WeWork Inc., once a trailblazer in the coworking space industry, navigated a tumultuous journey characterized by meteoric growth, financial turbulence, and a dramatic failed initial public offering (IPO). This article delves into the intricate history of WeWork, exploring key events, financial intricacies, and the ultimate demise of a company that once stood at the forefront of the tech industry.

Overview and first failed IPO – WeWork Rise and Fall

As of December 31, 2022, WeWork, headquartered in New York City, commanded a global presence, operating 43.9 million square feet of coworking space across 779 locations in 39 countries. With a diverse membership base of 547,000 individuals, the company maintained an average commitment term of 19 months.

Founded by Adam Neumann in 2010, WeWork embarked on a mission to revolutionize workspaces globally. Starting with its first location in lower Manhattan, the company's vision was to "create environments where people and companies come together and do their best work." WeWork rapidly expanded, reaching San Francisco in 2011 and making its international debut in 2014 by offering services in London and Israel. By the end of that year, WeWork boasted 15,000 members across eight cities. In a pivotal moment in 2017, SoftBank's Vision Fund invested $4.4 billion into WeWork, valuing the company at $20 billion. SoftBank CEO Masayoshi Son justified the investment, stating that WeWork was leveraging technology and proprietary data systems to transform the way people work. Over the next two years, WeWork became the largest private occupier of office space in Manhattan and achieved a staggering valuation of $47 billion.

However, the narrative took a downturn in August 2019 when WeWork had to shelve its initial public offering due to revelations about the company's financial struggles and business plans. Subsequently, co-founder Adam Neumann stepped down as CEO, and the company underwent significant restructuring, including laying off 20% of its global workforce.

As of December 31, 2022, WeWork, headquartered in New York City, commanded a global presence, operating 43.9 million square feet of coworking space across 779 locations in 39 countries. With a diverse membership base of 547,000 individuals, the company maintained an average commitment term of 19 months.

Founded by Adam Neumann in 2010, WeWork embarked on a mission to revolutionize workspaces globally. Starting with its first location in lower Manhattan, the company's vision was to "create environments where people and companies come together and do their best work." WeWork rapidly expanded, reaching San Francisco in 2011 and making its international debut in 2014 by offering services in London and Israel. By the end of that year, WeWork boasted 15,000 members across eight cities. In a pivotal moment in 2017, SoftBank's Vision Fund invested $4.4 billion into WeWork, valuing the company at $20 billion. SoftBank CEO Masayoshi Son justified the investment, stating that WeWork was leveraging technology and proprietary data systems to transform the way people work. Over the next two years, WeWork became the largest private occupier of office space in Manhattan and achieved a staggering valuation of $47 billion.

However, the narrative took a downturn in August 2019 when WeWork had to shelve its initial public offering due to revelations about the company's financial struggles and business plans. Subsequently, co-founder Adam Neumann stepped down as CEO, and the company underwent significant restructuring, including laying off 20% of its global workforce.

WeWork business model

WeWork's business model revolved around offering flexible workspace solutions through a space-as-a-service platform. The company sought to simplify the traditional complexities of leasing office space by adopting a membership-based approach, providing both individuals and enterprises with a premium and convenient experience.

The primary revenue stream for WeWork came from memberships, offering access to the company's global network of workspaces. These memberships were flexible, with different plans catering to diverse needs, including hot desking, dedicated desks, or private offices. In addition to membership fees, WeWork generated revenue through service fees, encompassing various amenities and services beyond basic workspace. This comprehensive approach aimed to make WeWork a one-stop solution for businesses, covering conference rooms, printing facilities, IT support, and more. WeWork introduced the All-Access membership, allowing members mobile access to book workspaces, conference rooms, and offices on a flexible basis. This feature targeted individuals and businesses seeking hybrid work experience, offering the convenience of accessing workspace as needed.

The company set itself apart by providing a broad range of amenities at its locations, going beyond office space to include glamorous office designs, unlimited coffee, free snacks and beers, lounges, phone booths, outdoor terraces, exercise rooms, swimming pools, valet parking, and unique offerings like mini golf. These amenities aimed to create a vibrant and collaborative work environment. WeWork's global presence was a key attraction, with a network of workspaces in various cities and countries. This aspect appealed to businesses with employees who required workspace while traveling or working in various locations.

Positioning itself as a solution for the evolving nature of work, WeWork accommodated both individuals and enterprises seeking flexible and hybrid work arrangements. The platform provided infrastructure for companies to seamlessly manage their remote and in-office work through the WeWork Workplace management solution.

WeWork's business model revolved around offering flexible workspace solutions through a space-as-a-service platform. The company sought to simplify the traditional complexities of leasing office space by adopting a membership-based approach, providing both individuals and enterprises with a premium and convenient experience.

The primary revenue stream for WeWork came from memberships, offering access to the company's global network of workspaces. These memberships were flexible, with different plans catering to diverse needs, including hot desking, dedicated desks, or private offices. In addition to membership fees, WeWork generated revenue through service fees, encompassing various amenities and services beyond basic workspace. This comprehensive approach aimed to make WeWork a one-stop solution for businesses, covering conference rooms, printing facilities, IT support, and more. WeWork introduced the All-Access membership, allowing members mobile access to book workspaces, conference rooms, and offices on a flexible basis. This feature targeted individuals and businesses seeking hybrid work experience, offering the convenience of accessing workspace as needed.

The company set itself apart by providing a broad range of amenities at its locations, going beyond office space to include glamorous office designs, unlimited coffee, free snacks and beers, lounges, phone booths, outdoor terraces, exercise rooms, swimming pools, valet parking, and unique offerings like mini golf. These amenities aimed to create a vibrant and collaborative work environment. WeWork's global presence was a key attraction, with a network of workspaces in various cities and countries. This aspect appealed to businesses with employees who required workspace while traveling or working in various locations.

Positioning itself as a solution for the evolving nature of work, WeWork accommodated both individuals and enterprises seeking flexible and hybrid work arrangements. The platform provided infrastructure for companies to seamlessly manage their remote and in-office work through the WeWork Workplace management solution.

The rise and fall of the WeWork IPO

The rise of the WeWork IPO was marked by unprecedented enthusiasm and speculation. WeWork's rapid expansion and innovative approach to office spaces had captured the imagination of investors, leading to substantial private funding rounds and a lofty valuation. The company's charismatic co-founder, Adam Neumann, was hailed as a visionary, and WeWork's global footprint seemed poised for exponential growth. The stage was set for a blockbuster IPO that would redefine the real estate and coworking sectors.

However, the euphoria surrounding the WeWork IPO was short-lived. As the company prepared to go public, cracks in its business model and corporate governance began to emerge. Concerns over its staggering losses, questionable leadership decisions, and unconventional governance structure cast a shadow over the once-celebrated IPO. The initial valuation of $47 billion came under scrutiny, and doubts about WeWork's sustainability started to erode investor confidence. The stage was being set for a monumental fall that would send shockwaves through the financial world.

The rise of the WeWork IPO was marked by unprecedented enthusiasm and speculation. WeWork's rapid expansion and innovative approach to office spaces had captured the imagination of investors, leading to substantial private funding rounds and a lofty valuation. The company's charismatic co-founder, Adam Neumann, was hailed as a visionary, and WeWork's global footprint seemed poised for exponential growth. The stage was set for a blockbuster IPO that would redefine the real estate and coworking sectors.

However, the euphoria surrounding the WeWork IPO was short-lived. As the company prepared to go public, cracks in its business model and corporate governance began to emerge. Concerns over its staggering losses, questionable leadership decisions, and unconventional governance structure cast a shadow over the once-celebrated IPO. The initial valuation of $47 billion came under scrutiny, and doubts about WeWork's sustainability started to erode investor confidence. The stage was being set for a monumental fall that would send shockwaves through the financial world.

Factors contributing to the failure of the WeWork IPO

Several factors coalesced to contribute to the spectacular failure of the WeWork IPO. One of the primary reasons was the revelation of staggering financial losses and a lack of a clear path to profitability. WeWork's rapid expansion and aggressive leasing of commercial real estate had led to astronomical operating costs, far outpacing its revenue. This unsustainable financial model raised red flags among potential investors, who grew increasingly wary of pouring money into a business with uncertain prospects.

Additionally, the controversial leadership style of Adam Neumann and the unconventional corporate governance structure raised concerns about the company's long-term stability. Reports of erratic behavior, self-dealing, and conflicts of interest further eroded investor trust. The lack of a clear succession plan and governance oversight added to the apprehension surrounding WeWork's ability to weather market challenges and deliver sustained value to its shareholders.

These internal governance issues, when combined with the financial woes, proved to be a potent recipe for the downfall of the IPO. Furthermore, the timing of the IPO coincided with a broader market sentiment shift, with investors becoming increasingly discerning about high-growth, high-loss businesses. The failure of other high-profile IPOs in the tech and sharing economy sectors had already set a cautious tone in the market. WeWork's own valuation and financial disclosures came under intense scrutiny, leading to a loss of confidence in the company's ability to meet the lofty expectations set by its valuation. These external market dynamics compounded the challenges WeWork faced in bringing its IPO to fruition.

The failure of the WeWork IPO sent shockwaves through the real estate market, particularly in the commercial office space segment. WeWork had been a major player in leasing office spaces, often entering into long-term lease agreements with landlords and then subletting the spaces to its clients. The company's rapid expansion and aggressive leasing strategy had led to a significant footprint in prime real estate locations across the globe. Landlords and property owners who had entered into lease agreements with WeWork now faced uncertainty and potential vacancies.

Analyzing the WeWork IPO Prospectus

Central to the unraveling of the WeWork IPO was the scrutiny of its prospectus, a critical document that provides insights into a company's financials, operations, and risk factors. The WeWork prospectus, when subjected to intense examination, revealed a confluence of red flags that ultimately contributed to the downfall of the IPO. Key among these was the revelation of staggering losses, with the company hemorrhaging billions of dollars annually. The prospectus also laid bare the intricacies of WeWork's complex lease agreements, raising concerns about its long-term financial obligations and exposure to market downturns.

Several factors coalesced to contribute to the spectacular failure of the WeWork IPO. One of the primary reasons was the revelation of staggering financial losses and a lack of a clear path to profitability. WeWork's rapid expansion and aggressive leasing of commercial real estate had led to astronomical operating costs, far outpacing its revenue. This unsustainable financial model raised red flags among potential investors, who grew increasingly wary of pouring money into a business with uncertain prospects.

Additionally, the controversial leadership style of Adam Neumann and the unconventional corporate governance structure raised concerns about the company's long-term stability. Reports of erratic behavior, self-dealing, and conflicts of interest further eroded investor trust. The lack of a clear succession plan and governance oversight added to the apprehension surrounding WeWork's ability to weather market challenges and deliver sustained value to its shareholders.

These internal governance issues, when combined with the financial woes, proved to be a potent recipe for the downfall of the IPO. Furthermore, the timing of the IPO coincided with a broader market sentiment shift, with investors becoming increasingly discerning about high-growth, high-loss businesses. The failure of other high-profile IPOs in the tech and sharing economy sectors had already set a cautious tone in the market. WeWork's own valuation and financial disclosures came under intense scrutiny, leading to a loss of confidence in the company's ability to meet the lofty expectations set by its valuation. These external market dynamics compounded the challenges WeWork faced in bringing its IPO to fruition.

The failure of the WeWork IPO sent shockwaves through the real estate market, particularly in the commercial office space segment. WeWork had been a major player in leasing office spaces, often entering into long-term lease agreements with landlords and then subletting the spaces to its clients. The company's rapid expansion and aggressive leasing strategy had led to a significant footprint in prime real estate locations across the globe. Landlords and property owners who had entered into lease agreements with WeWork now faced uncertainty and potential vacancies.

Analyzing the WeWork IPO Prospectus

Central to the unraveling of the WeWork IPO was the scrutiny of its prospectus, a critical document that provides insights into a company's financials, operations, and risk factors. The WeWork prospectus, when subjected to intense examination, revealed a confluence of red flags that ultimately contributed to the downfall of the IPO. Key among these was the revelation of staggering losses, with the company hemorrhaging billions of dollars annually. The prospectus also laid bare the intricacies of WeWork's complex lease agreements, raising concerns about its long-term financial obligations and exposure to market downturns.

Questionable Financial Metrics

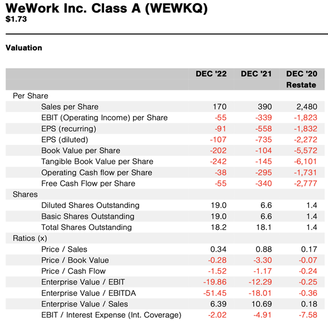

A closer look at WeWork's financials revealed alarming figures. The company reported substantial losses, with negative earnings per share (EPS) and operating cash flow. WeWork's valuation, once sky-high, came into question as investors questioned the company's ability to generate sustainable profits.

A closer look at WeWork's financials revealed alarming figures. The company reported substantial losses, with negative earnings per share (EPS) and operating cash flow. WeWork's valuation, once sky-high, came into question as investors questioned the company's ability to generate sustainable profits.

Valuation Analysis

Data Source: 2023 FactSet Research Systems Inc.

WeWork's financial metrics, such as negative EPS and operating cash flow, raised concerns among potential investors. The company's valuation, calculated using metrics like price-to-sales and price-to-book value ratios, seemed inflated compared to its actual financial performance.

Management and Culture Problems

The financial concerns surrounding WeWork were not the only factors contributing to its failed IPO. The company's management and culture also played a significant role in its downfall. WeWork's co-founder and former CEO, Adam Neumann, was at the center of controversy. Neumann's unconventional leadership style and questionable business practices raised eyebrows among investors and industry experts. He was known for his flamboyant lifestyle and extravagant spending, which appeared incongruous with WeWork's financial struggles. Moreover, Neumann's control over the company's decision-making, through his ownership of special shares with enhanced voting power, raised concerns about corporate governance. Investors feared that Neumann's influence could potentially undermine the company's long-term stability.

WeWork was once praised for its vibrant and community-driven workspaces. However, as the company grew rapidly, reports of a toxic work culture began to emerge. Former employees highlighted a high-pressure environment, intense competition, and a lack of work-life balance. These revelations further eroded investor confidence in WeWork's ability to sustain its growth and retain top talent.

The culmination of financial concerns, management controversies, and cultural issues led to a significant loss of investor trust. WeWork's IPO plans crumbled as potential investors grew wary of the company's viability and valuation. Ultimately, WeWork was forced to withdraw its IPO filing, marking a significant blow to its reputation and financial prospects.

The financial concerns surrounding WeWork were not the only factors contributing to its failed IPO. The company's management and culture also played a significant role in its downfall. WeWork's co-founder and former CEO, Adam Neumann, was at the center of controversy. Neumann's unconventional leadership style and questionable business practices raised eyebrows among investors and industry experts. He was known for his flamboyant lifestyle and extravagant spending, which appeared incongruous with WeWork's financial struggles. Moreover, Neumann's control over the company's decision-making, through his ownership of special shares with enhanced voting power, raised concerns about corporate governance. Investors feared that Neumann's influence could potentially undermine the company's long-term stability.

WeWork was once praised for its vibrant and community-driven workspaces. However, as the company grew rapidly, reports of a toxic work culture began to emerge. Former employees highlighted a high-pressure environment, intense competition, and a lack of work-life balance. These revelations further eroded investor confidence in WeWork's ability to sustain its growth and retain top talent.

The culmination of financial concerns, management controversies, and cultural issues led to a significant loss of investor trust. WeWork's IPO plans crumbled as potential investors grew wary of the company's viability and valuation. Ultimately, WeWork was forced to withdraw its IPO filing, marking a significant blow to its reputation and financial prospects.

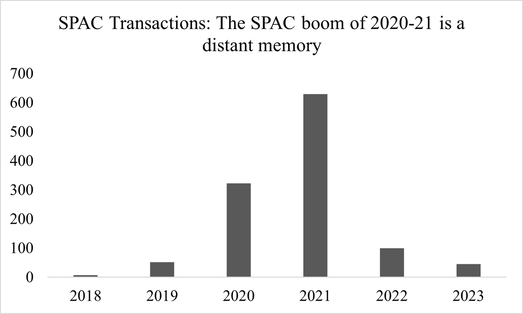

Special Purpose Acquisition Companies (SPACs): The Modern IPO Alternative

A SPAC, known as a "blank check company," is a shell corporation listed on a stock exchange, designed to take private companies public without the traditional initial public offering (IPO) process. SPACs are registered with the U.S. Securities and Exchange Commission (SEC) and are considered publicly-traded companies. They trade as units or as separate common shares and warrants on exchanges like Nasdaq and the New York Stock Exchange. Typically, 85% to 100% of the proceeds raised in the IPO are held in trust, used only for shareholder-approved business combinations or to return capital to shareholders. The years if 2020 and 2021 saw a boom in SPAC listings, but the high number of fraud-ridden transactions and a cooling public listing environment saw their frequency drop in 2022 and 2023.

A SPAC, known as a "blank check company," is a shell corporation listed on a stock exchange, designed to take private companies public without the traditional initial public offering (IPO) process. SPACs are registered with the U.S. Securities and Exchange Commission (SEC) and are considered publicly-traded companies. They trade as units or as separate common shares and warrants on exchanges like Nasdaq and the New York Stock Exchange. Typically, 85% to 100% of the proceeds raised in the IPO are held in trust, used only for shareholder-approved business combinations or to return capital to shareholders. The years if 2020 and 2021 saw a boom in SPAC listings, but the high number of fraud-ridden transactions and a cooling public listing environment saw their frequency drop in 2022 and 2023.

Source: FactSet

SPAC Formation and Share Allocation Mechanics

SPAC formation involves an experienced management team or sponsor, contributing nominal capital for about a 20% interest in the SPAC, known as founder shares. The remaining ~80% interest is held by public shareholders through units offered in the SPAC’s IPO. These units consist of a share of common stock and a fraction of a warrant. After the IPO, the proceeds are placed in a trust account, and the SPAC has 18-24 months to complete a merger with a target company, termed as de-SPACing. If a merger is not completed within this timeframe, the SPAC liquidates, returning the IPO proceeds to the public shareholders.

SPAC formation involves an experienced management team or sponsor, contributing nominal capital for about a 20% interest in the SPAC, known as founder shares. The remaining ~80% interest is held by public shareholders through units offered in the SPAC’s IPO. These units consist of a share of common stock and a fraction of a warrant. After the IPO, the proceeds are placed in a trust account, and the SPAC has 18-24 months to complete a merger with a target company, termed as de-SPACing. If a merger is not completed within this timeframe, the SPAC liquidates, returning the IPO proceeds to the public shareholders.

Detailed SPAC Merger Process

Once a target company is identified, the SPAC prepares and files a proxy statement for shareholder approval of the merger. This document includes a description of the proposed merger, governance matters, and comprehensive financial information of the target company. Shareholder approval is followed by regulatory clearance, culminating in the closing of the merger. The target company then becomes a public entity, and a Form 8-K, equivalent to a Form 10 filing (referred to as the Super 8-K), must be filed with the SEC within four business days of closing.

Once a target company is identified, the SPAC prepares and files a proxy statement for shareholder approval of the merger. This document includes a description of the proposed merger, governance matters, and comprehensive financial information of the target company. Shareholder approval is followed by regulatory clearance, culminating in the closing of the merger. The target company then becomes a public entity, and a Form 8-K, equivalent to a Form 10 filing (referred to as the Super 8-K), must be filed with the SEC within four business days of closing.

WeWork's SPAC Merger with BowX Acquisition Corp

WeWork's transition to a publicly traded company was achieved through a merger with BowX Acquisition Corp., a SPAC. Announced on March 26, 2021, the deal valued WeWork at approximately $9 billion. This strategic decision enabled WeWork to access the necessary capital for growth, leveraging the increasing demand for flexible workspaces. WeWork received approximately $1.3 billion, including a $800 million private placement from major investors like Insight Partners, Starwood Capital Group, and Fidelity Management.

WeWork's transition to a publicly traded company was achieved through a merger with BowX Acquisition Corp., a SPAC. Announced on March 26, 2021, the deal valued WeWork at approximately $9 billion. This strategic decision enabled WeWork to access the necessary capital for growth, leveraging the increasing demand for flexible workspaces. WeWork received approximately $1.3 billion, including a $800 million private placement from major investors like Insight Partners, Starwood Capital Group, and Fidelity Management.

Deal Mechanics and Control in WeWork's SPAC Merger

The financial structure of the WeWork-BowX deal included BowX's $483 million cash in trust and a $800 million private placement investment, contributing to WeWork's expected liquidity of $2.4 billion. Notably, the merger was unanimously approved by both companies' Boards of Directors, with completion anticipated by the third quarter of 2021. As per the merger terms, WeWork's current shareholders were expected to retain about 83% ownership in the combined entity, ensuring significant control over the company's direction post-merger.

The financial structure of the WeWork-BowX deal included BowX's $483 million cash in trust and a $800 million private placement investment, contributing to WeWork's expected liquidity of $2.4 billion. Notably, the merger was unanimously approved by both companies' Boards of Directors, with completion anticipated by the third quarter of 2021. As per the merger terms, WeWork's current shareholders were expected to retain about 83% ownership in the combined entity, ensuring significant control over the company's direction post-merger.

WeWork's Market Position and Future Outlook

Initially valued at $47 billion in 2019, WeWork's valuation dropped to around $8 billion due to concerns over its business model and management. However, the SPAC deal provided a path to recovery, with WeWork expecting to become adjusted EBITDA positive by 2022 and to more than double its revenue by 2024. This optimistic outlook was underpinned by the demand for flexible workspaces and WeWork's revised cost structure and business strategy.

In summary, WeWork's IPO through the SPAC merger with BowX Acquisition Corp represents a strategic move in the flexible workspace industry, highlighting the utility of SPACs in facilitating public listings and providing essential growth capital. The deal's structure and mechanics exemplify the complexity and potential of using SPACs in today's financial landscape, with WeWork well-positioned to capitalize on the evolving work environment post-pandemic.

Initially valued at $47 billion in 2019, WeWork's valuation dropped to around $8 billion due to concerns over its business model and management. However, the SPAC deal provided a path to recovery, with WeWork expecting to become adjusted EBITDA positive by 2022 and to more than double its revenue by 2024. This optimistic outlook was underpinned by the demand for flexible workspaces and WeWork's revised cost structure and business strategy.

In summary, WeWork's IPO through the SPAC merger with BowX Acquisition Corp represents a strategic move in the flexible workspace industry, highlighting the utility of SPACs in facilitating public listings and providing essential growth capital. The deal's structure and mechanics exemplify the complexity and potential of using SPACs in today's financial landscape, with WeWork well-positioned to capitalize on the evolving work environment post-pandemic.

Covid

Let’s rewind to 2021, the peak of Covid – 19. If at that time, you were offered to buy shares of an office/space lending company, while everyone was starting to work from home would you buy them or would you let the chance slip? Looking back at this question in 2023 it seems like the answer is obvious ‘Please keep my hard-earned money as far as you can from that company’. With that being said, in 2021 the answer to the question was not so evident. In fact, for a period of two months from April to June of 2021 the company’s stock performed better than the S&P 500. Unfortunately, for a lot of investors the coming years would not be so kind as a lot of them fell into the trap of now failed office - lending darling WeWork.

Let’s rewind to 2021, the peak of Covid – 19. If at that time, you were offered to buy shares of an office/space lending company, while everyone was starting to work from home would you buy them or would you let the chance slip? Looking back at this question in 2023 it seems like the answer is obvious ‘Please keep my hard-earned money as far as you can from that company’. With that being said, in 2021 the answer to the question was not so evident. In fact, for a period of two months from April to June of 2021 the company’s stock performed better than the S&P 500. Unfortunately, for a lot of investors the coming years would not be so kind as a lot of them fell into the trap of now failed office - lending darling WeWork.

Source: FactSet

While for many companies, the pandemic was a nightmare, for WeWork it was a blessing in disguise. As the pandemic was spreading, the world was engulfed in uncertainty. This also affected the financial markets, where many investors, due to the risks associated with Covid – 19 started selling their positions, with the lowest point of S&P 500 being March 20th 2020. At the beginning there were many questions specifically regarding WeWork’s business model as more and more companies were transitioning to hybrid or remote. It was predicted that this would lower the demand for office spaces, which was WeWork’s specialty.

Source: FactSet

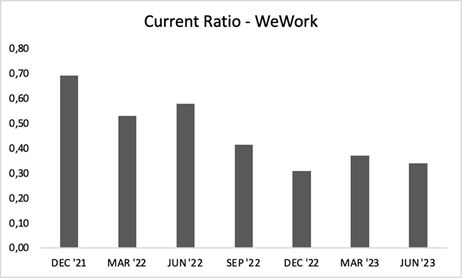

In a turn of events, the pandemic in fact raised WeWork’s office lending demand. One of the reasons was that many employees that were trying to get back to normal office conditions, had to find new ‘Pandemic’ proof workspaces. Moreover, there were a lot of people who could not access their offices, but still wanted the office work environment. These two main factors served as WeWork’s lifeline for most of 2021. This increased WeWork’s profits and gave them the necessary boost to support their eventual SPAC. If we look at their previous financials, some of the main ratios to look at to understand their financial health were their liquidity ratios. The further away we go from the pandemic’s peak, the lower their liquidity ratios get. In December 2021 their liquidity ratio was 0.43, while by no means it is an amazing number it still was better than the 0.11 Cash Ratio recorded in 2023. This was a direct indicator of the company’s low cash flows and high debt levels, which directly affected their valuation too.

WeWork Vs Competitors

WeWork was not the only company, who worked in the office lending space. There are many competitors with the most notable one being CBRE Group, Inc. What is interesting is that if you had invested at both companies on the day that WeWork did it’s SPAC your return today for WeWork would be – 99.66% while for CBRE Group, Inc. would be +69.33%. On top of this, CBRE Group, Inc. has positive net income a complete contrast with WeWork. This example shows more than anything that, if WeWork was more careful with their management decisions and were more focused on efficiently using their assets they could have been now in a completely different position. While the pandemic gave WeWork a few more extra years to live, the company was not able to capitalize on this unexpected hero and this eventually led to their demise.

WeWork was not the only company, who worked in the office lending space. There are many competitors with the most notable one being CBRE Group, Inc. What is interesting is that if you had invested at both companies on the day that WeWork did it’s SPAC your return today for WeWork would be – 99.66% while for CBRE Group, Inc. would be +69.33%. On top of this, CBRE Group, Inc. has positive net income a complete contrast with WeWork. This example shows more than anything that, if WeWork was more careful with their management decisions and were more focused on efficiently using their assets they could have been now in a completely different position. While the pandemic gave WeWork a few more extra years to live, the company was not able to capitalize on this unexpected hero and this eventually led to their demise.

Chaper 11 failure

By August 2023, Wework’s stock plunged 97%. On November 6, 2023, Wework filed for Chapter 11 bankruptcy protection, only confirming the inevitable and culminated years of financial turbulence, signaling that the pandemic’s changes were more than a temporary setback. In the filing, WeWork listed about $18.7 billion in debts and $15.1 billion in assets as of June 30.

By August 2023, Wework’s stock plunged 97%. On November 6, 2023, Wework filed for Chapter 11 bankruptcy protection, only confirming the inevitable and culminated years of financial turbulence, signaling that the pandemic’s changes were more than a temporary setback. In the filing, WeWork listed about $18.7 billion in debts and $15.1 billion in assets as of June 30.

Chapter 11 bankruptcy explained

Chapter 11 bankruptcy is a legal recourse in the United States designed to assist businesses facing severe financial challenges. When a company voluntarily files for Chapter 11, it becomes a "debtor in possession," maintaining control of its assets and operations as it navigates the reorganization process. This initiates an automatic stay, shielding the company from creditor actions. The primary objective is to create a reorganization plan, often developed with the guidance of legal and financial experts, outlining how the company intends to address its financial woes. This plan, subject to approval by the bankruptcy court and a majority of creditors, may involve debt reduction, contract renegotiation, or asset sales. The debtor aims to emerge from bankruptcy as a financially rejuvenated entity, capable of sustained operations and profitability. Chapter 11 is sought by companies facing financial distress, providing them with a strategic means to restructure and, ideally, secure a more viable future while protecting their ongoing operations.

Chapter 11 bankruptcy is a legal recourse in the United States designed to assist businesses facing severe financial challenges. When a company voluntarily files for Chapter 11, it becomes a "debtor in possession," maintaining control of its assets and operations as it navigates the reorganization process. This initiates an automatic stay, shielding the company from creditor actions. The primary objective is to create a reorganization plan, often developed with the guidance of legal and financial experts, outlining how the company intends to address its financial woes. This plan, subject to approval by the bankruptcy court and a majority of creditors, may involve debt reduction, contract renegotiation, or asset sales. The debtor aims to emerge from bankruptcy as a financially rejuvenated entity, capable of sustained operations and profitability. Chapter 11 is sought by companies facing financial distress, providing them with a strategic means to restructure and, ideally, secure a more viable future while protecting their ongoing operations.

WeWork's case

WeWork has struggled in a commercial real estate market that has been rocked by the rising cost of borrowing money and the rise of smart working. The company said it entered into a restructuring agreement with most of its stakeholders with the aim of slashing its debt (by about $3 billion), while looking to trim its commercial office lease portfolio. The number of locations that will remain open is still not known, but, according to the most recent filing, the company said it had 777 locations in 39 countries. According to Tolley, the company’s “primary challenge” continues to be lease liabilities, which account for about two-thirds of Wework’s operating costs. Wework’s decision to renegotiate or abandon leases at “underperforming” locations hinted at a strategic pivot and a downsizing of their once expansive real estate empire. Landlords with exposure to WeWork could take significant hits if their leases are terminated although the locations outside of the U.S. and Canada will not be affected by the bankruptcy proceedings, as well as franchisees worldwide. Beyond real estate costs, WeWork has pointed to increased member churn and other financial losses. But despite rising competition and lingering uncertainty following the bankruptcy filing, the company still has half a million members.

WeWork has struggled in a commercial real estate market that has been rocked by the rising cost of borrowing money and the rise of smart working. The company said it entered into a restructuring agreement with most of its stakeholders with the aim of slashing its debt (by about $3 billion), while looking to trim its commercial office lease portfolio. The number of locations that will remain open is still not known, but, according to the most recent filing, the company said it had 777 locations in 39 countries. According to Tolley, the company’s “primary challenge” continues to be lease liabilities, which account for about two-thirds of Wework’s operating costs. Wework’s decision to renegotiate or abandon leases at “underperforming” locations hinted at a strategic pivot and a downsizing of their once expansive real estate empire. Landlords with exposure to WeWork could take significant hits if their leases are terminated although the locations outside of the U.S. and Canada will not be affected by the bankruptcy proceedings, as well as franchisees worldwide. Beyond real estate costs, WeWork has pointed to increased member churn and other financial losses. But despite rising competition and lingering uncertainty following the bankruptcy filing, the company still has half a million members.

What happens now?

While the full impact of the bankruptcy filing is still uncertain, Tolley claimed: “In a year, we’re going to be right where we are today. We are open for business for half a million people ... all around the world,”. “The only difference is a year from now the company will be profitable in a way that it just has never gotten to in the past.”

A pressing question stands withing the industry: what will become of the vacated WeWork spaces? There are various possible scenarios. First, established co-working entities like IWG could expand their market shares. As an atypical real estate investment, a PE firm could acquire Wework and keep operating the innovative co-working spaces. Landlords of underperforming spaces could take ownership and operate the locations under Wework’s brand. However, there is a high level of uncertainty regarding the viability of the co-working model as it is not the same as 3 years ago as the pandemic dramatically reshaped notions of office spaces. Co-working spaces are changing to accommodate hybrid work models and meet increased demand for short-term, flexible leases. The real test for competitors, potential investors, and landlords will be adapting these spaces to the new demands without repeating past mistakes. What becomes of these co-working spaces may not only shape the future of an industry but also reflect the evolving preferences of a workforce that has been dramatically changed by the global pandemic.

While the full impact of the bankruptcy filing is still uncertain, Tolley claimed: “In a year, we’re going to be right where we are today. We are open for business for half a million people ... all around the world,”. “The only difference is a year from now the company will be profitable in a way that it just has never gotten to in the past.”

A pressing question stands withing the industry: what will become of the vacated WeWork spaces? There are various possible scenarios. First, established co-working entities like IWG could expand their market shares. As an atypical real estate investment, a PE firm could acquire Wework and keep operating the innovative co-working spaces. Landlords of underperforming spaces could take ownership and operate the locations under Wework’s brand. However, there is a high level of uncertainty regarding the viability of the co-working model as it is not the same as 3 years ago as the pandemic dramatically reshaped notions of office spaces. Co-working spaces are changing to accommodate hybrid work models and meet increased demand for short-term, flexible leases. The real test for competitors, potential investors, and landlords will be adapting these spaces to the new demands without repeating past mistakes. What becomes of these co-working spaces may not only shape the future of an industry but also reflect the evolving preferences of a workforce that has been dramatically changed by the global pandemic.

By Rares Ionescu, Amos Appendino, Domenico Destito, Ettore Marku

Sources

- - Factset

- - WeWork Investor Relations

- -Reuters

- - PwC

- -NY Times

- -Financial Times

- -WSJ

- -The Guardian

- -Business Insider

- -Associated press