From a poor fishing village on China’s Southern coast, in less than 30 years Shenzhen has developed into one of the most important tech hubs in the world. This new Silicon Valley offered a unique mixture of tech know-how and cheap manufacturing costs. But it was only with Alibaba’s IPO in 2014 that the actual venture boom in China began, with local and foreign investors lured into backing risky start-ups alike. Huge investment rounds were carried out by funds like Qiming, Sequoia China, Tiger, and SoftBank, fostering what became some of the most valuable start-ups in the world. The easiness of money and light regulatory environment made thrive the so-called “PPT companies”, companies whose prospectuses were basically a PowerPoint presentation.

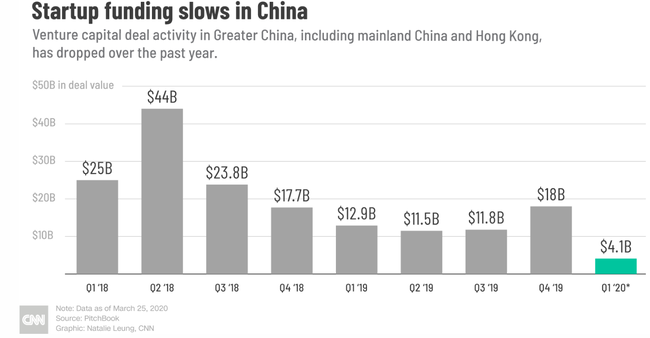

After reaching a peak in 2018, what seemed to be an incessant flow of capital has plummeted. While in 2018 Chinese start-ups attracted nearly 30% of global venture capital, in 2019 they managed to raise only $54 billion, about half of the figure of the previous year. Indeed, investors have become more cautious, after seeing the poor performance of several tech companies, such as electric car maker NIO and smartphone manufacturer Xiaomi, after their IPO. The geopolitical and economic uncertainty stemming from the US-China trade war also decreased the confidence of both domestic and foreign investors. As valuations were reaching unsustainable levels, this may be seen as part of the natural cycle and levelling off, and the capital dry-up may actually be instrumental in cooling off the industry.

However, this “capital winter” coupled with deepening economic slowdown were the background for the failure of hundreds of tech start-ups, including unicorns. The outbreak of coronavirus exacerbated this situation, cutting off funds even more, with commitments put on hold as investors will need to re-evaluate the companies and market altogether. Investors anticipate considerable reductions in valuations, and start-ups that don’t lower their expectations will be even more unlikely to attract funding. The pandemic froze activity during the most important period of the year for fundraising, which goes from the Lunar New Year to summer. VC investment in start-ups throughout Greater China marks a decrease of more than 65% compared to the same period a year ago.

After reaching a peak in 2018, what seemed to be an incessant flow of capital has plummeted. While in 2018 Chinese start-ups attracted nearly 30% of global venture capital, in 2019 they managed to raise only $54 billion, about half of the figure of the previous year. Indeed, investors have become more cautious, after seeing the poor performance of several tech companies, such as electric car maker NIO and smartphone manufacturer Xiaomi, after their IPO. The geopolitical and economic uncertainty stemming from the US-China trade war also decreased the confidence of both domestic and foreign investors. As valuations were reaching unsustainable levels, this may be seen as part of the natural cycle and levelling off, and the capital dry-up may actually be instrumental in cooling off the industry.

However, this “capital winter” coupled with deepening economic slowdown were the background for the failure of hundreds of tech start-ups, including unicorns. The outbreak of coronavirus exacerbated this situation, cutting off funds even more, with commitments put on hold as investors will need to re-evaluate the companies and market altogether. Investors anticipate considerable reductions in valuations, and start-ups that don’t lower their expectations will be even more unlikely to attract funding. The pandemic froze activity during the most important period of the year for fundraising, which goes from the Lunar New Year to summer. VC investment in start-ups throughout Greater China marks a decrease of more than 65% compared to the same period a year ago.

The measures to contain coronavirus slowed down the global economy, and volatility remains high as the severity and length of this state of emergency are still uncertain. During crises, start-ups undergo longer periods between financings, and valuation step-ups become less likely and less optimistic. On top of that, travel restrictions and lockdowns are impeding the interaction with prospective investors; even if some entrepreneurs have been pitching investors through video conferencing, there is a limit to how much can be done online when millions of dollars are at stake.

Start-ups have a vital role in China's long-term economic ambitions. While some analysts anticipate a revival in funding at the end of the outbreak, the economic landscape may have changed completely. VCs emphasise sustainable growth and profitability, so that entrepreneurs will have to focus on cost cutting and reconsider their growth ambitions. Many of the most successful companies were forged during crisis: Google grew in the aftermath of the dot-com bust, and Airbnb was founded in the midst of the Great Recession. In the midst of the coronavirus crisis, start-ups must react quickly and prepare for the future. And funding will follow.

Camilla Gaetani

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Start-ups have a vital role in China's long-term economic ambitions. While some analysts anticipate a revival in funding at the end of the outbreak, the economic landscape may have changed completely. VCs emphasise sustainable growth and profitability, so that entrepreneurs will have to focus on cost cutting and reconsider their growth ambitions. Many of the most successful companies were forged during crisis: Google grew in the aftermath of the dot-com bust, and Airbnb was founded in the midst of the Great Recession. In the midst of the coronavirus crisis, start-ups must react quickly and prepare for the future. And funding will follow.

Camilla Gaetani

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.