Microsoft (MSFT) and IBM (IBM) are two of the largest technology companies in the world, with a market cap of 2075 and 120 billion dollars respectively. Even though Microsoft has imposed itself as one of the most important players in the sector, the rivalry between the two brands has been long standing. In this article, we will have a closer look at the historical performance of the two companies in the last thirty years, how the performed during crises and how they evolved and remained relevant throughout the years.

The beginnings

Microsoft was founded on April 4, 1975 in Albuquerque by two friends from Seattle: Paul Allen, a young programmer, and Bill Gates, a student at Harvard. They produced software for the Altair 8800, one of the first microcomputers, but by the end of 1978 their revenues toppled $1 million. Microsoft was already a profitable firm. It had money in the bank and did not feel pressured to go public. This firm was practically the opposite of what we often see in the current tech cycle. In 1975, Microsoft produced and sold a "BASIC Interpreter," which is the first milestone listed in the company's IPO prospectus. In 1980, IBM contracted Microsoft to create a non-exclusive operating system for the company's first personal computer. This is the moment that marked the consequent success of Microsoft, which is profoundly linked to IBM. The MS-DOS was born from that system, and it became one of Microsoft's most profitable products ever. MS-DOS was the operating system of choice for practically every PC on the market at the time, and it was also utilized in all IBM systems.

IBM, or International Business Machines, was founded in 1911. Since the beginning, when it was founded as the Computing Tabulating Recording Enterprise, IBM has been a publicly listed company. Ever since, the company has grown at an incredible rate. Since 1913, IBM's stock has been routinely split and paid out healthy dividends. During its early years, the C-T-R Company specialized in accounting and calculating equipment, business time recorders, and mechanical punch card systems. Instead of being the invention-driven corporation it subsequently became, it focused on typical office products. Thomas Watson became the company's president in 1924 and renamed it International Business Machines, or IBM. Watson developed IBM's success in his first few years through business and marketing methods, designing goods tailored to individual customers' needs, and extensively investing in the company's sales staff. IBM began to become a household name in the 1920s and 1930s. However, it was not until Thomas Watson's son, Thomas Watson Jr., took over in the 1950s that the corporation began to promote this line of business. Many of the core technologies such as: RAMAC, FORTRAN, System/360 etc. that enabled computers to become business staples were pioneered by IBM during the 1950s and 1960s.

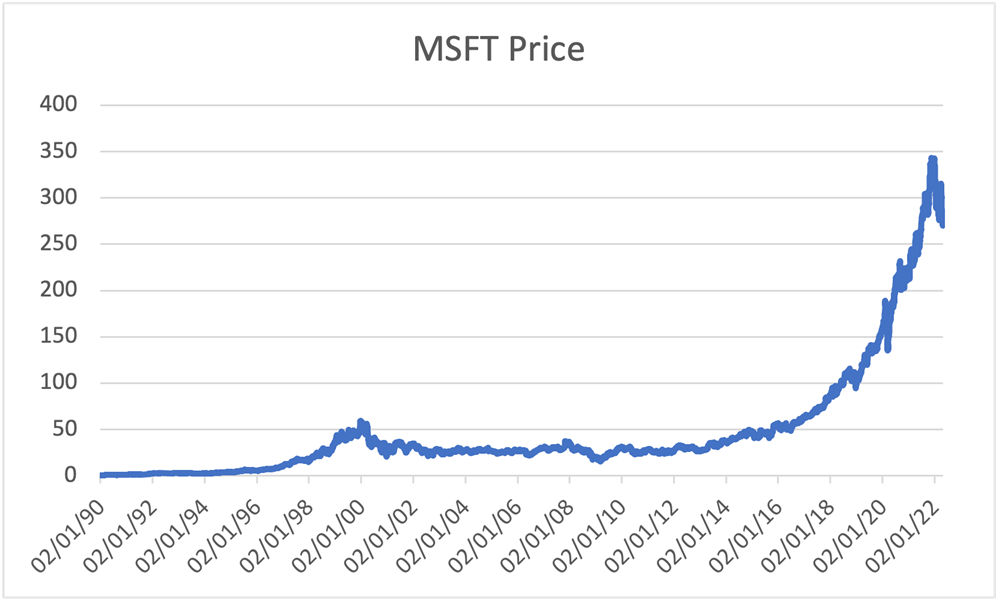

In 1986, Microsoft went public for the first time, with a $21 offering price that went as high as $35.50 by the end of the day. The year before, the company had launched Windows, an operating system that, contrary to MS-DOS, featured a graphical interface. On the first day, 2.5 million shares were sold, raising $61 million. Analysts named it "the deal of the year."

An interesting fact is that Co-founder Bill Gates sold $1.6 million in shares and retained a 45 percent stake which was worth $350 million. In a range of 10 years (1986-1996) Microsoft stock climbed more than a hundredfold.

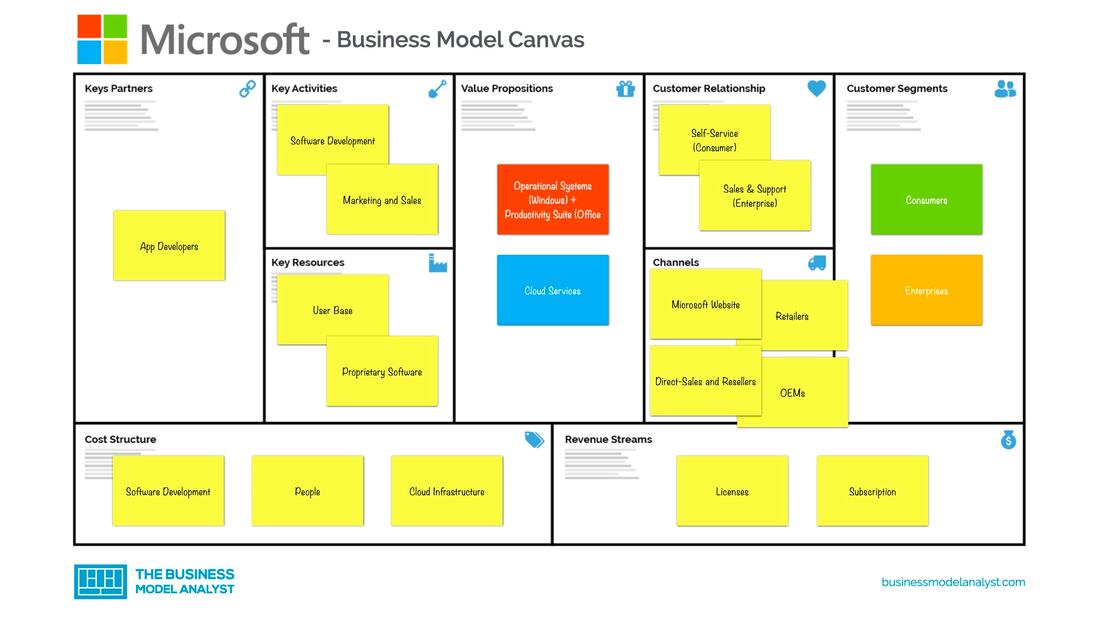

Microsoft’s Business Model

Microsoft is a software and hardware company that provides its services for both entertainment and business. The firm's core operations are the selling, distribution, and support. However, in order to support all goods and services, its business strategy entails a few types, which include:

The beginnings

Microsoft was founded on April 4, 1975 in Albuquerque by two friends from Seattle: Paul Allen, a young programmer, and Bill Gates, a student at Harvard. They produced software for the Altair 8800, one of the first microcomputers, but by the end of 1978 their revenues toppled $1 million. Microsoft was already a profitable firm. It had money in the bank and did not feel pressured to go public. This firm was practically the opposite of what we often see in the current tech cycle. In 1975, Microsoft produced and sold a "BASIC Interpreter," which is the first milestone listed in the company's IPO prospectus. In 1980, IBM contracted Microsoft to create a non-exclusive operating system for the company's first personal computer. This is the moment that marked the consequent success of Microsoft, which is profoundly linked to IBM. The MS-DOS was born from that system, and it became one of Microsoft's most profitable products ever. MS-DOS was the operating system of choice for practically every PC on the market at the time, and it was also utilized in all IBM systems.

IBM, or International Business Machines, was founded in 1911. Since the beginning, when it was founded as the Computing Tabulating Recording Enterprise, IBM has been a publicly listed company. Ever since, the company has grown at an incredible rate. Since 1913, IBM's stock has been routinely split and paid out healthy dividends. During its early years, the C-T-R Company specialized in accounting and calculating equipment, business time recorders, and mechanical punch card systems. Instead of being the invention-driven corporation it subsequently became, it focused on typical office products. Thomas Watson became the company's president in 1924 and renamed it International Business Machines, or IBM. Watson developed IBM's success in his first few years through business and marketing methods, designing goods tailored to individual customers' needs, and extensively investing in the company's sales staff. IBM began to become a household name in the 1920s and 1930s. However, it was not until Thomas Watson's son, Thomas Watson Jr., took over in the 1950s that the corporation began to promote this line of business. Many of the core technologies such as: RAMAC, FORTRAN, System/360 etc. that enabled computers to become business staples were pioneered by IBM during the 1950s and 1960s.

In 1986, Microsoft went public for the first time, with a $21 offering price that went as high as $35.50 by the end of the day. The year before, the company had launched Windows, an operating system that, contrary to MS-DOS, featured a graphical interface. On the first day, 2.5 million shares were sold, raising $61 million. Analysts named it "the deal of the year."

An interesting fact is that Co-founder Bill Gates sold $1.6 million in shares and retained a 45 percent stake which was worth $350 million. In a range of 10 years (1986-1996) Microsoft stock climbed more than a hundredfold.

Microsoft’s Business Model

Microsoft is a software and hardware company that provides its services for both entertainment and business. The firm's core operations are the selling, distribution, and support. However, in order to support all goods and services, its business strategy entails a few types, which include:

- Razor and Blade: apps, software, and Xbox games work specifically for each operating system,and they don't run in different ones.

- Lock-in: due to high switching costs, customers keep using Microsoft software and apps.

- Freemium: Linkedin, for example, is a free business social network, but some resources are only available for premium subscribers.

- Subscription: besides Linkedin, Microsoft applies this business model to Office 365 and cloud services, just to mention a few.

- Hidden Revenue: for instance, both Linkedin and Bing (Microsoft’s search engine) show the users ads on their platforms.

- Ingredient Branding: despite being just built into computers, Microsoft brands are flagrantly shown in the products.

IBM’s business model

IBM revolves around Cloud computing, Artificial intelligence, Computer hardware, and Computer software. The Big Blue business model has changed dramatically over the years, and has demonstrated to be able to adapt and reinvent itself through tough times and difficult decisions. They divested from the networking business back in the ‘90s, from PCs in the 2000s (with the ThinkPad series being acquired by Lenovo), and recently from semiconductors. In 2020, the company announced the latest split off: it will continue to focus on the AI and cloud service (after acquiring the cloud company Red Hat for $34 billion in 2019) while separating the Global Technology Services business which provides technical support to 4,600 clients and has a backlog of $60 billion and accounted for a quarter of its revenues at the time. The new company, Kyndryl, has listed on the NYSE in 2021.

IBM and Microsoft during crises: 2007-08 Great Financial Crisis vs 2020 Covid-19 Pandemic.

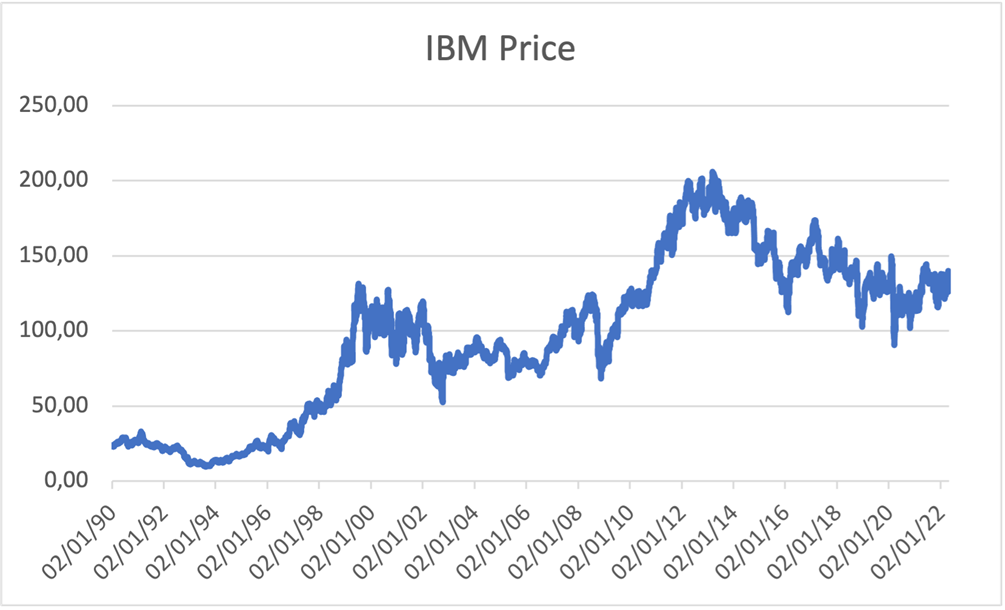

It is interesting to analyse the performance of these two firms during periods of financial distress, such as the Great Financial Crisis of 2007-2008 and the sell-off in 2020 due to the Covid-19 pandemic. In 2008, as almost all other firms in the world, IBM and Microsoft were struggling, but both fundamentals and their respective share prices at the time demonstrated their strength and resilience during tough times.

IBM’s share price fell by a maximum of 21% during the Great Financial Crisis, considerably less than the US market, with the S&P falling by as much as 50%. Their software business, which grew by 9% in the last quarter of 2008, was the main reason they outperformed the market. It was a testament of IBM’s proficiency in strategic transformation, as they were able to shift into more profitable segments of the industry, which helped them mitigate some losses.

For Microsoft, 2009 was a moment in history. It was the first time since its foundation, 34 years prior, that the company reported a drop in revenues. Founded in 1975, the tech giant managed to achieve incredible amounts of growth year on year, morphing into one of the fastest growing businesses in history. As soon as the company reported their first ‘bad’ year, a lot of doubt and uncertainty arose around Microsoft, which translated into a 45% decline in their share price. They managed to quickly recover from the situation, as Steven Ballmer, CEO of Microsoft in 2010, writes in the shareholder letter of 2010 : “Now, just 12 months later, I’m gratified to report that fiscal 2010 was a year of remarkable accomplishments.”

Covid-19 was a slightly different story, with IBM performing worse than they did during the Great Financial Crisis, and Microsoft navigating through the pandemic almost perfectly. Unlike what happened during the previous crisis, IBM’s share price dipped by approximately 37% in march 2020, slightly more than the 30% drop of the S&P500. The last few years have been a period of transition for IBM, as they struggle to find the correct strategic decisions that brought them success in the past. However, their recent move into cloud computing, one of the few sectors that benefitted from the pandemic, fueled a very quick recovery, as they managed to restore their share price to pre-pandemic levels in April 2021.

Microsoft, on the other hand, was almost completely unaffected by the pandemic. MSFT fell by approximately 30% in March 2021, but the recovery was almost as quick as the fall, initiating an upward trend that continued throughout the end of 2020 and 2021. Their dominance in cloud computing, and their reputation as one of the safest firms in the world helped them almost completely bypass the Covid-19 Pandemic.

Microsoft and IBM, where do they stand in the tech sector?

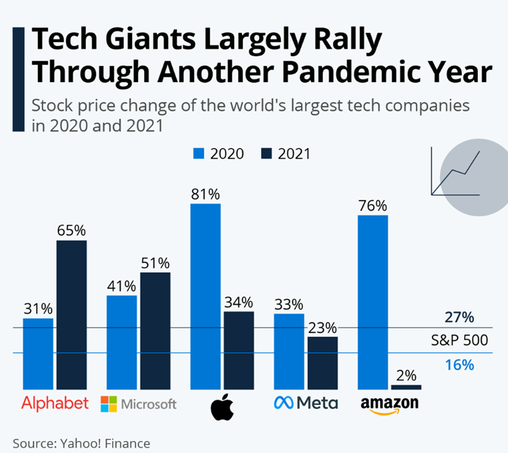

As most firms struggled during 2021, another year shaped by the pandemic, tech giants continued to demonstrate their resiliency during a global crisis. Alphabet, Microsoft, Meta and Apple outperformed the market by a huge margin in both 2020 and 2021. Surprisingly, Amazon’s huge price increase of 76% in 2020 slowed down to a mere 2% increase in 2021. In a year where the world switched to remote interaction and online shopping, tech giants were the ones to benefit, as almost all other sectors were crippled by the pandemic.

Similar to other tech giants, Microsoft was among the top tech stocks of 2021, while also outperforming the broader market. Microsoft and other big names demonstrated their strength and experience when it comes to navigating through a crisis, as smaller tech firms struggled to keep up. Sustained growth in stock price was backed by strong fundamentals, with Microsoft posting excellent numbers for profitability. Their Return on Equity of 47.08% and Earnings per Share of $8.05 are remarkable, when you consider that the tech sector is currently at a loss on average.

The last decade has been very unsatisfactory for IBM, and although they managed to survive the crisis and recover rather quickly, they still face the same situation they did before the pandemic. Stale financial performance combined with strategic ineffectiveness, has locked the century old firm in a downtrend that goes back to March 2013, the first time their shares broke past $200. During the last two years they did outperform the tech sector, and they currently bolster a Return on Equity of 23.41% and Earnings per Share of $5.11. Yet, the lack of growth prospects is the likely cause of their relatively flat performance in the stock market.

IBM revolves around Cloud computing, Artificial intelligence, Computer hardware, and Computer software. The Big Blue business model has changed dramatically over the years, and has demonstrated to be able to adapt and reinvent itself through tough times and difficult decisions. They divested from the networking business back in the ‘90s, from PCs in the 2000s (with the ThinkPad series being acquired by Lenovo), and recently from semiconductors. In 2020, the company announced the latest split off: it will continue to focus on the AI and cloud service (after acquiring the cloud company Red Hat for $34 billion in 2019) while separating the Global Technology Services business which provides technical support to 4,600 clients and has a backlog of $60 billion and accounted for a quarter of its revenues at the time. The new company, Kyndryl, has listed on the NYSE in 2021.

IBM and Microsoft during crises: 2007-08 Great Financial Crisis vs 2020 Covid-19 Pandemic.

It is interesting to analyse the performance of these two firms during periods of financial distress, such as the Great Financial Crisis of 2007-2008 and the sell-off in 2020 due to the Covid-19 pandemic. In 2008, as almost all other firms in the world, IBM and Microsoft were struggling, but both fundamentals and their respective share prices at the time demonstrated their strength and resilience during tough times.

IBM’s share price fell by a maximum of 21% during the Great Financial Crisis, considerably less than the US market, with the S&P falling by as much as 50%. Their software business, which grew by 9% in the last quarter of 2008, was the main reason they outperformed the market. It was a testament of IBM’s proficiency in strategic transformation, as they were able to shift into more profitable segments of the industry, which helped them mitigate some losses.

For Microsoft, 2009 was a moment in history. It was the first time since its foundation, 34 years prior, that the company reported a drop in revenues. Founded in 1975, the tech giant managed to achieve incredible amounts of growth year on year, morphing into one of the fastest growing businesses in history. As soon as the company reported their first ‘bad’ year, a lot of doubt and uncertainty arose around Microsoft, which translated into a 45% decline in their share price. They managed to quickly recover from the situation, as Steven Ballmer, CEO of Microsoft in 2010, writes in the shareholder letter of 2010 : “Now, just 12 months later, I’m gratified to report that fiscal 2010 was a year of remarkable accomplishments.”

Covid-19 was a slightly different story, with IBM performing worse than they did during the Great Financial Crisis, and Microsoft navigating through the pandemic almost perfectly. Unlike what happened during the previous crisis, IBM’s share price dipped by approximately 37% in march 2020, slightly more than the 30% drop of the S&P500. The last few years have been a period of transition for IBM, as they struggle to find the correct strategic decisions that brought them success in the past. However, their recent move into cloud computing, one of the few sectors that benefitted from the pandemic, fueled a very quick recovery, as they managed to restore their share price to pre-pandemic levels in April 2021.

Microsoft, on the other hand, was almost completely unaffected by the pandemic. MSFT fell by approximately 30% in March 2021, but the recovery was almost as quick as the fall, initiating an upward trend that continued throughout the end of 2020 and 2021. Their dominance in cloud computing, and their reputation as one of the safest firms in the world helped them almost completely bypass the Covid-19 Pandemic.

Microsoft and IBM, where do they stand in the tech sector?

As most firms struggled during 2021, another year shaped by the pandemic, tech giants continued to demonstrate their resiliency during a global crisis. Alphabet, Microsoft, Meta and Apple outperformed the market by a huge margin in both 2020 and 2021. Surprisingly, Amazon’s huge price increase of 76% in 2020 slowed down to a mere 2% increase in 2021. In a year where the world switched to remote interaction and online shopping, tech giants were the ones to benefit, as almost all other sectors were crippled by the pandemic.

Similar to other tech giants, Microsoft was among the top tech stocks of 2021, while also outperforming the broader market. Microsoft and other big names demonstrated their strength and experience when it comes to navigating through a crisis, as smaller tech firms struggled to keep up. Sustained growth in stock price was backed by strong fundamentals, with Microsoft posting excellent numbers for profitability. Their Return on Equity of 47.08% and Earnings per Share of $8.05 are remarkable, when you consider that the tech sector is currently at a loss on average.

The last decade has been very unsatisfactory for IBM, and although they managed to survive the crisis and recover rather quickly, they still face the same situation they did before the pandemic. Stale financial performance combined with strategic ineffectiveness, has locked the century old firm in a downtrend that goes back to March 2013, the first time their shares broke past $200. During the last two years they did outperform the tech sector, and they currently bolster a Return on Equity of 23.41% and Earnings per Share of $5.11. Yet, the lack of growth prospects is the likely cause of their relatively flat performance in the stock market.

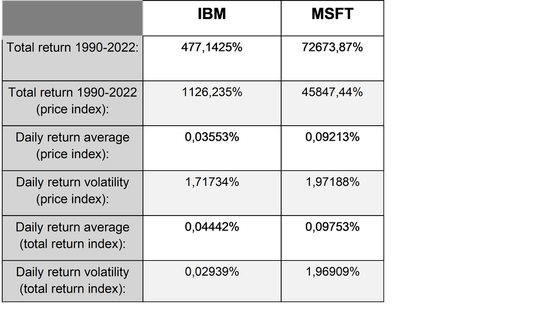

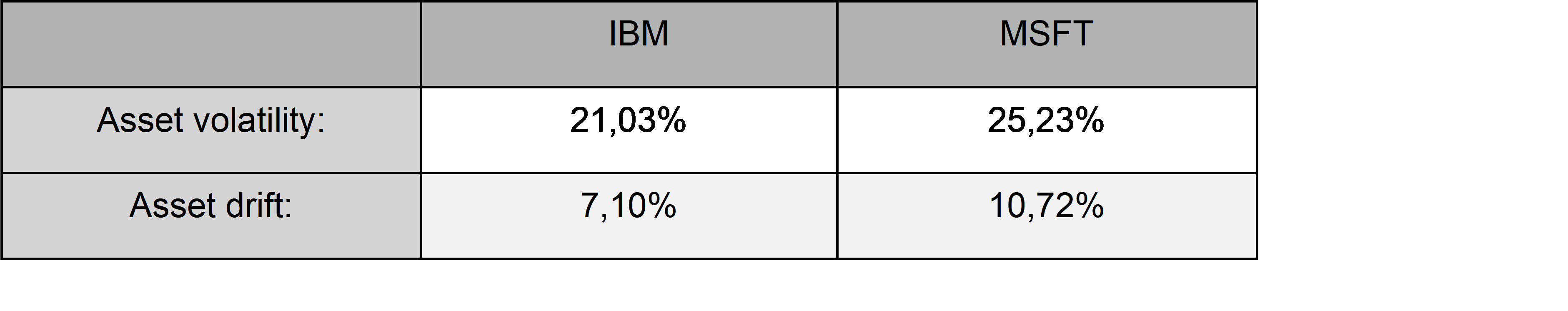

Price and returns analysis

Institutional investors strongly advise having in portfolio shares of huge and safe companies like Microsoft Corp and IBM. There are many reasons to buy stocks of the calibre of Microsoft and IBM. Microsoft rallied on Wall Street in the last days of April, with the stock up by more than 6% after the quarterly accounts announced after closing highlighted yet another record quarter. The Redmond giant has confirmed its successful positioning in the current landscape, relying on a mix between a cloud strategy, an excellent positioning in the trend of digitalization, the Office and the Surface line, and the boom of gaming with its Xbox console. Once again, the cloud was the protagonist of the quarter, with the Intelligent Cloud division responsible for 11% revenue growth driven by Azure, Microsoft’s cloud platform for companies that grew by 46% in the quarter. IBM’s stocks earned more than one percentage point, by virtue of revenue and earnings exceeding analysts' expectations. The first quarter of 2022 showed Earning per Share of $1.40, better than the $1.38 expected from the market. In absolute terms, net earnings from continuing operations were $662 million, with a 64% jump compared to last year, while total net profit fell by 23%. Revenues were 14.2 billion dollars, higher than the 13.85 billion dollars estimated by analysts and up 7.7% compared to 2021. This year IBM shares performed better than the S&P 500, thanks to a performance of -3% against the -6% of the main American index.

Particularly relevant, especially with regard to IBM, is the dividend yield. On April 26, the IBM board of directors declared an increase in the regular quarterly cash dividend to $1.65 per common share, payable June 10, 2022 to stockholders of record as of May 10, 2022. This is the 27th year in a row that IBM has increased its quarterly cash dividend: IBM has paid consecutive quarterly dividends since 191: “Our cash generation is solid, and we continue to invest in the business and return value to shareholders through our longstanding dividend policy.”, said Krishna, IBM chairman and CFO.

By analysing historical IBM dividends we can find a present yield of 4.86% and an historical one of 4.90% in the last 10 years. The Payout Ratio in the last 10 years is 75.25% (127.21% this FY). Analysts keep on predicting that the dividend policy of IBM will remain on these levels, estimating a forecast yield of 4.93% and a DPS growth of 3.56% in the next 5 years, testimony of a phenomenon known as “dividend stickiness”

By analysing historical IBM dividends we can find a present yield of 4.86% and an historical one of 4.90% in the last 10 years. The Payout Ratio in the last 10 years is 75.25% (127.21% this FY). Analysts keep on predicting that the dividend policy of IBM will remain on these levels, estimating a forecast yield of 4.93% and a DPS growth of 3.56% in the next 5 years, testimony of a phenomenon known as “dividend stickiness”

IBM

Sentaca (5G):

In January 2022, IBM acquired Sentaca, a leading TelCo consulting services and solutions provider. The acquisition accelerated IBM's hybrid cloud consulting business, adding critical skills to help communications service providers (CSPs) and media giants modernize on multiple cloud platforms.

Sentaca joined IBM Consulting's fast-growing Hybrid Cloud Services business to solve clients' strategic and technology challenges such as cost-of-ownership, monetization, scalable and secure architecture, and address opportunities like 5G. Sentaca's domain expertise, assets and client relationships is helping IBM meet industry demand and strengthen its position as a prime systems integrator for the emerging network and 5G market.

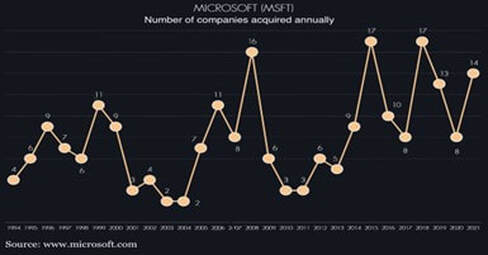

Since Arvind Krishna became IBM CEO, the company has acquired more than 20 companies – 10 in Consulting alone – to bolster its hybrid cloud and AI capabilities, in particular after the acquisition of RedHat for 34 billion dollars in 2019. The announcement of the Sentaca acquisition follows several acquisitions by IBM of leading cloud consulting firms – Nordcloud, Taos, BoxBoat and SXiQ – in 2021, which significantly expanded IBM's multicloud transformation, management expertise and capabilities in Europe and North America.

PwC Consulting

One of the first and most relevant acquisition made by IBM was in 2002 with the offer on PwC Consulting of an amount of 3.5 billion dollars. IBM integrated the consulting service into a new global business unit called IBM Business Consulting Services, extending the reach of its Global Services Business. At the time, it was the largest consulting services organization in the world, having operations in more than 160 countries. The acquisition allowed IBM to combine business consulting with technology solutions, which many of its clients were demanding at the time. IBM had the hard job of integrating PwC Consulting with its 30,000 employees and a private partnership mindset within Global Services, which has a staff of 150,000 and is part of one of the world's largest publicly traded corporations. However, for this particular operation IBM did not approach the integration with the traditional acquirer's mentality of imposing its way of doing things on the acquired; instead, it adopted many PwC practices and philosophies, and named PwC Consulting executives to key top position.

Change in business

The new IBM is shifting back to a services business model with an as-a-service emphasis. Infrastructure-as-a-Service, commonly referred to as simply “IaaS,” is a form of cloud computing that delivers fundamental compute, network, and storage resources to consumers on-demand, over the internet, and on a pay-as-you-go basis.

The most apparent way IBM is changing is in its product mix, shifting away from hardware to more of software and services model, and this follows overall trends in the IT industry. Of course, IBM also handles the critical data for some of the largest corporations in the world, so it must also handle workloads built on legacy codes and equipment, in addition to innovating to new models and solutions. Modernizing these workloads takes effort, and the company has spent much of the last few years updating its product portfolio. Hardware has decreased from 25% of IBM's 2007 revenue to just 10% in 2017. This was partly due to the divestment of its PC and low-end server business in the 2000s, combined with the acquisition of roughly 34 companies, mostly in software and services, over the past five years. In addition, the way in which software is sold has changed, and over the past 10 years, IBM has moved from 47% recurring as-a-service revenue to 61% as-a-service revenue as of 2017. And 22% of revenue, or $17 billion of IBM's business, now occurs within the IBM cloud, up from just $4 billion a few years ago.

IBM’s transition has been difficult at times, but it does appear to leave the company in a far better place today. IBM recent and past evolution is emblematic of how businesses can (and should) evolve to remain relevant and profitable through times. With a series of disinvestments and acquisitions, Big Blue was able to move from poorly performing sectors to high-margin, high-growth ones. All of this work has, of course, taken some investment. IBM ramped investments in research & development, capital expenditures, and bolt-on acquisitions from $34 billion between 2012 and 2014 to $37 billion between 2015 and 2017, even as its revenue declined. A clear shift began in 2015, when the company scrapped its earnings-per-share targets and heavily dialled back on share repurchases.

The company will continue to invest, but now forecasts growth and operating leverage going forward, targeting low-single-digit revenue growth, mid-single-digit pre-tax income growth, and high-single-digit EPS growth over the long term.

Sentaca (5G):

In January 2022, IBM acquired Sentaca, a leading TelCo consulting services and solutions provider. The acquisition accelerated IBM's hybrid cloud consulting business, adding critical skills to help communications service providers (CSPs) and media giants modernize on multiple cloud platforms.

Sentaca joined IBM Consulting's fast-growing Hybrid Cloud Services business to solve clients' strategic and technology challenges such as cost-of-ownership, monetization, scalable and secure architecture, and address opportunities like 5G. Sentaca's domain expertise, assets and client relationships is helping IBM meet industry demand and strengthen its position as a prime systems integrator for the emerging network and 5G market.

Since Arvind Krishna became IBM CEO, the company has acquired more than 20 companies – 10 in Consulting alone – to bolster its hybrid cloud and AI capabilities, in particular after the acquisition of RedHat for 34 billion dollars in 2019. The announcement of the Sentaca acquisition follows several acquisitions by IBM of leading cloud consulting firms – Nordcloud, Taos, BoxBoat and SXiQ – in 2021, which significantly expanded IBM's multicloud transformation, management expertise and capabilities in Europe and North America.

PwC Consulting

One of the first and most relevant acquisition made by IBM was in 2002 with the offer on PwC Consulting of an amount of 3.5 billion dollars. IBM integrated the consulting service into a new global business unit called IBM Business Consulting Services, extending the reach of its Global Services Business. At the time, it was the largest consulting services organization in the world, having operations in more than 160 countries. The acquisition allowed IBM to combine business consulting with technology solutions, which many of its clients were demanding at the time. IBM had the hard job of integrating PwC Consulting with its 30,000 employees and a private partnership mindset within Global Services, which has a staff of 150,000 and is part of one of the world's largest publicly traded corporations. However, for this particular operation IBM did not approach the integration with the traditional acquirer's mentality of imposing its way of doing things on the acquired; instead, it adopted many PwC practices and philosophies, and named PwC Consulting executives to key top position.

Change in business

The new IBM is shifting back to a services business model with an as-a-service emphasis. Infrastructure-as-a-Service, commonly referred to as simply “IaaS,” is a form of cloud computing that delivers fundamental compute, network, and storage resources to consumers on-demand, over the internet, and on a pay-as-you-go basis.

The most apparent way IBM is changing is in its product mix, shifting away from hardware to more of software and services model, and this follows overall trends in the IT industry. Of course, IBM also handles the critical data for some of the largest corporations in the world, so it must also handle workloads built on legacy codes and equipment, in addition to innovating to new models and solutions. Modernizing these workloads takes effort, and the company has spent much of the last few years updating its product portfolio. Hardware has decreased from 25% of IBM's 2007 revenue to just 10% in 2017. This was partly due to the divestment of its PC and low-end server business in the 2000s, combined with the acquisition of roughly 34 companies, mostly in software and services, over the past five years. In addition, the way in which software is sold has changed, and over the past 10 years, IBM has moved from 47% recurring as-a-service revenue to 61% as-a-service revenue as of 2017. And 22% of revenue, or $17 billion of IBM's business, now occurs within the IBM cloud, up from just $4 billion a few years ago.

IBM’s transition has been difficult at times, but it does appear to leave the company in a far better place today. IBM recent and past evolution is emblematic of how businesses can (and should) evolve to remain relevant and profitable through times. With a series of disinvestments and acquisitions, Big Blue was able to move from poorly performing sectors to high-margin, high-growth ones. All of this work has, of course, taken some investment. IBM ramped investments in research & development, capital expenditures, and bolt-on acquisitions from $34 billion between 2012 and 2014 to $37 billion between 2015 and 2017, even as its revenue declined. A clear shift began in 2015, when the company scrapped its earnings-per-share targets and heavily dialled back on share repurchases.

The company will continue to invest, but now forecasts growth and operating leverage going forward, targeting low-single-digit revenue growth, mid-single-digit pre-tax income growth, and high-single-digit EPS growth over the long term.

Activision Blizzard

On January 18, 2022, the company founded by Bill Gates announced an acquisition plan in the form of an "all-cash deal", that is, providing for a cash payment (without funding or other monetary forms) of Activision Blizzard, the third world gaming company for sales, after Tencent and Sony. In the video game industry this is the most important operation in history: we are talking about an offer for 95 dollars per share, for a total of $68.7 billion. Not a problem for a company that holds an average of 50% of its assets in cash in recent years.

Calculating the price through the DCF, (that is considering that the rate of growth of the sales is decreasing from current 25% to a 10% in 5 years; 35% of EBITDA on sales constant at 35%; the cost of money considered to be 7% constant, which is the highest margin of the current hypothetical level for this industry) analysts have come to the conclusion that $95 dollars per share for Activision Blizzard is a fair price; but it is in absolute terms that is without considering the synergies that would derive from the connection with related businesses.

This acquisition will definitely leverage achievable synergies from the connection between the two companies, so the real value for Microsoft is much higher than $95 per share. To define how much higher it can be, it would be necessary to know the future plans of Satya Nadella, Microsoft CEO, regarding the gaming sector in the perspective of Microsoft.

It would seem that Microsoft took advantage of Activision Blizzard’s difficult time to make a seemingly very attractive offer that in fact perfectly reflects the real value of the company. Microsoft will then become a leading player in the gaming market that is expected to grow exponentially in the coming years.

LinkedIn

In December 2016 Microsoft acquired LinkedIn for 26.2 billion dollars, for one of the most relevant M&A operations made by Bill Gates’ company. By analysing the reasons of the acquisition, we can find:

by Lorenzo Borriello, Joris Pema and Deivi Hamzaraj

On January 18, 2022, the company founded by Bill Gates announced an acquisition plan in the form of an "all-cash deal", that is, providing for a cash payment (without funding or other monetary forms) of Activision Blizzard, the third world gaming company for sales, after Tencent and Sony. In the video game industry this is the most important operation in history: we are talking about an offer for 95 dollars per share, for a total of $68.7 billion. Not a problem for a company that holds an average of 50% of its assets in cash in recent years.

Calculating the price through the DCF, (that is considering that the rate of growth of the sales is decreasing from current 25% to a 10% in 5 years; 35% of EBITDA on sales constant at 35%; the cost of money considered to be 7% constant, which is the highest margin of the current hypothetical level for this industry) analysts have come to the conclusion that $95 dollars per share for Activision Blizzard is a fair price; but it is in absolute terms that is without considering the synergies that would derive from the connection with related businesses.

This acquisition will definitely leverage achievable synergies from the connection between the two companies, so the real value for Microsoft is much higher than $95 per share. To define how much higher it can be, it would be necessary to know the future plans of Satya Nadella, Microsoft CEO, regarding the gaming sector in the perspective of Microsoft.

It would seem that Microsoft took advantage of Activision Blizzard’s difficult time to make a seemingly very attractive offer that in fact perfectly reflects the real value of the company. Microsoft will then become a leading player in the gaming market that is expected to grow exponentially in the coming years.

In December 2016 Microsoft acquired LinkedIn for 26.2 billion dollars, for one of the most relevant M&A operations made by Bill Gates’ company. By analysing the reasons of the acquisition, we can find:

- Integration: from a strategic point of view, the CEO of Microsoft has well explained the move: focus on the professional world. The acquisition brings together the leading professional cloud and the world’s largest professional network. The reference is to Office 365, the Azure cloud and Dynamics software. LinkedIn acquisition is indeed "the key to achieve our ambition to reinvent productivity and business processes”, according to Nadella.

- Newsfeed: with LinkedIn, Microsoft buys a missing piece: a platform based on a news stream. Looking to the future, Nadella writes that "the combination makes new experiences possible, such as a newsfeed that provides articles based on the projects you are working on" and, with the integration in Office, "expert tips to contact via LinkedIn to achieve their aims”.

- Migration to services: Nadella has been explicit so far. His unspoken (but equally clear) concerns regard the an overall change for Microsoft’s business model. From the ambition to combine hardware and software signed by Steve Ballmer, we move to a company focused on providing services, especially professional.

- Stocks value: Microsoft paid out 196 dollars for shares. The proposal is, of course, generous. But it also takes advantage of a downturn, because LinkedIn shares were worth $226 a year before the offer. After the news of the acquisition, in a few minutes the titles have risen by 49%, touching the levels of the Microsoft offer. The gap between the 196 euro paid by Microsoft and the price of Friday, June 10 2016 narrows looking at the target price set by many analysts: 160 dollars. As of June 9, 38 analysts had rated LinkedIn. Results: 25 Buy, 17 Hold and one Sell. Translated: the last earnings report had penalized the title too much. And, beyond the price unstitched by Microsoft, it was a good time to buy.

- Skype’s previous acquisition: $26.2 billion is a huge amount, also because, looking at the fundamentals, it means a value equal to 26 times the EBITDA. A proportion like this is a risk, but not a judgment. This is demonstrated by the Skype case. Even then there was no lack of criticism. Redmond acquired a loss-making company (of $7 million) and paid $8.5 billion, or 32 times EBITDA. Skype has proven to be one of the most successful and profitable acquisitions in Microsoft’s history.

- Refinitiv

- Yahoo Finance

- FT

- IlSole24Ore

- Microsoft

- IBM

- History.com

by Lorenzo Borriello, Joris Pema and Deivi Hamzaraj