semiconductor industry in response to US sanctions. However, the operations of the fund have not been as smooth as desired. In 2022, an anti-corruption investigation began, lasting more than one year. The investigation impacted investment pace and market confidence, also resulting in more than 10 people being investigated as well as some individuals involved disappearing from public view.

Notwithstanding these struggles, in 2023, the fund contributed to two major operations in the local semiconductor industry. Firstly, the fund participated in the $7 billion (Rmb50 billion) capital increase of Yangtze Memory Technologies Co., Ltd. (YMTC) announced on the 3rd of February 2023 with a $1.9 billion funding. Secondly, on the 31st of October 2023, in Changxin Xinqiao Storage Technology Co. Ltd.’s $5.3 billion capital increase, with a $1.9 billion investment.

Yangtze Memory Technologies Co., Ltd. (YMTC) – $7bn capital increase

Yangtze Memory Technologies Co., Ltd. (YMTC) was founded in Wuhan, China in 2016. The company primarily focuses on designing and producing 3D NAND flash memory (a non-volatile memory in which memory cells are stacked vertically to increase memory storage). YTMC is China’s leading memory chip producer and the only Chinese company that participates in the global NAND memory market. Yangtze is said to have been aggressively developing “world’s most advanced memory chip” with the help of government-led investment vehicles.

In December 2022, the U.S. government added YTMC and more than 20 other Chinese companies to the “Entity List” which hindered the access to the U.S. chip-making technology. These chipmakers found themselves in a tough situation due to the heavy reliance on their American counterparts. Chinese administration then had to resort to funding domestic suppliers and R&D activities.

Before being blacklisted, YTMC had been looking for ways to de-Americanise its production chain by cooperating with local vendors, including Naura Technology and Advanced Micro-Fabrication Equipment (AMEC). This backward move in production was costly for the company and just became worse after the sanctions. Nonetheless, China saw potential in Yangtze’s major role within the domestic chip industry. In March 2023, YMTC received $7bn from state-backed funds, most notably the $1.9bn coming from the Big Fund. Even with the capital injection, the company was still in a dilemma to find domestic alternatives for its chip's components. Despite the cutting-edge technology from Naura and AMEC, it is still not known if the cooperation would turn out to be fruitful. Experts reckoned that the two companies might not be able to provide YTMC with an adequate amount of production kits and sufficiently advanced chipmaking tools. In fact, there is no feasible option for domestic lithography system in China. The situation was worsened by the Netherlands’ sanctions which prevented ASML, nearly a monopoly in lithography machinery, from joining hands with Chinese IC firms for some of its technology. The most advanced Chinese lithography tools do not even come close to what YTMC demands to produce its 3D NAND.

After under a year of pouring all the additional funding into finding substitutes, the Wuhan-based company once again called for a fundraising campaign. This time, the round was “oversubscribed” by domestic investors, showing investors’ confidence in the development of the Chinese semiconductor industry. To meet the expectations, the company went to great lengths to tackle the problem wherein some parts are irreplaceable by domestic suppliers by reaching out to producers in other countries such as Japan and Korea.

Changxin Xinqiao Storage Technology Co. Ltd. – $5.4bn capital increase

Beijing continued to show signs of doubling down on efforts to expand its domestic chipmaking capacities by investing $1.99bn in Changxin Xinqiao whose 33.15% of the total registered capital belongs to the Big Fund.

Changxin Xinqiao Storage Technology Co. Ltd. (CXMT) has been established in Hefei City since 2021. The two-year-old start-up at the time shared the general manager, Zhao Lun, with ChangXin Memory Technologies – China's top dynamic random access memory (DRAM) chipmaker. Changxin Xinqiao has filed for the construction of “a manufacturing base of 12-inch memory wafer”, thus becoming the first in China to mass produce integrated DRAM. Furthermore, the chipmaker aims at producing high-bandwidth memory (HBM), advanced memory chips for artificial intelligence.

Recognizing the pivotal role of Changxin Xinqiao in the semiconductor industry, investors put $5.4bn into the company, $1.99bn of which came from the Big Fund. Due to its success, Changxin had also planned to go IPO on Shanghai’s Nasdaq-style STAR board in 2023. However, the company decided to call its stock exchange debut off due to volatile market conditions. In fact, the shareholder restructuring Changxin performed around mid-2023 had served to prepare the company for the potential listing.

Conclusions

Amidst sanctions imposed by Western countries, Chinese chipmakers urgently need help seeking local alternatives for various manufacturing stages and find themselves left behind by international competitors by a decade. In response, China has been going to great lengths to move production domestically by calling for a union of national investors. These efforts are anticipated to pay off since the semiconductor industry’s sales revenue forecast has signaled outstanding potential. It is still unclear how the outcome will turn out given this volatile state of the economy and geopolitics, but one certainty prevails: The Chinese government is dedicated to fostering the development of homemade chips at all costs.

By Gianluca Battaini, Pietro Golzio, Sofia Rubino, Anh Tho Vu

Sources:

- S&P Global

- Statista

- Financial Times

- Bloomberg

- Reuters

- Verdict

- New York Times

- CNN Business

- South China Morning Post