Industry Overview

Retail food delivery is a courier service in which restaurants, bars, stores or an independent food-delivery company deliver food to a customer. This industry is composed by both offline and online delivery systems. In the traditional offline form of delivery, the consumer places an order directly to the local bar or restaurant and waits for it to bring the food. This service was more widespread in the past. In recent years, with the rise in digital technologies, customers now prefer to order directly through apps or websites, so the online delivery model is expanding and replacing the offline model. The drivers of this turnabout are the increasing use of smartphones, the change in consumer behaviour and, this year, the COVID-19 pandemic. In fact, with the restrictions imposed by all governments on bars and restaurants, the latter have reinvented their business turning increasingly to home delivery.

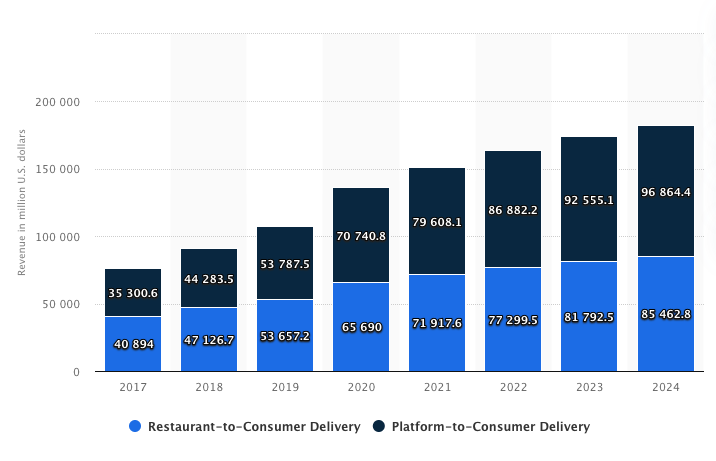

Online food delivery market size is US$136,431m and it is projected to grow at an annual rate of 7.5% over the next few years, resulting in US$182,327m revenue in 2024. The market’s largest segment is Platform-to-Consumer delivery, with a 51,8% of the total market value.

Retail food delivery is a courier service in which restaurants, bars, stores or an independent food-delivery company deliver food to a customer. This industry is composed by both offline and online delivery systems. In the traditional offline form of delivery, the consumer places an order directly to the local bar or restaurant and waits for it to bring the food. This service was more widespread in the past. In recent years, with the rise in digital technologies, customers now prefer to order directly through apps or websites, so the online delivery model is expanding and replacing the offline model. The drivers of this turnabout are the increasing use of smartphones, the change in consumer behaviour and, this year, the COVID-19 pandemic. In fact, with the restrictions imposed by all governments on bars and restaurants, the latter have reinvented their business turning increasingly to home delivery.

Online food delivery market size is US$136,431m and it is projected to grow at an annual rate of 7.5% over the next few years, resulting in US$182,327m revenue in 2024. The market’s largest segment is Platform-to-Consumer delivery, with a 51,8% of the total market value.

Source: Statista

Depending on whether the logistic is provided at the restaurant, we have two types of models for the platform-to-consumer delivery segment: aggregators and new developers. The key players which operate according to the first model are Delivery Hero, FoodPanda, Grubhub and Just Eat, while for the second one brands like UberEats, Deliveroo and Foodora operate globally and are continuing to capture new regions.

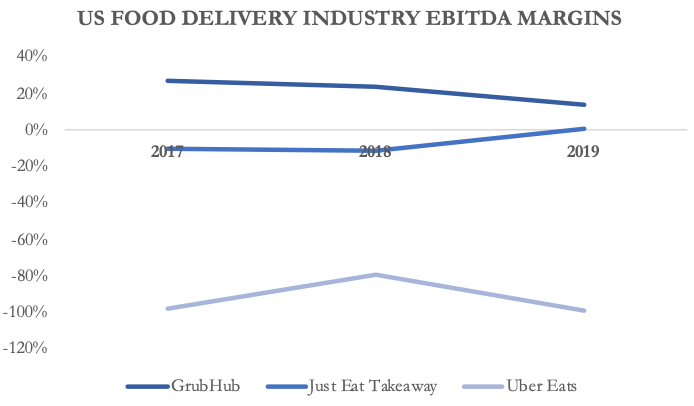

Especially in the last two quarters, the demand for food delivery has increased exponentially. Nevertheless, the business is not that profitable, especially for companies that deal with logistics directly. Grubhub, for example, experienced an increase in sales of 53% in the last quarter, but its costs increased even more, by 60%. In the food delivery market, new developers must endure the increasing cost of the logistics and a constant promotional activity in order to face competition. This market is highly competitive because consumers are significantly price sensitive and the barriers to entry are low. That’s why, despite the favourable macro conditions, the companies operating in the food delivery industry keep having cost-containment issues. For instance, UberEats, despite doubling its sales with respect to last year, reported a $232m adjusted EBITDA loss in the first quarter of 2020, with a 23.3% improvement from the same quarter in 2019. The following graph highlights this profitability issue at the EBITDA margin level for three main players in the industry: GrubHub, Just Eat Takeaway, and Uber Eats.

Especially in the last two quarters, the demand for food delivery has increased exponentially. Nevertheless, the business is not that profitable, especially for companies that deal with logistics directly. Grubhub, for example, experienced an increase in sales of 53% in the last quarter, but its costs increased even more, by 60%. In the food delivery market, new developers must endure the increasing cost of the logistics and a constant promotional activity in order to face competition. This market is highly competitive because consumers are significantly price sensitive and the barriers to entry are low. That’s why, despite the favourable macro conditions, the companies operating in the food delivery industry keep having cost-containment issues. For instance, UberEats, despite doubling its sales with respect to last year, reported a $232m adjusted EBITDA loss in the first quarter of 2020, with a 23.3% improvement from the same quarter in 2019. The following graph highlights this profitability issue at the EBITDA margin level for three main players in the industry: GrubHub, Just Eat Takeaway, and Uber Eats.

Source: FactSet, Uber 10K FY2019

More specifically, is it convenient for a company to operate in the online food delivery market? To understand the reasons of this profitability issue and to gain a clearer picture of the food delivery industry we have performed a Porter Five Forces analysis.

Porter Five Forces Analysis

Bargaining power of buyers

In this industry, end customers sit in very strong position, and this allows them to request lower prices and higher quality. The main reason for this is that the food delivery service, offered by the players in this industry, has very little room for differentiation. As a result, customers tend to choose based on price and this makes it difficult for companies to retain customer loyalty if they do not offer continuous discounts. This is also exacerbated by the absence of switching costs for customers. It is important to notice that the “buyers” category includes also bars and restaurants, which effectively receive a service from the companies that deliver their products. However, in this case, their bargaining power is relatively low, because they would typically work with all delivery companies available and it is the end customer that chooses the one he prefers. Depending on whether the delivery is managed by the delivery company itself or not, the value perceived by the customers changes substantially. The so–called aggregators are not responsible for picking up and delivering the food, while new developers offer this type of service combined with shorter delivery time and the possibility to check where the rider is. Although customers have shown appreciation for this additional service, it results in higher delivery charges. And if they could choose, they would prefer to wait longer when it involves economic savings.

To conclude, the buyers’ bargaining power in this industry is high, mainly driven by the end customers’ strong position.

Bargaining power of suppliers

Evaluating the bargaining power of suppliers is a bit more complicated because the definition of “supplier” is not so clear-cut in this case. The main resources used by food delivery companies are technology, which not always is internally developed, and rider services. With respect to technology supply, we assumed for simplicity that the amount of technology that is not developed internally is negligible. With regards to the riders, instead, depending on the country, they are sometimes employed by the companies and this makes their categorization as suppliers complicated. However, assuming that they are considered suppliers, their bargaining power is obviously very low as they are not specialized nor concentrated. As a result, the bargaining power of suppliers in this industry is relatively low.

Threat of substitute product

The main substitute for food delivery companies’ services are deliveries performed by restaurants directly. This type of service, as mentioned previously, is slowly fading. Indeed, it is less and less convenient for bars and restaurants to employee someone to perform this service directly when they can rely on external contractors. Therefore, the threat of substitute is low.

Rivalry between established competitors and threat of new entrants

Because of the high bargaining power of buyers paired with the low product differentiation, the rivalry between existing competitors is very high. Indeed, there are only a bunch of large competitors that engage in price competition leading to margin erosion. For this reason, despite the relatively low capital investment that is required to start a food delivery company, the threat of new entrants is low because, even if a company had the capital to enter this line of business, it would have to subsidize its operations for a long time and bear significant losses before turning into profit.

The result of all this is that the few players in the industry are substantially faced with only three options: leave the market, buy a competitor and scale up, or be bought.

Industry Consolidation

The coronavirus pandemic has caused a further increase in the volumes of the food delivery industry, which already saw a staggering 42% pre-Covid 19 growth between Q1 2018 and Q1 2020. However, beneath the enthusiasm of phenomenal growth and momentum lies a troubling reality: burdensome marketing expenses, coupled with default low margins, further squeezed by ever-fierce price/commission wars with competitors, have shown the unsustainability of the current business model. As of today, players are all bleeding cash and relying on endless rounds of financing to make up the losses. In fact, negative profits have become standard in the industry: In 2019, UberEats booked EBITDA of -$771 million, followed by privately owned DoorDash (estimated operating loss of $450 million) and Grubhub (-$19 million). But if companies do not turn a profit soon, funding will eventually run out.

The food delivery industry is often described as winner-takes-most. Nonetheless, the current environment sees a handful of players in each country reducing the already razor-thin margins of the restaurant industry by engaging in cutthroat competition. The path to profitability seems to lie in consolidation, as synergies together with increased market shares and pricing power would allow for a more sustainable model. According to LinkLaters, there were north of 25 M&A deals in the industry as a whole in 2018-2019, valued at a combined $20.12 billion.

This trend towards consolidation reached its peak in the summer of 2020, when the announcement of two exciting mega-mergers changed the landscape of the industry: Just Eat Takeaway.com’s acquisition of Grubhub and Uber’s acquisition of Postmates. What follows is an analysis of these two deals.

Just Eat Takeaway.com acquisition of Grubhub

Porter Five Forces Analysis

Bargaining power of buyers

In this industry, end customers sit in very strong position, and this allows them to request lower prices and higher quality. The main reason for this is that the food delivery service, offered by the players in this industry, has very little room for differentiation. As a result, customers tend to choose based on price and this makes it difficult for companies to retain customer loyalty if they do not offer continuous discounts. This is also exacerbated by the absence of switching costs for customers. It is important to notice that the “buyers” category includes also bars and restaurants, which effectively receive a service from the companies that deliver their products. However, in this case, their bargaining power is relatively low, because they would typically work with all delivery companies available and it is the end customer that chooses the one he prefers. Depending on whether the delivery is managed by the delivery company itself or not, the value perceived by the customers changes substantially. The so–called aggregators are not responsible for picking up and delivering the food, while new developers offer this type of service combined with shorter delivery time and the possibility to check where the rider is. Although customers have shown appreciation for this additional service, it results in higher delivery charges. And if they could choose, they would prefer to wait longer when it involves economic savings.

To conclude, the buyers’ bargaining power in this industry is high, mainly driven by the end customers’ strong position.

Bargaining power of suppliers

Evaluating the bargaining power of suppliers is a bit more complicated because the definition of “supplier” is not so clear-cut in this case. The main resources used by food delivery companies are technology, which not always is internally developed, and rider services. With respect to technology supply, we assumed for simplicity that the amount of technology that is not developed internally is negligible. With regards to the riders, instead, depending on the country, they are sometimes employed by the companies and this makes their categorization as suppliers complicated. However, assuming that they are considered suppliers, their bargaining power is obviously very low as they are not specialized nor concentrated. As a result, the bargaining power of suppliers in this industry is relatively low.

Threat of substitute product

The main substitute for food delivery companies’ services are deliveries performed by restaurants directly. This type of service, as mentioned previously, is slowly fading. Indeed, it is less and less convenient for bars and restaurants to employee someone to perform this service directly when they can rely on external contractors. Therefore, the threat of substitute is low.

Rivalry between established competitors and threat of new entrants

Because of the high bargaining power of buyers paired with the low product differentiation, the rivalry between existing competitors is very high. Indeed, there are only a bunch of large competitors that engage in price competition leading to margin erosion. For this reason, despite the relatively low capital investment that is required to start a food delivery company, the threat of new entrants is low because, even if a company had the capital to enter this line of business, it would have to subsidize its operations for a long time and bear significant losses before turning into profit.

The result of all this is that the few players in the industry are substantially faced with only three options: leave the market, buy a competitor and scale up, or be bought.

Industry Consolidation

The coronavirus pandemic has caused a further increase in the volumes of the food delivery industry, which already saw a staggering 42% pre-Covid 19 growth between Q1 2018 and Q1 2020. However, beneath the enthusiasm of phenomenal growth and momentum lies a troubling reality: burdensome marketing expenses, coupled with default low margins, further squeezed by ever-fierce price/commission wars with competitors, have shown the unsustainability of the current business model. As of today, players are all bleeding cash and relying on endless rounds of financing to make up the losses. In fact, negative profits have become standard in the industry: In 2019, UberEats booked EBITDA of -$771 million, followed by privately owned DoorDash (estimated operating loss of $450 million) and Grubhub (-$19 million). But if companies do not turn a profit soon, funding will eventually run out.

The food delivery industry is often described as winner-takes-most. Nonetheless, the current environment sees a handful of players in each country reducing the already razor-thin margins of the restaurant industry by engaging in cutthroat competition. The path to profitability seems to lie in consolidation, as synergies together with increased market shares and pricing power would allow for a more sustainable model. According to LinkLaters, there were north of 25 M&A deals in the industry as a whole in 2018-2019, valued at a combined $20.12 billion.

This trend towards consolidation reached its peak in the summer of 2020, when the announcement of two exciting mega-mergers changed the landscape of the industry: Just Eat Takeaway.com’s acquisition of Grubhub and Uber’s acquisition of Postmates. What follows is an analysis of these two deals.

Just Eat Takeaway.com acquisition of Grubhub

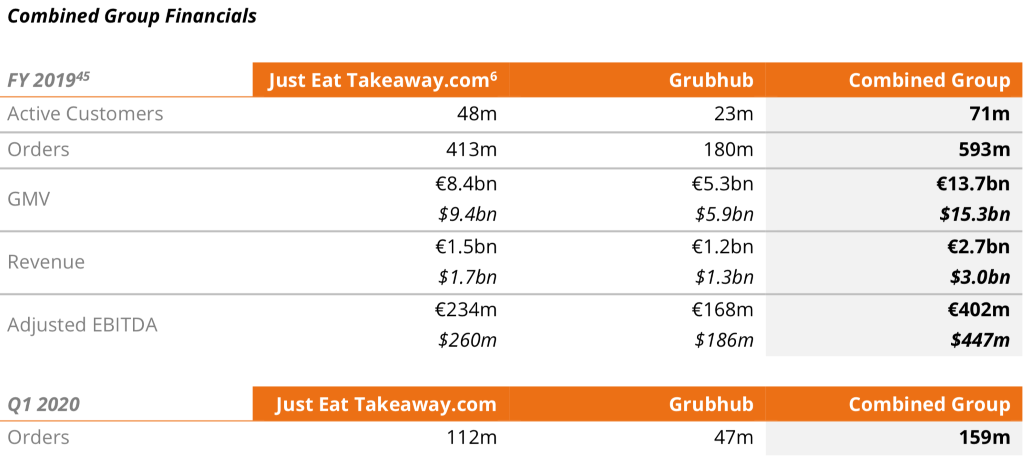

Source: FactSet

On June 10th, 2020 Just Eat Takeaway announced to the public it had reached an agreement for the all-stock acquisition of Grubhub for $7.3 billion. Grubhub shareholders will receive American depositary receipts (“ADRs”) representing 0.6710 Just Eat Takeaway.com ordinary shares in exchange for each Grubhub share, which were thus valued at $75.15 per share, a 27 percent premium to their closing price of $59.05 on June 9th. The closing of the transaction (anticipated for Q1 2021) is subject to customary conditions such as the required approval of both firms’ shareholders and the deal review by US and UK antitrust authorities.

Just Eat Takeaway (LSE: JET - Euronext: TKWY) was created earlier this year through the $7.8 billion combination of Just Eat Plc and Takeaway.com, two of the earliest participants in Europe’s food-delivery market. Amsterdam based Takeaway.com, founded by current CEO Jitse Groen in 2000, traditionally focused on selling software to restaurants which managed their own deliveries. However, given the technological advancements of the industry, it has gradually developed its own delivery platform and driver fleet. Its initial growth and profitability, boosted by the strategic choice to enter exclusively into markets where it can become a leader, allowed it to merge with London-based Just Eat. The firm already has dominant positions in three of the world's four largest profit pools for food delivery: the U.K., Germany and the Netherlands, although recently it has been facing growing competition from both UberEats and Amazon-backed company Deliveroo.

Founded in 2004, Grubhub (NYSE: GRUB) is a Chicago based online and mobile food ordering and delivery platform. It has more the 20 mln active users and partners with nearly 300,000 restaurants across 4,000 U.S. cities. Publicly traded since 2014 on the NYSE, the Grubhub portfolio of brands includes Grubhub, Seamless, LevelUp, AllMenus and MenuPages.

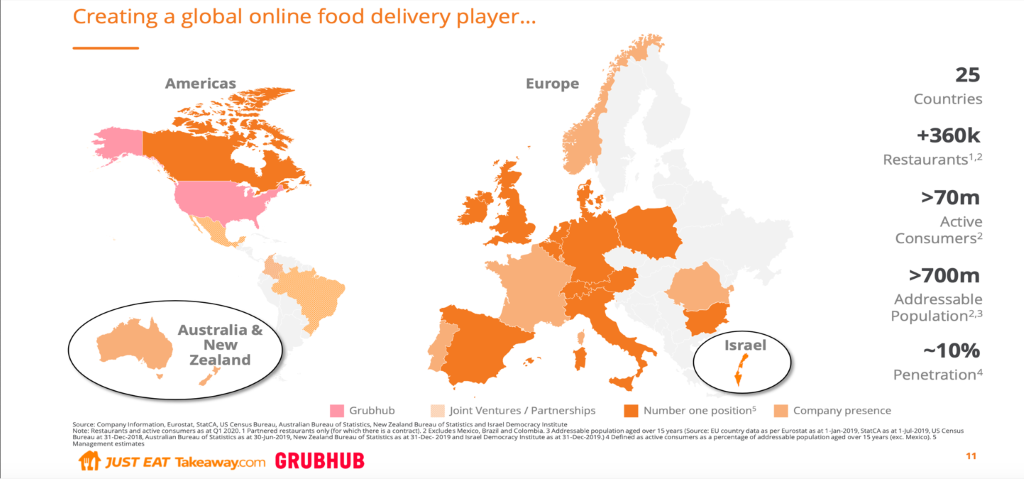

This deal gives Just Eat Takeaway, already a leader in the EU, a foothold in the US market, thus forming the world’s largest food delivery business outside China by GMV and Revenues. In order to minimize short-term disruption to both restaurants and customers, Grubhub is to remain headquartered in Chicago and its founder and chief executive, Matt Maloney, will join Just Eat Takeaway’s board and oversee its business in North America. In fact, Maloney and Jitse Groen, founder and CEO of JET, have a long-standing relationship and have built their firms, which operate in different regions, with similar values. Therefore, they are believed to be a good fit, as the parallel corporate cultures allow for smooth integration and the complementarity of both geographical and operational factors enable strategic synergies.

Just Eat Takeaway (LSE: JET - Euronext: TKWY) was created earlier this year through the $7.8 billion combination of Just Eat Plc and Takeaway.com, two of the earliest participants in Europe’s food-delivery market. Amsterdam based Takeaway.com, founded by current CEO Jitse Groen in 2000, traditionally focused on selling software to restaurants which managed their own deliveries. However, given the technological advancements of the industry, it has gradually developed its own delivery platform and driver fleet. Its initial growth and profitability, boosted by the strategic choice to enter exclusively into markets where it can become a leader, allowed it to merge with London-based Just Eat. The firm already has dominant positions in three of the world's four largest profit pools for food delivery: the U.K., Germany and the Netherlands, although recently it has been facing growing competition from both UberEats and Amazon-backed company Deliveroo.

Founded in 2004, Grubhub (NYSE: GRUB) is a Chicago based online and mobile food ordering and delivery platform. It has more the 20 mln active users and partners with nearly 300,000 restaurants across 4,000 U.S. cities. Publicly traded since 2014 on the NYSE, the Grubhub portfolio of brands includes Grubhub, Seamless, LevelUp, AllMenus and MenuPages.

This deal gives Just Eat Takeaway, already a leader in the EU, a foothold in the US market, thus forming the world’s largest food delivery business outside China by GMV and Revenues. In order to minimize short-term disruption to both restaurants and customers, Grubhub is to remain headquartered in Chicago and its founder and chief executive, Matt Maloney, will join Just Eat Takeaway’s board and oversee its business in North America. In fact, Maloney and Jitse Groen, founder and CEO of JET, have a long-standing relationship and have built their firms, which operate in different regions, with similar values. Therefore, they are believed to be a good fit, as the parallel corporate cultures allow for smooth integration and the complementarity of both geographical and operational factors enable strategic synergies.

Source: FactSet

This acquisition builds on the strategic rationale for JET’s recent merger with Just Eat Plc. The Group is built to achieve market leadership in four of the world’s largest profit pools in food delivery: the U.S., the U.K., the Netherlands and Germany. These markets how substantial further opportunities for growth, significant penetration upside and longer-term profitability improvements. In fact, thanks to its prominent position in Canada through SkipTheDishes, JET will now become a powerful player in North America. According to Mr. Groen, this geographical region remains underpenetrated, nowhere near its end-state. The increased scale and resources of the group will enable Maloney and his team with the flexibility to focus on long-term investment decisions, thus improving Grubhub’s position in the US over time.

However convenient to avoid regulatory concerns (which crumpled Uber’s hopes of acquiring Grubhub in May), the firms’ lack of geographical overlap implies that marketing synergies are limited. Hence advertising expense, one of the main components of both firms’ cost structures and vital in order to gain and retain customers in a competitive market such as that of the US, will likely take some time to adjust, therefore squeezing profitability in the short term. Furthermore, shareholders’ initial dislike towards the deal has been no secret: following confirmation of a preliminary agreement between the two companies, JET’s stock price fell by 13%. The owners’ distrust is mostly driven by the lack of confidence that Grubhub is to maintain its strong position in the US food delivery market.

Uber Acquisition of Postmates

The recently announced agreement under which Uber Technologies will acquire Postmates Inc. in a deal valued approximately $2.65 billion marks a milestone in market consolidation. The all-stock purchase of the fourth largest player in the US food delivery industry was announced on July 6, following Uber’s abandonment of GrubHub takeover due to antitrust concerns. After the board of directors of both companies approved it and the US Department of Justice granted early termination of the HSR waiting period for the transaction, is expected to close in the fourth quarter of 2020, subject to the approval of Postmates stockholders and other customary closing conditions.

Uber Technologies (NYSE: UBER), headquartered in San Francisco, was founded in 2009 with the mission to create opportunity through movement. Uber’s global tech platform disrupted personal mobility by connecting people with independent providers of ride services and leveraging its proprietary technology applications expanded into the food delivery and logistics industries. Uber’s technology is available in over 10,000 cities across 69 countries and, as of 2019, counted more than 111 million monthly active platform consumers. It has a market cap of $86.6 billion and, as of the end of fiscal year 2019, reported approximately $14.1 billion in revenues.

Postmates Inc. is a private company, headquartered in San Francisco, founded in 2011 with the mission to enable anyone to have anything delivered on demand. The company operates a logistics and on-demand delivery platform, which connects customers with the most selection of local couriers in the US. Being the market leader in Los Angeles and markets across the Southwest, Postmates provides access to over 600,000 merchants and operates in 4,200 US cities, serving 80% of US households across all states and counting more than 500,000 fleet members. Since inception, the platform has generated over $7.5 billion in gross merchandise volume and in the first quarter of 2020 it reported $107 million in revenues.

As stated by Uber CEO Dara Khosrowshahi, the deal is aligned with the company’s intent to act as a consolidator for the right assets at the right price and would bring together Uber’s Rides and Eats platform and Postmates’ brand and distinctive delivery assets in the US.

Among the key drivers supporting Uber’s high expectations in terms of operating efficiency and profitability acceleration this deal could deliver, it should be highlighted the positive trend in Postmates’ gross bookings, which amounted to $643 million in Q1, representing a growth of over 67% year-on-year and over 50% quarter-on-quarter in Q2. Another crucial aspect relates to the complementarity of Postmates’ foothold to Uber Eats’ geographic reach, which is expected to boost the buyer’s presence in the American Southwest. The potential to expand and strengthen the customer base is further supported by Postmates’ well-loved brand with over 10 million loyal active customers. Postmates’ business is complementary to Uber Eats on the partnerships’ side as well, providing Uber with the potential to penetrate small and medium-sized local restaurants, given the target’s huge network of partnered merchants, mostly consisting of local “hero” brands. From the operations’ perspective, Postmates’ integrated platform with improved batching and chaining capabilities is expected to enhance efficiency, contributing to facilitating delivery for non-partnered merchants.

Although Postmates will continue to operate under its own name, cross-selling opportunities resulting from users’ possibility to switch between the two providers to benefit from complementary choices could result in revenue synergies. The increase in scale is expected to drive significant efficiencies and cost savings, with over $200 million of run rate synergies expected to be achieved one year after close, mainly resulting from the elimination of redundant expenditures in G&A, sales and marketing, courier utilization and payment fees.

This acquisition has been defined as both defensive and offensive. Given the challenges faced by its ride-hailing business in the pandemic, as evidenced by the $2.9 billion loss posted for the first three months of the year, betting on the growth of Uber Eats, whose revenues rose 53%, has the potential to mitigate the headwinds experienced by the Rides division.

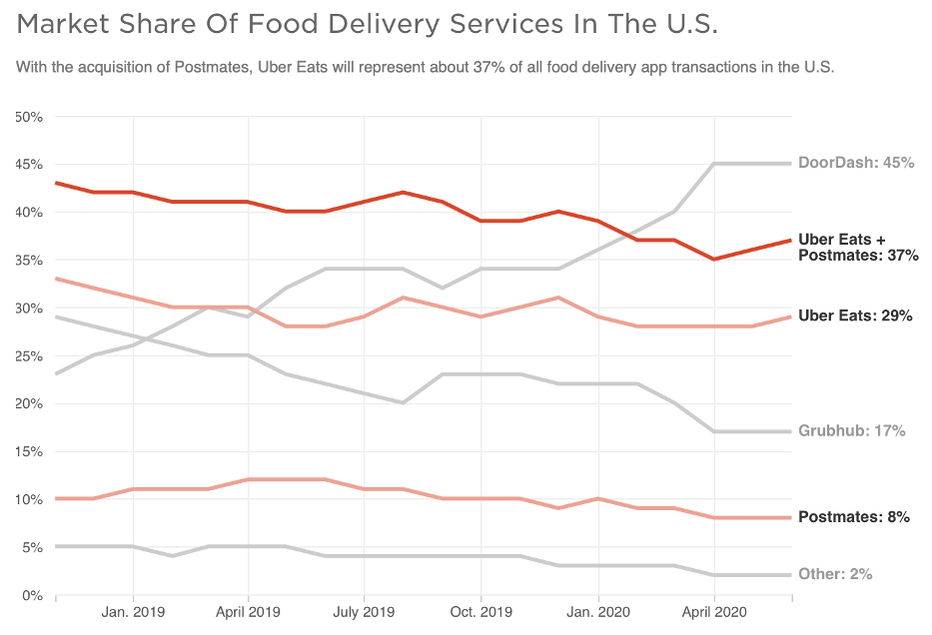

The heating pressure towards consolidation, resulting from the threats posed by this market’s characteristics, led delivery app companies to circle one another to gain scale through M&As. Taking over Postmates’ 8% of the domestic market share, Uber will become the second largest player in the market with 37% market share, strengthening its position with respect to the market leader DoorDash (45% market share) and to GrubHub (17% market share).

However convenient to avoid regulatory concerns (which crumpled Uber’s hopes of acquiring Grubhub in May), the firms’ lack of geographical overlap implies that marketing synergies are limited. Hence advertising expense, one of the main components of both firms’ cost structures and vital in order to gain and retain customers in a competitive market such as that of the US, will likely take some time to adjust, therefore squeezing profitability in the short term. Furthermore, shareholders’ initial dislike towards the deal has been no secret: following confirmation of a preliminary agreement between the two companies, JET’s stock price fell by 13%. The owners’ distrust is mostly driven by the lack of confidence that Grubhub is to maintain its strong position in the US food delivery market.

Uber Acquisition of Postmates

The recently announced agreement under which Uber Technologies will acquire Postmates Inc. in a deal valued approximately $2.65 billion marks a milestone in market consolidation. The all-stock purchase of the fourth largest player in the US food delivery industry was announced on July 6, following Uber’s abandonment of GrubHub takeover due to antitrust concerns. After the board of directors of both companies approved it and the US Department of Justice granted early termination of the HSR waiting period for the transaction, is expected to close in the fourth quarter of 2020, subject to the approval of Postmates stockholders and other customary closing conditions.

Uber Technologies (NYSE: UBER), headquartered in San Francisco, was founded in 2009 with the mission to create opportunity through movement. Uber’s global tech platform disrupted personal mobility by connecting people with independent providers of ride services and leveraging its proprietary technology applications expanded into the food delivery and logistics industries. Uber’s technology is available in over 10,000 cities across 69 countries and, as of 2019, counted more than 111 million monthly active platform consumers. It has a market cap of $86.6 billion and, as of the end of fiscal year 2019, reported approximately $14.1 billion in revenues.

Postmates Inc. is a private company, headquartered in San Francisco, founded in 2011 with the mission to enable anyone to have anything delivered on demand. The company operates a logistics and on-demand delivery platform, which connects customers with the most selection of local couriers in the US. Being the market leader in Los Angeles and markets across the Southwest, Postmates provides access to over 600,000 merchants and operates in 4,200 US cities, serving 80% of US households across all states and counting more than 500,000 fleet members. Since inception, the platform has generated over $7.5 billion in gross merchandise volume and in the first quarter of 2020 it reported $107 million in revenues.

As stated by Uber CEO Dara Khosrowshahi, the deal is aligned with the company’s intent to act as a consolidator for the right assets at the right price and would bring together Uber’s Rides and Eats platform and Postmates’ brand and distinctive delivery assets in the US.

Among the key drivers supporting Uber’s high expectations in terms of operating efficiency and profitability acceleration this deal could deliver, it should be highlighted the positive trend in Postmates’ gross bookings, which amounted to $643 million in Q1, representing a growth of over 67% year-on-year and over 50% quarter-on-quarter in Q2. Another crucial aspect relates to the complementarity of Postmates’ foothold to Uber Eats’ geographic reach, which is expected to boost the buyer’s presence in the American Southwest. The potential to expand and strengthen the customer base is further supported by Postmates’ well-loved brand with over 10 million loyal active customers. Postmates’ business is complementary to Uber Eats on the partnerships’ side as well, providing Uber with the potential to penetrate small and medium-sized local restaurants, given the target’s huge network of partnered merchants, mostly consisting of local “hero” brands. From the operations’ perspective, Postmates’ integrated platform with improved batching and chaining capabilities is expected to enhance efficiency, contributing to facilitating delivery for non-partnered merchants.

Although Postmates will continue to operate under its own name, cross-selling opportunities resulting from users’ possibility to switch between the two providers to benefit from complementary choices could result in revenue synergies. The increase in scale is expected to drive significant efficiencies and cost savings, with over $200 million of run rate synergies expected to be achieved one year after close, mainly resulting from the elimination of redundant expenditures in G&A, sales and marketing, courier utilization and payment fees.

This acquisition has been defined as both defensive and offensive. Given the challenges faced by its ride-hailing business in the pandemic, as evidenced by the $2.9 billion loss posted for the first three months of the year, betting on the growth of Uber Eats, whose revenues rose 53%, has the potential to mitigate the headwinds experienced by the Rides division.

The heating pressure towards consolidation, resulting from the threats posed by this market’s characteristics, led delivery app companies to circle one another to gain scale through M&As. Taking over Postmates’ 8% of the domestic market share, Uber will become the second largest player in the market with 37% market share, strengthening its position with respect to the market leader DoorDash (45% market share) and to GrubHub (17% market share).

Source: FactSet

Under the terms of the transaction, Uber will issue approximately 84 million shares of common stock for 100% of the fully diluted equity of Postmates. Uber common stock issued in the transaction will be valued at $31.45 based on Uber’s 10-day VWAP as of June 29 and shareholders representing more than 55% of Postmates’ outstanding shares have committed to approve the deal.

Powered by FactSet

Annalisa Sgaramella

Francesca Romana Curato

Tommaso Scarlatti

Powered by FactSet

Annalisa Sgaramella

Francesca Romana Curato

Tommaso Scarlatti